The world isn’t ending, but perhaps it’s going to change a little faster thanks to the global COVID-19 pandemic. If it does, there will be companies that will benefit from it. As an investor all you need to do is be ahead of the change and look at what happens when this all fades away…

Latest ASX News

The idea of a successful investment portfolio is appealing to everyone.

However, the extremely sensitive and volatile nature of the share market and stocks make it a risky bet.

We see moves in share prices hourly on the ASX. Sometimes, even the most uninformed investors can predict these movements from a mile off.

But often there are complete left-of-field surprises that catch even the most seasoned professionals off-guard.

So, how do you become a responsible investor in the Australian share market? You’ll need more than just your instinct …

Two Stocks with the Vaccination We’ve Been Searching for

The ASX is chock-full of great companies. There are companies not only dominating the domestic landscape, but the global landscape too. And they’re always working towards growth. I’d go so far to say there’s not a single company on the ASX that’s just going through the motions.

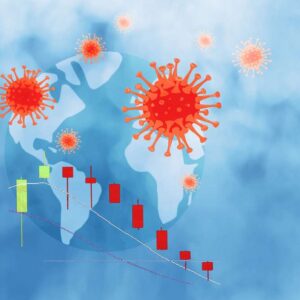

The Coronavirus Portfolio

Fair warning: Today’s piece is long, but we think the current outbreak warrants an in-depth look at investing in this new environment. Even with the number of cases steadily rising, markets looked remarkably bullish over the last three weeks of trading. And then all of this changed.

Wipeout or Opportunity? — The Stock Market Crash

Whew, it’s ugly out this morning.

The markets are a sea of red and the headlines are a tad dramatic.

The Data Shows the Virus Could Be Spreading Fast: What Could Happen Next?

Financially speaking the market has been shaken out of its complacency by this latest Italian and South Korean news. At the same time the gold price and gold stocks started to attract investor funds as people sought out safe haven assets.

What the ISX and NSX Deal Really Means

Can you see the irony here? A competing stock exchange with its stock listed on its competitor’s stock exchange. That’s the situation with the National Stock Exchange of Australia (NSX).