Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | XJO Falls, Powell Hints at More Hikes, UK Inflation Stubborn

ASX 200 closes 1.63% lower as tech stocks tumble

The ASX 200 closed a substantial 1.63% lower on Thursday.

All sectors were in the red but one in particular felt the brunt of the selling. Can you guess?

The Information Technology sector fell nearly 4% today, paring steady gains in recent weeks spurred by the big cousin in the US and AI hype.

Megaport [ASX:MP1] closed 8.2% down.

Novonix [ASX:NVX] closed 5.1% down.

Technology One [ASX:TNE] finished 4.8% down.

Xero [ASX:XRO] fell 4.4%.

Brainchip [ASX:BRN] fell 4%.

And here’s a farewell New Yorker-type cartoon generated by Bing. It’s meant to depict a market reporter saying goodbye to colleagues in a busy office with skyline views.

Not bad, barring the absence of colleagues and the spaghetti fingers … and the one leg with two feet.

Source: Bing AI

Are any ASX stocks hitting their 52-week highs today?

The market is taking a beating.

But is any stock bucking the trend and rising to fresh highs?

Yes, but only a handful.

Brickworks [ASX:BKW] hit a new 52-week high today and is up an even 50% over the past 12 months on a dividend yield of ~2.3%. Quite a solid performance from an ASX veteran.

Another big name is Telix Pharmaceuticals [ASX:TLX]. The stock is up 200% over the past year. Late yesterday, the company agreed to acquire Lightpoint Medical to ‘expand its late-stage urologic pipeline’.

A very interesting inclusion is luxury retailer Cettire [ASX:CTT]. The stock is up a mammoth 500% over the past 12 months and up 90% year to date, trouncing the performance of struggling peers.

Why has the market deemed the stock immune to the discretionary spending crunch? Is the idea here that consumers interested in luxury goods are not the type of consumer to care much about a budget squeeze (given their budgets are high to begin with)?

Zuckerberg ‘ready to fight Elon Musk in a cage match’

Who needs augmented reality when reality doesn’t need any more augmenting?

It’s been reported that tech billionaires Mark Zuckerberg and Elon Musk are considering fighting each other in a cage match.

The winner assumes control of the loser’s companies, presumably?

I’ve confirmed that Mark Zuckerberg is serious about fighting @elonmusk and is now waiting on the details (if Musk decides to follow through)

“The story speaks for itself,” a Meta spokesperson says re: Zuck’s IG post saying “send me location”https://t.co/4g1IkqOl47

— Alex Heath (@alexeheath) June 22, 2023

Johns Lyng down 8% on earnings update

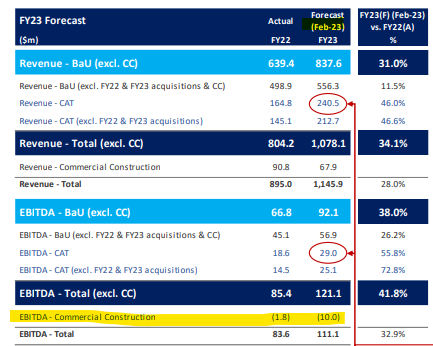

Building services firm Johns Lyng [ASX:JLG] is down 8% after releasing an earnings update for FY23.

Back in February, Johns forecast FY23 revenue to hit $1.146 billion and EBITDA to reach $111.1 million (unlike revenue, the company didn’t bother forecasting EBITDA to two extra decimals).

Today, Johns ‘upgraded’ this guidance — if you exclude the commercial construction segment in the estimate.

FY23 revenue is now expected to be $1.19 billion, up 10.2% on February’s guidance.

Normalised FY23 EBITDA is now expected to be $133.2 million (again excluding commercial construction).

Total normalised EBITDA — including commercial construction — is expected to be $115.9 million. The discrepancy between the two EBITDA figures lies in commercial construction.

Johns reduced the segment’s revenue and EBITDA forecasts by $7.9 million and $5 million respectively. This time, Johns didn’t bother with spelling out the change in percentages.

Source: Johns Lyng

But from its February investor presentation, we see that Commercial Construction EBITDA was forecast to be -$10 million in FY23.

A $5 million reduction (a widening in EBITDA loss) equates to a 50% downgrade to its previous EBITDA guidance for the segment.

Commenting on the pesky segment, management said:

‘The reduction is consistent with the headwinds facing this sector in Australia and vindicates the Group’s previously announced strategy to exit this business line.’

ASX 200 ‘getting smashed’, down 1.5%

The ASX 200 is down 1.5% in midday trade, deepening morning’s losses.

No sector was spared.

But our editorial director Greg Canavan thinks the dumping is deserved. For Greg, the recent rally simply ‘made no sense’.

ASX200 getting smashed. Thoroughly deserved. Recent rally made no sense pic.twitter.com/jjibjvOzu6

— Greg Canavan (@gcanavan2) June 22, 2023

You lounge on a beach in Greece and think, ‘I’d be so much happier if Europe had deeper capital markets’

late to this, but this is pure gold in the FT comment section pic.twitter.com/Hayrf22ULs

— Robert Smith (@BondHack) June 21, 2023

Fossil fuels vs critical minerals: what is the better investment right now?

Big news for resource investors came on Tuesday…

It was the day the government released its long-awaited update for our own Critical Minerals Strategy. A piece of policy that could shape our resource sector and the investor opportunity for decades to come.

And what did we get?

A whole lot of nothing, really.

$500 million worth of government money going toward the Northern Australia Infrastructure Facility (NAIF) was the only meaningful policy in the whole update. Other than that, there is plenty of good ideas present, just no clear direction on how the government plans to implement them.

For example, the media release mentions that the government is working with industry to link them with international partners. A few key markets specifically named are the US, UK, Japan, Korea, India, and the EU.

But there are no details on what help the government is really offering on this front.

And that’s because I suspect they’re offering nothing meaningful at all…

The fact of the matter is a stronger critical minerals sector simply requires more money.

Underinvestment is the biggest threat to this trend. Not a lack of interest from international buyers.

A lot of the smaller and newer projects just can’t secure the funds to get a mine up and running, mainly because investors are unwilling to take a chance on such risky ventures when safer alternatives exist.

I mean, just look at what Woodside Energy Group [ASX:WDS] is doing.

On the same day this critical minerals update was released, Woodside announced a new $10.6 billion oil project in Mexico. Known as Trion, this deepwater venture is expected to produce 479 million barrels of oil and be profitable in less than four years.

In other words, while most are getting excited about renewables and net zero, Woodside is doubling down on fossil fuels. And to be honest, investors are lapping it up right now.

Woodside shares have held up pretty well despite falling oil prices. And their commitment to this Trion project saw a modest rise in the stock as well. Proof that the market believes that oil isn’t going away anytime soon, either.

Like I said, though, it is the money that matters.

The fact that Woodside is able and willing to commit so much to oil is what is telling. If the government — and the downstream buyers, for that matter — want similar results for critical minerals, then they need to stump up the cash.

https://www.moneymorning.com.au/20230622/fossil-fuels-or-critical-minerals-which-is-the-better-investment-right-now.html

UK core inflation rises, surprising economists

Peak, what peak?

UK core inflation rose to 7.1% in May from 6.8% the previous month to reach the highest level since March 1992.

Headline inflation was obstinately unchanged at 8.7%, materially higher than the 8.4% expected by the market. That’s the fourth month in a row where headline inflation exceeded forecasts.

Will future forecasts re-calibrate accordingly?

In any case, the Bank of England seems destined to raise rates further later this week.

Traders now predict a peak rate of 6% early next year.

Paul Dales, chief UK economist at Capital Economics, told the Financial Times the “acceleration in core inflation leaves the UK looking increasingly like the global outlier and the stagflation nation”.

Stagflation nation. Never a sought-after tagline.

Source: Financial Times

Gold Road Resources dips on lower production guidance

Gold Road Resources [ASX:GOR] is down nearly 7% after lowering its FY23 production guidance.

Gold Road fingered ‘reliability and utilisation of the production drills and availability of blasting resources [coming] below expectations’.

A ‘recent significant rain event’ didn’t help.

All up, these factors reduced GOR’s availability of run-of-mine grade ore to the miner’s processing plant. Gold Road had to supplement by processing lower-grade ore from stockpiles.

Gold Road is now guiding for FY23 production at 320,000 and 350,000 ounces, down from the earlier guidance of 340,000 to 370,000 ounces.

This lower production estimate will raise GOR’s all-in sustaining costs per ounce. But Gold Road didn’t quantify by how much.

A full review of the AISC per ounce will be discussed in the June 2023 quarterly report.

ASX 200 down over 1% approaching midday

The ASX 200 is down 1.09% nearing midday.

The worst performers:

- Gold Road Resources [ASX:GOR], down 6.6% after lowering FY23 gold production guidance, which will impact the miner’s all-in sustaining cost per ounce

- Lake Resources [ASX:LKE], down 4.7%. The slight bounce yesterday quickly evaporated this morning

- Virgin Money [ASX:VUK], down 4.6%

- PEXA Group [ASX:PXA], down 4.6%

- Magellan Financial Group [ASX:MFG], down 4.6%

How will we execute the green energy transition?

Are you tired of reading about the energy transition yet?

I hope your threshold can withstand one more article.

Last week, I raised two points about the net zero push.

The first raised the possibility of the world scaling back its net zero ambitions as politicians and voters bristle at the implied costs.

I quoted colleague Nick Hubble who said:

‘…almost all media coverage in Europe and the US is already highly critical of net zero. Even the politicians have woken up.’

The second point credited bureaucrats with enough intelligence to realise net zero requires a whole lot of materials.

That’s why Europe’s list of critical materials has doubled in the past decade.

I then concluded that the real issue — the crux of it all — is how the world plans to address the demand surge in critical metals everyone sees coming.

You know it, I know it, everyone knows it — the world will need to do a lot of digging to source the manna for the electrified future.

Here’s the European Commission in 2020:

‘Growth in materials use, coupled with the environmental consequences of material extraction, processing and waste, is likely to increase the pressure on the resource bases of the planet’s economies and jeopardize gains in well-being.

‘Without addressing the resource implications of low-carbon technologies, there is a risk that shifting the burden of curbing emissions to other parts of the economic chain may simply cause new environmental and social problems, such as heavy metal pollution, habitat destruction, or resource depletion.’

Blunt and clear-eyed.

So what’s the solution?

https://commodities.fattail.com.au/how-will-we-execute-the-green-energy-transition/2023/06/21/

What’s going on at Best & Less?

Value retailer Best & Less [ASX:BST] is having a rough week.

On Tuesday, Best & Less issued a big profit downgrade with management taken aback by the deterioration of consumer demand.

Today, the retailer announced its executive chair, Ray Itaoui, will take up CEO duties full-time. Meaning Erica Berchtold — who was set to assume the role in a matter of months — departs before even starting.

The leadership update did not mention why Best & Less did not go ahead with Erica Berchtold’s appointment.

$BST followed up its profit downgrade with a leadership update. $BST.AX will not proceed with appointing Erica Berchtold as CEO. Instead, current executive chair Ray Itaoui will assume the executive role full time. #ASX https://t.co/ui3JgjBR6d pic.twitter.com/YZm78xUDqm

— Fat Tail Daily (@FatTailDaily) June 22, 2023

Amid all this tumult, the company is also dealing with a off-market takeover bid from an entity associated with Brett Blundy and Ray Itaoui himself. This bidder — BBRC — already has voting power of about 72% and has lodged an offer to acquire the rest of BST shares for $1.89 a share.

That’s why Best & Less didn’t crater on news of the massive profit downgrade.

BBRC’s offer is now unconditional and will close at 7pm on Friday 30th June.

Best & Less’s independent board committee (which excludes Blundy and Itaoui) said this in a letter to shareholders today:

‘In light of the deterioration in BLG’s trading performance, as well as the likely reduced trading liquidity of BLG shares given the Bidder’s increased Voting Power as a result of acceptances received under the Offer, the BLG Independent Board Committee (comprising of Stephen Heath, Melinda Snowden and Colleen Callander) (IBC) believes that the BLG share price may fall materially following the close of the Offer.

‘Accordingly, the IBC recommends that those shareholders who have a shorter-term horizon for their investment in BLG or who have concerns about their future ability to exit their holdings should ACCEPT NOW.

‘Shareholders who have a longer-term investment horizon and are comfortable in remaining a minority shareholder in BLG may consider ‘taking no action’. However, the IBC encourages you to read in full the risks of remaining a minority shareholder as noted in BLG’s Original Target’s Statement dated 22 May 2023.’

Bitcoin flirts with 52-week high on ETF plans

It’s been a while since the original cryptocurrency saw front-page coverage.

The ‘crypto winter’ cooled more than prices — enthusiasm waned, too.

But the mainstream press dusted off the cryptocurrency and thrust it back to the spotlight.

The reason?

Bitcoin got close to its 52-week high on the back of plans by BlackRock to launch a Bitcoin exchange traded fund.

The cryptocurrency is currently trading just above US$30,000 and was around US$25,000 just days ago.

Here’s Bloomberg reporting overnight:

‘Crypto investors have drawn succour from the start of a digital-asset exchange, EDX Markets, backed by firms including Citadel, Fidelity and Charles Schwab. Separately, BlackRock and WisdomTree have applied in quick succession to launch spot US bitcoin exchange-traded funds.

‘Those moves dissipated some of the gloom caused by a US Securities and Exchange Commission crypto crackdown that includes lawsuits against exchange operators Binance and Coinbase. The agency in the process designated a raft of digital tokens as unregistered securities.

‘“The rally is backed by institutional demand,” said Hayden Hughes, co-founder of social-trading platform Alpha Impact. “The BlackRock announcement on a Bitcoin ETF, plus EDX Markets, gave bitcoin a boost on hopes that traditional institutions will add depth to the crypto market.”’

Good morning!

Good morning! Kiryll here!

Let’s see what today brings in the busy world of markets.

Here’s Bing’s AI-generated image of a busy reporter trying to meet his deadline.

Source: Bing

Key Posts

-

5:05 pm — June 22, 2023

-

4:39 pm — June 22, 2023

-

2:56 pm — June 22, 2023

-

2:42 pm — June 22, 2023

-

1:06 pm — June 22, 2023

-

1:02 pm — June 22, 2023

-

12:46 pm — June 22, 2023

-

12:14 pm — June 22, 2023

-

11:54 am — June 22, 2023

-

11:46 am — June 22, 2023

-

10:57 am — June 22, 2023

-

10:19 am — June 22, 2023

-

10:08 am — June 22, 2023

-

10:00 am — June 22, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988