Investment Ideas From the Edge of the Bell Curve

ASX Today – Live ASX News | ASX Up 0.58%

RBA: global growth forecasts revised down since May

The Reserve Bank of Australia has revised down its global growth forecasts since its May Statement on Monetary Policy following a weaker outlook for real incomes and faster hikes in policy rates.

The RBA also noted growth in Australia’s major trading partners is expected to fall ‘well below the pre-pandemic average this year.’

Locally, the RBA expects Australian GDP to grow by 3.25% over 2022, 1.75% over 2023, and 1.75% over 2024.

RBA admitted these forecasts were lower than three months ago.

While slowing economic growth will increase unemployment, the central bank forecasts unemployment to ‘remain low by standards of recent decades.’

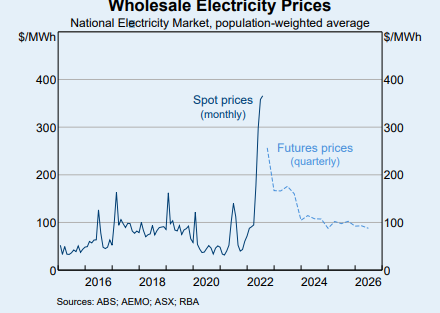

RBA: household electricity and gas prices to ‘increase significantly’

The Reserve Bank noted that high wholesale prices will be passed through to retail electricity and gas prices over time, adding to CPI inflation.

As a result, households’ electricity and gas prices are expected to ‘increase significantly in the September quarter’.

RBA expects CPI inflation to feel the bulk of the effect in the December quarter.

Wholesale energy costs account for about one-third of households’ electricity and gas bills, as they directly affect retailers’ costs. The pass-through from wholesale electricity prices to retail prices tends to be gradual, reflecting the fact that most retailers hedge at least some of their exposure to fluctuations in wholesale prices.

The wholesale market was affected by disruptions in coal supply.

Around 60 per cent of electricity generation in the NEM stems from coal-fired power. As such, disruptions in several large coal-fired power plants over recent months put pressure on the supply of electricity. A number of plants have been offline in recent months, with some facing unplanned maintenance problems. Other plants produced less power than usual due to a combination of factors, including difficulty accessing sufficient coal because of supply chain issues and illness-related staff absenteeism, and/or production at some coal mines being disrupted by rainfall and extraction difficulties. As a result, coal-fired electricity generation has been substantially lower in 2022 than in recent years.

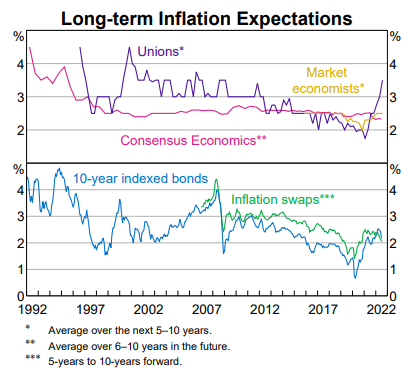

RBA: short-term inflation expectations high

The Reserve Bank noted in its latest Statement on Monetary Policy that short-term inflation expectations have ‘increased further.’

But the central bank was buoyed that longer-term inflation expectations ‘mostly remain consistent with the inflation target.’

Shorter-term inflation expectations were in part driven by firms foreseeing the need to raise wages.

Liaison reports and surveys of wages growth expectations point to a further lift in wages growth over coming quarters. Over 60 per cent of firms that reported their expectations in the business liaison program in 2022 so far expect to raise wages by more than 3 per cent over the year ahead.

RBA: inflation remains broadly based

In its latest Statement on Monetary Policy, the Reserve Bank of Australia issued its thoughts and forecasts on the key economic issues … including inflation.

The RBA said inflation continues to be broadly based.

About 3/4 of prices in the CPI basket grew faster than 3% in annualised terms in the June quarter.

Measures of inflation that strip away irregular or temporary price changes indicate underlying inflation was high in the June quarter.

Fuel prices rose by 4% in the June quarter, contributing 0.2% to headline inflation.

A bigger contributor to headline inflation was new dwelling construction, accounting for roughly 1/3 of the total CPI increase in the June quarter.

ASX ends 0.58% higher on Friday

The S&P/ASX 200 closed 0.58% higher on Friday, led by a 1.87% rise by the Materials sector.

Lithium stocks had a green day, with Novonix (ASX:NVX) leading the way, gaining 13.7%.

Core Lithium, Liontown Resources, and Ioneer all closed higher, too.

Megaport (ASX:MP1) and Block (ASX:SQ2) had the biggest declines, down 7% and 6% respectively.

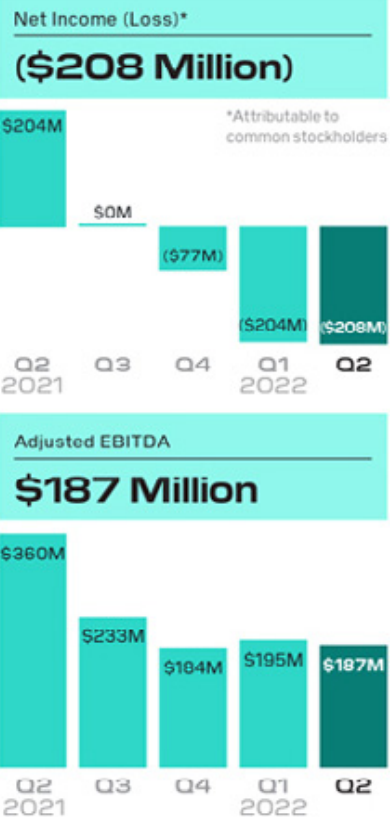

Block down 6% as market digests Q2 FY22 results

Block, otherwise known as Square, reported its Q2 FY22 results.

During the quarter, Block generated a gross profit of US$1.47 billion, up 29% year over year (YoY).

While gross profit rose, net income continued a downward trend.

Block posted a net loss of US$208 million, down from a net profit of US$204 million in Q2 FY21.

Adjusted EBITDA also fell, from US$360 million in Q2 FY21 to US$187 million in Q2 FY22.

The latest quarter was also marked by a 6% YoY decline in total net revenue, which came in at US$4.4 billion.

Block attributed the decline to a decrease in bitcoin revenue.

Excluding bitcoin and BNPL revenue, total net revenue was US$2.41 billion, up 23% YoY.

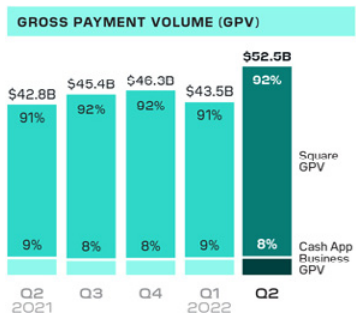

All up, SQ2 processed US$52.5 billion in gross payments volume during the quarter, up 23% YoY.

Transaction-based gross profit as a percentage of GPV was 1.14%, down 13 basis points YoY and down 4 basis points QoQ.

Lithium juniors among ASX winners in late afternoon trade

The best-performing stocks in late afternoon trade:

- Ecograf (ASX:EGR) up 25%

- Incannex Healthcare (ASX:IHL) up 22%

- Novonix (ASX:NVX) up 12.5%

- Magnis Energy (ASX:MNS) up 12%

- Paradigm Biopharmaceuticals (ASX:PAR) up 12%

- Australian Strategic Materials (ASX:ASM) up 9%

- Weebit Nano (ASX:WBT) up 9%

- Liontown Resources (ASX:LTR) up 6.5%

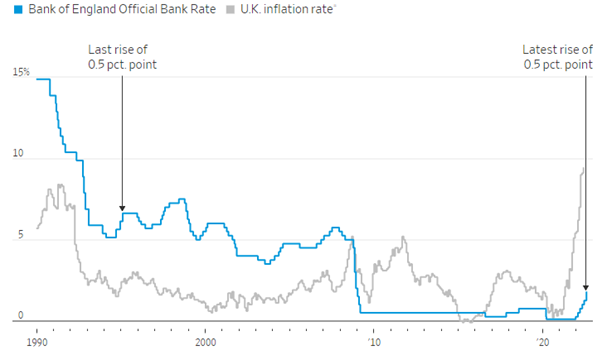

Bank of England: UK to enter recession from Q4 this year

In a statement following its historic decision to raise interest rakes by 50 basis points, the Bank of England glumly forecast the United Kingdom to enter a recession from the fourth quarter of this year.

Real household post-tax income is also projected to ‘fall sharply’ in 2022 and 2023.

Consumption growth is set to turn negative.

This will be exacerbated by firms increasing their selling prices.

The central bank stated that firms ‘generally report that they expect to increase their selling prices markedly, reflecting the sharp rises in their costs.’

BoE was also solemn about its inflation forecasts, expecting inflation to remain at ‘very elevated levels throughout much of 2023.’

In its own words:

CPI inflation is expected to rise more than forecast in the May Report, from 9.4% in June to just over 13% in 2022 Q4, and to remain at very elevated levels throughout much of 2023, before falling to the 2% target two years ahead.

The expectation of ‘very elevated’ inflation throughout 2023 will make it harder for the central bank to anchor inflation expectations.

On that front, BoE said it’s acting to ensure longer-term inflation expectations are anchored at the 2% target.

The Bank of England expects #CPI inflation to rise over 13% in 2022 Q4 and 'remain at very elevated levels' in 2023.

Yet #BoE also said it will act to 'ensure that longer-term #inflation expectations are anchored at the 2% target.'

A difficult road ahead.

— Fat Tail Daily (@FatTailDaily) August 5, 2022

Bank of England passes biggest rate rise since 1995

The Bank of England is sensing the situation is dire.

To combat rampant inflation, the central bank raised interest rates by 0.5% overnight.

Not quite on par with the US Federal Reserve’s 0.75% hike but historic by BoE standards.

The 50bp increase, taking the rate to 1.75%, was the biggest hike since 1995 and the first half-point increase since 1997.

This US stock rose 33,092% in under a month

On 15 July, an obscure Hong Kong-based company known as AMTD Digital finalised its IPO on the NYSE.

With roughly a US$1 billion market cap, and a fairly niche investment banking business model, AMTD wasn’t exactly turning heads. By all accounts, it seemed just like any other newly listed small-cap stock.

But for reasons unknown, this stock quickly turned into the latest fad…

From their IPO offer price of US$7.80 per share, AMTD stock spiked all the way up to US$2,589 per share on 2 August. That’s a 33,092% gain in just 18 days!

At this peak, AMTD carried over a US$400 billion market cap, making it a top 20 listed company across the entire US for a brief moment.

They were bigger than JPMorgan, bigger than ExxonMobil, even bigger than Walmart.

And all this ‘success’ was on the back of a business that was making just US$25 million in revenues…

At face value, this seems like a glaring pump-and-dump scam.

Most investors would probably expect this kind of activity from a crypto coin, not some regulated company. But the sheer scale of this ‘meme stock’ fiasco makes it hard to make any definitive conclusions.

The only thing we can say for certain is that even regulation can’t stop all outliers.

https://www.moneymorning.com.au/20220805/this-us-stock-has-delivered-a-33092-gain-in-under-a-month.html

Brent crude oil erases all gains since Russia’s invasion of Ukraine

Global oil prices dropped on Thursday to their lowest levels since even before Russia invaded Ukraine in February.

Oil prices slumped as commodity traders worry about a global recession crimping energy demand.

Benchmark Brent crude futures at one point fell to US$94.12, the lowest close since February 18.

On intraday basis, Brent crude has erased all gains since Russia invaded Ukraine pic.twitter.com/TnoNiCVilN

— Liz Ann Sonders (@LizAnnSonders) August 4, 2022

BNPL’s ultimatum: sink or swim

I followed and kept tabs on Afterpay for years. It was easily one of the best — if not the best — recommendations we made in our small-cap-focused paid newsletter.

I won’t disclose any specific details, but I can tell you that subscribers who followed our advice walked away with a four-digit percentile gain. It’s the kind of return that every small-cap investor dreams of.

But, of course, much of this was due to the speculative frenzy surrounding the stock at the time. Before COVID, all people wanted from BNPL stocks was growth amongst users, merchants, and transactions.

Profit was the least of their concern. That was something that would come later down the line…

Today, though, in our inflation-fixated world, things are different. Cheap capital and unlimited growth are no longer the staples they once were. Instead, investors have started to care about respectable cash flow, earnings, and of course, profit.

It shows that no matter how popular a trend may be, market cycles and sentiment are still king.

No one knows how long this bearish cloud will hang over markets either. I can only imagine it will require inflation to be tamed and the Fed to tone down its tightening rhetoric, at least. And even then, by the time that happens, who knows what the state of the global economy will be…

In this context, the short-term outlook for BNPL will almost certainly be rocky.

But one could also argue that many of these risks have already been priced in. After all, we’ve seen BNPL stocks suffer massive share price declines over the past year.

The challenge for them now is to prove whether they will sink or swim.

Because no matter how bad the market may get, good businesses will find ways to deliver on long-term potential.

https://www.moneymorning.com.au/20220804/bnpls-ultimatum-sink-or-swim.html

Incannex jumps 20% after completing APIRx acquisition

Cannabinoid pharmaceutical development firm Incannex Healthcare (ASX:IHL) opened 20% higher on Friday after completing the acquisition of APIRx Pharmaceuticals.

IHL said the acquisition means it has aggregated the ‘world’s largest portfolio of patented medicinal cannabinoid drug formulations.’

Incannex issued 218.2 million new shares to APIRx stakeholders at a notional value of 57.3 cents per share.

As announced in March, the acquisition consideration totals around US$93.3 million payable in the form scrip consideration.

APIRx stakeholders have entered a 12-month voluntary escrow, restricting the disposal of any interest in any of the freshly issues shares for 12 months from the acquisition’s completion.

Incannex said the acquisition transfers 22 additional clinical and pre-clinical research and development projects to its portfolio.

The company claims its research projects have ‘aggregate addressable markets of approximately US$400 billion per annum.’

IHL did not state what share of these substantial markets is feasible for it to capture.

In its latest quarterly, Incannex reported spending $4.9 million on R&D in the 12 months ending 30th June.

ASX opens 0.3% higher

The S&P/ASX 200 is currently up 0.3% in early Friday trade, boosted by the materials sector.

Battery tech stock Novonix (ASX:NVX) opened 8% higher.

Gold miner Ramelius Resources (ASX:RMS) is up 6%.

BNPL stock Zip (ASX:ZIP) is up 4.5%, while Afterpay-owner Block (ASX:SQ2) is down 7%.

Core Lithium appoints new CEO

Australian lithium developer Core Lithium (ASX:CXO) has a new CEO.

Gareth Manderson replaces Stephen Biggins as CXO’s new chief executive officer.

Mr Biggins announced his resignation in March, citing personal reasons.

In March, Ms Biggins was quoted as saying:

Core is in perfect position to reach its next stage of growth as a lithium producer, and I feel it is the right time to step down as Managing Director and pass the torch on to the right person to lead Core in this next stage.

Gareth Manderson joins CXO following a stint at Rio Tinto, where he was General Manager Sustaining Capital.

CXO noted Mr Manderson delivered a project portfolio of over 600 projects at Rio, spending $1.6 billion each year across 17 mines.

The new CEO will have total fixed remuneration of $718,250, with a base salary of $692,958.

CXO trades at a market cap of $2.1 billion, with CXO shares up 100% year to date.

European Lithium signs MoU with BMW for lithium hydroxide supply

Junior lithium stock European Lithium (ASX:EUR) signed a non-binding memorandum of understanding (MoU) with automaker BMW AG.

While EUR said it was its first offtake of battery-grade lithium hydroxide, the agreement is non-binding.

A MoU does not legally bind the involved parties to a contract, but does indicate a willingness to negotiate and come to binding arrangements down the track.

EUR stated:

Under the MoU, EUR and BMW AG will work together to negotiate suitable commercial terms for BMW AG to purchase the LiOH produced by EUR. EUR grants BMW AG the first right to purchase 100% of the LiOH produced from the identified resources.

If EUR and BMW agree to a binding contract, BMW will pay US$15 million upfront, which EUR will recompense through ‘equal set offs against lithium hydroxide delivered to BMW.’

If received, European Lithium will use the US$15 million to develop its Wolfsberg Project.

EUR cautioned:

The parties are currently negotiating binding agreements, and no assurance is given that the any binding agreements will be entered into.

EUR shares are down 40% year to date.

Afterpay-owner Block misses estimates for June quarter

Block (ASX:SQ2), the digital payments firm who acquired Afterpay last year, released its June quarter results early on Friday.

Block, formerly known as Square, was hit by impairment losses on its bitcoin holdings and missed payment volume estimates.

Block recorded US$52.5 billion in gross payment volume in the second quarter of 2022, up 23% YoY, but came short of the US$53.47 billion consensus estimate.

Block — which is listed both on the ASX and the New York Stock Exchange — fell 7% in after-hours trading.

The fintech is down 45% year to date.

Key Posts

-

5:54 pm — August 5, 2022

-

5:33 pm — August 5, 2022

-

5:15 pm — August 5, 2022

-

4:57 pm — August 5, 2022

-

4:21 pm — August 5, 2022

-

4:12 pm — August 5, 2022

-

3:41 pm — August 5, 2022

-

1:07 pm — August 5, 2022

-

12:55 pm — August 5, 2022

-

12:35 pm — August 5, 2022

-

11:54 am — August 5, 2022

-

11:41 am — August 5, 2022

-

11:25 am — August 5, 2022

-

10:43 am — August 5, 2022

-

10:34 am — August 5, 2022

-

10:22 am — August 5, 2022

-

10:07 am — August 5, 2022

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988