Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | XJO to Follow Wall St Higher; Oil and Bonds Ease, Qantas, BOQ, Telstra All Feature

Market close update

The ASX200 closed up 0.63% at 7,085.0, its fifth consecutive session of gains as sentiments shift in the US with many hoping interest rates have peaked.

Talk of Chinese stimulus also pushed up the ASX and Materials sector, which gained +0.97%. The best performer today was Info Tech, which gained +1.70%

‘The world’s second-largest economy [China] is considering raising its budget deficit, which could see a new round of stimulus,’ said Josh Gilbert, a market analyst. ‘This should help provide another tailwind to the local market today.’

Shares in iron ore giants Rio leapt 2.1%, while BHP rose 1.5%, while Fortescue was up 1.6%.

Lithium producers also had a good day, with Sayona Mining hitting the index’s top performer of the day, up nearly 10%, followed by Lake Resources up 8.1%. Core Lithium rose 6.9% and Pilbara Minerals gained 3.9%.

Qantas gained 1.9% after long time Chairman Richard Goyder bowed to shareholder pressure and announced he will step down in late 2024. Two other board members join him in leaving as the company tries to refurnish its image.

Bank of Queensland saw its shares plummet 4.3% after reporting a 70% fall in NPAT to $124 million. The result was considerably lower than estimates and has increased doubts on the lender, which is already been struggling with anti-money laundering investigations from AUSTRAC.

Rise of the Asian Urbanite Fires This Commodity

Money Morning Editor Callum Newman thinks he’s found a gap in the market where others arent looking, and thankfully its a bright spot for Australians.

Here’s an excerpt:

‘For a decade the world has expected the high price of iron ore to go the way of the dodo because the demand would not be there.

Rio, and the price of iron ore, are telling us that the demand IS there.

Now think about all those Indians and Vietnamese and Middle Easterners urbanising…

At some point it’s possible supply and demand don’t meet the current equilibrium and the prices go higher, not lower.

We already saw this in 2021 when iron ore went over $200 a tonne.

Nobody except me seems to think this can happen again.

But look around the commodity markets.

If there’s a current theme, it’s that the slightest disruption to supply can send prices soaring.

Over the last two years, we’ve seen price spikes in oil, coal, rare earths, lithium and iron ore. Now we are seeing uranium rumble.

The general outline is that demand stays constant, or keeps growing, while investment in future supply has been anaemic for a long time.

This is shaping up for an extended bull market in commodities.’

If you’d like to read the whole article and see why iron ore could be one to watch,

Click below.

https://www.moneymorning.com.au/20231011/rise-of-the-asian-urbanite-fires-this-commodity.html

Rental vacancies fall to new record low

Australia’s rental vacancy fell to a new record low in September, reaching just 1.06% vacant housing nationally.

Adelaide and SA had the lowest vacancy rates in September, with just 0.65% of its housing stock vacant.

‘Vacancy is now sitting well under 1% in three of Australia’s capital cities,’ said PropTrack economist Anne Flaherty.

‘More markets are expected to fall below 1% over the coming year as demand continues to grow.’

‘Across Australia’s regional areas, every state has seen vacancy fall by at least 20 percentage points over the quarter.’

‘Declining vacancy rates are increasing competition for rentals and placing growing pressure on rents.’

‘As a result, rents are predicted to continue rising at above trend levels over the coming months, particularly in the capitals.

Source: PropTrack

Australia leads the world in…(checks notes)…mortgage repayment pain

The latest data out from the IMF in its World Economic Outlook said the chances of a ‘hard landing’ recession had gone down, and the world remained on track for a ‘soft landing’.In this scenario, inflation would slowly return back down to 2-3% while central banks would maintain the reigns of higher interest rates without crashing an economy.

However, for many Australians, the pain being felt in repayments is worse than ever. The IMF has come out with figures for these mortgage repayment woes, and it shows the ratio of debt servicing to disposable income has risen sharply in economies with high percentages of variable rate mortgages like Australia.

Australia is now the most expensive place in the world (per disposable income) for servicing mortgage repayments in all advanced economies.

\

\

Source: AFR -IMF

‘While higher mortgage rates and lower affordability have suppressed demand, supply constraints have nonetheless contributed to keeping house prices above pre-pandemic levels in several countries and complicating central bank efforts to bring inflation back to target,’ the IMF said as part of the report.

The IMF also predicted that Australia will expand by just 1.2% next year, down from its previous forecast of 1.7%. The IMF also forecasted unemployment would climb to 4.3% from its current 3.7% as growth slows.

Commonwealth Bank Household Spending Insights released

The CommBank Household Spending Insights index used de-identified payments from 7 million CBA customers to get a picture of spending habits and a snapshot of the economy.

Australian household spending rose in September, led by hospitality, food and beverages, and petrol.

The HSI Index rose 0.5% in September, led by increased spending on hospitality and food & beverages (2.7%), and transport (1.5%). Petrol prices rose 3% in the month, contributing to the increase in transport spending.

Education spending also rose 1.4% in September due to an increase in overseas university students.

Victoria saw the biggest spending growth among the states in September, up 1.5% on the month as the AFL Finals heled drive spending. This reverses the recent trend of Victoria having the weakest monthly spending growth, but its annual spending growth remains the weakest of any state at just 0.2%.

However, spending fell in five of the CommBank HSI Index’s 12 underlying categories in September, including recreation, utilities, health, household goods and household services. Annual spending growth dropped to 1.8% in September from a peak of 18.7% in August 2022 – well below the current rate of inflation.

A separate Home Buying Index also fell 0.4% in September.

Commonwealth Bank Chief Executive Matt Comyn had a positive outlook on the economy, he said ahead of the bank’s AGM today.

‘The fundamentals of the Australian economy remain strong,’ he said. ‘At the same time, we recognise that the impacts of higher inflation and higher rates are being felt unevenly across customers and the economy.’

Comyn expects pressure on households to ease as inflation continues to fall.

‘We are well provisioned for the changing financial conditions and our strong balance sheet provides flexibility to navigate the current environment while delivering sustainable returns.’

Qantas Chairman to leave next year

Qantas Chairman Richard Goyder has finally caved to public and shareholder pressure to leave after a bitter year of scandals and regulatory gaffs for the airline.

Maxine Brenner and chairwoman of the remuneration committee, Jacqueline Hey, have agreed to leave at the airline’s interim result in February. Mr Goyder will step down ahead of the 2024 annual general meeting.

The list of scandals is a long one; some of the highlights include:

- Competition watchdog threatens a record $250 million fine for allegedly selling thousands of ‘ghost flight’ tickets to cancelled flights.

- The High Court rejected Qantas’s appeal in a case where it was found to have illegally sacked 1,700 workers during the pandemic — they now face a $200 million payout for the workers.

- ACCC is investigating Qantas for what it calls ‘slot hoarding’ at Sydney airport to block

- Qantas is accused of using the government to run a ‘protection racket’ in its blocking of 21 additional Qatar Airways flights into Australia.

- Qantas was forced into a u-turn after customer backlash from customers after threatening to cancel $370 million in flight credits due to expire from the pandemic.

- ex-CEO Alan Joyce retires early under pressure in September, with a $24 million remuneration package that causes public outcry.

This list has been long enough to damage the airline’s reputation and customer trust, which incoming CEO Vanessa Hudson admitted in recent weeks.

‘We know we have a lot of work to do to win back the trust of our customers,’ Hudson said in a statement. ‘This investment is a significant commitment to improving our customer experience and making Qantas the airline of choice for travellers.’

Telstra [ASX:TLS] to acquire Versent for $264.5m

Telstra has announced plans to buy cloud consulting company Versent for $267.5 million.

The acquisition is part of Telstra’s ‘Purple tech service business’ to drive growth and support digitisation. Beyond this jargon, the real reason for the purchase was its proprietary cloud software, called Stax, which manages Amazon Web Services cloud computing environments. Around 40% of the ASX100 companies use its services.

Versent reported $130 million in revenue in FY23, showing a CAGR of 17% between FY20-23.

David Burns, Group Executive, Telstra Enterprise, said the acquisition of Versent supports Telstra’s T25 growth strategy, saying:

‘Since launching our Telstra Purple technology services business four years ago, we’ve seen growing demand for technology solutions – particularly in cyber security and cloud-led transformation – as enterprises, governments and whole industries continue to digitise their operations,’ Mr Burns said

Markets saw little movement as a response, adding 1 cent onto the share price with a 0.26% gain, whether this was because the news had been well signposted or the fact that it will not likely materially help Telstra’s difficult position within the Australian market.

The deal has taken a year to complete and has seen competition from rivals such as Japan’s NTT.

Boss Energy [ASX:BOE] restarts Honeymoon uranium mine

Boss Energy [ASX:BOE] has announced the commencement of mining at Honeymoon which will lead up to processing this quarter.

Commenting on the achievement Boss Managing Director, Duncan Craib said:

‘It is a testament to the hard work and effort undertaken by all Boss employees over many years to reach today’s pivotal milestone, the commencement of mining activities on Honeymoon‘.

Mining operations were suspended in November 2013 as falling uranium prices made the mine uneconomic to run.

Uranium has since been on the road to recovery. Uranium extended its surge to US$72.75, the highest since touching US$73 before the Fukushima disaster in 2011, as strong demand for utilities coincided with low inventories and threats to supply.

Volatile fossil fuel prices due to uncertain supply and U-turns in decarbonisation strategies has also highlighted the need for nuclear within the power mix for many countries.

Source:TradingEconomics

BoQ posts biggest loss in over a year

Bank of Queensland [ASX:BOQ] shares are down by 5.71% falling 33 cents, their biggest one-day drop in over a year after the lender reported a 70% fall in annual profits and a reduced dividend to boot.

Statutory net profits were $124 million after tax while operating expenses were up 8% from last year.

The final dividend was down 3 cents to 21 cents per share, helping bring the share price down to its lowest point since July this year.

In a statement today the company said:

‘As pressures on the mortgage market persisted through the year, management made a decision to moderate growth where economic returns could not be achieved, resulting in a contraction of the mortgage lending portfolio‘

Europe gas prices spike as Finland investigates possible sabotage

Gas prices in Europe are up nearly 30% in a week as disrupted supply again underlines the strategic vulnerability of the continent.

The initial pressure came on 7th October when Hamas launched its deadly morning attack on Israel.

As a response, Israeli PM, Benjamin Netanyahu closed many of its refineries and plants, including the Tamar Gas Fields, which lies 80km offshore from Haifa. This huge gas field alone produced 10.25 billion cubic metres of gas in 2022, and its shuttering was enough to disrupt markets.

Then, Sunday night, Finish workers closed the Balticonnector gas pipeline, noting a sudden drop in pressure without further comment. It was then noted that the shared communication cable was also damaged — raising the first suspicions.

Then Norsar, the Norwegian Seismological Foundation, said today that it had detected a ‘probable explosion‘ along the finish coast. After initial assessments today, there are now clear signs of damage that appear obvious enough to point to sabotage, yet the word is carefully avoided for now.

‘It is likely that the damage to both the gas pipe and the communication cable is the result of external activity,’ President Sauli Niinisto of Finland.

‘The observed damage could not have been caused by normal use of the pipeline or by pressure fluctuations.’

The Balticonnector gas pipeline runs between Finland and Estonia and has played a key part in moving away from reliance on Russian gas.

Source: Washington Post

All watching are clearly thinking of Russian involvement, but so far, everyone is hesitant to jump to conclusions after early finger-pointing at Russia in the aftermath of the Nordstream gas pipeline sabotage— now a year on — seems unfounded.

The Nordstream blame game continues, but multiple sources have corroborated a pro-Ukrainian force being the culprit. The next question will be what is NATO’s response if evidence mounts of Russia’s involvement in this incident.

For Europe, the pipeline will likely take months to fix, and gas prices may continue their upward trajectory back to the numbers seen during the Euro Gas Crisis after the invasion of Ukraine.

Source: TradingEconomics

Good morning

Good morning all,

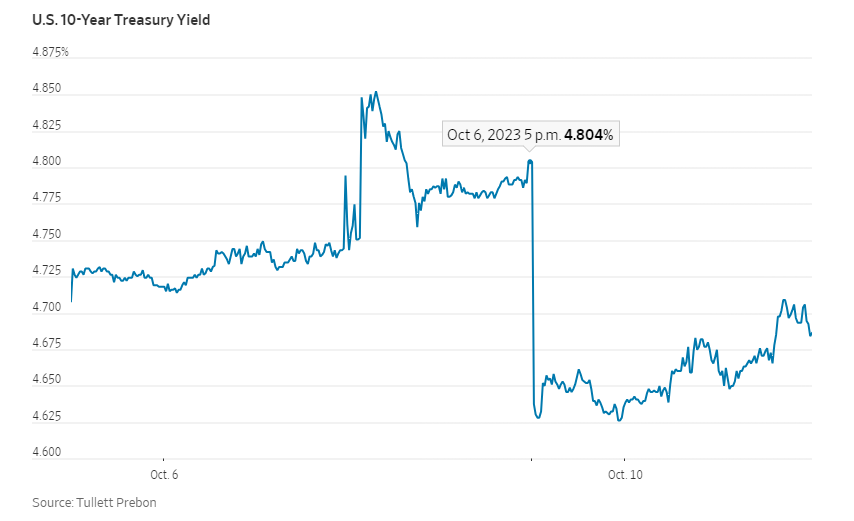

The ASX 200 opened up 0.49% to 7,075.0 as U.S. Treasury bond yields eased pressure on the markets after the bond market reopened following closure for the Columbus Day holiday.

A dovish tone from Federal Reserve Vice Chairman Philip Jefferson and Bank of Dallas president Lorie Logan suggested that the recent surge in long-term Treasury yields was helping tighten financial conditions and may reduce the need for the U.S. central bank to raise its benchmark interest rate again.

This was a sign that the Fed may be slowing down its aggressive rate hike campaign.

U.S. 10-year treasury bond yields are down -15bps to 4.65% after closing Friday at 4.783%. It is the biggest daily slide since March’s regional banking panic that took down several banks, including the tech bro favoured Silicon Valley Bank.

Source: Tullett Prebon

In Europe and elsewhere, bond yields fell as people sought the safety of bonds as concerns about the Middle East spread.

Australian 10-year fell -8bps to 4.43%. U.K.’s 10-year was down -5bpt to 4.42%.

Oil prices fell back slightly after a spike following the attack on Israel. Brent Crude is down 0.60% to US$87.62.

The Dow finished up 0.40%, the tech-heavy Nasdaq was up 0.58%, and the S&P 500 closed up 0.52%.

The rush into Gold has subsided after the initial news of the attack, with prices down -0.16%.

Iron Ore is up 0.37% as China eyes stimulus; however, Singapore iron ore futures point to a coming dip.

Euro natural gas prices jumped again overnight, rising 14% after spiking yesterday as the Israeli government instructed Chevron to shutter its Tamar gas field in northern Israel.

Yesterday’s reported pipeline issues between Finland and Estonia that also pushed up supply are now being investigated as possible sabotage.

Officials had said a ship had passed over the pipeline, causing the damage potentially with an anchor. However, the latest seismic data from Norsar, the Norwegian seismological foundation, said it had detected a probable explosion. Finland is now investigating.

The Aussie dollar rose against the USD, gaining 0.32%, reaching AU/USD 64.30 cents.

Key Posts

-

4:36 pm — October 11, 2023

-

3:52 pm — October 11, 2023

-

3:36 pm — October 11, 2023

-

3:24 pm — October 11, 2023

-

3:10 pm — October 11, 2023

-

2:57 pm — October 11, 2023

-

2:49 pm — October 11, 2023

-

2:36 pm — October 11, 2023

-

2:26 pm — October 11, 2023

-

11:05 am — October 11, 2023

-

10:22 am — October 11, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988