Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | XJO Falls; Market Waits for CPI Data; Adore Beauty, Healius, QBE Feature

ASX ends in the red as lithium miners hit 52-week lows

After a modest lift in the morning, the Aussie stock market ended lower on Monday.

The broad All Ords index closed 0.70% lower to start the week.

Some big names also registered new 52-week lows. Like Telstra, Lottery Corp, Treasury Wine Estates, IGO, Allkem, Tabcorp, Sayona Mning, Core Lithium, and Pepper Money.

Clearly, lithium miners are out of favour right now.

Brown coal stocks fell 9% in 2022-23

The ABS said total stocks of ‘economically demonstrated energy resources’ fell by 1.3% in 2022-23.

The worst hit were brown coal stocks.

Brown coal stocks fell 8.9% to 632,100PJ.

Economically demonstrated energy resources are known deposits that are ‘economically exploitable given current technology and relative commodity prices’.

Why am I pointing out brown coal stocks in particular?

The latest ABS data dump said brown coal was one of Australia’s main sources of domestic energy production and was mostly used for domestic production of electricity.

ABS: renewable energy production continues to grow

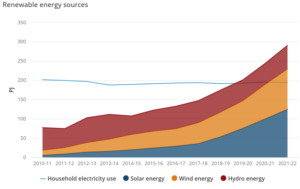

Australia’s production of renewable energy continued to grow, up 19% to 291PJ (petajoules).

ABS:

‘Renewable energy sources can now supply 30% of domestic electricity use and have exceeded aggregate annual household electricity demand since 2019-20, with combined solar and wind energy supply exceeding aggregate household demand for the first time in 2021-22.’

ABS: Aus production of renewable energy rose 19% to 291 petajoules.

ABS: 'Renewable energy sources can now supply 30% of domestic electricity use and have exceeded aggregate annual household demand for the first time in 2021-22.' pic.twitter.com/Y4XN6fBTqw

— Fat Tail Daily (@FatTailDaily) November 27, 2023

Solar and wind outpaced household electricity needs

The Australian Bureau of Statistics revealed that solar and wind energy supply exceeded household electricity use for the first time in 2021-22.

For the first time, the output from solar and wind was greater than Aussie household demand.

Dusk down 3% as sales slump continues

Candle and fragrance retailer Dusk [ASX:DSK] is down 3% after releasing a trading update during its AGM.

Total sales for the first twenty weeks of FY24 were $38.8 million, down 11.3% on the same stretch last year.

Dusk management wanted it known that total sales are up 30% on FY20.

Dusk is selling more candles than its most recent non-pandemic year. It just sold a lot more candles than usual during the pandemic and sales are normalising to historic trend.

Since listing in 2020, the stock is down 45% all time.

$DSK.AX $DSK is down 3% after a trading update showed sales continue to flag.

Dusk management said the upcoming Christmas period will significantly influence FY24 results. pic.twitter.com/XQfjIqyRBK

— Fat Tail Daily (@FatTailDaily) November 27, 2023

Catch the latest episode of What’s Not Priced In

– What updates from $LOV, $KGN, $TPW, $NCK & $AX1 reveal about consumer demand

– $ORG takeover chaos

– $NVDA huge quarter largely priced in

– High cost of capital forcing investors to get serious about valuations

– AI no substitute for good researchhttps://t.co/appzhBuv4I— Fat Tail Daily (@FatTailDaily) November 24, 2023

Adore Beauty’s earlier trading update

Last week, Adore Beauty [ASX:ABY] held its AGM and put out a trading update.

Q1 FY24 revenue was up 4.7% on prior corresponding period to $47.5 million.

Active customers ‘returned to growth’, rising 1.5% to 803,000.

Management said trading conditions remained ‘challenging given higher cost of living pressures and subdued consumer sentiment’.

But ABY thinks its ‘on track’ to achieve EBITDA margin of 2-4% in FY24. Quite a slim margin.

Adore Beauty up 20% on rejected THG takeover offer

Makeup brand Adore Beauty [ASX:ABY] is up 20% after confirming AFR’s report that it received a takeover offer from THG to acquire the business for $1.25-$1.30 cash per share.

THG is a UK-based e-commerce retail company.

However, Adore Beauty said it rejected THG’s offer.

Adore’s board thought the bid ‘undervalued the company, was unable to be implemented, and was not in the best interests of shareholders’.

Both Adore and THG, formerly The Hut Group, have something in common. Tumbling valuations.

Since listing in early 2021 on the London Stock Exchange, THG is down 90%! Adore is down 83% all time.

Smartpay down 7% on 1H24 interim result

Payment terminal provider Smartpay [ASX:SMP] is down 7% after releasing its 1H24 interim results.

It’s always interesting assessing results from stocks whose operations you encounter in your day-to-day. Some of my local cafes have Smartpay terminals.

So, why did the market take umbrage to SMP’s 1H24 performance?

> Revenue up 33% to $46.9 million

> Normalised EBITDA up 31% to $10.6 million

> Normalised profit before tax up 68% to $4.8% million

> Operating cashflow of $9 million, down 11% ‘due to the payment of tax’

The ‘normalised’ is doing a lot of work here. The result was normalised for a ‘cyber incident’.

> Actual net profit after tax was down 27% to $2.6 million

> Free cash flow down 72% to $1 million

Smartpay’s revenue is also growing only in Australia. New Zealand sales are totally flat in recent halves.

And free cash flow is trending in the wrong direction.

Good morning!

Good morning!

Kiryll here.

We’ve got some interesting company announcements today I want to cover. And some interesting ones from last Friday.

Let’s get to it!

[By the way, you can send in your thoughts/takes/commentary on today’s market news to our podcast email wnpi@fattail.com.au]

Key Posts

-

5:33 pm — November 27, 2023

-

3:03 pm — November 27, 2023

-

2:51 pm — November 27, 2023

-

2:35 pm — November 27, 2023

-

1:58 pm — November 27, 2023

-

12:35 pm — November 27, 2023

-

12:31 pm — November 27, 2023

-

12:09 pm — November 27, 2023

-

11:16 am — November 27, 2023

-

10:58 am — November 27, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988