Investment Ideas From the Edge of the Bell Curve

ASX Today: Live ASX News | Pointerra and Dubber Sink, Mayne Pharma Spikes

Pushpay requests trading halt pending proxy vote on taking the fintech private

Donor management fintech Pushpay (ASX:PPH) requested a trading halt on Wednesday pending a material announcement in relation to a shareholder vote on the scheme of arrangement that, if approved, would see Pegasus BidCo acquire Pushpay.

Last week, three Pushpay shareholders let it be known they intend to vote against taking the fintech private, bucking the unanimous recommendation of Pushpay’s non-conflicted directors.

Pushpay management later said the total percentage shareholding between the trio intending to vote against the scheme was about 12%.

For the acquisition to go through, over 75% of the ‘votes of shareholders in each interest class who are entitled to vote and actually vote must be voted in favour of the Scheme’ and more than 50% of the total number of Pushpay shares on issue must be voted in favour of the Scheme.

Arizona Lithium settles Big Sandy claims dispute

Lithium junior Arizona Lithium (ASX:AZL) settled a claims dispute relating to its Big Sandy lithium project in the US.

The dispute concerned ‘certain federal unpatented mining claims’ in Arizona with Bradda Head Lithium (BHL).

In a confidential settlement, Arizona and Bradda Head agreed on a claim exchange, foregoing litigation.

The terms of this exchange include AZL transferring 66 federal lode unpatented mining claims to BHL with BHL transferring 55 claims to AZL.

Arizona Lithium said the transfer of the 66 claims to BHL ‘will not have any material effect on the development of the Big Sandy lithium project’.

So why the long-running dispute, initiated in 2021?

Labour market concentration hurting wages growth: RBA research

Why is wages growth low in Australia?

In a research discussion paper, the Reserve Bank’s Jonathan Hambur suggests rising labour market concentration is partly to blame.

A concentrated labour market impinges competition for labour, hampering wages growth.

Additionally, slower business creation growth exacerbates firm concentration. When new businesses spring up, they seek out labour, improving workers’ bargaining power.

When business entry is low, workers’ bargaining power withers.

Hambur writes:

“Declining firm entry and dynamism appear to have contributed to the increased impact of concentration, and lower wages growth, by lowering competition for labour among incumbent firms. Declining union coverage and occupational mobility may also have played a role, but declining firm entry appears to have been the main driver.”

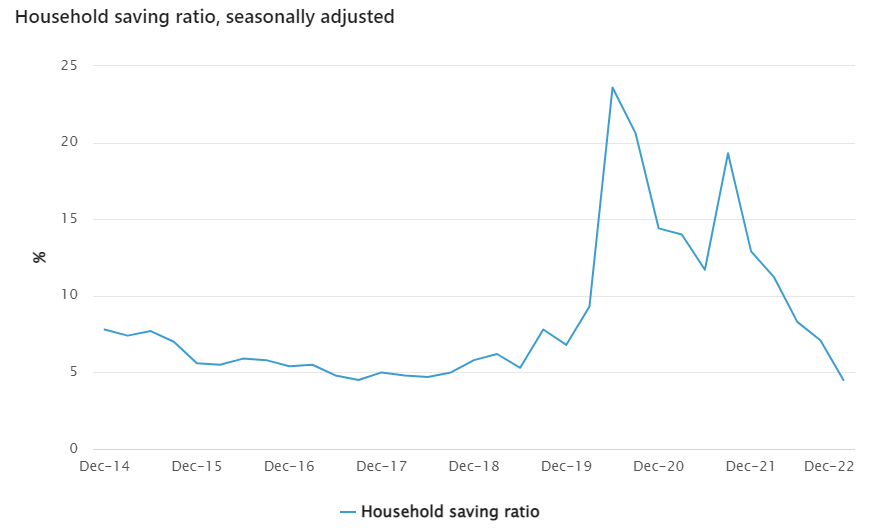

Australia’s household saving ratio continues to fall

Our household savings are dwindling.

In its latest release, the Australian Bureau of Statistics noted household saving to income ratio fell for the fifth straight quarter, down from 7.1% to 4.5%.

Gross disposable income fell in the December quarter even as compensation of employees picked up.

Australia’s household saving ratio is now at the lowest level since September 2017.

ABS’s Katherine Keenan said the retrenchment was driven by higher mortgage interest payments, higher income tax charges, and higher spending.

Source: ABS

Monthly CPI up 7.4%, economic activity up 0.5% in December quarter

The ABS released two big updates today: CPI data for the month of January and Australia’s GDP data for the December quarter.

Let’s start with GDP.

Australia’s gross domestic product rose less than expected, by 0.5%, in the December quarter. GDP grew 2.7% through 2022. GDP growth has slowed for two quarters running now.

Household spending did a lot of the work in propping up GDP, rising 0.3% in the quarter.

The ABS said household spending was dominated by spending on food; hotels, cafes, and restaurants; and transportation.

Real GDP growth for Q4 disappoints expectations coming in much weaker than expected. Notable that population growth has accelerated meaning that per capita growth is flat. The slow down is clearly in train. pic.twitter.com/tnvDr2MBs9

— Alex Joiner 🇦🇺 (@IFM_Economist) March 1, 2023

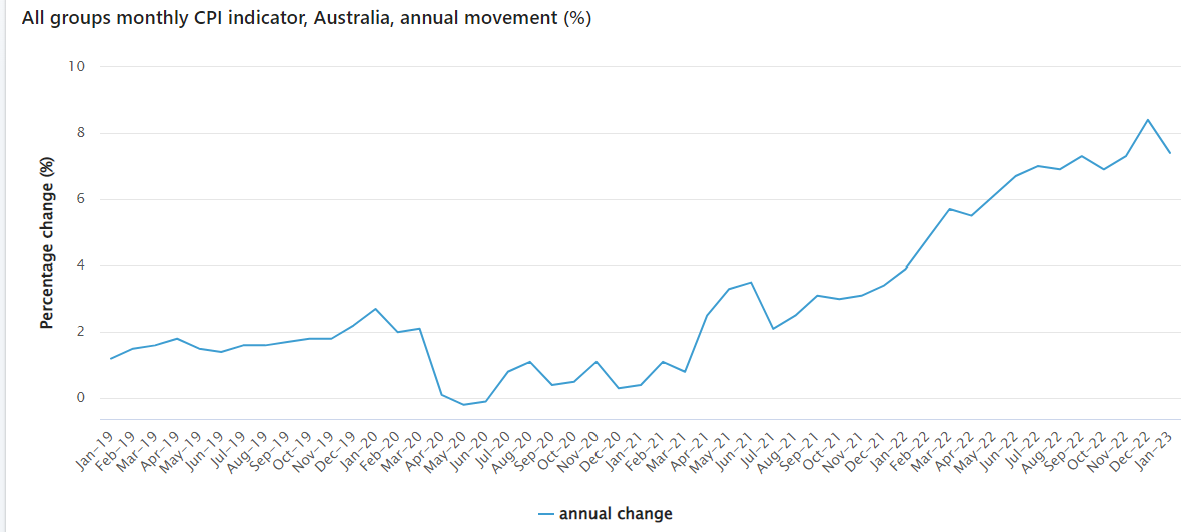

Now for the monthly inflation data.

The monthly CPI indicator rose 7.4% in the year to January 2023. That’s lower than the substantial 8.4% rise for the year to December 2022 but still elevated.

The 7.4% reading is the second highest annual increase since the ABS started calculating monthly CPI data in September 2018.

Excluding holiday travel, the monthly CPI indicator rose 6.7% in the year to January 2023, down from 7.4% in December 2022.

Source: ABS

When an 89% salary raise isn’t what it’s cracked up to be

Would you like an 89% salary increase this year?

Who wouldn’t, right? Everyone can use extra cash.

Well, in December 2022, the average yearly salary increase hit 89%.

As you may have figured out, I am not talking about wages in Australia…but Argentina.

While an 89% salary increase may seem like a lot, the annual consumer price index in Argentina hit 94.8% in December, up from ‘just’ 50.7% in January 2022.

So even with an average 89% increase in salaries in 2022, workers in Argentina lost purchasing power to inflation.

Numbers may vary, but it’s a similar story here in Australia.

According to Seek, on average, advertised salaries increased by 4.4% year-on-year to January 2023. Workers that saw the largest increases were in the trades and services sector, with wage growth hitting a whopping 6.3% in the 12 months to January 2023.

It may sound high, but keep in mind that these increases aren’t keeping up with the 7.8% inflation rate.

Inflation is a real wealth killer, a hidden tax. And inflation can quickly erode your salary and your savings.

I don’t say this lightly.

Growing up in Argentina, I saw first-hand the devastating effects of inflation and hyperinflation.

Once people received their pay at the beginning of the month, they would rush to the supermarket to buy groceries for the month. By the end of the month, their salary was worth less, much less.

That’s why they would also face large queues at the banks…to exchange their money into US dollars.

You see, that was the only way to keep the value of your salary until the next pay cheque. But it was all a vicious cycle, the fact that people were getting rid of their Argentinean currency would feed inflation even more.

Argentina has been battling high inflation for decades.

Still, for governments, inflation has a silver lining…

https://www.moneymorning.com.au/20230301/why-youd-hate-this-89-salary-raise.html

Pointerra in perilous cash position

Pointerra’s balance sheet is in duress.

For one, Pointerra’s equity has been obliterated and is in negative territory after 1H23’s net loss.

The business now has negative net assets of $242,000.

As a result, its working capital position is parlous. Total current liabilities of $3.7 million exceed total current assets of $3.3 million.

Pointerra management are unfazed.

The company’s directors prepared a cash flow forecast which indicated Pointerra will have ‘sufficient cash flows to meet all commitments and working capital requirements for the 12-month period’ from today.

#3DP's equity has been obliterated and is negative after 1H23’s net loss.#Pointerra now has negative net assets of $242,000.

As a result, its working capital position is parlous. Total current liabilities of $3.7 million exceed total current assets of $3.3 million.#ASX pic.twitter.com/9fxhFI647I

— Fat Tail Daily (@FatTailDaily) March 1, 2023

While the directors are unfazed, the auditors are jittery, stating in the 1H23 accounts that a “material uncertainty exists that may cast significant doubt on the Consolidated Entity‘s ability to continue as a going concern.”

Pointerra down 20% on 1H23 results

Releasing its half-year accounts late yesterday didn’t stave off the reckoning today, with Pointerra (ASX:3DP) shares down ~20% in afternoon trade on Wednesday.

3D geo-spatial data firm Pointerra saw 1H23 revenue grow 20% to $3.8 million but net losses widen 33% to $3.2 million.

Revenue growth has slowed, with 1H22 revenue rising 104% on 1H21.

Pointerra said 1H23 revenue was lower than expected, affected by ‘unavoidable program delays with key US customers, expected to resolve during H2’.

Management expects 2H23 to ‘recover lost ground’, keeping a ‘positive outlook for the balance of H2 and into FY24’.

One thing that popped out in the 1H23 accounts was this:

While revenue rose about 20%, admin expenses rose nearly 150%.

The jump in admin expenses largely stemmed from higher employee benefit expenses and $1.2 million in consulting fees.

14% of Sezzle’s income driven by one merchant

Yesterday, buy now, pay later firm Sezzle released its 1Q and FY22 results to the ASX.

But since Sezzle is also a reporting company in the US, it also has to file a more comprehensive US SEC 10-K report, which it did today.

Plenty of information was already covered in Sezzle’s ASX release, but some information was new.

Like the fact that for the year ended December 2022, about 14% of Sezzle’s total income came from one merchant. Last year, no merchant drove more than 10% of Sezzle’s total income.

That’s obviously a precarious position from a risk-management perspective, which Sezzle itself admitted:

“The concentration of a significant portion of our business and transaction volume with a limited number of scaled e-commerce platforms exposes us disproportionately to any of those partners choosing to no longer partner with us or choosing to partner with a competitor, and to any events, circumstances, or risks affecting such partners. In addition, a material modification in the financial operations of any significant scaled e-commerce partner could affect the results of our operations, financial condition, and future prospects.”

With BNPL becoming ever more commoditised, the risk is real that this unnamed merchant switches to a competitor or even just renegotiates better rates, hurting income in either scenario.

In its 10-K, $SZL said 14% of its total income for the year ended December 2022 came from one merchant. Last year, no merchant drove more than 10% of #Sezzle’s total income.

76% of its customers are Gen Z and Millennial. #ASX #ausbiz #BNPL pic.twitter.com/nbQCefBbgP

— Fat Tail Daily (@FatTailDaily) March 1, 2023

Dubber’s cash flow risk

Dubber’s $37 million 1H23 net loss brings its total accumulated losses to $222 million. Its market cap is $95 million, by the way.

The key risk with Dubber is liquidity.

The firm ended the half with $26.7 million in cash and cash equivalents, down substantially from $108.5 million at the end of 1H22.

That cash won’t last long if Dubber keeps up its spending.

1H23 free cash flow was a negative $27 million. Meaning if the trend holds true, Dubber will run out of cash by the end of this fiscal year.

Dubber’s management thinks the business has ‘adequate resources to continue as a going concern for not less than 12 months’, saying it has $30 million in cash at call deposits:

“At 31 December 2022 the Group has cash and deposits totaling $56,723,235, however during the 6 month period the entity recorded a loss before tax of $36,898,661 (6 months to 31 December 2021: $31,727,597) and incurred net cash outflows from operating activities of $26,406,243 (6 months to 31 December 2021: $20,223,199). The Group’s ability to continue as a going concern is dependent upon its ability to substantially improve its operating cash flows in the short term. To achieve this the Group is undertaking a restructuring programme announced on 28 February 2023 to focus the business on core priorities as set out below and forecasts sufficient cash savings that, together with existing available cash, it will be able to fund its operations and continue as a going concern for the next 12 months.”

Dubber downer — $37m 1H23 loss prompts business restructure

Dubber (ASX:DUB) — provider of call recording and audio management services — is down over 9% on Wednesday morning after the market digested its 1H23 accounts released after-hours yesterday.

1H23 revenue fell 13% to $14 million while losses rose 18% to $37 million. Dubber blamed this ‘principally … on revenues in the first half of FY22 that were reversed in the second half of FY22 due to the change in the company’s interpretation of accounting standards.’

But Dubber said its ‘adjusted recurring revenue’ paints a different picture, growing 21%.

This adjusted figure ‘excludes one-time revenues/income (such as professional services fees) and is adjusted to remove any revenues recorded in a quarterly period that have been subsequently reversed due to changes in the Company’s interpretation of accounting standards.’

Accounting standards featured heavily in Dubber’s half-yearly!

Dubber also announced it will restructure its business following a review. The restructure ‘re-aligns its operations more closely to its core strategy’, Dubber said.

This realignment is expected to deliver ‘in excess of $5 million in savings per quarter without impacting the company’s revenue growth potential or customer service’.

The restructure will entail redundancies.

Steve McGovern, CEO of Dubber, commented:

“The review and restructure announced today highlight our primary focus and commitment to our Service Provider partners. We’ve invested in providing a world class platform built specifically for the scale of Service Provider networks and are now streamlining delivery of products built on the Dubber Platform to accelerate the growth and commercial benefits to them. Having recently engaged with many of our Tier 1 Services Provider partners in the UK, Europe and North America, this confirms my confidence in the Company’s strategy.”

Good morning

Good morning!

Earnings season is about to wrap up as we get the last remaining results announcements.

Pointerra and Dubber both chose to release their results after-hours on Tuesday (often an ominous sign) and their shares have promptly plummeted today.

We’ll cover their results in a minute.

Elsewhere, US stocks finished lower overnight, bringing to a close a disappointing February for all three major US indexes.

In fact, year to date, the Dow is actually down 1.5%. After being up as much as 9% this year, the benchmark S&P 500 is now up a more modest 3.8%. The Nasdaq — that bellwether of exuberance and technological hope — is still up a healthy 10.3% year to date.

Key Posts

-

4:45 pm — March 1, 2023

-

4:24 pm — March 1, 2023

-

3:58 pm — March 1, 2023

-

3:41 pm — March 1, 2023

-

3:33 pm — March 1, 2023

-

3:17 pm — March 1, 2023

-

2:33 pm — March 1, 2023

-

1:56 pm — March 1, 2023

-

12:46 pm — March 1, 2023

-

12:08 pm — March 1, 2023

-

11:52 am — March 1, 2023

-

11:20 am — March 1, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988