In 2007, Steve Jobs worked out how to turn what was previously a clunky, speciality device into something indispensable.

The iPhone was born.

It wasn’t the first smartphone by any means, but it was the one that changed everything.

Today, almost everyone in the entire world owns a smartphone of some description.

And while Apple [NASDAQ:AAPL] don’t have the market to themselves, they do own a sizeable chunk of between 15–20% of the entire smartphone space.

But get this…

Investing in tech beats buying it

If you’d bought shares in Apple instead of an iPhone on its release date (8 Jan 2007), you’d have turned the $499 purchase price into a whopping $34,819 by today.

That’s a 29% annual return!

So why was the iPhone so revolutionary?

Well, when you strip it back, I think it comes down to just one thing.

Simply put, Apple put the power of the internet into everyone’s pocket.

This was a pivotal moment in terms of consumer behaviour.

By 2007, internet speeds and wi-fi had reached a critical inflection point, making mobile internet far better than in times past.

And with the iPhone, you no longer had to be sitting at your desktop computer to access the online world.

Apple also developed the App Store model where independent developers could create apps for iPhone users.

Not only did this create a Cambrian explosion of ideas which made the iPhone better for users, but Apple also got a 30% clip on all revenue.

Apple had the perfect product, at the perfect time, with the marketing genius of Jobs behind it.

It was what I call a ‘tech collision’ point.

These are rare but crucial moments for investors to be aware of.

Now, as I said, investing in Apple turned out to be a ‘no-brainer’ move in hindsight. But nothing is ever obvious at the time.

I mean, the world’s ‘best’ investor, Warren Buffett didn’t own any Apple stock until 2016, missing out on much of the early growth spurt.

Here’s the thing though…

I think we’ve just witnessed a new kind of iPhone moment.

And if you can work out how this story plays out, you could give yourself a chance of landing returns, perhaps even more lucrative than Apple’s.

Let me explain…

The big idea

AI (artificial intelligence) has been on everyone’s lips this year and we’ve seen some stunning stock price moves already.

Just like the iPhone put the internet in everyone’s pocket, AI is set to put an ‘expert’ in everyone’s pocket.

This is a big idea.

Generative AI — the idea that AI can interact with humans in real time — is a 100x improvement on the simple ‘search’ function that defined the web until this point in time.

Imagine it…

AI apps that can mimic the best doctors, lawyers, teachers, investors, tutors, accountants, marketers, musicians…anything in the world.

Everyone will have an AI assistant that’s tailored to their own individual needs.

The ‘dumb’ assistants of the past — think Siri or Alexa — never really caught the public imagination.

They were OK as a parlour trick, but they weren’t an indispensable part of your life.

But the likes of Amazon, Google, Meta, and Apple have high hopes for revamped AI versions, using a similar strategy as the one that worked for the iPhone.

The new idea is that you can choose various AI assistants in much the same way you choose apps for your phone.

‘“We never had that App Store moment for the assistants,” said Carolina Milanesi, a consumer technology analyst for the research firm Creative Strategies who was a consultant for Amazon.’

Generational buying opportunity incoming?

As I said before, we’ve seen stunning stock gains in the likes of Nvidia and some people are already calling it a bubble.

In the short term, they could be right — though I think that has more to do with the general shakiness in markets than anything else.

There’s an excellent Twitter thread here that goes over the looming bond market issues if you’re interested.

Long story short, the rapid rise of interest rates this year could break something soon and we could see a bond market meltdown.

But we’ve seen this story before too.

In the wake of the 2007 iPhone launch we saw early gains across tech stocks cut short by the interruption of the 2008 GFC.

Tech stocks were hit hard by an issue in credit markets as investors ran for the sidelines.

But with hindsight, that downturn was a time of immense opportunity.

The temporary market rout provided generational buying opportunities if you understood the immensity of the mobile trend the iPhone had helped start.

Consider a company like Broadcom Inc [NASDAQ:AVGO].

This wireless technology infrastructure company listed in 2009 in the depths of the GFC lows at just US$18.20.

Today its shares trade for around US$922!

Or how about Cirrus Logic Inc [NASDAQ:CRUS]?

This is a company that specialises in hardware and software specifically for the mobile market. It’s a crucial piece of the mobile tech stack.

Their shares fell from US$8.67 in 2007 to as low as US$2.62 in December 2008 as the GFC panic sell off hit.

However, as I said, that provided astute investors — who understood the age of the smartphone was upon us — an unbelievable entry price.

Today, shares in Cirrus Logic sell for US$74.

My point is, however the stock market goes in the short term, don’t underestimate the enormity of the tech transformation this ‘AI moment’ is set to have.

What to consider?

Here’s some ideas to get your research started…

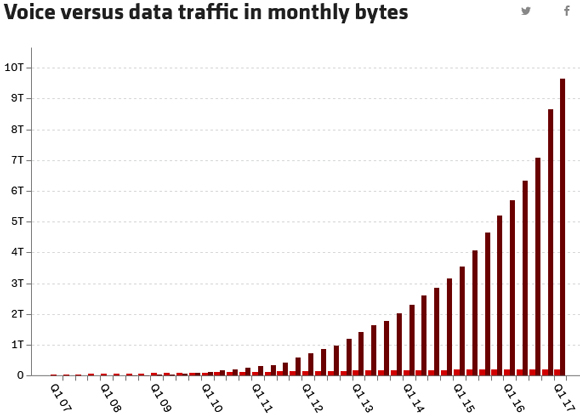

Check out this chart from 2007 to 2017:

|

|

| Source: Vox |

As you can see, demand for data ramped up exponentially as the iPhone moment sparked a huge increase in smartphone use.

AI is set to have an even bigger effect on data use.

So, companies that accrue value from the use of data are clearly good places to look.

Data centres, microchip companies, chip designers, and software specialists, these are some of the ‘shovel sellers’ that could benefit from the AI explosion.

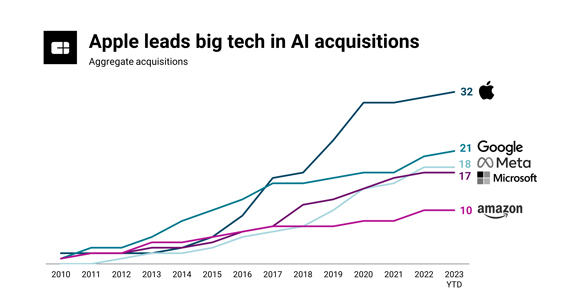

There’s another theory I’ve read that says big tech will be the big winners of AI, because they have the scale in terms of technology, data, expertise, and distribution to make it work.

This is a bit different from the dotcom boom, which saw garage start-ups like Google grow to replace the former leading tech companies.

I’m not 100% sold on this idea.

In any disruption, it always seems like the big companies have the advantage until it becomes clear they don’t.

But I agree, they’ll certainly try to lock in their advantage.

You can see that big tech is already on an AI buying spree:

|

|

| Source: CB Insights |

As an investor, if you can find those niche players that big tech needs or wants, you may find some good opportunities.

Here’s a more left field idea…

AI is a very energy intensive endeavour.

As MSN recently reported:

‘”The energy consumption of something like ChatGPT inquiry compared to some inquiry on your email, for example, is going to [be] probably 10 to 100 times more power hungry,” Sajjad Moazeni, professor of electrical and computer engineering at UW, told Yahoo Finance.’

This could be a boon for renewable energy companies.

Big data companies like Google Cloud, Amazon Web Services, Azure, and Microsoft all have commitments in place to match their annual electricity consumption with renewable energy investments.

Lastly there’s the other side of the coin — the companies to avoid.

Just like the iPhone killed the digital camera industry, I bet there’ll be entire industries replaced by new AI alternatives that are cheaper, faster, and simply better.

Like it or not, this future is coming.

As an investor, now is the time to prepare for it.

Good investing,

|

Ryan Dinse,

Editor, Money Morning