The Magnis Energy Technologies Ltd’s [ASX:MNS] share price is up on a board appointment update.

At the time of writing, Magnis shares are up 1.7% and were up as much 5% in early trade.

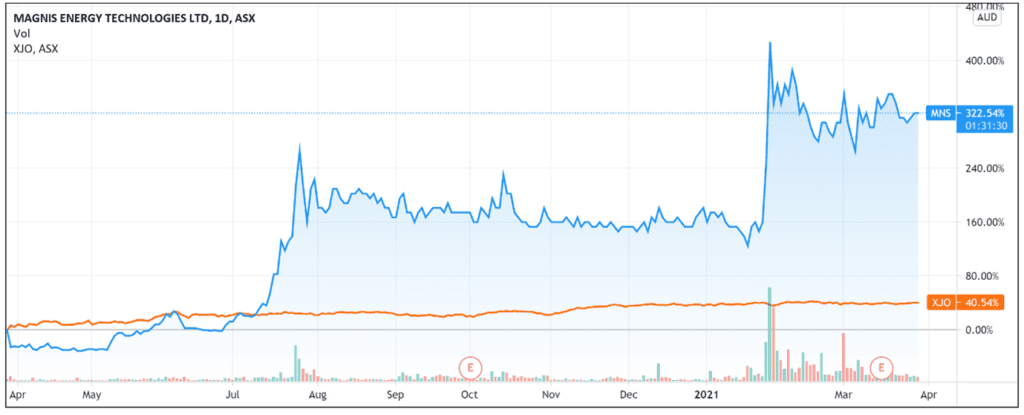

The lithium battery technology developer is enjoying a solid year with the MNS share price up 50% YTD, and up 320% over the last 12 months.

Magnis announces significant board appointments

In today’s announcement, Magnis Energy explained that it is entering a ‘significant growth phase’, prompting the need to appoint board members with experience in the energy and investment sectors.

Three Ways to Invest in the Renewable Energy Boom

According to the company, the announced board appointments are the ‘first changes being made to bring in the necessary skillsets required’ for Magnis’s near-term growth plans.

All new board directors commence their appointments today.

The appointments include:

- Mona E Dajani, independent non-executive director: lead lawyer specialising in acquisitions, dispositions, financing and project development transactions involving energy facilities in the US. Mrs Dajani is also an advisor to the Biden administration and to the US Department of Energy, as well as being a board member of the American Council on Renewable Energy.

- Dr Richard Petty, independent non-executive director: former member of the Business Twenty (B20), the official business community engagement forum for the G20; former Chairman of the Australian Chamber of Commerce Hong Kong & Macau; and former Chairman of CPA Australia.

- Zarmeen Pavri, independent non-executive director: managing director and co-founder of India Avenue, which advises and offers investment solutions to investors seeking access to India’s capital markets. Most recently, Mr Silva was the Head of Portfolio Management for ANZ Wealth.

Commenting on the new appointments, Magnis Chairman Frank Poullas stated:

‘Today’s announcement is significant and exciting for the company and its loyal shareholders…

‘We have appointed experienced individuals with diverse skillsets to complement the Board’s current skills and experience.’

Magnis continues hiring spree

Today’s ASX update follows Magnis hiring battery experts to lead production at Magnis’s New York lithium-ion battery plant.

As I covered a few weeks back, Tesla’s first engineer at Tesla’s Gigafactory in Nevada was hired by Magnis as the battery plant’s chief executive officer.

The key appointments at Magnis’s Imperium3 New York (iM3NY) lithium-ion battery plant started immediately with the goal to start production in late 2021.

What does this mean for the MNS share price?

Magnis’s recent announcements aim to tell investors that the company is working with industry experts across the world to deliver on its projects’ promises.

According to Magnis Chairman Frank Poullas, the skillsets of today’s appointees will ‘assist with a potential US listing of iM3NY, financing of the Townsville battery plant, global expansion for cell manufacturing, targeted promotion of the company into fund managers, ESG and impact funds and higher internal levels of corporate governance.’

Of course, every company wishes to assemble the right people with the right skillsets.

No doubt Magnis’s peers will also seek to bolster their boards and executive teams with industry experience and expertise.

Therefore, while today’s update will be encouraging for investors as Magnis is showing it’s doing what’s necessary, investors will still be on the lookout to see if that proves sufficient.

If you are interested in finding out more about lithium stock investment opportunities, then do make sure to check out this free report.

The report reveals three stocks that could surge on the back of renewed demand for lithium in 2021. It is free to download right now.

Regards,

Lachlann Tierney,

For Money Morning

Comments