Investment Ideas From the Edge of the Bell Curve

ASX News Today | ASX Inches Higher; TPG, Inghams, AGL Fall

Ethereum 2.0 is almost here: ‘oil of the future’?

Three weeks ago, I mentioned how Ethereum [ETH] — the world’s second-largest cryptocurrency — is preparing for change. If you missed it, you can read all about it right here.

The main point was that after years of waiting and seemingly endless development, Ethereum 2.0 is now actually happening. It’s a major update not just for the crypto platform but potentially for the blockchain technology as a whole.

Known as ‘The Merge’, this update will transition Ethereum from a Proof-of-Work framework to a Proof of Stake. In doing so, the hope is that it will increase transaction speed, reduce gas charges (network fees), and reduce overall energy consumption.

After all, the one thing most people know about Proof of Work is simply how energy-intensive it is.

Critics have even used this fact as a cheap shot to discredit Bitcoin [BTC] in the past. They claim that it requires an ungodly amount of power to keep the blockchain working. But the circumstances aren’t nearly as black and white as that.

Proof of Stake, however, could finally silence these criticisms once and for all. Because while the intricacies of this cryptographic algorithm are still complex, it should completely remove the need for crypto miners.

So, if successful, The Merge may finally pave the way for a new era of crypto.

Hell, it just might be the start of a new era for money as we know it…

Read full article here.

https://www.moneymorning.com.au/20220819/ethereum-2-0-is-almost-here.html

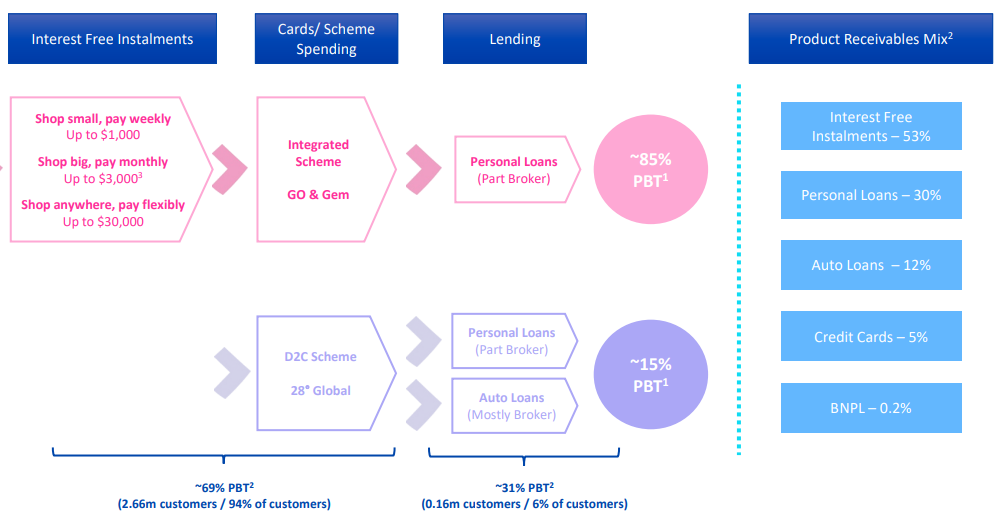

Latitude: BNPL makes up only 0.2% of product receivables mix

In its 1H22 presentation, fintech Latitude Financial revealed that buy now, pay later (BNPL) only made up 0.2% of its group gross loan receivables as at 30 June 2022.

Group gross receivables fell 1% half-on-half to $6.3 billion in 1H22 and 3% year on year.

While LFS reported that its BNPL mix was largely negligible, its ‘interest free instalments’ option accounted for 53% of gross receivables.

‘Interest free instalments’ sure does sound like BNPL, but Latitude distinguishes the latter by defining its BNPL promotion thus:

“$2000 TV on 24 months flexible = Customer not required to pay any amount during the Interest Free plan period. Customers can make extra payments at any time with no penalties. The residual balance of the payment plan will incur interest once the Interest Free period is over.”

Property market: the house always wins in the end

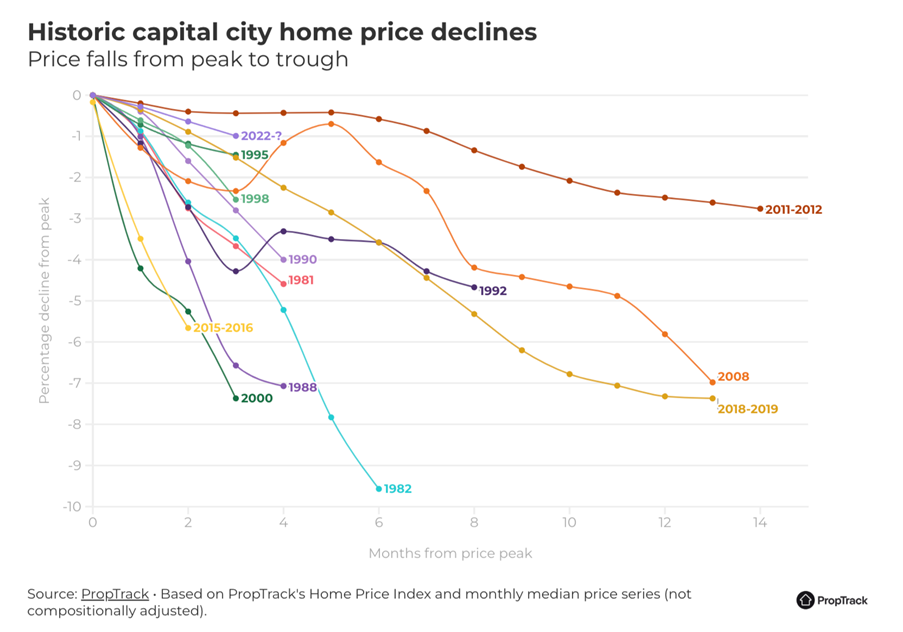

‘We expect capital city prices to fall 18 per cent over the balance of 2022 and 2023, before a 5 per cent gain in 2024 as mortgage rates fall’, said ANZ senior economists Felicity Emmett and Adelaide Timbrell this week.

But as Catherine Cashmore wrote overnight, an 18% crash in median values (because that’s what it would be if the forecast played out) hasn’t occurred in the Aussie property market for decades…

Catherine pointed to the chart below, showing capital city price falls from peak to trough since the early 1980s:

Catherine went on:

“Sure, the median can cover a lot.

If an owner needs to sell — and there are no buyers — likely they’ll have to slash the price 10–20% to get a sale.

I’ve seen a few examples of that over the first half of this year, particularly at the top end of the market.

But to get a broad-based drop of 18% in the median capital city house price would require a large proportion of property owners desperate to sell, hitting the market over the period, and nothing to support prices on the other side.

I just can’t see it happening.

A large proportion of households with variable rate mortgages are well ahead in repayments.

We’re not in a period where it’s hard to find employment.

It’s not the GFC.

And let’s face it, those that are subject to increases in rates will do everything they must to avoid default.”

Read full article here.

https://www.dailyreckoning.com.au/the-house-always-wins-in-the-end/2022/08/18/

Will soaring energy prices benefit the stock performance of oil and gas companies?

Will soaring energy prices benefit the stock performance of oil and gas companies, or will it cause even higher inflation that depresses overall stock prices?

As Jim Rickards explains, the question really asks about energy prices, stock markets, inflation, and volatility, all at the same time.

As he writes:

“So those are the drivers: Biden’s bad policies, Merkel’s bad policies, China’s mismanagement, and self-interest of Putin and MBS. The question for analysts predicting energy prices is whether these conditions will persist. If yes, the energy prices will at least remain high and perhaps go higher. If no, then energy prices may fall.

“We don’t see any change in policy coming. Biden is committed to a Green New Deal and will not retreat from his anti-oil and gas policies. Germany must now bow to the Green Party and will not reverse its opposition to nuclear, coal, oil, and natural gas (even though it depends on natural gas). China’s coal war with Australia will not be over soon, and there’s not enough natural gas in the world to satisfy all the demand. Putin and MBS are expert players who will manipulate output to maximise revenues. So energy prices will remain at high levels and gradually go higher.

“One result will be higher stock prices for energy companies, especially the major ones such as ExxonMobil, Shell, BP, and Chevron. These companies have been beaten down because of the politics of the Green New Deal and anti-oil activism by politicised asset managers such as Larry Fink at BlackRock and the California Public Employees’ Retirement System (CalPERS).

“The third part of the question is whether inflation (caused, in part, by higher energy prices) will depress stock prices in the long run. There’s a missing link in that question, which is economic performance. It is possible to have strong growth and higher stock prices in an inflationary environment. In fact, it’s not unusual in the early stages for both. Of course, real growth is lower than nominal growth by the amount of the inflation. But stock prices are nominal, not real. So the early stages of inflation can be accompanied by higher stock prices.

“There’s also a tight relationship between energy prices and real growth. If energy prices are going up along with the price of everything else (generalised inflation), then the momentum may continue as described above. But if energy prices are going up by themselves in a kind of supply shock scenario, there’s a feedback loop. In this kind of environment, higher energy prices are a good leading indicator of lower energy prices.”

Read full article here.

https://www.dailyreckoning.com.au/answering-a-readers-question/2022/08/17/

AGL’s return on equity trending in the wrong direction

Energy retailer AGL released its FY22 results on Friday, noting challenging macroeconomic conditions heightening volatility in the energy markets.

But managing director and CEO Graeme Hunt said AGL’s underlying fundamentals “remain strong and resilient”:

“The underlying fundamentals for the business remain strong and resilient and AGL is well positioned from FY24 to benefit from sustained higher wholesale electricity prices, as historical hedging positions progressively roll off. The strength of AGL’s long-term owned and contracted coal position and gas supply contracts ensures we are well positioned to manage the impact of the rise in commodity prices on our cost base and continue to provide affordable and reliable electricity to our customers.”

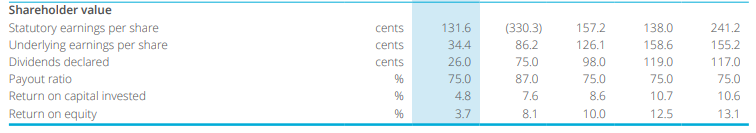

Yet AGL’s five-year summary shows a business with shrinking returns on equity.

AGL’s ROE has declined in each of the last five years, dwindling from 13.1% in FY18 to 3.7% in FY22.

The Australian 10-year bond yield is currently hovering at around 3.3%.

AGL down as underlying profit falls 58%

AGL shares are currently down 3% as the energy retailer posted declines in underlying EBITDA and profit.

Underlying EBITDA fell 27% to $1.2 billion.

Underlying profit fell 58% to $225 million.

AGL declared a total dividend of 26 cents per share unfranked in FY22, down from 75 cents unfranked in FY21.

AGL noted that the costs associated with its withdrawn demerger are expected to be $145 million, with $125 million included in FY22 as a significant item.

AGL said the drop in its underlying EBITDA and profit was expected, citing numerous reasons for the decline:

“As we anticipated, Underlying EBITDA and Underlying Profit after tax were both down year on year, reflecting the expected step down in Trading and Origination Electricity earnings due to lower realised contracted and wholesale customer prices, increased costs of capacity to cover periods of peak electricity demand, and the absence of the Loy Yang Unit 2 insurance proceeds recognised in FY21. Other factors that negatively impacted the result included planned and unplanned plant outages, unprecedented market volatility and suspension, milder weather, increased residential solar volumes and margin compression via customer switching.”

Key Posts

-

1:01 pm — August 19, 2022

-

12:28 pm — August 19, 2022

-

11:59 am — August 19, 2022

-

11:37 am — August 19, 2022

-

11:10 am — August 19, 2022

-

10:50 am — August 19, 2022

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988