Investment Ideas From the Edge of the Bell Curve

ASX Today — Live ASX News | XJO Rises, Liontown Soars on Albermarle Bid

Liontown Resources closes 68% higher but questions emerge about disclosure

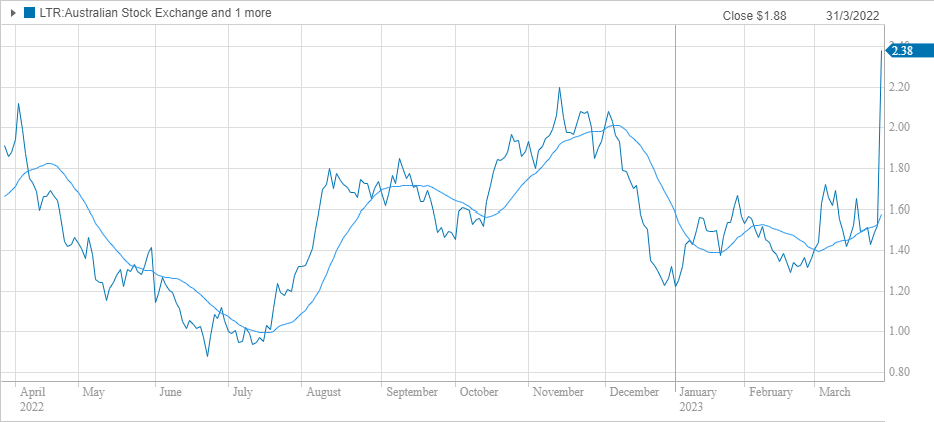

Budding lithium developer Liontown Resources (ASX:LTR) finished Tuesday up 68%, hitting a new all-time high of $2.57, following a takeover bid from lithium behemoth Albermarle.

Liontown actually ended the day higher than Albermarle’s rejected bid of $2.50 a share, suggesting investors are predicting a bidding way or an upped Albermarle offer.

But Albermarle already raised its price multiple times, having lobbed a bid at $2.20 a share last October and then a $2.35 a share bid earlier this month.

These earlier bids raise questions about Liontown’s disclosure practices.

Should the developer have disclosed the rejected bids earlier?

Note, too, that Liontown chairman Timothy Goyder bought 1 million LTR shares on 20 January 2023, a few months after Albermarle’s first offer and two months before Albermarle’s second and third.

Binance and its CEO sued by CFTC

Another big crypto exchange is in regulators’ crosshairs. This time it’s the world’s biggest crypto exchange, Binance.

The Commodity Futures Trading Commission is suing both Binance and its chief executive Changpeng Zhao over alleged regulatory violations.

The regulator will argue in court that Binance broke US derivatives rules and should have been registered with the CFTC years earlier.

In a statement, the CFTC said:

“The complaint charges that Binance Holdings Limited, Binance Holdings (IE) Limited, and Binance (Services) Holdings Limited (together, Binance) operate the Binance centralized digital asset trading platform along with numerous other corporate vehicles through an intentionally opaque common enterprise, with Zhao at the helm as Binance’s owner and chief executive officer. The defendants allegedly chose to knowingly disregard applicable provisions of the CEA while engaging in a calculated strategy of regulatory arbitrage to their commercial benefit.

“In its continuing litigation against the defendants, the agency seeks disgorgement, civil monetary penalties, permanent trading and registration bans, and a permanent injunction against further violations of the CEA and CFTC regulations, as charged.”

CFTC’s Gretchen Lowe was forceful in her summation of Binance’s conduct:

“The defendants’ own emails and chats reflect that Binance’s compliance efforts have been a sham and Binance deliberately chose – over and over – to place profits over following the law.”

Binance’s chief executive Changpeng Zhao — also known as CZ — said in a statement the CFTC’s complaint was an ‘incomplete recitation of facts’, disagreeing with the regulator’s characterization of ‘many of the issues alleged’.

He went on:

“Binance.com does not trade for profit or “manipulate” the market under any circumstances. Binance “trades” in a number of situations. Our revenues are in crypto. We do need to convert them from time-to-time to cover expenses in fiat or other crypto currencies. We have affiliates that provide liquidity for less liquid pairs. These affiliates are monitored specifically not to have large profits.

“Personally, I have two accounts at Binance: one for Binance Card, one for my crypto holdings. I eat our own dog food and store my crypto on Binance.com. I also need to convert crypto from time-to-time to pay for my personal expenses or for the Card.“

My Response to the CFTC Complaint | Binance Blog https://t.co/TadyotM7HN

— CZ 🔶 BNB (@cz_binance) March 27, 2023

Bloomberg’s Matt Levine was intrigued by the regulator’s legal angle:

“The CFTC’s complaint here gestures at traditional regulatory concerns like retail customer protection and cracking down on money laundering. But it is mostly about cutting off a big international crypto exchange from big sophisticated proprietary market-making firms in the US. I think the market expectation here was that if you are a big trading firm trading with your own money and your own algorithms, and you have enough lawyers and offshore shell entities, you can trade on any crypto exchange in the world from the comfort of your Chicago office: There might be a technical argument that it’s not allowed, but your lawyers are aggressive and sophisticated enough to get around that technicality, and anyway why would the CFTC care? But the CFTC does care, perhaps not because it wants to protect big US high-frequency trading firms from the risks of trading on Binance, but because Binance is the biggest crypto exchange and this is a lever to crack down it.”

The rule of thumb: If it hurts when you kick it, it’s probably Money Stuff. https://t.co/symmWypeGI

— Matt Levine (@matt_levine) March 27, 2023

FDIC chairman testifies on the state of the US banking system following failure of SVB

Michael S. Barr was not the only high ranking US official testifying before the US Committee on Banking, Housing, and Urban Affairs overnight.

Federal Deposit Insurance Corporation chairman Martin J. Gruenberg also addressed the committee and submitted a 20-page testimony outlining his thoughts on the turmoil triggered by the collapse of Silicon Valley Bank.

Gruenberg wanted it known at the outset Silicon Valley Bank and Signature Bank ‘were allowed to fail’.

‘Shareholders lost their investment. Unsecured creditors took losses. The boards and the most senior executives were removed,’ the FDIC chairman continued.

The FDIC, along with the Fed and the US Treasury, acted to protect depositors of these banks because of the ‘possibility of a contagion effect on other banks’.

Gruenberg said his organisation will release a report by May 1, 2023, outlining policy options related to ‘deposit insurance coverage levels, excess deposit insurance, and the implications for risk-based pricing and deposit insurance fund adequacy.’

You can read his full testimony here.

US Fed’s Michael S. Barr on why Silicon Valley Bank failed

Why did Silicon Valley Bank fail?

Why not hear it from the Vice Chair for Supervision of the Board of Governors of the Federal Reserve — Michael S. Barr.

In prepared remarks before the US Senate Committee on Banking, Housing, and Urban Affairs, Barr laid down his explanation of the bank’s failure:

‘To begin, SVB’s failure is a textbook case of mismanagement. The bank had a concentrated business model, serving the technology and venture capital sector. It also grew exceedingly quickly, tripling in asset size between 2019 and 2022. During the early phase of the pandemic, and with the tech sector booming, SVB saw significant deposit growth. The bank invested the proceeds of these deposits in longer-term securities, to boost yield and increase its profits.3 However, the bank did not effectively manage the interest rate risk of those securities or develop effective interest rate risk measurement tools, models, and metrics.

‘At the same time, the bank failed to manage the risks of its liabilities. These liabilities were largely composed of deposits from venture capital firms and the tech sector, which were highly concentrated and could be volatile. Because these companies generally do not have operating revenue, they keep large balances in banks in the form of cash deposits, to make payroll and pay operating expenses. These depositors were connected by a network of venture capital firms and other ties, and when stress began, they essentially acted together to generate a bank run.’

Barr continued:

‘The bank waited too long to address its problems, and ironically, the overdue actions it finally took to strengthen its balance sheet sparked the uninsured depositor run that led to the bank’s failure. Specifically, on Wednesday, March 8, SVB announced that it realized a $1.8 billion loss in a sale of securities to raise liquidity and planned to raise capital during the following week. Uninsured depositors interpreted these actions as a signal that the bank was in distress. They turned their focus to the bank’s balance sheet, and they did not like what they saw.

‘In response, social media saw a surge in talk about a run, and uninsured depositors acted quickly to flee. Depositors withdrew funds at an extraordinary rate, pulling more than $40 billion in deposits from the bank on Thursday, March 9. On Thursday evening and Friday morning, the bank communicated that they expected even greater outflows that day. The bank did not have enough cash or collateral to meet those extraordinary and rapid outflows, and on Friday, March 10, SVB failed.

‘Panic prevailed among SVB’s remaining depositors, who saw their savings at risk and their businesses in danger of missing payroll because of the bank’s failure.’

You can read the full speech here.

Contrarian investing and the commodities opportunity

‘Where all men think alike,’ wrote Walter Lippmann, ‘no one thinks very much.’

And in times of confusion, fear, and panic, thinking tends to coalesce into herd mentality.

In these times, independent thinking — contrarian thinking — stands out.

In markets, this independence can also offer opportunities for the intrepid thinker.

As our Editorial Director Greg Canavan recently wrote in a piece for The Insider:

‘To survive in these markets, you need to think like a contrarian. That could be difficult because not everyone is a contrarian. As humans, we prefer to seek safety in the herd rather than standing alone, exposed.

‘But what promotes survival in humans risks extinction — or at least a slow death — in financial markets. Following the herd mindlessly can end up being very costly.

‘So it’s important to stay rational while others are losing their minds. In times of heightened uncertainty, like you’re seeing now, being rational is the same as thinking like a contrarian.’

And the commodities sector is shaping up to be an arena where the contrarian investor can apply themselves.

https://www.moneymorning.com.au/20230328/contrarian-investing-and-the-commodities-opportunity.html

February Australian retail sales in line with market expectations, up 0.2% month-on-month

The latest retail sales data has just been published by the ABS.

Australian retail sales for February rose 0.2% month on month, following a 1.8% rise in January.

ABS’s Ben Dorber described the retail turnover as ‘modest’:

‘On average, retail spending has been flat through the end of 2022 and to begin the new year.’

Australian retail sales for Feb comes in right on market expectations at 0.2%mom, coming after a rebound in January. Signs of retail slowdown are evident but not a red flag for the #RBA to pause next week pic.twitter.com/I0ZkjRmDc0

— Alex Joiner 🇦🇺 (@IFM_Economist) March 28, 2023

Liontown hits all-time high on Albermarle bid

Liontown Resources has hit an all-time high on the back of rejecting Albermarle’s takeover bid priced at $2.50 a share.

LTR shares hit $2.42 in late morning trade, up 55% from yesterday’s close.

Despite the spike, the lithium stock is up roughly 26% over the past 12 months.

Lithium stocks spike on Liontown news

Albermarle’s bid for Liontown Resources rippled across the ASX lithium sector.

The bid stoked buying in other lithium stocks, stocks that have struggled recently.

- Liontown Resources is up 50%

- Core Lithium is up 18%

- Pilbara Minerals is up 14%

- Argosy Resources is up 12.5%

- Sayona Mining is up 12%

- Allkem is up 11%

- Ioneer is up 11%

- Lake Resources is up 10.5%

- Leo Lithium is up 8.5%

- Galan Lithium is up 8%

- IGO is up 6.5%

- Vulcan Energy is up 5%

Albermarle's rejected takeover bid for $LTR sparked a rally in #ASX lithium stocks. $LTR $CXO $PLS $SYA $AKE $LKE $AGY $INR $LLL $GLN $IGO $VUL https://t.co/FiKXvsJFCC pic.twitter.com/fCcMVa90GB

— Fat Tail Daily (@FatTailDaily) March 28, 2023

Liontown Resources surges 50% on Albermarle takeover bid

The lithium heavyweights are coming for Aussie developers.

Albermarle — one of the world’s largest lithium producers — is eyeing off ASX developer Liontown Resources (ASX:LTR).

But Liontown is holding firm, for now.

LTR revealed today it received multiple takeover bids from Albermarle, the latest one coming in at $2.50 a share via a scheme arrangement.

Earlier offers came in at $2.20 a share in October last year and $2.35 a share on March, 3rd.

After ‘carefully considering’ the latest bid, Liontown’s board unanimously determined the offer ‘substantially undervalues Liontown’, rejecting Albermarle for a third time.

$LTR is up 50% after rejecting #Albermarle's takeover bid priced at $2.50 a share. #lithium #ASX #ausbiz pic.twitter.com/R2Iniid54l

— Fat Tail Daily (@FatTailDaily) March 28, 2023

Key Posts

-

4:52 pm — March 28, 2023

-

3:32 pm — March 28, 2023

-

3:22 pm — March 28, 2023

-

11:58 am — March 28, 2023

-

11:53 am — March 28, 2023

-

11:50 am — March 28, 2023

-

11:43 am — March 28, 2023

-

11:15 am — March 28, 2023

-

11:04 am — March 28, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988