Investment Ideas From the Edge of the Bell Curve

ASX News Live | ASX Jumps 1%, US Inflation Cools, Tech Stocks Surge

Lake Resources rebounds 160% since July low

Lithium developer Lake Resources [ASX:LKE] has gained 160% since falling to 60 cents in mid-July.

After peaking at $2.65 in April, the lithium stock fell 75% to 60 cents in July as exuberance left the sector and Lake Resources confronted a negative short report from J Capital.

Since then, LKE has bounced back sharply.

ASX ends 1.12% higher, Lake Resources surges

The S&P/ASX 200 ended 1.12% higher on Thursday, buoyed by the consumer discretionary and information technology sectors.

The biggest market movers at the close:

- Lake Resources up 20.5%

- Life360 up 13%

- City Chic Collective up 13%

- Novonix up 10.9%

- Block up 8.4%

- Pointsbet up 6.4%

- Brainchip up 5%

Openpay wants to raise $5.75 million under SPP

Following an extraordinary general meeting yesterday, BNPL stock Openpay has determined to accept over-subscriptions received under the share purchase plan (SPP) announced in May.

Accepting over-subscriptions means OPY can exceed its previously stated $2 million cap on the SPP.

Openpay now wants to raise $5.75 million under the SPP, leaving the door open for a further increase.

In its June quarterly, OPY reported having $10.4 million in cash, with $532.3 million in available funding facilities.

The SPP ends today at 5pm.

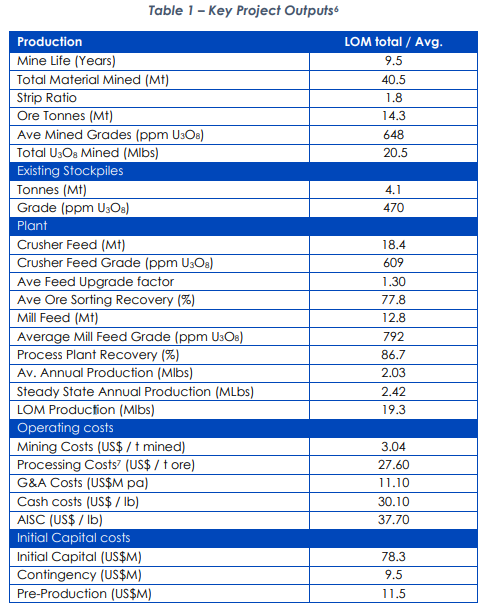

Lotus Resources: DFS confirms Kayelekera a ‘low-cost, quick restart uranium operation’

Uranium miner Lotus Resources today released details of a Definitive Feasibility Study which it said confirmed Kayelekera — its Malawi uranium project — as a ‘low-cost, quick restart uranium operation.’

Lotus said Kayelekera ranks of one of the lowest capital uranium projects globally, with an ability to ‘quickly recommence production (15 months development for construction/refurbishment) once a Final Investment Decision has been made.’

The post-tax NPV at an 8% discount rate was estimated at US$193 million, assuming pricing for uranium of US$75/lb.

LOT shares are trading largely flat on Thursday and are down 25% year to date.

Biggest ASX market movers at midday

The biggest market movers on the All Ords at midday:

- Wisr (ASX:WSR) is up 17.5%

- Lake Resources (ASX:LKE) is up 13%

- City Chic Collective (ASX:CCX) is up 12.5%

- BWX (ASX:BWX) is up 12%

- Novonix (ASX:NVX) is up 10.5%

- Sayona Mining (ASX:SYA) is up 9.5%

- Block (ASX:SQ2) is up 9%

- Life360 (ASX:360) is up 9%

Why the Fed may cut — not hike — rates in 2022

The latest numbers are in…

US inflation for July has officially cooled to 8.5%. That’s a decent reprieve from the 41-year high figure of 9.1% in June.

For investors, this is a good sign that ‘peak inflation’ may really be behind us. We will, however, have to wait and see if the monthly trend continues to be sure. Because while I’d be surprised if this data is a one-off anomaly, it is still possible.

So while we’re not out of the inflationary woods just yet, this is the first step to clearing the way.

All of which begs the question: what’s the Fed’s next move?

Powell and co may feel less inclined to resort to big hikes from here on out. I’d certainly be surprised if we saw more 75-basis-point rises in the near future. Having said that, reports from Reuters suggest they’re not going to slowdown just yet either:

‘The Fed is “far, far away from declaring victory” on inflation, Minneapolis Federal Reserve Bank President Neel Kashkari said at the Aspen Ideas Conference, despite the “welcome” news in the CPI report.

‘Kashkari said he hasn’t “seen anything that changes” the need to raise the Fed’s policy rate to 3.9% by year-end and to 4.4% by the end of 2023.’

Whether it’s this year or next, all signs suggest to me that the Fed will need to start cutting rates pretty soon. They simply can’t afford to send the US into a recession, especially with ongoing geopolitical tensions between both Russia and China.

That’s why last night’s inflation figures were so important.

It is our first confirmation that the Fed may be slowing down the US economy…something that it should have started doing 12 months ago.

But I digress…

The point isn’t that they were too slow to keep inflation under control; the bigger concern is that they’ll overstep the mark trying to keep it under wraps. Because if they keep hiking throughout the remainder of 2022 and into 2023, a recession will be all but guaranteed.

Read full article here.

https://www.moneymorning.com.au/20220811/why-we-may-see-a-fed-rate-cut-not-hike-in-2022.html

Freelancer to merge freight divisions to form Australia’s ‘largest freight marketplace’

Freelancing and crowd-sourcing marketplace Freelancer will merge its freight divisions Freightlancer and Loadshift to form what it calls ‘Australia’s largest freight marketplace’.

FLN said the two divisions have delivered 125 million kilometres of freight across the country in the last 12 months.

Freelancer CEO Matt Barrie commented:

Merging our freight division into one platform is a significant milestone for the business. Combining the two platforms will give our carriers more opportunities to find loads, while offering shippers access to more carriers across Australia. Today, we are moving everything from grain to machinery across the country.

Freightlancer and Loadshift will merge under the Loadshift banner, with the latter becoming a full marketplace platform for freight.

Loadshift will introduce a 3% fee for shippers and a 10% fee for carriers.

In the last 12 months, FLN said Loadshift processed a notional gross load value of $350 million of freight posted.

Over the past 12 months, FLN is down 60%.

Bitcoin climbs above US$24,000 for first time since mid-June

Bitcoin has breached US$24,000, currently trading at US$24,410.

Since hitting a multi-year low in mid-June, bitcoin has gained nearly 30%.

Has inflation peaked?

Headline US inflation was unchanged in July, coming in below expectations.

Core inflation, measuring prices less food and energy, also came in lower than expected.

So, has inflation peaked?

Forget the zero headline; core inflation takes a dive last month, coming in at an annualized 3%, driven by a decrease in services. Compare it to the ~5% average it's been at since October 2021.

One month doesn't make a trend, but the most encouraging print I could have imagined. pic.twitter.com/gVpmusKpo1

— Mike Konczal (@mtkonczal) August 10, 2022

Holy cow: There was ZERO inflation last month. That's the headline number, which is well below expectations of +0.2%.

Also a good core inflation reading: +0.3%, also below expectations of 0.5%.

Finally some good news on the inflation front. We've likely seen the inflation peak.

— Justin Wolfers (@JustinWolfers) August 10, 2022

93% of US tech stocks above 50-day moving averages

93% of US tech stocks are trading above their 50-day moving averages in a broad rally for the sector.

The rally isn’t exclusive to tech. 84% of S&P 500 stocks are also trading above their 50-day moving averages.

We've seen a breadth thrust on this rally with 84% of S&P 500 stocks back above their 50-DMAs. Tech's reading is now at 93%.

From our Daily Sector Snapshot at https://t.co/SNJTLu5lro. pic.twitter.com/BLx28H654g

— Bespoke (@bespokeinvest) August 10, 2022

Growth outperforming value in recent weeks

The growth to value ratio is rising, with the recent rally seeing growth outperforming value.

Here's a long-term chart of the growth to value ratio. When the line is rising, growth is outperforming value. pic.twitter.com/O3QQqE7INp

— Bespoke (@bespokeinvest) August 10, 2022

US inflation cools but remains high

The US Bureau of Labor Statistics reported that the CPI was unchanged in July as declining gasoline prices offset shelter and food increases.

The CPI was unchanged in July on a seasonally adjusted basis after rising 1.3% in July.

Over a 12 month basis, the index rose 8.5%, down from the 9.1% increase for the period ending June.

The gasoline and energy index fell 7.7% and 4.6% respectively over the month.

The index for all items except food and energy rose 0.3% in July, smaller than in April, May, or June.

July CPI #inflation eased: +8.5% y/y vs. +8.7% est. & +9.1% in prior month; core +5.9% vs. +6.1% est. & +5.9% prior … headline CPI unchanged m/m vs. +0.2% est. & +1.3% in prior month; core +0.3% vs. +0.5% est. & +0.7% prior pic.twitter.com/XUulz4Ssu9

— Liz Ann Sonders (@LizAnnSonders) August 10, 2022

A great CPI report. If you use the unrounded numbers the headline was actually -0.02%, deflation! Core was +0.3%, the lowest since September 2021. The more intertial parts of core, eg rent, slowed too.

I only update a little based on 1 month but the update is a good one. pic.twitter.com/Uk2pgfiQcr

— Jason Furman (@jasonfurman) August 10, 2022

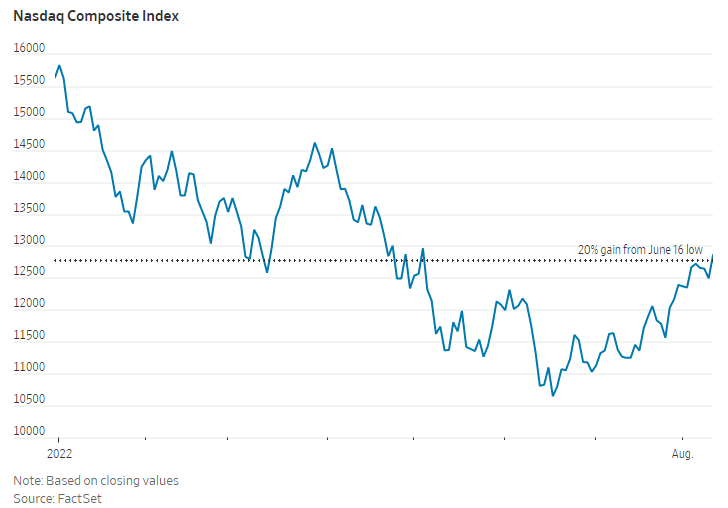

The Nasdaq is back in a bull market

The tech-heavy US index has gained over 20% since mid-June, although it is still down 18% this year.

The Nasdaq rose 2.9% overnight after softer-than-expected inflation figures released in the US.

Tech and consumer-discretionary stocks have led recent bull run while bond yields continue to fall as markets bet the Fed will soon ease the pace of its interest rate hikes.

The yield on the 10-year US Treasury fell to 2.786% overnight from an 11-year high of 3.482% on June 14.

The S&P 500 is also on the move, making back nearly 50% of its bear market losses.

Didn’t make it today but S&P 500 has come very close to clawing back 50% of its bear market decline

[Past performance is no guarantee of future results] pic.twitter.com/YJ0qNZUmZL— Liz Ann Sonders (@LizAnnSonders) August 10, 2022

Key Posts

-

5:05 pm — August 11, 2022

-

4:56 pm — August 11, 2022

-

4:49 pm — August 11, 2022

-

3:53 pm — August 11, 2022

-

12:29 pm — August 11, 2022

-

12:14 pm — August 11, 2022

-

11:53 am — August 11, 2022

-

11:40 am — August 11, 2022

-

10:35 am — August 11, 2022

-

10:25 am — August 11, 2022

-

10:11 am — August 11, 2022

-

10:05 am — August 11, 2022

-

9:54 am — August 11, 2022

-

9:29 am — August 11, 2022

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988