Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | XJO Opens 1% Lower; US Fed’s Overtightening Fear; Domain, Nuix, Origin, Telstra Feature

Commsec: ASX’s mixed earnings season

Some great data from CommSec on the Aussie earnings season so far.

As at the close on Thursday August 17, 66 of the ASX 200 companies had reported earnings. And 40% were higher on the day of earnings release with the average loss of -0.1% #commsec @CommSec #earningsseason #reportingseason #ausecon #auspol #earnings pic.twitter.com/kbgUS59Cdy

— CommSec (@CommSec) August 17, 2023

At the half-way mark of the earnings season, aggregate results for companies reporting full year results:

Revenue +11%

Expenses +17%

Net profit -30.8%

Dividend +4%

Cash -12%#commsec @CommSec #earningsseason #reportingseason #ausecon #auspol #earnings— CommSec (@CommSec) August 17, 2023

ASX 200 slumps to 5-week low

[VIDEO] Market Close: The Australian sharemarket sank to a 5-week low on Thursday, following a weak lead from Wall Street and a continued slowdown of China’s economy.https://t.co/fGwMP3Mxn8

— CommSec (@CommSec) August 17, 2023

July’s total overseas arrivals rose the most since January 2020

Will this add slack to the labour market, easing services inflation?

Total overseas arrivals (including Australian resident returns) into Australia rose from 1,357,680 people in June 2023 to 1,749,240 people in July 2023, the most since January 2020. Arrivals are 667,630 higher than July 2022. #ausecon #auspol @CommSec pic.twitter.com/o5TQhnZuxb

— CommSec (@CommSec) August 17, 2023

Nuix’s going concern risks

Each annual report has a section on the business as a going concern. The section is there for management to reassure investors the business has the funds or future revenue stream to sustain itself indefinitely.

In Nuix’s case, the going concern section was full of qualifications.

Here’s a key excerpt:

‘The uncertainties attached to funding sources, the unknown outcomes of the litigation matters together with the potential business impacts of the ongoing litigation matters and their attendant reputational and financial impacts, gave rise to the Group concluding that while there are uncertainties related to events or conditions that may, depending on the circumstances, cast doubt on the entity’s ability to realise its assets and discharge its liabilities in the normal course of business, it remains appropriate that the financial statements be prepared on a going concern basis.’

$NXL flagged risks to its going concern but management is nonetheless satisfied Nuix will be able to sustain itself. $NXL.AX #ASX pic.twitter.com/8NVPveIJHf

— Fat Tail Daily (@FatTailDaily) August 17, 2023

Nuix down 12% on FY23 results

Software firm Nuix [ASX:NXL] is down 12% in late trade on Thursday after releasing its FY23 results.

- Statutory revenue up 19.8% to $182.5 million

- EBITDA up 189.2% to $34.9 million

- Net loss after tax of $5.6 million, down from a loss of $22.8 million in FY22

- Annualised contract value up 14.5% to $185.5 million

- Customer churn down slightly to 5.3% from 5.4%

- Cash on hand at year-end of $29.6 million

Statutory EBITDA was materially higher than FY22 because of lower ‘non-operational legal costs [what are operational legal costs?]’ and ‘general cost containment’.

While statutory revenue was up, customer receipts dipped ~4% to $165.2 million.

Nuix ended the year with negative free cashflow of $12.8 million, reducing its FY23 cash balance from $46.8 million to $29.6 million.

Inghams rose prices to offset cost inflation

If you’ve noticed chicken and turkey prices rising, that’s likely because producers like Inghams are raising prices to offset concomitant cost increases.

While poultry volumes were flat in FY23, Inghams’s revenue rose 12.2% due to price increases.

But the hikes weren’t gratuitous. ING’s costs rose 11.8% in FY23.

Wonder what the Reserve Bank will make of that cost inflation!

Inghams rises 14% on FY23 results

Chicken and turkey merchant Inghams [ASX:ING] is up 14% at midday trade on Thursday, nearing its 52-week highs.

The reason?

Strong FY23 results.

- Net profit after tax up 72.1% to $60.4 million

- EBITDA up 13% to $418.5 million

- Revenue up 12.2% to $3.04 billion

- Despite core poultry volume falling 0.4% to 463.5kt

The rise in revenue despite flat poultry volumes was attributed to higher net selling prices ‘in response to the increased underlying total costs (up 11.9%).’

Inghams said cost inflation for its business — feed, fuel, freight, ingredients, cooking oil, and repairs — exceeded general inflation.

NextEd’s pipeline disrupted by working Visa

More on NextEd’s trading update, which, I must say, is commendable in its honesty. NextEd really laid it out for investors.

The education firm admitted that a big part of its business is converting ELICOS students into its vocational certificate and diploma courses.

Before the pandemic, about 30% of NXD’s ELICOS students progressed to these courses.

For the recent July course intake, this fell to ~10%.

The remaining ELICOS cohort moved onto the 408 Visa, ‘many of whom would have otherwise extended their ELICOS studies or progressed into vocational courses’.

NXD estimates the hit to the industry’s current annual revenue from international students switching from studying to the 408 Visa is over $700 million.

But NextEd sees a silver lining, in contrast to its shareholders.

The firm thinks when the temporary Visa ends, a ‘significant number of holders will seek to stay in Australia and take up a student visa for ELICOS or vocational studies’.

NextEd argued this will ‘create a material future revenue opportunity’.

Time shall tell.

NXD’s management did issue soft FY24 guidance, albeit vague:

‘The impact of the continuation of the COVID-19 408 Visa on H2 FY24 is difficult to quantify given the positive mitigating actions, many of which are underway. However, NextEd is confident the measures it is putting in place will materially offset emerging 408 Visa impacts.

‘NextEd currently expects that its H2 FY24 revenues will be higher than both H1 FY24 and the H2 FY23 pcp.’

NextED sinks 35% on trading update

Education services firm NextEd [ASX:NXD] hit a new 52-week low on Thursday, currently down over 30% following a trading update relating to the Australian government’s ‘temporary COVID-19 408 Visa’.

The 498 Visa grants holders unlimited working rights for 12 months without the need to study.

That last bit is important, because the 408 Visa holders quadrupled this year.

Source: NextEd

NextEd expected this temporary Visa arrangement to end last month. It didn’t.

The company admitted the extension of this Visa is having adverse effects:

- Some English Language Intensive Courses for Overseas Students (ELICOS) are ‘studying for shorter durations to move to the 408 Visa

- Fewer ELICOS students are ‘progressing into vocational courses’

The temporary 408 Visa is disrupting NextEd’s customer pipeline.

Two factors influencing the price of gold: Ryan Clarkson-Ledward

It’s no secret that, globally speaking, tensions are rising.

Russia’s invasion of Ukraine may be the most obvious example, but it certainly isn’t the only one. Ever since the pandemic, we’ve seen old ideals of open trade begin to stall and falter.

Governments are now increasingly focused internally or within their regional blocs. Moves that suggest globalisation may, in fact, be the biggest victim of COVID.

Russia simply gave one more reason than most to draw more ire. And while there are arguments to be made of the effectiveness of the sanctions placed on Russia, it’s the intent that sends a real message.

That’s why, this year, we’re seeing more buying of physical gold from central banks. As Invesco’s head of official institutions, Rod Ringrow, tells the Financial Times:

‘Up until this year, central banks were willing to buy or sell gold through ETFs and gold swaps…

‘This year it’s been much more physical gold and the desire to hold gold in country rather than overseas with other central banks…it’s part of the reaction to the freezing of the Bank of Russia’s reserves,’

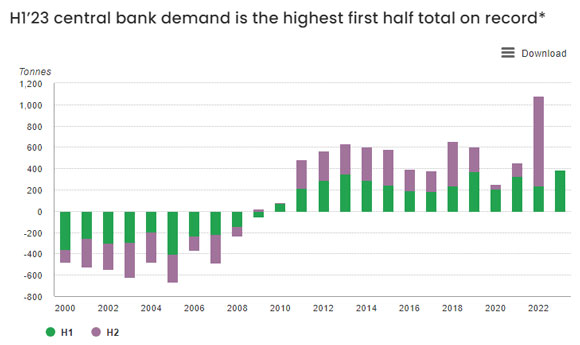

As a result, demand for the first half of 2023 is at its highest level in decades:

|

| Source: World Gold Council |

We’ll have to wait and see if the second half can repeat the huge surge (purple bar) we saw last year. But for now, at least, the stage is set for strong gold price resilience in the face of this central bank demand.

But they’re not the only ones…

https://www.moneymorning.com.au/20230817/two-factors-pushing-the-price-of-gold-up-right-now.html

Are BHP, Commonwealth Bank, and CSL overvalued?

Are the three biggest stocks on the ASX overvalued?

Let’s run the numbers to find out.

https://www.moneymorning.com.au/20230815/are-the-biggest-asx-stocks-overvalued.html

Are BHP, Commonwealth Bank, and CSL overvalued?

Are the three biggest stocks on the ASX overvalued?

Let’s run the numbers to find out.

https://www.moneymorning.com.au/20230815/are-the-biggest-asx-stocks-overvalued.html

How the market reacted to the latest unemployment figures

The $XJO rebounded somewhat on the news. pic.twitter.com/Vnd8talWMc

— Fat Tail Daily (@FatTailDaily) August 17, 2023

How the market reacted to the latest unemployment figures

The $XJO rebounded somewhat on the news. pic.twitter.com/Vnd8talWMc

— Fat Tail Daily (@FatTailDaily) August 17, 2023

Unemployment rises to 3.7% in July but ‘all key indicators still point to a tight labour market’

Australia’s unemployment rate notched slightly higher to 3.7% in July, up 0.2% from June.

While the number of unemployed rose by 36,000 people in July to 541,000, this was still 172,000 lower than before the pandemic.

It was a similar story for the employment-to-population ratio.

While the ratio dropped 0.2% to 64.3%, it was well above pre-pandemic levels and still close to historic highs set in May.

The underutilisation rate, combining unemployment and underemployment, rose 0.2% to 10.1%. This was 3.9% lower than March 2020.

The Australian Bureau of Statistics’ Bjorn Jarvis said: ‘In trend terms, all key indicators still point to a tight labour market.’

Australia's unemployment rate rose 0.2% to 3.7% in July (seasonally adjusted).

However, ABS's Bjorn Jarvis said 'in trend terms, all key indicators still point to a tight labour market.'#auspol #ASX pic.twitter.com/wtwfI5hUeL

— Fat Tail Daily (@FatTailDaily) August 17, 2023

Jarvis also warned about extrapolating too much from month-on-month changes, as the July reading was influenced by holidays:

‘July includes the school holidays, and we continue to see some changes around when people take their leave and start or leave a job. It’s important to consider this when looking at month-to-month changes, compared with the usual seasonal pattern. The only other fall in employment in 2023 was in April, which also included school holidays.‘

Unemployment rises to 3.7% in July but ‘all key indicators still point to a tight labour market’

Australia’s unemployment rate notched slightly higher to 3.7% in July, up 0.2% from June.

While the number of unemployed rose by 36,000 people in July to 541,000, this was still 172,000 lower than before the pandemic.

It was a similar story for the employment-to-population ratio.

While the ratio dropped 0.2% to 64.3%, it was well above pre-pandemic levels and still close to historic highs set in May.

The underutilisation rate, combining unemployment and underemployment, rose 0.2% to 10.1%. This was 3.9% lower than March 2020.

The Australian Bureau of Statistics’ Bjorn Jarvis said: ‘In trend terms, all key indicators still point to a tight labour market.’

Australia's unemployment rate rose 0.2% to 3.7% in July (seasonally adjusted).

However, ABS's Bjorn Jarvis said 'in trend terms, all key indicators still point to a tight labour market.'#auspol #ASX pic.twitter.com/wtwfI5hUeL

— Fat Tail Daily (@FatTailDaily) August 17, 2023

Jarvis also warned about extrapolating too much from month-on-month changes, as the July reading was influenced by holidays:

‘July includes the school holidays, and we continue to see some changes around when people take their leave and start or leave a job. It’s important to consider this when looking at month-to-month changes, compared with the usual seasonal pattern. The only other fall in employment in 2023 was in April, which also included school holidays.‘

Chinese shadow bank misses ‘dozens of payments’

More bad news out of China.

Yesterday, Bloomberg reported that Zhongrong International — which manages US$138 billion — missed payments on ‘dozens of products and has no immediate plans to make clients whole’.

At least 30 products are now overdue, with the shadow bank now halting redemptions on some instruments.

In a note, Bloomberg Economics said there’s danger of a negative feedback loop:

‘The big danger is that a negative feedback loop kicks in, with property stress causing strains in the financial system, undermining credit expansion and depressing growth, which, in turn, exacerbates the slump in the property sector.’

Major shadow bank in China just missed tons of payments…

"Zhongrong International Trust Co. missed payments on dozens of products and has no immediate plan to make clients whole" https://t.co/SCA2wyn2Wt

— Joe Weisenthal (@TheStalwart) August 16, 2023

Chinese shadow bank misses ‘dozens of payments’

More bad news out of China.

Yesterday, Bloomberg reported that Zhongrong International — which manages US$138 billion — missed payments on ‘dozens of products and has no immediate plans to make clients whole’.

At least 30 products are now overdue, with the shadow bank now halting redemptions on some instruments.

In a note, Bloomberg Economics said there’s danger of a negative feedback loop:

‘The big danger is that a negative feedback loop kicks in, with property stress causing strains in the financial system, undermining credit expansion and depressing growth, which, in turn, exacerbates the slump in the property sector.’

Major shadow bank in China just missed tons of payments…

"Zhongrong International Trust Co. missed payments on dozens of products and has no immediate plan to make clients whole" https://t.co/SCA2wyn2Wt

— Joe Weisenthal (@TheStalwart) August 16, 2023

Why investors should use base rates

Investors underutilise base rates when making investment decisions.

Investment strategist Michael Mauboussin wrote a whole tome on using base rates … and you can access it free here.

I believe that base rates remain very underutilized. From the time I started on the buyside in 2004 I wanted to collect and see these data. So @dcalz and I appreciated the opportunity to put it together when we had access to the data via HOLT.https://t.co/Qab5MD7H3I https://t.co/eg1Q40PP8d

— Michael Mauboussin (@mjmauboussin) August 16, 2023

Gold falls below US$1,900 an ounce

The price of spot gold fell below US$1,900 an ounce overnight, to a fresh five-month low.

NBA’s senior commodities strategist Baden Moore told the AFR yesterday gold was facing the ‘perfect storm’:

‘When we saw gold prices around $US2050, it reflected a market where the US regional bank crisis was peaking, and you had Federal Reserve rate cut expectations for 2024 out to around 220 basis points. That’s all pulled back now.

‘The more resilient US outlook combined with the continued prospect of China stimulus is supportive to base metal and crude prices [but] the prospect of further deferral of US Fed funds rate cuts is a negative to gold prices from here.’

Source: Kitco

US bond yield hits highest level since 2008

The 10-year US Treasury yield hit a 15-year high overnight.

The 10-year yield closed at 4.258% yesterday, the highest level since June 2008.

Never a great period for comparison.

Source: WSJ

Speaking with the Wall Street Journal, Penn Mutual Asset Management’s Zhiwei Ren said rising yields on longer-term bonds are correlated with ‘lower risk-asset prices; I think that’s what markets are worried about right now.’

The rising 10-year yield is interesting, given the market’s long-standing belief that the US Fed is close to its rate hike peak given inflation is cooling.

The steady rise in the 10-year yield could suggest investors are realising interest rate cuts are not coming any time soon. The US economy will be trudging through a plateau of high rates for a while yet.

RBA and US Fed wary of inflation risks

The US Fed’s latest meeting minutes echoed inflation concerns outlined in the latest meeting minutes released by our own Reserve Bank.

Here’s the RBA:

‘Members discussed a range of scenarios for inflation, including the possibility that inflation does not return to the target band by around mid-2025. This could occur if services price inflation declines more slowly than forecast, the recovery in productivity growth incorporated into the forecasts does not eventuate or if wages growth is more responsive to the tight labour market than assumed. On the other hand, inflation could fall faster than anticipated if the decline in real household disposable income over the prior year weighs more heavily on consumption. More broadly, members noted the lags in the operation of monetary policy meant that the full effects of the 400 basis points of monetary policy tightening over the prior year were yet to be felt. Accordingly, members acknowledged the significant uncertainty about the economic outlook.‘

And here’s the US Fed:

‘Participants generally noted a high degree of uncertainty regarding the cumulative effects on the economy of past monetary policy tightening. Participants cited upside risks to inflation, including those associated with scenarios in which recent supply chain improvements and favorable commodity price trends did not continue or in which aggregate demand failed to slow by an amount sufficient to restore price stability over time, possibly leading to more persistent elevated inflation or an unanchoring of inflation expectations. In discussing downside risks to economic activity and inflation, participants considered the possibility that the cumulative tightening of monetary policy could lead to a sharper slowdown in the economy than expected, as well as the possibility that the effects of the tightening of bank credit conditions could prove more substantial than anticipated.’

US Federal Reserve: ‘significant upside risk’ to inflation

The latest US Fed meeting minutes are out.

Here are the choicest excerpts.

Significant upside risk to inflation remains:

‘With inflation still well above the Committee’s longer-run goal and the labor market remaining tight, most participants continued to see significant upside risks to inflation, which could require further tightening of monetary policy.’

However, some Fed participants worried the effects of monetary tightening ‘could prove more substantial than anticipated’:

‘Some participants commented that even though economic activity had been resilient and the labor market had remained strong, there continued to be downside risks to economic activity and upside risks to the unemployment rate; these included the possibility that the macroeconomic effects of the tightening in financial conditions since the beginning of last year could prove more substantial than anticipated.’

This risk of more substantial effects led a number of officials to warn against ‘inadvertent overtightening’:

‘A number of participants judged that, with the stance of monetary policy in restrictive territory, risks to the achievement of the Committee’s goals had become more two sided, and it was important that the Committee’s decisions balance the risk of an inadvertent overtightening of policy against the cost of an insufficient tightening.’

Fed officials’ baseline inflation forecasts are skewed to the upside:

‘The staff continued to judge that the risks to the baseline projection for real activity were tilted to the downside. Risks to the staff’s baseline inflation forecast were seen as skewed to the upside, given the possibility that inflation dynamics would prove to be more persistent than expected or that further adverse shocks to supply conditions might occur. Moreover, the additional monetary policy tightening that would be necessitated by higher or more persistent inflation represented a downside risk to the projection for real activity.’

Good morning

Good morning, all.

Welcome to another ASX live blog.

I say this often, but it’s another busy one.

We’ve got plenty of big ASX companies reporting and plenty of macro news to unpack — like the US Fed meeting minutes and the latest UK inflation data.

Key Posts

-

5:26 pm — August 17, 2023

-

5:23 pm — August 17, 2023

-

3:08 pm — August 17, 2023

-

2:59 pm — August 17, 2023

-

2:29 pm — August 17, 2023

-

1:59 pm — August 17, 2023

-

1:10 pm — August 17, 2023

-

12:44 pm — August 17, 2023

-

12:21 pm — August 17, 2023

-

12:05 pm — August 17, 2023

-

12:00 pm — August 17, 2023

-

12:00 pm — August 17, 2023

-

11:50 am — August 17, 2023

-

11:50 am — August 17, 2023

-

11:34 am — August 17, 2023

-

11:34 am — August 17, 2023

-

10:59 am — August 17, 2023

-

10:59 am — August 17, 2023

-

10:51 am — August 17, 2023

-

10:40 am — August 17, 2023

-

10:25 am — August 17, 2023

-

10:11 am — August 17, 2023

-

10:04 am — August 17, 2023

-

9:56 am — August 17, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988