Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | XJO Falls Over 1%; S&P 500 Records Worst CPI Day Since 2022; Domain, AMP, Dexus Feature

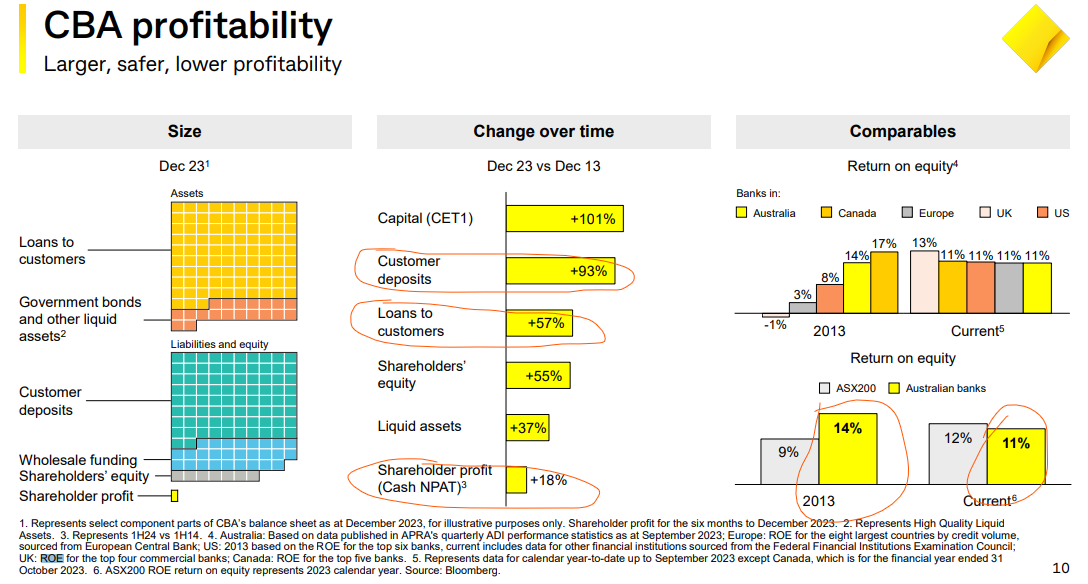

Banks’ profitability down in the last decade

Commonwealth Bank released hundreds of pages of information today. A true data dump.

In the slide deck, CBA summed up the industry’s profitability.

Australian banks have seen return on equity slide from 14% in 2013 to 11% now.

Despite that, the Big Four have done alright, in aggregate.

In that decade, CBA’s share price gained ~80%.

NAB gained ~35%.

ANZ gained ~11%.

Westpac, the outlier, lost ~8%.

But the level of profitability is not the only thing that matters for value creation. The amount of invested capital matters, too.

And the big banks have grown their coffers since 2013.

CBA’s customer deposits grew 93% since 2013 and its customer loans 57%. But, in a sign of competition’s toll, cash profit only rose 18% on 2013.

Revenge of the retailers: Callum Newman

Excerpt from Callum Newman’s latest for Fat Tail Daily.

***

Aussie retail stocks are flying up lately.

Yesterday it was the turn of online furniture retailer Temple & Webster [ASX:TPW]. It rose nearly 9% on the day and is up 20% in a couple of weeks.

This follows on from ripping runs in Cettire [ASX:CTT], JB Hi-Fi [ASX:JBH] and Nick Scali [ASX:NCK].

A friend of mine told me he “should” have bought up the sector last year.

What stopped him?

You can guess – all the macro noise about interest rates, the Fed, recession and all the rest of it.

In my small cap advisory, Australian Small Cap Investigator, I did happen to recommend a retailer – Beacon Lighting Group [ASX:BLX].

It’s now up 47% in about a year…

In hindsight, one could say I went a bit early.

It’s only since about December, like most of the market, that Beacon began to really move. (Clearly, I might have recommended a few others too!)

I’m glad I stayed the course here.

We all have weaknesses when it comes to the market.

For my buddy, it was focusing too much on variables he can’t control, and often may not matter long term anyway.

For me, it’s impatience.

Often stocks just need time to move. They can dawdle, dip and drag like a recalcitrant teenager.

My tendency is to sell them off and go looking for some action elsewhere. Then I’ll look back and cringe at what happened after.

Last year was a perfect time to plant many market “seeds” and see what sprouts. Stocks were hammered. Sentiment was in the toilet.

It was a market to accumulate shares in a business you were happy to hold for 2 years or more.

In this case, like Beacon.

I remember mentioning the idea to another friend of mine. He was dismissive. I ignored him and told my readers to get their hands on it.

What is to like about Beacon?

Is size Commonwealth Bank’s competitive advantage?

Is size CBA’s competitive advantage?

And is that advantage sustainable and pervasive enough to warrant the lofty valuation?

Here’s more from James Thomson in today’s Chanticleer:

‘The first point is that size does matter. The fact that CBA clearly leads the market in the proportion of retail and business customers that call the bank their main financial institution does drive real competitive advantage, Comyn says.

‘That scale doesn’t shelter CBA from market forces, as shown by the fact the intense competition pushed the bank’s net interest margin down 6 basis points to 1.99 per cent in the half; incidentally, Comyn says that’s about 20 basis points below where NIM would have been in previous market cycles.

‘But CBA’s sheer size means its deposit base is stronger, which means its wholesale funding costs are lower, which means its earnings are generally more consistent, and its all-important dividend remains steadier.

‘“The fact that we have a very large, and by far the strongest deposit base, and the stability and consistency of earnings through the cycle result in, amongst other things, a lower cost of capital,” Comyn says. “And then that predictability and consistency drives valuation, or certainly drives some elements of valuation.’

Is CBA priced to perfection? “Not necessarily”, says CEO Matt Comyn

James Thomson just published a great piece for the AFR’s Chanticleer column.

Here’s a snippet:

‘“Priced for perfection,” said Atlas Funds Management’s Hugh Dive.

‘“One of the most expensive banks in the world,” said Citi’s Brendan Sproules.

‘“Extremely stretched on every possible measure,” according to Jonathan Mott of Barrenjoey.

‘These calls are clearly not without merit. CBA’s valuation trades at a staggering 100 per cent premium to its big four peers (up from an average premium of 40 per cent before COVID) and at 2.6 times its book value. As Sproules has noted, its dividend yield is now skinnier than the risk-free rate, the 10-year bond yield.

‘But as Comyn delivered a 3 per cent fall in December half cash profit on Wednesday, and warned of continuing pressure on lending and deposit margins, the question was obvious: is Comyn as confused as the investment community about CBA’s lofty valuation?

‘“Not necessarily,” he says.’

OpenAI’s Karpathy addresses departure

A story breaks.

And the subject immediately responds.

The Information announced one of OpenAI’s founders — Andrej Karpathy — is leaving.

Karpathy quickly responded on Twitter after the story broke.

Hi everyone yes, I left OpenAI yesterday. First of all nothing "happened" and it’s not a result of any particular event, issue or drama (but please keep the conspiracy theories coming as they are highly entertaining :)). Actually, being at OpenAI over the last ~year has been…

— Andrej Karpathy (@karpathy) February 14, 2024

P.S. Now that I’m on Karpathy’s Twitter page. He’s got some interesting thoughts. Here’s a take on the Tiktokification of learning. Learning’s primary feeling shouldn’t be fun, but effort.

# on shortification of "learning"

There are a lot of videos on YouTube/TikTok etc. that give the appearance of education, but if you look closely they are really just entertainment. This is very convenient for everyone involved : the people watching enjoy thinking they are…

— Andrej Karpathy (@karpathy) February 10, 2024

Co-founder of OpenAI departs

OpenAI co-founder and former director of AI at Tesla Andrej Karpathy has left OpenAI.

Clued in tech publication The Information just broke the news.

Why is he leaving?

And where to?

Elon Musk’s AI upstart, Grok?

Exclusive: @karpathy has left OpenAI https://t.co/e5sJ2BtRrq

— Jon Victor (@jon_victor_) February 14, 2024

CBA still overvalued: Greg Canavan

Our editorial director Greg Canavan thinks Commonwealth Bank [ASX:CBA] remains overvalued!

Still overvalued. 😀 https://t.co/mxyMPwPFbl

— Greg Canavan (@gcanavan2) February 14, 2024

Cettire valuation

Last week, I ran a Twitter poll on whether Cettire [ASX:CTT] is overvalued.

Is the current multiple justified?

61% of the respondents thought the multiple was justified. 33% thought it was too high. The others were unsure.

Not very scientific, but interesting to see the breakdown nonetheless.

$CTT 1H24 net profit rose 60% to $12.8m at a net profit margin of ~3.6%. In 1H23 it was 4.3%.$CTT.AX's 2H23 net income was ~$8m so its LTM earnings are ~$20.8m. Cettire is thus trading at ~70x LTM.

Is that too high? Or is that justified by the sales growth?

— Fat Tail Daily (@FatTailDaily) February 7, 2024

Lunch

Time for me (Kiryll) to grab some lunch.

Enjoy this Superbowl halftime show in the meantime.

CBA down on 1H24 results: is the bank overvalued?

Is Commonwealth Bank [ASX:CBA] overvalued?

Last week, I spoke with Greg Canavan about the bank’s quality premium and whether it was too high.

Today, CBA released its 1H24 results, with the market sending the bank’s shares nearly 3% lower.

Talking stocks on new WNPI ep:

✅Is $NVDA priced to perfection?

✅Why $DMP is example of expectations outpacing business performance

✅ $CTT's capital light business

✅What do $MYR & $NCK results suggest about consumer?

✅ $CAR & $CBA valuationshttps://t.co/MrbTe0F3En— Fat Tail Daily (@FatTailDaily) February 9, 2024

CBA: “higher rates unevenly felt”

The Reserve Bank has mentioned this before and the Commonwealth Bank has affirmed it: higher interest rates are being unevenly felt.

Some households are cutting back spending more than others. And some are saving less than others.

Despite every age category recording wages growth, younger generations are spending less and dipping into savings more. The under 44s saw their savings drop year on year despite spending less on discretionary goods this year.

The over 55s, on the other hand, are spending the most and saving the most.

Mark Zuckerberg reviews Apple’s Vision Pro: “Quest is the better product, period”

Meta Platforms’ Mark Zuckerberg reviewed Apple’s Vision Pro.

In sum, he thinks Meta’s Quest ‘is the better product, period’.

Does this mean anything?

You wouldn’t hear Pepsi’s CEO calling Coke the best soda ever.

Mark Zuckerberg reviews the device that everyone is talking about. pic.twitter.com/MATsyC2CTO

— Dare Obasanjo🐀 (@Carnage4Life) February 14, 2024

Lyft shares rise 60% after hours as press release incorrectly cites 500bps margin growth … instead of 50bp

That’s a costly typo.

Uber rival Lyft rose 60% after hours after an earnings release incorrectly stated the firm’s profit margin expanded 500 basis points instead of 50.

Just an extra zero. But what a difference that zero makes.

The stock returned most of those typo-gotten gains when Lyft issues the correction.

But some investors slow to see the amended release will be peeved.

$LYFT in their release said 500bps of EBITDA margin expansion (as a % of GBV) in 2024 and just said on the call it's actually 50bps

Stock went from +65% to +11% 😂 pic.twitter.com/J42LHtJDfu

— Thomas Reiner (@treiner5) February 13, 2024

IDP Education, Downer, AMP, Seven Group, Strike Energy rise on announcements

But not all stocks are falling.

In fact, quite a few firms with announcements today are faring well.

- IDP Education [ASX:IEL], up 11.7%

- Downer [ASX:DOW], up 9.9%

- AMP [ASX:AMP], up 8%

- Seven Group [ASX:SVW], up 5.7%

- Strike Energy [ASX:STX], up 4%

GUD, Graincorp, and Domain fall on results

The All Ords is down 1.3%.

Three prominent stocks are contributing to the index’s fall:

- GUD Holdings [ASX:GUD], down 14.7%

- Graincorp [ASX:GNC], down 12.3%

- Domain [ASX:DHG], down 5.2%

Net inflows for spot Bitcoin ETFs doubled in the last three days

The net cumulative inflows for all the spot Bitcoin ETFs approved earlier this year doubled in the past three days to over US$3 billion.

Does that partly explain Bitcoin’s recent rally?

The cryptocurrency is up 25% since late January.

The NET cumulative flows for the 10 bitcoin ETFs (incl GBTC) has doubled in past 3 days to over $3b (for context it took $GLD nearly 2yrs to get to this point) after another half a billion yesterday. The Nine alone are nearing $10b in flows. Chart via @BitMEXResearch pic.twitter.com/jTht9wDqVf

— Eric Balchunas (@EricBalchunas) February 13, 2024

Prior to today’s tumble, S&P500 was 13% above its 200-day moving average

Prior to today’s tumble on hot CPI data, the US benchmark index was 13% above its 200-day moving average.

Bloomberg data boffins noted this happened only on 5% of S&P 500 trading days this century.

On top of that, the exposure of hedge funds to ‘money-losing tech firms is hovering near a two-year high’.

And hedge funds’ exposure to money-printing Nvidia is at a record high, too.

As FT Alphaville’s Robin Wigglesworth quipped last year:

‘Who knows when it will happen, but it does look like Nvidia — excellent company though it is — is on the way to become another classic momentum-fuelled hedge fund hotel that will eventually collapse in hilarious fashion. There are no stupid investments, only stupid prices.’

S&P 500 has worst CPI reaction since September 2022

US investors did not like how sticky US inflation is proving to be.

Core inflation — more telling than headline inflation — rose by more than expected. Core inflation was up 0.4% in January alone! That’s an annual rate of 4.8%. Not great.

Prominent US economists are not pleased.

Jason Furman said the latest CPI data is ‘not good’. He noted the Fed’s preferred inflation measure — PCE — is still expected to be ‘within a comfortable range’. But he’s now ‘more nervous’.

Core CPI comes in hotter than expected, 0.4% in the month of January–which is a 4.8% annual rate.

I'm not a big fan of second derivative forecasting but those of you who are should be worried. Annual rates:

12 months: 3.9%

6 months: 3.6%

3 months: 4.0%

1 month: 4.8% pic.twitter.com/BkPLfHLbpa— Jason Furman (@jasonfurman) February 13, 2024

Investors are nervous, too. Here’s Bloomberg with the summary:

‘The risk-off momentum pushed the S&P 500 down 1.4 per cent on Tuesday, its worst CPI-day performance since September 2022. The Nasdaq 100 Index fell 1.6 per cent, while the stocks with the highest short interest dropped 5.5 per cent in the biggest loss in almost a year. Roughly 91 per cent of the stocks on the New York Stock Exchange traded lower, the most since March 2023.

‘Whether this rout continues is anyone’s guess – but a 13 per cent gap between the S&P 500 and its 200-day moving average historically is a bad sign. The set-up preceded losses for the S&P 500 in 2011, 2015 and 2018, data compiled Andrew Thrasher, technical analyst and portfolio manager at Financial Enhancement Group, show.’

Key Posts

-

4:11 pm — February 14, 2024

-

3:13 pm — February 14, 2024

-

2:38 pm — February 14, 2024

-

2:16 pm — February 14, 2024

-

2:00 pm — February 14, 2024

-

1:51 pm — February 14, 2024

-

1:45 pm — February 14, 2024

-

1:44 pm — February 14, 2024

-

12:25 pm — February 14, 2024

-

12:11 pm — February 14, 2024

-

11:54 am — February 14, 2024

-

11:33 am — February 14, 2024

-

11:25 am — February 14, 2024

-

11:06 am — February 14, 2024

-

11:03 am — February 14, 2024

-

10:46 am — February 14, 2024

-

10:34 am — February 14, 2024

-

10:18 am — February 14, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988