Investment Ideas From the Edge of the Bell Curve

Live ASX Updates | ASX Ends Lower But Tech Stocks Rally

ASX closes lower but tech stocks surge

The ASX 200 ended 0.01% lower on Thursday, surrendering early morning gains that saw the benchmark rise as much as 0.5%.

The benchmark was dragged down by the energy and materials sectors, with the S&P/ASX Energy index ending the day 2.2% lower.

Yet tech stocks ended sharply higher, with the S&P/ASX Information Technology index rising 1.9%.

At market close, the biggest gainers were:

- Tyro Payments (ASX:TYR), up 17.5%

- Marley Spoon (ASX:MMM), up 13%

- Pointsbet (ASX:PBH), up 11.5%

- Cettire (ASX:CTT), up 10%

- Sayona Mining (ASX:SYA), up 10%

- Life360 (ASX:360), up 9.6%

- Freelancer (ASX:FLN), up 9%

- Myer (ASX:MYR), up 9%

- Block (ASX:SQ2), up 8.9%

- Nuix (ASX:NXL), up 8%

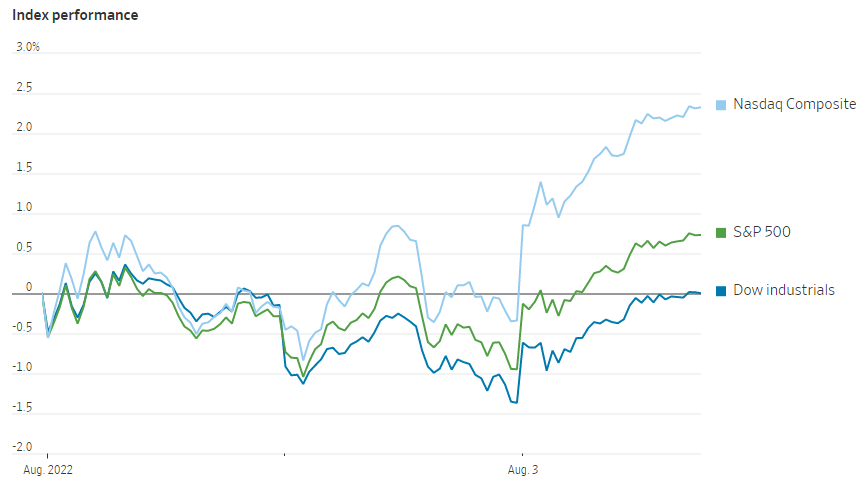

Nasdaq in a bull market?

The tech-heavy Nasdaq Composite gained 2.6% overnight, propelling local Aussie tech stocks higher on Thursday.

Nasdaq’s lift overnight brings it close to bull market territory.

The index is up 19% from its closing low on 16th of June and 20% from its intraday low on the same day, pointed out research firm Bespoke.

It's a bull market (almost).

The Nasdaq is up 19% from its closing low on 6/16 and 20% from its intraday low on the same day.

— Bespoke (@bespokeinvest) August 3, 2022

RBA: Index of Commodity Prices falls in July

The Reserve Bank of Australia reported earlier this week that preliminary estimates for July indicate the Index of Commodity Prices fell 8.5% on a monthly average basis, after falling 2.8% in June.

The index still remains historically elevated.

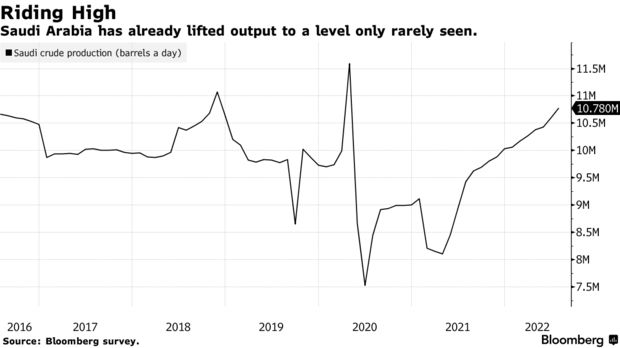

ICYMI: OPEC+ agrees small oil output hike

ICYMI: OPEC+ agreed overnight to raise its output … but the hike was one of the smallest oil production increases in its history.

The oil cartel will only add about 100,000 barrels a day of oil in September.

Rob McNally, president of Rapidan Energy Group, told Bloomberg it was the smallest quota increase since 1986 in absolute terms.

From a global balance perspective, today’s minuscule quota increase — the smallest since 1986 in absolute terms and smallest ever in percentage terms — is noise. Though, if pump prices keep falling, the White House will likely claim credit.

Bloomberg commodities journalist Javier Blas put the OPEC+ ‘hike’ in context:

The OPEC+ increase isn’t real, either, as most member are already pumping at their maximum capacity. Only Saudi Arabia and the UAE can increase. If they adhere to their quotas, the 100,000 b/d translates in an extra 26,000 b/d for Riyadh and 8,000 b/d for Abu Dhabi.

Let’s put the 26,000 b/d Saudi increase into context: the kingdom’s quota for Sept is 11.006m b/d.

That’s ~7,650 barrels per minute. So Riyadh would produce the extra oil in about three minutes and a half. A bit longer that a fist bump greeting, but not a lot longer.

Let's put the 26,000 b/d Saudi increase into context: the kingdom's quota for Sept is 11.006m b/d. That's ~7,650 barrels per minute. So Riyadh would produce the extra oil in about three minutes and a half. A bit longer that a fist bump greeting, but not a lot longer | #OOTT 4/4

— Javier Blas (@JavierBlas) August 3, 2022

Hedge fund Tiger Global loses big in second quarter

Hedge fund Tiger Global — founded by ‘Tiger cub’ Chase Coleman — posted heavy losses in the second quarter, hurt badly by the tech sell-off.

The Financial Times reported that a long-only fund managed by Tiger Global ended the latest quarter down 63.6% after fees.

The firm’s flagship fund didn’t fare much better, ending the first half of the year down 50% after fees.

In a letter sent to investors and seen by FT, a humbled Tiger Global reflected:

In reflection on the first half of the year, it is clear we underestimated the impact of rising global inflation and entered 2022 with too much exposure.

This time, however, we did not appreciate how unique the circumstances were that enabled inflation to rise and persist.

https://www.ft.com/content/87347d49-390d-408b-9059-2e5a42b5787c

Sayona Mining ‘on track’ to recommence production in Q1 2023

Lithium junior Sayona Mining (ASX:SYA) said it was on track to recommence spodumene production in Q1 2023 at the North American Lithium (NAL) operation in Quebec.

Sayona said the NAL operation has ‘picked up speed’, with about 30% of plant and equipment upgrades completed.

SYA reported that construction work is on schedule, with 50 construction workers on site, with that number to double by September.

Sayona has committed about $100 million to the restart.

Having started the June quarter with $19.8 million in cash, Sayona ended the quarter with $195.7 million after issuing over $190 million in new shares.

SYA shares are currently up 5% and up 55% year to date. Having traded as high as 39 cents in April, the lithium stock is now exchanging hands for 20 cents.

Anson Resources reports ‘further increases’ in lithium grades at Paradox

Junior lithium developer Anson Resources (ASX:ASN) reported a ‘further major increase in lithium assay grades’ as part of its drilling campaign at the Paradox Lithium Project in Utah, USA.

Anson said drilling at one of the wells returned lithium grades ‘up to 70% higher’ than previously reported in fast-track assays in July.

ASN said an upgraded JORC Indicated and Inferred Resource is ‘planned to be confirmed in near future‘.

Anson talked up the ‘unique’ location of its Utah project, stating:

The three factors; high pressure, porosity (both horizontal and vertical) and shallow depth are key attributes of the Project and are not present anywhere else in the area. In combination, they provide strong indicators of low extraction costs and beneficial ESG outcomes.

ASN shares are currently up 8% but down 4% year to date.

Raiz sees FUM ‘rise sharply’ in July

Fintech Raiz Invest (ASX:RZI) reported a 5.8% rise in global funds under management (FUM) in July.

Global FUM rose to $1 billion in July, from $954 million in June.

RZI first achieved the $1 billion FUM mark late last year.

Global FUM is down 2.2% on a three-month basis.

RZI managing director George Lucas pointed to a ‘pick-up in market sentiment‘:

The pick-up in market sentiment after the heavy selling in the April-June quarter due to inflationary fears and disruptive macroeconomic events saw FUM rise sharply by 5.8% to $1.01 billion – back above the $1 billion benchmark first achieved late last year.

Active Customer numbers also increased in Australia, Malaysia, and Indonesia, with the latter recording the biggest increase at 2.6% to 259,944.

Although the Indonesian and Malaysian FUM numbers only comprise a small percentage of total FUM, we are pleased to present these numbers for the first time, confident they will steadily grow.

While Lucas noted the big increase in active customers for RZI’s Indonesia segment, the 259,944 active customers accounted for a total FUM of $910,000, with the average account of $3.52.

RZI’s Australia segment continues to have the largest average account, totaling $3,423. Australia’s total FUM came in at $995.7 million in July, down 2.3% on a three-month basis.

Flight Centre the most shorted ASX stock in July

Flight Centre (ASX:FLT), Betmakers (ASX:BET), and Block (ASX:SQ2) were the most shorted stocks on the ASX at the end of July.

Lithium developer Lake Resources (ASX:LKE) and BNPL firm Zip (ASX:ZIP) also featured in the top ten.

Most shorted #stocks on the #ASX at the end of July:

– $FLT with 15.2% shares reported as short

– $BET with 12.1%

– #SQ2 with 11.4%

– $NAN with 11.4%

– $LKE with 10.2%

– $RRL with 9.4%

– $ZIP with 9%

– $EML with 8.5%

– $MSB with 8.2%

– $PNV with 8.2%— Fat Tail Daily (@FatTailDaily) August 4, 2022

ASX midday winners and losers

The biggest gainers on the ASX at midday:

- Myer (ASX:MYR) up 15%

- Marley Spoon (ASX:MMM) up 15%

- Tyro Payments (ASX:TYR) up 12%

- Family Zone Cyber Safety (ASX:FZO) up 10%

- Imugene (ASX:IMU) up 10%

- Block (ASX:SQ2) up 9.5%

- Cettire (ASX:CTT) up 8%

The biggest losers on the ASX at midday:

- Orica (ASX:ORI) down 10%

- Frontier Digital Ventures (ASX:FDV) down 7%

- Graincorp (ASX:GNC) down 5%

- New Energy Solar (ASX:NEW) down 4%

- Lynas Rare Earths (ASX:LYC) down 4%

- Adriatic Metals (ASX:ADT) down 4%

BNPL stocks open higher

ASX BNPL stocks opened sharply higher on Thursday morning as the sold-off sector continues an unexpected rally.

- Laybuy (ASX:LBY) is up 13%

- Block (ASX:SQ2) is up 10%

- Openpay (ASX:OPY) is up 10%

- Sezzle (ASX:SZL) is up 6.5%

- Zip (ASX:ZIP) is up 5.5%

- IOUpay (ASX:IOU) is up 4.7%

- Splitit (ASX:SPT) is up 4%

The big rally in BNPL stocks has sparked questions about its causes.

Are BNPL stocks viable going concerns? Can their business model be sustainable? And is the recent rally characteristic of bear market behaviour or is this a legitimate turnaround?

Are the recent spikes in #BNPL stocks like $ZIP and $SZL a …

— Fat Tail Daily (@FatTailDaily) July 28, 2022

Block, EML, Zip, Life360 open higher

Aussie tech stocks are leading the ASX higher on Thursday.

Leading the way were Block (ASX:SQ2), EML Payments (ASX:EML), and Zip (ASX:ZIP).

- Block is currently up 9%

- EML is currently up 6%

- Zip is currently up 6%

- Life360 is currently up 5.8%

- Pointsbet is currently up 5%

- Megaport is currently up 5%

ASX 200 opens 0.5% higher on strong gains in tech

The S&P/ASX 200 opened 0.5% higher on Thursday, boosted by strong gains in the tech sector.

The S&P/ASX Information Technology index opened 2.3% higher today, bringing its 1-month gains to 18%.

The S&P/ASX Consumer Discretionary index opened 1.2% higher this morning, bringing its 1-month gains to 7%.

The S&P/ASX Materials, S&P/ASX Energy and S&P/ASX Consumer Staples indexes all opened lower on Thursday.

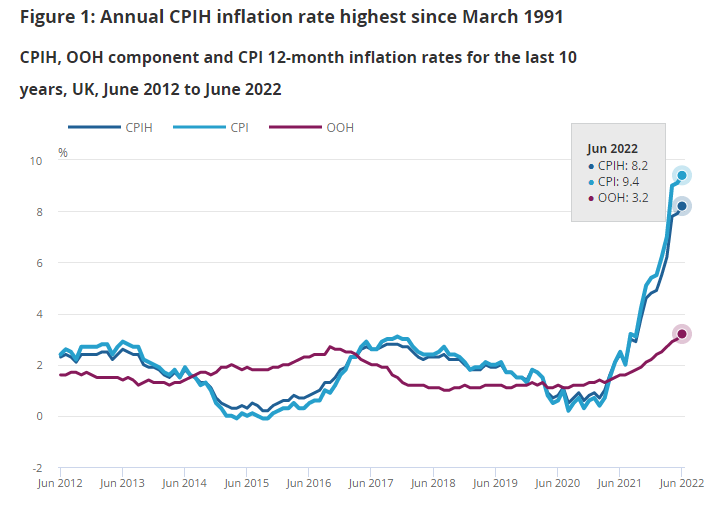

Bank of England considers biggest rate rise in more than 25 years

The Bank of England will announce its monetary policy decision today.

Commonwealth Bank analysts forecast the BoE to raise the bank rate by 0.5% to 1.75%, noting that ‘CPI inflation remains very high, the labour market is tight and wages growth is strong.’

UK inflation reached 9.4% in June on an annualised basis.

The BoE has raised interest rates in 0.25% increments since December but flagged it will act ‘forcefully’ if required to combat rampant inflation.

Renewables are deflationary

While much of the rhetoric about the energy transition has been centred on climate, make no mistake, this is driven by economics.

Renewables are deflationary.

The cost of renewables comes from investing upfront, but once that infrastructure is built, you can catch energy from the sun and wind.

On the other hand, fossil fuels get more expensive the further you have to dig to get them. Not to mention they are subject to energy shocks like the one today.

Renewables are now the cheapest source of energy in history and deploying them faster should help curb inflation.

It’s good to see that countries are starting to realise this.

Read more here.

https://www.moneymorning.com.au/20220803/inflation-killer.html

ASX set to rise as US stocks rally overnight

Aussie stocks are poised to edge higher on Thursday after US stocks rose overnight.

The major US indexes posted their first green session in August.

- The S&P 500 closed 1.6% higher

- The Dow Jones Industrial Average closed 1.3% higher

- The tech-heavy Nasdaq Composite closed 2.6% higher

The market did not seem fazed by US House Speaker Nancy Pelosi’s Taiwan visit, despite strong warnings from China.

US stocks were also bolstered by a positive economic report which showed the US services sector continued to grow in July.

The Institute for Supply Management’s index showed conditions for businesses like restaurants, hotels, and retailers hit a 3-month high in July.

Key Posts

-

5:00 pm — August 4, 2022

-

4:37 pm — August 4, 2022

-

4:19 pm — August 4, 2022

-

4:11 pm — August 4, 2022

-

2:48 pm — August 4, 2022

-

2:28 pm — August 4, 2022

-

2:13 pm — August 4, 2022

-

2:03 pm — August 4, 2022

-

1:39 pm — August 4, 2022

-

12:07 pm — August 4, 2022

-

10:58 am — August 4, 2022

-

10:34 am — August 4, 2022

-

10:23 am — August 4, 2022

-

10:14 am — August 4, 2022

-

10:00 am — August 4, 2022

-

9:49 am — August 4, 2022

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2026 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988