Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | XJO to Rise After Positive Earnings on Wall St; Aus Inflation Data Out Today

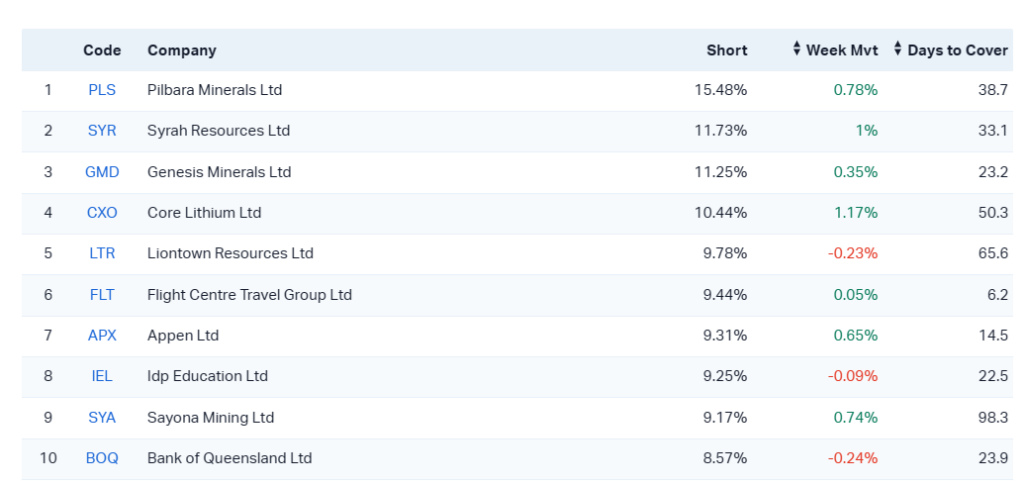

Top shorted stocks on the ASX

Here’s the latest list of top shorted stocks on the ASX.

It seems the biggest bets are on some of the battery mineral explorers, and miners aren’t going to perform what do you think?

Source: Market Index

For those of you who don’t know what shorting is or how it works, here’s a simple explanation:

In simple terms, a short of a company is a bet that its stock price will go down. Investors take short positions by borrowing shares of a stock and selling them. If the stock price does go down, the investor can buy the shares back at a lower price and return them to the lender, making a profit.

Here is a simplified example:

- An investor believes that the stock price of Company A is going to go down.

- The investor borrows 100 shares of Company A stock from a broker.

- The investor sells the 100 shares on the open market.

- The investor now has a short position in Company A.

- If the stock price of Company A goes down, the investor can buy back the 100 shares at a lower price and return them to the broker, making a profit.

- If the stock price of Company A goes up, the investor will lose money on their short position.

Short selling is a risky strategy, but it can be a profitable way to make money on stocks that are expected to decline in value. It is important to note that short sellers are required to put up a margin, which is a deposit that protects the broker in case the stock price goes up, and the investor loses money on their short position.

Market close update

Markets closed flat today as the Materials sector carried the day with +1.62% gains. This and Telecoms (+0.79%) were the only two sectors up today while the rest finished in the red.

The worst-performing sectors today were Real Estate (-2%) and Staples (-1.43%) which took considerable hits after CPI data was released in the morning.

All Ords also finished flat today, while gold producers had a rough day with the XGD down -2.05%.

Top gainers today were similar to yesterday, with strong gains seen from Wildcat Resources (+11.19%), which has been on a tear since it announced a broad intercept of lithium at its Tabba Tabba Project in WA.

Kogan (+9.40%) also had a positive day trading as the company released quarterly results that showed the company had turned a corner and saw its first quarter of sales growth since Q1FY22.

RBA, ANZ and CBA join chorus predicting November rate rise

Economists at NAB and CBA have joined with ANZ economists in predicting that the next interest rate decision on November 7th is likely a hike.

CBA economists Gareth Aird and Stephen Wu said in a note today:

“We consider the lift in underlying inflation over Q3 23 to be sufficiently strong for the RBA to act on their hiking bias at the upcoming board meeting.”

“We ascribe a 70 per cent chance to a 25 basis points rate increase in November and a 30 per cent chance to on hold.”

ANZ head of Australian Economics said today that the 25 basis points hike was also likely, saying:

“We had been highlighting the risk that the bank could act either late this year or early next, and we now think it’s more likely than not that risk will be realised.”

National Australia Bank, which has also predicted a hike in November, notes the risk of another rate rise to 4.6%, as they expect the RBA to revise up the near-term inflation forecasts.

“The RBA’s August forecast embedded a hope that they were already making in-roads into that demand driven domestic inflation problem,” said Taylor Nugent, a senor economist at NAB.

With these three now expecting a 25 basis point rise to 4.35% for November, now only Westpac of the major banks is betting that things will remain on hold. Westpac’s economic team, now helmed by former RBA Assistant Governor Luci Ellis, has kept its position, saying rates are unlikely to budge this year and even predicting interest rate cuts by the second half of next year.

Ampol earnings surge as oil spikes

Petrol and diesel supplier Ampol [ASX:ALD] saw a huge increase in earnings during the third quarter. In its trading update today the company released unaudited results which showed an incredible 65% increase in EBIT totalling $438 million.

This surge in earnings can be attributed, at least in part, to stronger refiner margins. Specifically, the group’s refining margins increased from $15.46 per barrel to $19.69 per barrel compared to the previous year.

The company also reported an 11% increase in sales volumes of diesel and jet fuel within its Australian arm and a huge 96% increase in International fuel sales volume due to lower third-party spot sales in the previous quarter.

Ampol has a market cap of $7.8 billion and saw its shares rise by 3.4%, reaching $32.82 per share.

Australian dollar climbs after CPI surprise

The Australian Dollar found its legs after CPI figures showed a surprise uptick in inflation for Q3. I say surprise as the market had placed expectations of CPI around 1.1% for the quarter, so the extra 0.1% was enough to spread fear within markets that RBA Governor Michele Bullock would follow through on warnings that the RBA board was taking a ‘low-tolerance‘ stance to inflation staying higher than their goals.

The June quarter saw a 0.8% rise in CPI, so rising fuel and rental costs largely drove a 0.8% QoQ rise. Not exactly unexpected considering the rapidly rising oil prices from the Middle East conflict and market uncertainty, thankfully, some of the pressure is coming out of the oil market, but fear still remains.

Here are the blow-by-blow comments from the RBA that have pushed us into thinking rates are ‘live’ in November:

Wednesday 11th – RBA assistant Governor Chris Kent said, “Some further tightening may be required to ensure that inflation, that is still too high, returns to target.”

Tuesday 17th October – RBA October meeting minutes published and stated, “The Board has a low tolerance for a slower return of inflation to target than currently expected. Whether or not a further increase in interest rates is required would, therefore, depend on the incoming data and how these alter the economic outlook and the evolving assessment of risks.”

Wednesday 18th October – RBA Governor Michele Bullock said, “The problem is we’ve had shock after shock after shock. The more that keeps inflation elevated, even if it’s from supply shocks, the more people adjust their thinking.”

Tuesday 24th October – RBA Governor Michele Bullock said in regards to getting inflation down, “It is possible that this can be done with the cash rate at its current level but there are risks that could see inflation return to target more slowly than currently forecast. The Board will not hesitate to raise the cash rate further if there is a material upward revision to the outlook for inflation.” She also restated, “The Board has been clear that it has a low tolerance for allowing inflation to return to target more slowly than currently expected.”

With higher expectations of interest rates, the AUD gained against many of its trading partners. It’s currently up 0.40% versus the U.S. Dollar at 63.81 cents.

Midday market update

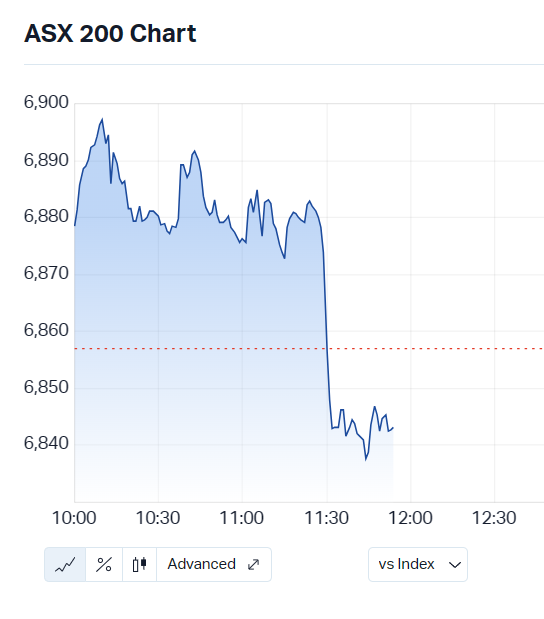

The ASX 200 is down -0.23% around midday as markets reversed all gains seen in the morning after the latest CPI data from the Australian Bureau of Statistics showed inflation up 1.2% this quarter and 5.4% YoY.

This was slightly above estimates and drove the case for a potential hike in November’s RBA meeting, sending shares down.

Eight of the eleven sectors are down, with the biggest gainer, Materials (+1.53%), well above other sectors as the rush for battery mineral companies continued, as well as strong gains in mining giants.

BHP Group (+1.89%), Fortescue Metals (2.62%), Rio Tinto (1.95%) all performed well this morning.

The biggest losses were within the Real Estate (-1.76%) and Staples (-1.68%) sectors, with drops continuing from yesterday seen in consumer staples giants Coles (-1.03%) and Woolworths (-2.20%).

More economists have weighed in on the chances of an interest rate hike in November, with ANZ shifting its views to favour the likelihood of a rise in rates next month but said it was far from certain.

ANZ head of economics Adam Boyton, said today:

“The RBA has highlighted risks of inflation expectations becoming embedded given ongoing shocks to energy prices, with consumers’ inflation expectations typically being quite responsive to petrol prices,” ANZ’s head of economics Adam Boyton wrote.

“While an additional interest rate increase will put further pressure on already strained finances across some households, the RBA’s most recent Financial Stability Review observed that households and businesses in Australia have, overall, coped reasonably well with the [4 percentage point] cash rate hikes so far.

“Having said that, a rate hike in November is not certain. Major inputs into the RBA’s longer-term inflation forecast are unlikely to have changed materially.

“Wages growth has generally undershot the RBA’s expectations over this cycle, while the likely increase in productivity in Q3 should provide some comfort to the Bank that a reversion to the pre-COVID trend is plausible. That is, the longer-term inflation forecasts could well be unaffected by today’s data.

“As a result, a decision to increase rates in November could well be a response to the risk that inflation might not return to target within a reasonable timeframe. A risk highlighted by the resilience of inflation in the [September inflation data].”

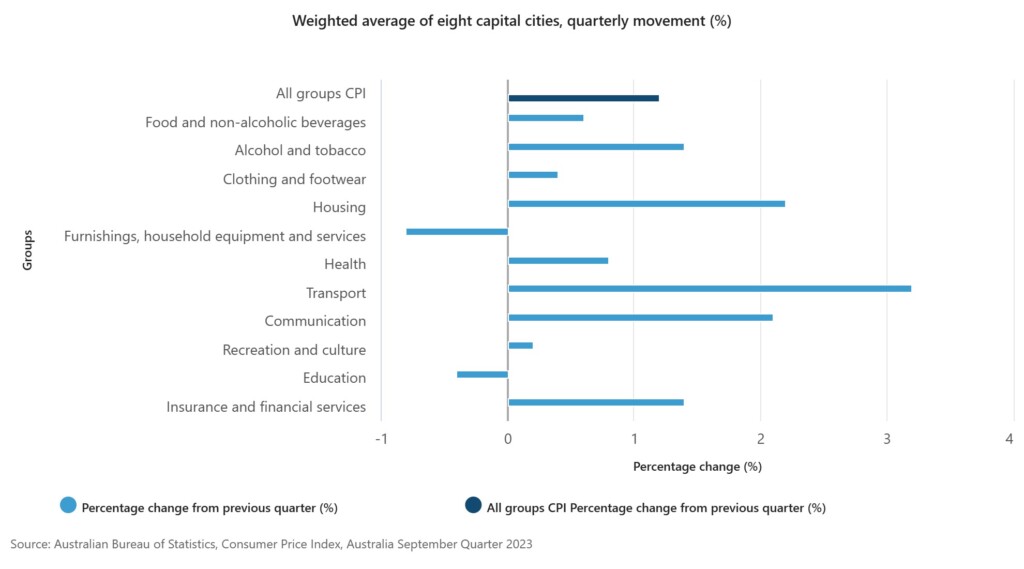

Australian inflation data a little hot, unsure if enough to push RBA to raise

Australia’s Consumer Price Index (CPI) rose by 1.2%, slightly surpassing economists’ expectations of a 1.1% increase. Annually, CPI showed a growth of 5.4%, exceeding the forecasted 5.3%.

The core CPI measure, which excludes food and energy costs, also rose by 1.2% for the quarter, higher than the anticipated 1.1%. In annual terms, core inflation increased by 5.2%, surpassing the predicted 5%. These figures indicate a higher-than-expected inflation rate.

The ABS pointed to fuel costs, electricity and rents as the biggest contributors to inflation during the quarter.

Rising oil prices in the September quarter contributed to increased costs for many sectors, however, adding to global inflationary pressures. Here’s a breakdown for the major cities of what that looked like.

.

.

Source: ABS

Significance for November rate call

In her first prepared speech last night, Governor Michele Bullock emphasised the possibility of further rate hikes if there is a significant upward revision to the inflation outlook, saying she is maintaining a ‘low-tolerance policy‘ to long-term inflation.

She went on to say:

‘The board will not hesitate to raise the cash rate further if there is a material upward revision to the outlook for inflation’

With the harder tone and today’s slight uptick, markets have priced a 30% chance of a raise, but it continues to climb at the time of writing.

The markets quickly responded to the news with a sharp drop in the ASX 200 as the data came through at 11:30am (AEST).

Source: Market Index

The RBA is set to convene on November 7 to determine whether to maintain the cash rate at 4.1% for the fifth consecutive month. This decision holds significant importance in managing inflation without turning the country into recession.

The big question next is if this is considered a material uptick. the equity markets believed it was, but what about economists?

For some, the 1.2% increase was ambiguous when it came to the RBA’s decision, with AMP’s Chief Deputy Economist Diana Mousina attributing it to a coin toss at this moment.

‘A key number I was looking for was that underlying measure of inflation, and coming out of 1.2% over the quarter, I think that there is a complete 50-50 coin toss as to whether the RBA will hike rates in November because it is a bit of a grey area,’ she said to ABC today.

‘I was thinking if the number was closer to 1.3% then the Reserve Bank would probably hike, but 1.2% probably does still mean that inflation projections over the next two years are still intact.’

Magellan CEO steps down

Embattled fund manager Magellan [ASX:MFG] has announced CEO David George is stepping down and being replaced by Board Director Andrew Formica.

The company’s stock has been under intense pressure after earlier this month, the company reported a $4 billion drop in funds under management for September. The fund experienced net outflows of $2 billion, which included a strong hit from retail investors.

Shares are down by 4.29% in this morning’s trading.

In the statement today, Mr Formica said:

‘The Board, in consultation with David, believe it is time to refocus leadership which will accelerate the progress made to date. The Board remains focused on the delivery of exceptional investment performance for our clients and are well positioned to continue to explore organic and inorganic growth opportunities. I am personally committed to the task of leading Magellan until such time that a new CEO can appointed.’

‘Our immediate focus is on ensuring we retain, attract, and appropriately incentivise our talent to drive performance excellence. An important step in achieving this is to address the existing Employee Share Purchase Plan (ESPP) Loans and we are pleased to today announce that additional retention payments will be made to close out the ESPP Loan balances for the majority of staff by September 2025.’

US earnings season in fulll swing

Some strong earnings overnight have helped turn the market, here is a breakdown of some of the bigger names.

Alphabet: reported after-hours missed cloud earnings while total revenue up 7% YoY to US$74.6 billion. Net income came in at US$18.37bn beating EPS expectations.

Microsoft: reported after-hours but another strong result with revenue beats across its segments. Revenue for Azure and Cloud is up 29%.

Spotify (+10.4%): Double beat, monthly active users grew 26% YoY to 574 million, which was 2 million above guidance, posted a surprise profit thanks to cost-cutting measures.

Verizon (+9.3): Earnings beat with revenue within expectations, free cash flow above consensus, reaffirmed full-year guidance but raised free cash flow outlook.

General Electric (+6.5%): Double beat, free cash flow well above consensus, strong Aerospace results driven by order growth in Engines, raised full-year guidance and announced second quarter timing for spinout of GE Vernova.

Coca-Cola (+2.9%): Double beat, raised full-year volume on strong demand and higher prices. For the quarter, unit case volumes rose 2% while prices rose 9%. Gross margins 90 bps ahead of consensus on pricing and lower freight costs.

General Motors (-2.3%): Double beat but withdrew FY23 guidance, ongoing UAW strike costs running at US$200 million per week.

Good morning

Good morning all, Charlie here

The ASX 200 opened up +0.19% but quickly extended that to +0.53% at 6,892.9 as markets were buoyed by positive trading on Wall Street overnight.

Eurozone PMI lowest in three years as services sector stagnates.

US manufacturing PMI highest in six months, services PMI highest in three months, inflation indicators easing.

Wall Street: The Dow +0.62%, Nasdaq +0.93%, S&P 500 +0.73%, Russell 2000 +0.82%.

Overseas Markets: FTSE +0.20%, STOXX +0.58%, Nikkei +0.20%, SSE +0.78%

Gold prices fell, -0.15% to US$1,970.82. Silver fell -0.25%.

Oil prices fell again as global economic growth concerns overshadowed the Middle East concerns. JPMorgan said that ‘demand destruction will outweigh wider Mideast conflict in oil markets’ and Israel said they were willing to delay the invasion to discuss hostage releases.

Brent Crude is down -1.95%, at US$88.08, while WTI crude is down -2.13% at US$83.67

Iron Ore is down slightly to US$118.45.

Bitcoin continues to remain high, up +3.72% to US$34,152.25 after huge gains made yesterday after the SEC lost in court, paving the way for a potential Bitcoin ETF.

The Aussie dollar is up +0.35%, to US63.57 cents.

Key Posts

-

4:51 pm — October 25, 2023

-

4:38 pm — October 25, 2023

-

4:29 pm — October 25, 2023

-

3:34 pm — October 25, 2023

-

3:18 pm — October 25, 2023

-

1:07 pm — October 25, 2023

-

12:05 pm — October 25, 2023

-

10:47 am — October 25, 2023

-

10:38 am — October 25, 2023

-

10:20 am — October 25, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988