Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | XJO to Open Down; RBA Decision Day, Likely Rates Hold, Qantas CEO Steps Down Early Amidst Turbulence

Market close update

ASX 200 closed flat, down 0.06% at 7,314.3 in a quiet day trading.

RBA’s decision to pause was the biggest news today, although it surprised few and did not manage to stimulate the markets.

Qantas shares closed 0.2% lower after outgoing CEO Alan Joyce brought forward his retirement by two months after a series of scandals this past few weeks have spurred the need for a fresh face in the embattled company.

He will step down as of Wednesday as Vanessa Hudson steps into the group CEO and managing director roles.

ASX 200 Sector Top Performance

- Health Care up +0.77%

- Industrials up +0.46%

- Staples up +0.43%

ASX 200 Sector Worst Performance

- Utilities down -1.18%

- Energy down -0.60%

- Real Estate down -0.51%

RBA keeps rates on hold at 4.10%

In a move that was widely expected, the RBA board has decided to keep rates on hold this month at 4.10%.

An overwhelming 97% of polled economists predicted the move today as many see signs that the market has slowed to the point of risking recession.

Today’s decision marks the last act as RBA Governor for Philip Lowe.

In his reasoning today, Dr Lowe outlined the board’s view of the economy, saying:

‘The Australian economy is experiencing a period of below-trend growth and this is expected to continue for a while. High inflation is weighing on people’s real incomes and household consumption growth is weak, as is dwelling investment.’

Dr Lowe will be replaced by former Deputy Governor Michele Bullock, who is seen as a continuity rather than a drastic shift of policy.

Michele Bullock’s previous comments as Deputy may come back to bite her, as many interpreted her comments back in June as hoping for rising unemployment when she stated that unemployment would need to climb to 4.5% to tame inflation.

‘Our assessment is that, for the first time in decades, firms’ demand for labour exceeds the amount of labour that people are willing and able to supply. That is, employment is above what we would consider to be consistent with our inflation target,’ Ms Bullock said.

With unemployment currently sitting at 3.6% an increase to that level would mean a further 140,000 people out of work.

With the RBA promising structural changes to the way decisions are made in the future, some may pick up these previous comments to attack her politically around future cuts.

Despite the board saying further tightening may be required, for many, today’s move puts the nail in the coffin in this tightening cycle.

The next question many will have is, when are we likely to see rate cuts?

Orora launches $1.35b equity raise to buy Saverglass

Bottle and can maker Orora launched a $1.345 billion equity raise this morning, split across a $450 million institutional placement and a $895 million rights issue.

The offer is 59% of Orora’s shares on issue, and the offer was priced at $2.70 per share, a 21% discount.

Orora plans to use the funds to target a $2.15 billion takeover of Saverglass, a 126-year-old French premium bottle maker best known for Grey Goose Vodka.

Saverglass has been privately owned by equity giant The Carlyle Group since 2016.

Midday market update

ASX 200 remains in the red by midday as markets await the RBA decision at 2:30pm.

ASX 200 sits down 0.43% at 7,287.5.

The heat remains on Qantas as Alan Joyce steps down as CEO amidst a series of scandals, including alleged government influence and the sale of tickets to cancelled flights which the ACCC is investigating.

Meanwhile, Origin will begin talks with the NSW government to keep the state’s largest power station open beyond 2025, following a report that predicted price spikes and reliability risks if the plant was decommissioned too early.

The Eraring Power station supplies around 25% of the state’s power needs but is seen as one of the largest carbon emitters in Australia.

Origin has stated its commitment to the closing date. Still, it has indicated a willingness to work with the government to strike a deal on the timeline to avoid any potential shortfalls in the state’s energy supply.

Australia Post proposes to raise basic postage rate by 25%

Australia Post has proposed to raise the basic postage rate from $1.20 to $1.50, effective from January 2024. The increase would be the first in five years.

The proposal is subject to approval by the Australian Competition and Consumer Commission (ACCC).

Australia Post said the increase is necessary to offset the declining revenue from its letters business.

The company reported a $200 million loss last week, which included a $384 million loss in its letters business.

‘We’ve made a number of changes in the past year to improve and simplify our business but, as we are entirely self-funded and receive no ongoing government funding, we need to ensure we reduce losses in our letters business,’ CEO Paul Graham said in a statement.

Gas unions launch strikes at Chevron’s WA plants

Unions will start rolling 24-hour stoppages at Chevron’s two major LNG projects in Western Australia from next week as talks between the parties fail.

The Offshore Alliance – made up of the Australian Workers’ Union and Maritime Union of Australia – notified Chevron overnight of the 24 one-hour stoppages at Gorgon and Wheatstone facilities starting on September 14 and continuing for two weeks.

A larger strike will follow a week of rolling stoppages averaging about 10 hours a day that are scheduled to start from Thursday.

Gorgon and Wheatstone LNG plants contribute about 7% of the global LNG supply and 47% of domestic gas in Western Australia.

So far, gas prices appear unchanged, as many markets anticipated the strike action as Chevron has appeared unwilling to budge on requests made by unions thus far.

The Offshore Alliance said it was escalating its industrial action in response to Chevron’s claim that negotiations were ‘intractable’, saying 24-hour strikes would show that bargaining was ‘far from ‘intractable’.

‘Our bargaining claims will look more and more reasonable as Chevron’s Gorgon and Wheatstone LNG exports dry up,’ they said.

‘The log of claims will ultimately be claims that Chevron will agree to, but not before they lose a few billion dollars – judging by the form guide. Which is OK as Chevron clearly have plenty of loose change in the Chevron piggy bank.’

Market open

ASX 200 opens down 0.50% at 7,282.1

The biggest movements this morning are the spiking iron ore prices, which are defying the poor results out of China.

According to analysts, low iron ore inventories at mills and ports are pushing prices up. Steel mills have reduced stock during the second half to conserve cash. With low inventories, steelmakers must buy in the spot market to meet needs, spiking prices in the shorter term.

- $AUD down -0.07% at 64.55 US cents

- ASX futures down -0.22% to 7,260.0

- Wall St Closed For Labor Day

- FTSE down -0.16%

- STOXX flat

- SSE up +1.40%

- Bitcoin down -0.51% to $US 25,806.95

- Spot gold down -0.10% to $US 1,937.38

- Iron ore up +7.44% to $US 118.19

- Brent Crude flat at $US 89.00pb

All figures shown are from 10:16am AEST

Can China recover without pushing debt higher?

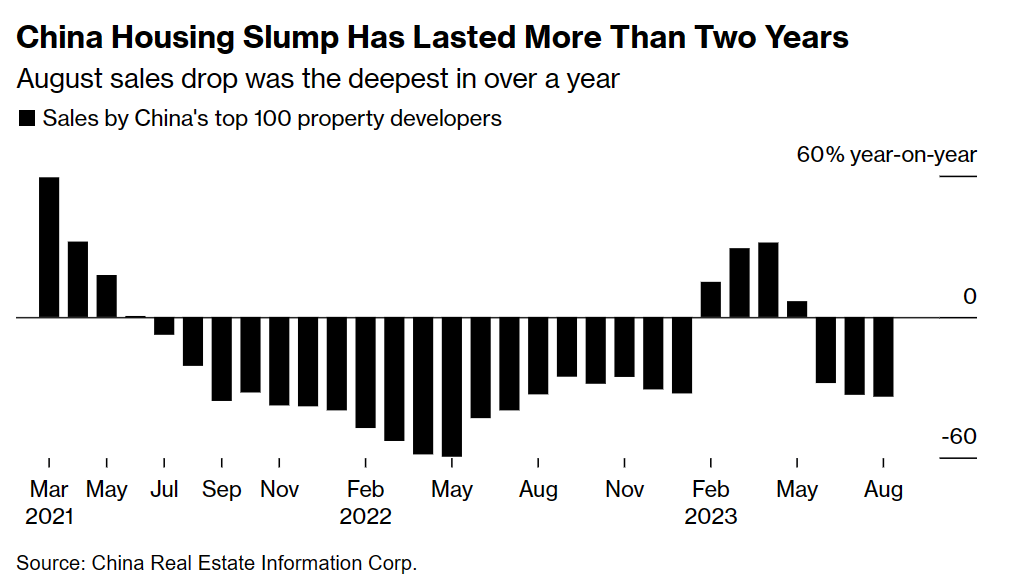

China’s economy is in trouble. The country is facing a number of challenges, including a slumping property market, slowing exports, and rising unemployment.

The government has taken a series of steps to boost growth, but it has stopped short of pulling out a full-throated stimulus package like it did during the global financial crisis in 2008-09.

One key reason for Beijing’s reluctance is its desire to control the growth of debt in the country.

China’s debt-to-GDP ratio is already high, and the government is worried about a debt crisis. Another reason is the government’s desire to shrink the property sector’s outsized influence on the economy.

The property sector has been a major driver of growth in recent years, but it is also seen as a bubble that is due to burst.

The government has taken a number of steps to boost growth, including lowering interest rates, cutting taxes, and injecting liquidity into the financial system. It has also allowed big cities to lower down-payment requirements on homes and taken steps to encourage second-property purchases. However, these measures have had limited impact so far.

Source: Bloomberg

The big question for China (and Australia, whose markets are heavily linked) is can they recover the economy without pushing debt to new highs.

International Markets

Wall Street is closed today for Labor Day Holiday, while European Markets are down overnight.

Asian Markets look strong this morning, however, the latest data from South Korea this morning showed the largest monthly increase in inflation in the last seven years, at 1%, which could rattle markets.

Today’s figures show the battle for inflation is not over for global markets, and many central banks are still favouring hold and raise biases rather than holding or cutting interest rates.

Pre-Market update

The Reserve Bank Board will meet this morning and is overwhelmingly expected to hold the cash rate unchanged at 4.10%.

Revealing the market’s stance, cash rate futures place a 14% chance of a 25bp rate cut at tomorrow’s meeting.

Qantas CEO Alan Joyce stepped down this morning, two months earlier than his planned retirement, after a horror week of negative press, lawsuits, and scandals.

China’s housing crisis continues to threaten more of the economy, with now 2/3rds of the top 50 property developers now at real risk of default.

Key Posts

-

4:45 pm — September 5, 2023

-

2:42 pm — September 5, 2023

-

2:24 pm — September 5, 2023

-

1:42 pm — September 5, 2023

-

12:09 pm — September 5, 2023

-

12:01 pm — September 5, 2023

-

10:33 am — September 5, 2023

-

10:20 am — September 5, 2023

-

9:55 am — September 5, 2023

-

9:48 am — September 5, 2023

-

9:38 am — September 5, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988