Investment Ideas From the Edge of the Bell Curve

ASX News Updates | ASX Up 0.5% At Midday; Bubs, Cettire, Bluebet, Openpay, Airtasker Feature

Luxury goods retailer Cettire closes 18% lower on FY22 results

Online luxury goods retailer Cettire (ASX:CTT) fell 18% on Tuesday on a day the wider market finished 0.5% higher.

Cettire plunged after net losses ballooned to $19 million, despite revenue rising 127% to $210 million.

Active customers rose 127% to 260,250, with 50% of gross revenue coming from repeat customers. Repeat customers generated 40% of gross revenues in FY21.

But while BNPL has a bad debts problem, it seems Cettire has a returns problem.

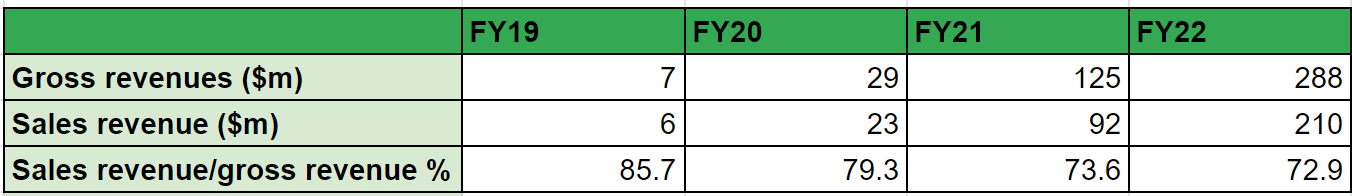

While CTT’s gross revenue rose 131% to $287.8 million, reported sales revenue (which is net customer returns and allowances) rose 127% to $209.9 million.

Sales revenue as a percentage of gross revenue has been trending down in recent years.

Sales revenue was about 86% of gross revenue in FY19 but is now about 73%.

What do widening customer returns imply?

Cettire acknowledged it “experienced higher return rates and higher fulfilment costs in H2, which impacted delivered

margins.”

IGO rises 4% as FY22 revenue rises 34% but net profit falls 40%

Diversified metals miner IGO (ASX:IGO) is currently up 4% after releasing its FY22 results.

Revenue rose 34% to $902.8 million on strong metals prices.

FY22 was the first full year’s earnings contribution from IGO’s lithium joint venture. IGO’s share of the lithium net profit after tax was $177 million.

Despite the strong revenue growth, net profit fell 40% to $330.9 million.

How come?

FY21 profit was elevated due to a one-off gain on IGO’s divestment of Tropicana.

If we compare to FY20, IGO’s FY22 net profit rose 110%, up from $155 million.

Peter Bradford, IGO’s CEO, commented:

“Our Nova Operation continued to deliver consistent production and, with the benefit of higher commodity prices, delivered record financial outcomes across all key financial metrics. This strong performance from Nova enabled the opportunity to expand our nickel business during FY22 with the successful completion of the Western Areas acquisition in June 2022. This transaction was a natural consolidation of the Western Australian nickel sector, delivering synergies and a stronger portfolio of nickel assets to IGO, which enables further work towards the development of a nickel downstream business for IGO.”

Year to date, IGO shares are up 10%.

Atomos down 15%, swings into FY22 net loss

Video equipment manufacturer Atomos (ASX:AMS) is currently down 15% after recording a net loss of $6 million in FY22, a $10 million swing from a FY21 net profit of $4.2 million.

Revenue was mostly flat, rising 4% to $82 million.

Atomos said FY22 bottom line was affected by “several one-offs including temporary price drops/promotions, increases in

headcount (not required and since removed), costs to establish cloud services and founder transition costs.”

Looking out, Atomos said its expanding its subscription-based services, aiming to boost recurring sales on high-margin software and cloud services.

Currently, AMS generates “almost all its revenue via one-off product sales.”

In FY23, it hopes to change that via its software and cloud products.

It seems Atomos is conscious of its modest revenue growth, saying it will appoint a chief commercial officer and chief product officer to the executive team.

The new chief commercial officer will oversee “demand generating marketing and direct sales.”

Chip developer Archer Materials rises 30% on tech update

Archer Materials (ASX:AXE) is currently up 30% after telling the market it has achieved its “long-term technology development goal” to fabricate biochip parts under 10 nanometres in size.

AXE said a sub-10 nanometre fabrication capability is “leading-edge in the semiconductor industry”.

The fabrication of sub-10 nanometre biochip features — but not a whole chip itself — marks an “important step” in Archer’s “potential future operation of Archer’s biochip.”

Devising smaller device features enables smaller overall chip sizes.

And smaller chips, argues Archer, can lead to attractive characteristics like better performance and reduced power consumption.

Baltic Exchange Dry Index back to 2020 levels

The Baltic Exchange Dry Index continues to fall in recent months, hitting levels not seen since 2020. \

The index measures the cost of shipping goods worldwide.

Baltic Exchange Dry Index continues to collapse and is now back to summer 2020 levels pic.twitter.com/6mKs2K3lrY

— Liz Ann Sonders (@LizAnnSonders) August 29, 2022

The year of delusion and the real meaning of wealth

2021 will go down in the history books as ‘The Year of Delusion’.

Anything that could be floated higher by a deranged central bank stimulus policy, did so.

Value, literally and figuratively, meant nothing.

The worthless became priceless.

If it was going up, it would continue to go up.

No amount of reason could persuade the FOMO brigade to exercise logic and act with restraint.

For those with long memories of bubbles past, 2021 was a long year.

Finally, as the year ended, some sanity began to prevail.

The hottest of the speculation hotbeds — cryptos and NASDAQ — thankfully and belatedly, topped out in early November.

2022 is when the cost of this period of excess and recklessness starts to be counted.

The collapse of this massive financial markets Ponzi scheme is still in its infancy.

Early victims, predictably and regrettably, are coming from the collapse of various crypto scams.

What was once considered priceless has reverted to its true value…nothing.

The collapse of various crypto pyramid schemes (and mark my words, there’s more to come) has turned into a lawyer’s picnic.

Bankruptcy filings.

Lawsuits countered by more lawsuits.

Liars accusing other liars of lying.

If you’re a spectator, and NOT a trapped speculator, it’s all great theatre.

However, for the millions who, knowingly or unwittingly, walked, ran, or high dived into this web of deception, it’s a sad and sorry situation.

Read full article here.

WSJ: Russia’s oil sales booming

Despite sanctions and attempted embargoes, Russia’s exports are booming, largely thanks to crude oil.

The Wall Street Journal reports that Russia earned US$97 billion from oil and gas sales through to July 2022.

Oil made up US$74 billion.

Russia has exported 7.4 million barrels of crude, diesel, and gasoline each day in July, according to the International Energy Agency.

That’s only about 600,000 barrels a day less since the start of the year.

Jim Rickards: energy shortages and higher prices

In yesterday’s piece for Fat Tail’s Daily Reckoning, veteran investment strategist Jim Rickards applied his insight and industry experience to the energy sector.

Specifically, Jim focused on the current energy crisis and the economic and political consequences of Russia’s invasion of Ukraine on the wider energy market.

“The dirty little secret among White House policymakers is that they like high energy prices because it helps to promote the Green New Deal (really the Green New Scam) goals of wind and solar power to replace oil and gas. The more expensive gas is the more feasible alternatives become. That represents the triumph of ideology over common sense. There’s a role for wind and solar, but even if you favour it, one has to recognise that it’s non-scalable, intermittent, and cannot come online fast enough to close the gap between existing energy supplies and growing demand for energy.

“Another drag on global energy output is the fact that major energy companies are reducing their investments in new exploration and development. Given the opposition to oil and gas from climate alarmists and do-gooder ideologue investors like BlackRock’s Larry Fink, major oil companies are reluctant to invest large amounts in projects that may be deemed unwanted or even banned in years to come. This can be reversed in future years but not in time to alleviate the current shortages.

“Investors should expect persistent energy shortages and much higher prices. These trends were underway before the war in Ukraine, but they were greatly exacerbated by the war.”

Read full article here.

What should investors focus on when valuing businesses?

I came across a second-hand bookstore on the weekend and, on impulse, bought a very cheap edition of the Chambers Dictionary for the house.

Not long after, I had to consult its pages.

Epiphenomenon.

An accompanying phenomenon, a less important or irrelevant by-product; a secondary symptom of a disease.

This isn’t an undergraduate essay, so why am I starting with a definition?

Epiphenomena tie in to what I’ve been thinking about lately — financial metrics and the usefulness of financial statement analysis.

Are popular financial ratios like Return on Equity (ROE) just epiphenomena of something more important?

Do ratios and items in financial statements focus on symptoms rather than causes?

Financial ratios focus on symptoms

Baruch Lev, a professor of accounting at New York University, wrote a whole book arguing that financial statements are losing their usefulness.

Lev attributed the decline to a misguided focus on symptoms rather than causes.

For him, traditional metrics wielded by equity analysts — like P/E or ROE — aren’t nearly as insightful as we think (emphasis added):

‘Traditional securities analysis focuses on symptoms, like sales, earnings, profitability (ROE, ROA), and solvency. But these are backward-looking consequences of past deployment of strategic assets (e.g., transforming patents into revenue-generating drugs in recent years), having limited predictive ability… In contrast, our proposed analysis focuses on the causal factors—the resources that determine the enterprise’s future performance.

‘Focusing on available strategic assets and their future potential, rather than on their past performance, leads to substantially improved investment decisions.’

Read full article here.

https://www.moneymorning.com.au/20220830/are-investors-assessing-businesses-correctly.html

BWX remains suspended on update it’s not in position to issue audited FY22 results

Natural beauty retailer BWX remains under voluntary suspension following a stark admission the business is not in a position to issue audited FY22 results as previously advised.

The hold up lies with a snag in revenue recognition.

But the revenue recognition doesn’t just touch on FY22. BWX said there are “certain revenue recognition issues” for 1H FY22 and FY21.

As flagged on 28 June, BWX is also set to impair its intangible assets “to a level significantly below their carrying value.”

All up, the revenue recognition and impairment snafus have obscured management’s earnings visibility enough that BWX is unsure if it will meet its FY22 guidance.

BWX said it may need to restate its FY21 and 1H FY22 results.

Key Posts

-

6:41 pm — August 30, 2022

-

4:16 pm — August 30, 2022

-

2:41 pm — August 30, 2022

-

1:42 pm — August 30, 2022

-

1:26 pm — August 30, 2022

-

1:20 pm — August 30, 2022

-

1:15 pm — August 30, 2022

-

1:06 pm — August 30, 2022

-

12:57 pm — August 30, 2022

-

12:49 pm — August 30, 2022

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988