Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | XJO to Fall as Wall St Rally Falters; RBA Decision today, Gold Falls from Record High

Market close update

The RBA’s decision to hold interest rates helped recover some of the losses, but the ASX 200 still finished down -0.89% at 7,061.6 its worst performance in six weeks.

Utilities and Health Care were the only two in the green at the close, with healthcare finishing flat, while utilities ended up at 0.55% thanks to Origin regaining some of its losses, up 2.42%.

Miners were the worst hit sector today, with BHP down -1.3%, and Rio Tinto down -1%. Fortescue Metals also fell -0.9%.

Capricorn Metals also tumbled 8.4% to $4.45 after chairman Mark Clark and director Mark Okeby sold 5 million and 2 million shares.

Investors were cheered by AustralianSuper’s commitment to help provide capital to make the switch to renewables for the Utilities giant after they were instrumental in voting down yesterday’s shareholder vote.

The biggest losses on the ASX 200 were seen by Liontown, which fell -8.82%, along with lithium rival Pilbara Minerals, which was down -8.50%.

Can 2024 be the comeback of the ASX?

As we near the end of the year, its going to take some movement to get the Australian benchmarks back into the green.

The ASX200 is now down -3.65%, not an insurmountable deficit but one that has struggled for much of the year.

Compare these results with equity performance in the US (especially in Aussie dollar terms), and you can see why investors are looking to US equities.

Is this sustainable though? are we headed to another rise before a big drop, or can markets hold on for a soft landing?

Similar concept, Aussie investor perspective. US market has delivered far superior returns than the domestic one, particularly in AUD terms. https://t.co/Lk6UL4yMNm pic.twitter.com/6vslPaByp5

— Alex Joiner 🇦🇺 (@IFM_Economist) December 5, 2023

Shares in Mesoblast sink further

Small-cap biotech Mesoblast [ASX:MSB] has seen its shares dip further today after announcing a capital raise.

The company’s shares are down by -21.6% today as the company offers new shares priced at 30 cents per share.

That’s now only 1 cent above the current price.

The company has seen its shares drop by -72% in the past 12-months as it struggles to gain momentum.

Despite this, the company has received firm commitments for an institutional placement and entitlement offer to raise $55 million at a 26% discount of 30 cents per new share.

Despite how poorly previous capital raisings have turned out for investors, Mesoblast notes that the placement was oversubscribed.

The company’s CEO, Dr Silviu Itescu, has also committed to taking up a majority of his entitlement.

RBA hold likely not enough to give retailers a better Christmas

The ABS Monthly Household Spending Indicator for October points to a further loss of momentum in consumer spending, with a possibility of going negative in real terms.

While this is obviously part of the story of bringing down inflation, it doesn’t make it any less difficult for retailers as we move into Christmas and the new year.

Source: Shane Oliver

Market update

The ASX 200 is down -0.96% after a small improvement after the RBA’s call to hold rates. The day is largely pretty down for most sectors, with only Utilities (+0.74%) and Health Care (-0.19%) staying in the green this afternoon.

The worst hit today was Materials (-1.75%) as commodity prices took a hit on the higher US Dollar.

Uncertainty about the next steps for the economy could weigh on sentiment, while the RBA’s tone sounded more ambiguous than hawkish. For example, Mr Bullock noted that:

‘Whether further tightening of monetary policy is required to ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks. In making its decisions, the Board will continue to pay close attention to developments in the global economy, trends in domestic demand, and the outlook for inflation and the labour market.’

The Australian dollar fell from US66.05 cents to US$65.85 after the decision, while the 3-year Australian Government bond fell from 4.06% to 4.02%. The 10-year fell from 4.45% to 4.42%.

RBA holds cash rate at 4.35%

The Reserve Bank of Australia has left the cash rate at the 12-year high of 4.35%.

In a move widely anticipated, the last meeting until February 2024 was a hold call.

Markets responded with a 10-point gain but are pretty muted so far.

In a statement, Mrs Bullock commented on the looming uncertainty in the market, saying:

‘There are still significant uncertainties around the outlook. While there have been encouraging signs on goods inflation abroad, services price inflation has remained persistent and the same could occur in Australia.’

There also remains a high level of uncertainty around the outlook for the Chinese economy and the implications of the conflicts abroad. Domestically, there are uncertainties regarding the lags in the effect of monetary policy and how firms’ pricing decisions and wages will respond to the slower growth in the economy at a time when the labour market remains tight.’

Evolution Mining in trading halt

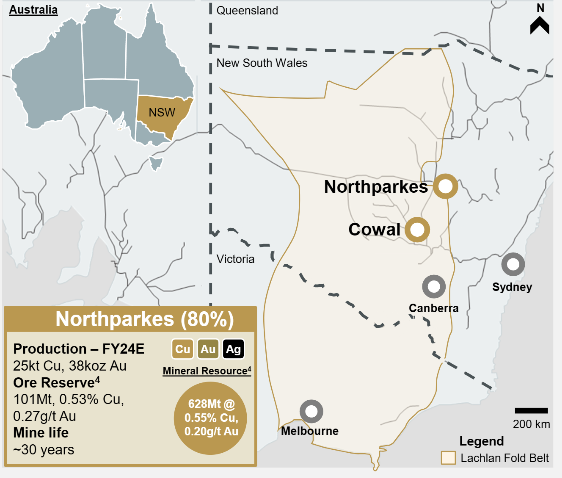

Evolution Mining [ASX:EVN] is in a trading halt after announcing plans of a $525 million share placement to fund an 80% stake in the gold and copper mine Northparkes in NSW.

Shares last traded at $4.14 per share. Post-acquisition, the miner is forecasting an FY24 5% production boost and reduction in capital intensity. Presentation here.

Source: EVN

Consumer confidence remains down

The latest ANZ-Roy Morgan Australian Consumer Confidence Index numbers are out, and things remain down.

As we await a decision from the RBA, we may need to see signs of more dovish talk from the heads there for confidence to move upwards.

Many are expecting a ‘hawkish pause’ meaning the RBA will continue its usual talk of no hesitation raises in the future to get inflation back down to its goal of 2-3%.

ANZ-Roy Morgan Australian Consumer Confidence: A serious turnaround in inflation would likely be required to see the index move meaningfully higher in 2024. It was practically unchanged last week ahead of the December #RBA Board meeting. #ausecon @AdelaideTimbrel @RoyMorganAus pic.twitter.com/Z6f7Ji6GpD

— ANZ_Research (@ANZ_Research) December 4, 2023

Gold and Bitcoin move in opposite directions

After Gold touched a record US$2,135 before sharply turning it seems the previously matching BTC vs Gold has broken down.

The two moved in sharply opposite directions as the apparent ‘war premium’ may have come out of the market after hostilities in the Red Sea yesterday pushed gold prices up.

Yemeni Houthi forces launched drone strikes in the Red Sea that attacked Israeli commercial ships and were engaged by a US warship. It seems the rhetoric was lifted after the attack, but nothing further was done.

Now, the pairs continue to move in opposite directions.

This is strange:

Bitcoin and Gold just moved in sharply opposite directions after weeks of similar price action.

Beginning late Sunday night, both assets jumped sharply.

Since then, #Bitcoin is up 6.5% while gold prices have posted a massive $100 reversal.

Gold prices are now… pic.twitter.com/md4SV5Wlmi

— The Kobeissi Letter (@KobeissiLetter) December 4, 2023

Weak signals send oil prices bearish

Oil prices continue to fall on concerns about a drop in demand and mixed confidence about the depth and duration of the OPEC+ supply cuts.

Brent Crude fell -0.87% to US$78.19, while WTI Crude fell -0.32% to US$73.26.

Saudi Arabia’s Energy Minister Prince Abdulaziz bin Salman said in a Bloomberg interview yesterday that he expected OPEC+ to bring about the 2.2 million in crude oil production cuts announced last week.

But doubts are rife as the deal seemed weakened due to pushback from African members who were concerned about quotas affecting their need for investment in their aging fields.

It seems the production cuts are voluntary in nature, as no agreement on enforcement was made at the OPEC meeting last week in Vienna.

Wider economic headwinds also have markets concerned, as demand could be stifled if the ‘soft landing’ turns into anything deeper.

Oil prices are now at a five-month low but have still been up 3.2% in the last six months.

Source: MarketsInsider

ANZ forecast hold today and house prices to rise

While we await the RBA’s Interest rate decision at 2:30pm AEST, let’s look at some predictions.

It’s widely held that the RBA is likely to keep interest rates on hold at 4.35% today, with another hike next year possible, but economists still weighed in.

ANZ economist Adelaide Timbrell anticipates another pause but thinks it’s unlikely to push down house prices.

The bank is forecasting further increases in demand that will outstrip supply, saying:

‘So housing prices are going to continue to go up, really really bad for housing affordability, not so bad for those who already own.’

Even with rates on hold, they still stand at a 12-year high and could apply pressure to the housing market as more effects of previous cuts wash through. Immigration is past its peak, so it will be interesting to watch house prices from here.

Morning market update

Good morning all, Charlie here

The ASX 200 opened down -0.38% to 7,097.4 this morning as the Wall Street rally runs out of puff for now. US tech stocks took the hardest hit, while gold also had heavy falls overnight.

It looks like investors took profits on Wall Street as all the large tech players took a hit. Tesla -1.1%, Nvidia -3.4%, Apple -1.3%.

On the Aussie market, the ASX is likely to remain subdued today as we await the RBA’s decision on interest rates later today. It is widely expected that they hold again, with the market pricing a 5% chance of a raise today.

US Dollar and bond yields bounced overnight, pushing down commodity prices. Copper fell -2.70%, and silver fell -3.65%.

Wall Street: Dow -0.11%, Nasdaq -0.84%, S&P 500 -0.54%

Overseas: FTSE -0.22%, STOXX flat, Nikkei -0.60%, SSE -0.29%

The Aussie dollar fell -0.79% to US 66.19 cents.

US 10-year bond yield +6bps to 4.25%. Australian 10-year bond yields -4bps to 4.45%.

Gold fell off its record high, down -4.22% to US$2,029.22. Silver fell -3.65% to US$24.50

Bitcoin rose +4.48% to US$41,882, falling after briefly touching US42k Ethereum rose +0.95% to US$2,224

Oil Brent fell -0.87% to US$78.19, while WTI Crude fell -1.09% to US$73.26, now at a four-month low.

Iron ore is down -1.8% to US$128.80 a tonne.

Key Posts

-

4:35 pm — December 5, 2023

-

4:02 pm — December 5, 2023

-

3:22 pm — December 5, 2023

-

3:00 pm — December 5, 2023

-

2:42 pm — December 5, 2023

-

2:35 pm — December 5, 2023

-

12:02 pm — December 5, 2023

-

11:06 am — December 5, 2023

-

10:51 am — December 5, 2023

-

10:34 am — December 5, 2023

-

10:23 am — December 5, 2023

-

10:10 am — December 5, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988