Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | XJO to Fall After Wall St Pullback; Oil Climbs on Red Sea Tension

Market close update

The ASX 200 closed down -0.43%, at 7,505.2 after the Wall St rally ran out of steam and traders took profits.

It was the first day since March where every stock in the Dow index was down overnight, after Wall St moved into overstreched territory before the sell-off.

Two of the eleven sectors finished in the green today on the ASX, with the rest down well into the red.

The worst performers were Tech (-1.60%), and Discetionary (-1.10%) mirroring the losses seen in US benchmarks.

Meanwhile, Oil continued to gain as more news came to light of further shipping avoiding the Red Sea, causing shipping to go all the way around Africa.

Top 5 Shorted stocks

The top five shorted stocks on the ASX remain to be made up of lithium players as the price of Lithium Carbonate, and Spodumene continue to fall as Chinese carmakers see falling demand and economic headwinds.

Pilbara Minerals continues to be the most shorted stock on the ASX, with 20.33% of its stocks shorted.

That’s far above the next-highest, graphite producer Syrah Resources, which currently has 14.4% of its stocks shorted.

Here are the remainder: with Core Lithium CXO, Genesis Minerals GMD, and newcomer Idp Education IEL

Source: Shortman

Rio Tinto hits record high

Rio Tinto [ASX:RIO] just hit another record high, moving against the rest of the market to gain +0.42% today, following the remarkable buoyancy of iron ore prices.

Iron ore has bucked analyst expectations this year, climbing while its main market, China, continues to struggle amidst its property crisis.

‘Every November-December, we see stockpiling in Asia ahead of the January-February, Chinese New Year,’ said ANZ’s head of FX research Mahjabeen Zaman.

Iron ore prices have increased 24% so far this year as demand from China remains strong. It appears Xi and leaders there want to bolster manufacturing to try to hit their growth targets of 5% GDP this year.

Leaders in China have told steel manufacturers there is no production limit this year. This, coupled with lower power costs, has sent steel makers there into overdrive.

China is simultaneously in talks with Australia, the UK, Europe, Thailand and the US to battle steel dumping by the country.

‘There is sufficient evidence that there is avoidance of anti-dumping duties and so an investigation is warranted’, said Thai officials recently who were investingating the evasion of anti-dumping measures there.

Altech Batteries Jump

Speciality battery materials producer Altech Batteries [ASX:ATC] has seen its shares jump by 12.50% in trading today.

The company released the new details of its Definitive Feasibility Study (DFS) of its Saxony-based battery materials plant.

In an interesting twist, the company has abandoned its plans to create its patented product and has instead opted for a cheaper alternative.

Instead of using its ‘Silumina Anodes’ battery materials, the company is now planning on creating alumina-coated silicone spheres.

These complex materials will then be sold to carmakers to improve the energy density of their batteries, potentially increasing the energy-density of batteries by 30%.

The simpler method will mean the plant output from 15 gigawatt-hours to 120 gigawatt-hours, an eightfold increase.

With the new output, the company says the plant will have an IRR of 34.6% with a payback period of 2.4 years.

Australian consumer spending

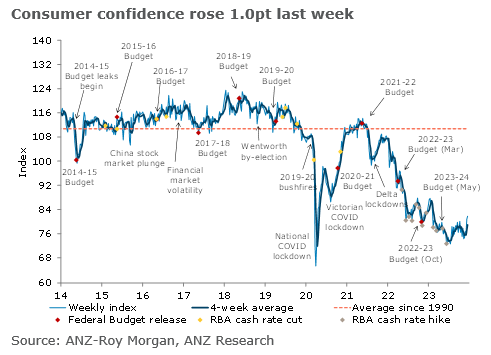

In its latest data, ANZ-Roy Morgan Australian Consumer Confidence Index edged up earlier this week.

But the gains were modest. Confidence about future finances has moved above neutral for the second time since January, but households continue to face the pressure of inflation and higher rates.

Source: ANZ-Roy Morgan

Here is an interesting tweet from David Scutt looking at a microcosm of consumer spending around beauty and fashion.

Both are a reliable yardstick for discretionary spending, especially around the Christmas period, to gauge confidence.

Australian spending on clothing and beauty looking particularly weak right now, according to @ANZ_Research card data. Sitting around 2019 levels despite inflation and population growth #ausbiz pic.twitter.com/D39ndgCnmY

— David Scutt (@Scutty) December 21, 2023

Midday market update

The ASX 200 is down -0.42% at 7,506.0 as a sell-off on Wall St dragged most sectors down.

Only Utilities (-0.34%) and Industrials (+0.33%) are up in trading around midday, as all nine other sectors fell.

Heavy losses in Tech (-1.13%) and Discretionary (-0.95%) mirror US indices as the Nasdaq fell 1.5%.

In the Materials sector, gold and lithium producers dragged everything down, with Newmont down -1.44% and Allkem falling -5.24%. BHP is also down -0.22%, while Rio Tinto held on, gaining +0.14%.

Liontown was one of the worst performers on the ASX, falling -6.85% after news it was involved in a legal dispute over royalty payments from its WA mine.

UK Inflation drops sharply, market hopes for earlier cuts

The latest UK CPI data surprised analysts with a 0.7% monthly drop.

The annual rate of CPI dropped to 3.9% from 4.6% in November.

British equities jumped overnight as investors were excited by the prospect of the BoE having some more headroom to potentially cut rates sooner than the second half of 2024.

The blue-chip FTSE 100 rose 1% overnight, well in front of the European STOXX 600, which closed up 0.3%.

Source: Macrobond

Core Inflation continues to trend down in countries as suppressed consumer spending, and lower oil prices give some relief to markets.

But the final move towards the target 2-3% inflation for Central Banks may prove to be challenging as services inflation proves to be sticker than many hoped.

It seems unlikely that central banks would cut pre-emptively without a significant downturn in the economy. After working so hard to bring inflation down, it is likely that many would be cautious to cut and restoke inflation before the battle is won.

An influential paper that has been widely circulated and mentioned in central bank circles by the IMF would give credence to this.

The basic summary of the paper is that by looking at 100 inflation shock episodes in history, they found that only 60% were effective at bringing down inflation to target levels.

Most of those took between 3-5 years, and the longer-tailed recoveries were mainly due to energy shocks, such as the 1973 oil crisis.

Importantly, the paper says:

‘Most unresolved episodes involved “premature celebrations”, where inflation declined initially, only to plateau at an elevated level or re-accelerate.

Сountries that resolved inflation had tighter monetary policy that was maintained more consistently over time, lower nominal wage growth, and less currency depreciation, compared to unresolved cases.

Successful disinflations were associated with short-term output losses, but not with larger output, employment, or real wage losses over a 5-year horizon, potentially indicating the value of policy credibility and macroeconomic stability.’

Pacific Smiles rejects bid

Dental chain Pacific Smiles [ASX:PSQ] rejected the bid from Genesis Capital today, saying the deal undervalued the company.

The offer was for $1.40 per share, which valued PSQ at $223 million.

Pacific Smiles updated its FY24 guidance with a boost to patient fees, pulling in a revenue of $293-297 million with underlying earnings between $26-28 million.

Genesis already owns an 18.75% stake in PSQ. Pacific intends to offer a limited deal to offer more non-public information to Genesis in order to sweeten the bid.

Shares in PSQ are up by 0.35% in this morning’s trading.

Morning market update

Good morning all. Charlie here

The ASX 200 opened down -0.24%, trading at 7,519.8 after traders took profits on Wall Street, with most indices down ~1.5%. The aggressive selloff could take some of the steam out of the recent bull run, but the run is likely to continue in the weeks to come.

The biggest loser on Wall St was freight company FedEx, which fell nearly 11% after missing quarterly profit estimates.

In the UK, Inflation fell more than expected. The annual CPI fell from 4.6% in November to 3.9%. The sudden drop in inflation gave traders renewed hope that the BoE would consider earlier interest rate cuts in the new year.

As a response, the pound fell 0.5%, while the FTSE 100 jumped 1%.

Back home, labour force data is due around 11:30am so stay tuned for that.

Oil prices rose again overnight as ongoing disruptions in the Red Sea oil trade continued to weigh on markets.

Currently, around 100 ships are taking the long route around Africa as a result of Houthi Militants drone attacks on commercial ships in the region.

Wall Street: Dow -1.27%, Nasdaq -1.50%, S&P 500 -1.47%.

Overseas: FTSE +1.02%, STOXX flat, Nikkei +1.37%, SSE -1.03%

The Aussie dollar fell -0.45% to US 67.32 cents.

US 10-year bond yield -8bps to 3.85%. Australian 10-year bond yields -11bps to 4.00%.

Gold fell -0.48% to US$2,031.41. Silver rose +0.43% to US$24.16.

Bitcoin rose +3.07% to US$43,601, and Ethereum rose 1% to US$2,192.

Oil Brent rose +0.70% to US$79.81, while WTI Crude rose +0.50% to US$73.80.

Iron ore is +1.3% at US$134.0 a tonne.

Key Posts

-

4:14 pm — December 21, 2023

-

3:47 pm — December 21, 2023

-

2:58 pm — December 21, 2023

-

2:47 pm — December 21, 2023

-

2:04 pm — December 21, 2023

-

1:55 pm — December 21, 2023

-

10:39 am — December 21, 2023

-

10:18 am — December 21, 2023

-

10:09 am — December 21, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2026 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988