Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | XJO to RISE; Rise in Profits for Big Players: NAB, Xero, Orica

Market close update

The ASX 200 held onto its gains today, up 0.28% to 7,015.1, after a spotty afternoon of trading. Despite the afternoon losses, only a handful of sectors finished in the red.

The Technology sector was the biggest loser today, down -4.82%, largely thanks to huge losses by Xero (-13.21%), which finished as the worst performer on the ASX 200 today.

Wisetech (-2.26%) also fell today as interest rate-sensitive sectors came under pressure. Energy (-0.91%) also had another day of losses as oil prices continued to slide. Brent Crude (+0.50%) saw a slight recovery from its heavy losses, while WTI Crude (+0.09%).

Meanwhile, BTC continues its upward momentum, gaining 3.62% to pass US$36,618.33.

Optus outage remains murky

Optus chief executive Kelly Bayer Rosmarin yesterday said there was a ‘technical network issue’ but failed to give any more details.

The network is up and running after a full day of outages, but there are still some ongoing issues in some areas.

There have been calls from many, including members of government who have called for compensation for the outages.

The company that owns Optus, SingTel, reported an 83% rise in profits in its half-year report today as the Singaporean telco giant continues its expansion.

SingTel reported net profits for the six months to September 30 were $1.58 billion.

More bearish prognostications without context

Past performance is no guarantee of future results.

But an interesting chart here by Crescat Captial LLC shows historical patterns in U.S. unemployment.

Do you think this time can be different?

At this stage, bond markets are pricing in the first-rate cuts for May. But some factors could bring this timeline forward or back.

Maybe this time is different, but in the past half-century:

⁰Every time the unemployment rate has crossed above its 24-month moving average, it marked the beginning of a significant deterioration in labor markets. pic.twitter.com/Vxuj8eoPOT— Otavio (Tavi) Costa (@TaviCosta) November 8, 2023

More than 800 large companies paid no tax in 2021-22

The Australian Tax Office’s latest transparency report, which covers 2,713 corporations, showed that tax collected by the office increased over the period but still had a large gap.

Higher taxes, totalling an extra $15.2 billion, were brought in from large mining company profits and higher oil prices, but there were 831(31%) of these large corporate entities that paid no tax.

The report gave various reasons for the zero tax bill, including companies making an accounting loss or claiming tax offsets that reduced their tax bill to zero.

‘This proportion [of nil tax paid] is similar to ASX data, which shows around 20 to 30 per cent of ASX 500 companies reporting a net loss to their shareholders in any given year,’ the ATO said in its report.

The ATO remains in limbo with its ongoing battle for multinationals to pay their fair share, with 139 companies disputing their tax bills in the current year, to the tune of approximately $2.6 billion.

Xero shunned by investors

Accounting platform Xero [ASX:XRO] is having a terrible day on the market, with its shares down by 12.37% in the early afternoon and is the current worst performer on the benchmark.

The company released its 1HFY24 results today, which wasn’t terrible overall for the company. Revenue was up 21% to NZ$800 million YoY, while EBITDA was up 90% to $206 million.

The company has struggled to balance cost-cutting with growth as the new CEO, Sukhinder Singh Cassidy, has attempted to focus the company on profitability.

Investors were not happy at the slim 13% growth in subscribers, especially as much of this growth was in the ANZ region rather than the company’s hopeful U.S. targeting.

The total number of subscribers is now 3.95 million, but the company says its next strategic target is expanding its U.S. operations and customer base.

‘We’re sharpening our focus on Xero’s key levers of growth. We will continue to balance growth and profitability, while delivering more value to our customers,’ Chief Executive Sukhinder Singh Cassidy said.

Market update

The ASX 200 is up 0.49% in afternoon trading at 7,029.7, extending its gains and shrugging off a shaky trading session on Wall St. Concerns by macro investors has caused some jitters in the markets as weakness within employment figures and concerns about interest rates have persisted this week.

On the ASX, the Healthcare (+1.21%) sector is leading the gains, with strong gains by CSL (+1.98%) pushing the sector up. Financials (+0.84%) is also doing well today, with CommBank (+1.69%) NAB (+0.75%), and ANZ (+1.06%) all up in the Big Four, while Westpac (-1.71%) struggles.

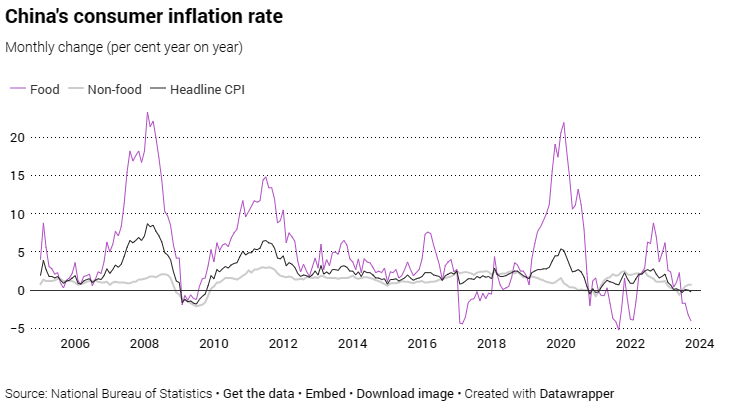

Chinese data came out earlier this afternoon, showing October CPI fell 0.2% year on year, while PPI data fell 2.6% year on year. Weak consumer prices continue to show a worrying trend of slow growth for the world’s second-largest economy.

Domestic demand remains sluggish, meaning stimulus is going to be needed to move the country out of its deflationary environment.

Source: NBS

Senior NBS statistician Dong Lijuan blamed the drop in CPI on an ample supply of agriculture products because of good weather and a drop in post-festival consumption following the ‘golden week’ holiday at the start of October.

Major miners here have lost some of their gains today after the new data, but most remain above breakeven. Rio Tinto is up +0.75%, BHP is up 0.56%, and Fortescue Metals is trading up +1.21%.

Orica climbs on solid profit upgrade

Mining services and blasting company Orica [ASX:ORI] is up by 2.26% this morning after a strong FY23 report in which the company reported a 24% increase in underlying EBIT of $698 million.

Net operating cashflow was up 148% at $899 million, up from $362 million in FY22.

Underlying NPAT was also up 16% for the company, which the company said was the result of strong blasting sales and digital technologies.

The company announced a 25-cent per share dividend, which brought the full-year dividend to 43 cents per share.

Job data for Australia

Here’s some of the latest job data visualised. Sadly, this data came out the day after the RBA’s latest call to raise interest rates, showing significant drops around the country’s major states.

With the latest estimates out from the NAB today, the bank expects unemployment to climb to 4.5% by the end of 2024.

According to the ABS September statistics, unemployment is near 3.6%, while participation remained flat at 66.8%.

Monthly hours worked fell by 1,940 million through September.

The day after the RBA hikes rates again to 4.35%, Seek data show job ads fell sharply last month, especially in the two most populous states: https://t.co/7ISIqjgmJI #ausecon #RBA #ausbiz #auspol Has the RBA just made another major misjudgement? pic.twitter.com/YugfADtUc5

— Michael Janda (@mikejanda) November 8, 2023

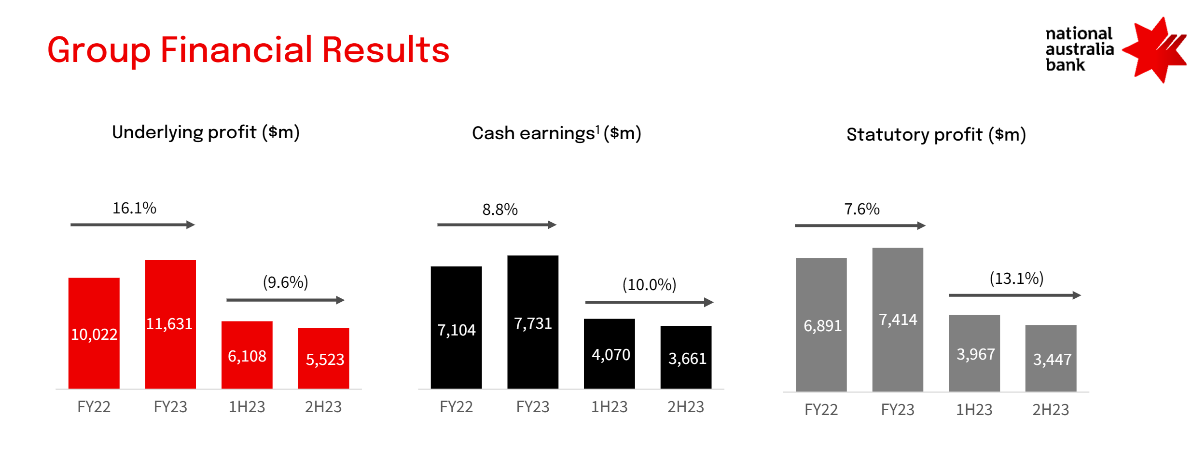

NAB raises cash profits

National Australia Bank [ASX:NAB] released its financial year 2023 results today as it struggles with a ‘more challenging environment‘. The major bank saw its cash profits rise by 8.8% to $7.7 billion for FY23 but saw its earnings and profits fall sharply from the first half of the year to the second half.

The bank said it expected the economy to slow into 2024 and unemployment to approach 4.5% by late 2024.

The bank announced an 84-cent final dividend, which brought its full year to 167 cents per share.

Source: NAB FY23 Report

Morning update

Good morning all, Charlie here

The ASX looks to open up this morning, with ASX 200 Futures up 0.42% to 7,019.5. The move looks to shrug off a mixed session on Wall St.

The S&P 500 finished just up, recovering from an early session low of -0.43%. It was the eighth consecutive session of gains for the index, its longest run since November 2021.

U.S. 10-year bond yields fell again, down -7bps to 4.49%. Fed Chair Jerome Powell has seemingly undone much of his work with comments in which he stated that the high bond yields were doing much of the work of the Fed.

The market has seen this as the Fed is reluctant to shift interest rates again and has sent yields down and equities running again.

The market is now pricing in ~92 basis points of Fed rate cuts through 2024.

Australian 10-year bond yields fell -19bps to 4.51%.

Wall Street: Dow -0.12%, Nasdaq flat, S&P 500 +0.10%.

Overseas: FTSE -0.11%, STOXX +0.60%, Nikkei -0.33%, SSE -0.16%

Gold prices fell heavily overnight, down -0.95% to US$1,950.18. Silver fell -0.35% to US$22.55.

The Aussie dollar fell -0.5% to US64.03 cents and looks to continue to drop.

Bitcoin is up +1.35% to US$35,777.35 passing the $35k mark with some strength, showing potential signs of a breakout.

Oil prices continues its volatility, falling sharply. Brent fell -2.27% to US$79.76, while WTI Crude fell -2.27% to US$75.61.

Iron ore fell back -0.54% to US$125.95, dropping along with major commodities.

Key Posts

-

4:12 pm — November 9, 2023

-

3:49 pm — November 9, 2023

-

3:14 pm — November 9, 2023

-

2:59 pm — November 9, 2023

-

2:48 pm — November 9, 2023

-

2:35 pm — November 9, 2023

-

11:14 am — November 9, 2023

-

10:41 am — November 9, 2023

-

10:32 am — November 9, 2023

-

9:47 am — November 9, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988