Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | XJO Set for Strong Day Following Wall St Rally; Meridian, Metcash and AQZ feature

Market Close Update

The ASX 200 closed today up 1.29%, at 7,279.0, with broad gains across the market. All sectors were in the green by the end of the day, with all ords up 1.3% after positive news out of China buoyed sentiments.

The price of iron ore jumped to its highest price in the past six months which saw shares of Rio Tino up 3%, while Fortescue finished over 4% up today, ending the week up almost up 10%.

That’s all from me today, have a great weekend!

Leo Lithium enters trading halt (again)

It’s been a rough few months for Leo Lithium. Shares are down nearly 50% over three months.

Many are quietly hinting at an alleged shakedown for more money from the Mali government, who have raised a series of vague issues and halted all Direct Shipping Ore (DSO) operations at the site.

Meanwhile, Leo Lithium has been on weeks of off-and-on trading halts while it tries to deal with the issue while bleeding stock value and the confidence of shareholders.

Source: TradingView

In the past few days, there appears to be some movement in the ‘negotiations’ as Leo called in support from one of its capital backers, Ganfeng.

The Chinese miners are specialists at dealmaking in Africa (although not always by legitimate means) and will hopefully resolve the situation.

The latest movement today has Leo entering yet another trading halt, with promises of an announcement and resumed trading on Tuesday, 19 September.

Here’s hoping it’s good news.

Australian dollar gains on positive China data

The Australian dollar gained today after a slew of Chinese economic data beat forecasts, suggesting that the world’s second-largest economy is recovering from a recent slowdown.

The AUD/USD advanced 0.43% to US64.65¢, putting it on track for a 1.4% weekly gain.

If it holds, it would be the largest increase in two months.

The Aussie dollar is often used as a liquid proxy for the Yuan as China is the single largest importer of Australian commodities.

Metcash says customers preference for value options increasing

Grocery distributor Metcash released its Trading update today, highlighting opportunities in the market as customers seek value amid the cost-of-living-crunch.

The IGA supplier said food sales had increased 6% in the past 18 weeks to the 3rd of September.

‘While demand continues to be solid in all pillars, the impact of higher interest rates and cost of living is impacting consumer confidence and the behaviour of some customers and shoppers in our retail networks,’ chair Peter Birtles told shareholders today.

Liquor sales increased 1.7% in the 18 weeks, with a significant bump in budget brands. Metcash liquor brands include Cellarbrations, Thirsty Camel and the Bottle-O.

The company noted that patrons on the premises were spending less while consumers were looking for greater value options in liquor.

Shares of the stock are slightly down. trading at -0.13%, $3.715 per share.

Source: Metcash Report

China data dump shows positive trend

China’s latest data dump of monthly figures showed the economy was turning a corner after some perilous months of stalling growth and rising fears of deflation.

The latest data beat analyst expectations, with retail sales and industrial production showing considerable improvements and China’s unemployment rate falling slightly.

BHP, Rio Tinto, and Fortescue stocks have surged today, with all gaining over 3%.

Source: Investing.com

Midday Market Update

The ASX 200 is up 1.73% at midday, trading at 7,311 with all sectors firmly in the green.

The Materials sector is the huge gainer today with all ords up 2.94%.

Qantas has defied all the recent negative press over the past month, gaining 1.25%, while in healthcare Ramsay Health Care remains in the green despite being downgraded by Fitch to BBB-.

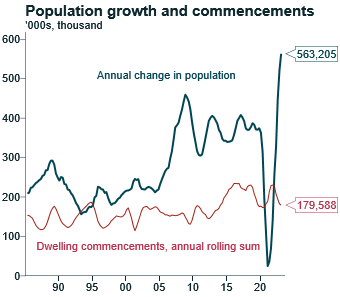

Immigration numbers show significant housing pressures likely

With Australia’s housing supply reasonably fixed in the short term, the latest immigration numbers paint an interesting picture for the future of housing.

From the March quarter of 2022 to March 2023, the number of new private sector houses commenced was down -15.8% while other forms of buildings were up 11.8%.

In seasonally adjusted terms, that works out to be a 14% increase in total dwelling commencements to 45,456 dwellings.

Should be interesting to watch house prices in the coming 12 months.

Source: ABS

Unemployment numbers in the spotlight

Property developer Tim Gurner gained the ire of the internet this week after accusing workers of becoming ‘arrogant’ and suggesting unemployment in Australia needed to jump 50%.

Now, unemployment figures are back in the spotlight, with the latest statistics from the ABS showing unemployment remained at 3.7% while the participation rate increased to 67%.

Here’s an interesting chart breaking down the evolution of employment in Australia by demographic.

Interesting chart on Aus bond yields vs equities

The yield on Australian bonds is typically lower than the yield on Australian equities, for good reason. Bonds are considered to be a lower-risk investment than equities.

That typical overperformance of equities is often referred to the ‘risk premium’. Investors demand and seek higher returns on riskier investments to compensate for the possible loss of capital.

We are in an interesting period where the difference between the two is lower than it has been for over a decade.

As we sit on the end of the tightening cycle, it’s going to be worth watching where this goes from here.

Will equities rise back out of the ashes?

Difference between the yield on Aussie bonds and Aussie equities (grey line) via DB… pic.twitter.com/sv8tHWd4BU

— christopher joye (@cjoye) September 13, 2023

Chip designer ARM IPO show tech still has legs

Arm Holdings Plc climbed 25% in its trading debut after raising nearly $5 billion in the year’s largest initial public offering to date.

It’s great news for equity markets and Softbank Group, which acquired Arm in 2016 for $32 billion.

After an initial deal to sell Arm to Nvidia for $40 billion fell through in 2022, the company has held onto Arm, awaiting a good time in the markets, which came and went last year.

‘The markets of last year didn’t really cooperate,’ Arm’s CEO Rene Haas said in an interview. ‘In terms of where we landed the plane, relative to where we thought we were six to nine months ago, we, we landed in a great place.’

The chip designer’s shares closed at $63.59 in NY trading overnight, giving Arm a market value of over $65 billion.

The IPO is a great litmus test for the market’s appetite for tech stocks more broadly. It shows the Nasdaq rally still has some legs as both retail and institutional investors eye the potential of AI and semiconductor stocks.

Investors in the IPO included some of Arm’s major customers, including Intel, Apple, Nvidia, Samsung and TSMC.

Latest episode of What’s Not Priced In out now

Here’s the latest episode of our weekly podcast, where Greg and I talk about inflation.

Is inflation re-accelerating? Will rising oil prices push central banks to raise rates further?

Is a recession now unlikely? And are markets overvalued?

These are the meaty questions we grappled with in this episode.

As for what’s not priced in? Recession remains a risk the market continues to under-price, at its peril.

Morning Market Update

The ASX 200 opened up 1.31% in what looks to be a very positive day trading.

A strong rally overnight saw the S&P 500 up by 0.84% and the Nasdaq up by 0.81% as US retail sales rose more than expected in August.

‘Today’s economic data confirms the path toward a soft landing, but without being so hot that the Fed thinks they might need to do a couple more rate hikes,’ said Ross Mayfield, Investment Strategy Analyst at Baird. ‘All together, it’s pretty bullish.’

European stocks leapt to their biggest one-day percentage gains in six months after the ECB raised interest rates for the tenth straight time but suggested it was at the end of its monetary tightening cycle.

Oil prices continue to surge to their highest prices since last November as tight supply continues to weigh on markets.

Key Posts

-

4:54 pm — September 15, 2023

-

4:12 pm — September 15, 2023

-

3:19 pm — September 15, 2023

-

2:30 pm — September 15, 2023

-

12:18 pm — September 15, 2023

-

12:11 pm — September 15, 2023

-

11:42 am — September 15, 2023

-

11:19 am — September 15, 2023

-

11:04 am — September 15, 2023

-

10:39 am — September 15, 2023

-

10:26 am — September 15, 2023

-

10:17 am — September 15, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988