Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | XJO Regains Ground to Finish Up; Global Markets Up Overnight, Aussie Dollar Holds Over 64 US Cents

Market Close Update

The ASX 200 regained its midday losses to end up 0.20% at 7,206.9 today after positive news from China yesterday lifted sentiment.

The Materials Sector was the biggest gainer on the day, with Iron ore prices at a six-month high and the US dollar losing some ground overnight. gold and iron miners jumped today.

On Wednesday in the US, investors await all-important CPI data, which will signal the Fed’s next move for interest rates and set the tone as markets try to shake off the tail end of their seasonal slow period.

ASX 200 Sector Top Performance

- Materials, up +0.89%

- Health Care, up +0.78%

- Industrials, up +0.35%

ASX 200 Sector Worst Performance

- Energy, down -1.43%

- Telecommunication, down -0.57%

- Real Estate, down -0.21%

Iron ore prices at six-month high

Iron ore prices surged following the release of robust new bank lending data in China on Monday, surpassing market expectations and alleviating some concerns about the economic trajectory of the Asian powerhouse.

Iron ore was up 1.14% to US$118.23, while in Singapore, the benchmark futures contract for October rose 3.55% to US$117.35, hitting the highest level since March.

The healthier signs from China came from lending increases, seen as a sign that the Chinese government is taking steps to support the economy, which has been slowing in recent months.

The data showed that banks extended 1.36 trillion yuan ($202 billion) in new yuan loans in August, up from 345.9 billion yuan in July. This was higher than the 1.20 trillion yuan expected by economists in a Reuters poll.

The offshore yuan remained resilient overnight, holding close to Monday’s peak and maintaining a trading rate of 7.3053 per dollar.

The surge in iron ore prices and the strong lending data in China had significant implications for Australian markets and the broader economic landscape.

First and foremost, the rally in iron ore prices was a boon for Australian mining giants, who all saw gains today.

Shares in heavyweights extended early gains, with Rio Tinto jumping 1.8%, BHP rallied 1.3% and Fortescue Metals rose 1.5 %.

Iron ore prices at six-month high

Iron ore prices surged following the release of robust new bank lending data in China on Monday, surpassing market expectations and alleviating some concerns about the economic trajectory of the Asian powerhouse.

Iron ore was up 1.14% to US$118.23, while in Singapore, the benchmark futures contract for October rose 3.55% to US$117.35, hitting the highest level since March.

The healthier signs from China came from lending increases, seen as a sign that the Chinese government is taking steps to support the economy, which has been slowing in recent months.

The data showed that banks extended 1.36 trillion yuan ($202 billion) in new yuan loans in August, up from 345.9 billion yuan in July. This was higher than the 1.20 trillion yuan expected by economists in a Reuters poll.

The offshore yuan remained resilient overnight, holding close to Monday’s peak and maintaining a trading rate of 7.3053 per dollar.

The surge in iron ore prices and the strong lending data in China had significant implications for Australian markets and the broader economic landscape.

First and foremost, the rally in iron ore prices was a boon for Australian mining giants, who all saw gains today.

Shares in heavyweights extended early gains, with Rio Tinto jumping 1.8%, BHP rallied 1.3% and Fortescue Metals rose 1.5 %.

Falling Lithium-Ion Battery Prices as EV sales pick up in Australia

The price of lithium-ion batteries has been falling in recent months, which is good news for the electric vehicle (EV) industry.

The average price of a lithium-ion battery pack fell by 13% in the first quarter of 2023, according to Benchmark Mineral Intelligence. This is the third consecutive quarter of price declines, and it is expected to continue in the coming months.

There are a number of factors contributing to the falling prices of lithium-ion batteries.

One is the increasing supply of lithium as more mines come online. Another is the improvement in battery technology, which is making batteries more efficient and less expensive to produce.

The falling prices of lithium-ion batteries are a major boost for the EV industry. EVs are more expensive than gasoline-powered cars, but the price gap is narrowing as battery prices fall.

Australia has seen its share of EV’s in new care sales increase in the second half of the year at 8.4%, up from 3.8% in the second half.

The Electric Vehicle Council’s annual State of EVs report showed 46,624 electric cars were sold between January and June 2023, compared to 39,353 in the year before.

In my 2014 book #CleanDisruption, I said that lithium-ion batteries would cost $100/kWh by the end of 2023.

Now, in September 2023, Benchmark Mineral Intelligence (@benchmarkmin) confirms lithium-ion batteries just dipped below $100/kWh. https://t.co/oGxVd7Pxrm

— Tony Seba (@tonyseba) September 11, 2023

Falling Lithium-Ion Battery Prices as EV sales pick up in Australia

The price of lithium-ion batteries has been falling in recent months, which is good news for the electric vehicle (EV) industry.

The average price of a lithium-ion battery pack fell by 13% in the first quarter of 2023, according to Benchmark Mineral Intelligence. This is the third consecutive quarter of price declines, and it is expected to continue in the coming months.

There are a number of factors contributing to the falling prices of lithium-ion batteries.

One is the increasing supply of lithium as more mines come online. Another is the improvement in battery technology, which is making batteries more efficient and less expensive to produce.

The falling prices of lithium-ion batteries are a major boost for the EV industry. EVs are more expensive than gasoline-powered cars, but the price gap is narrowing as battery prices fall.

Australia has seen its share of EV’s in new care sales increase in the second half of the year at 8.4%, up from 3.8% in the second half.

The Electric Vehicle Council’s annual State of EVs report showed 46,624 electric cars were sold between January and June 2023, compared to 39,353 in the year before.

In my 2014 book #CleanDisruption, I said that lithium-ion batteries would cost $100/kWh by the end of 2023.

Now, in September 2023, Benchmark Mineral Intelligence (@benchmarkmin) confirms lithium-ion batteries just dipped below $100/kWh. https://t.co/oGxVd7Pxrm

— Tony Seba (@tonyseba) September 11, 2023

Gina Rinehart increases stake in Liontown Resources

Billionaire Gina Rinehart’s Hancock Prospecting has increased its share of lithium miner Liontown Resources, lifting its 4.9% stake to 7.72% to become a substantial shareholder.

The move comes after Liontown accepted a $6.6 billion takeover bid from global lithium giant Albemarle.

There was speculation last week that Hancock would launch a rival takeover bid for Liontown.

This was reinforced by a veiled threat to block the takeover by Mr Rinehart yesterday as she seeks a seat on the Liontown board.

Gina Rinehart increases stake in Liontown Resources

Billionaire Gina Rinehart’s Hancock Prospecting has increased its share of lithium miner Liontown Resources, lifting its 4.9% stake to 7.72% to become a substantial shareholder.

The move comes after Liontown accepted a $6.6 billion takeover bid from global lithium giant Albemarle.

There was speculation last week that Hancock would launch a rival takeover bid for Liontown.

This was reinforced by a veiled threat to block the takeover by Mr Rinehart yesterday as she seeks a seat on the Liontown board.

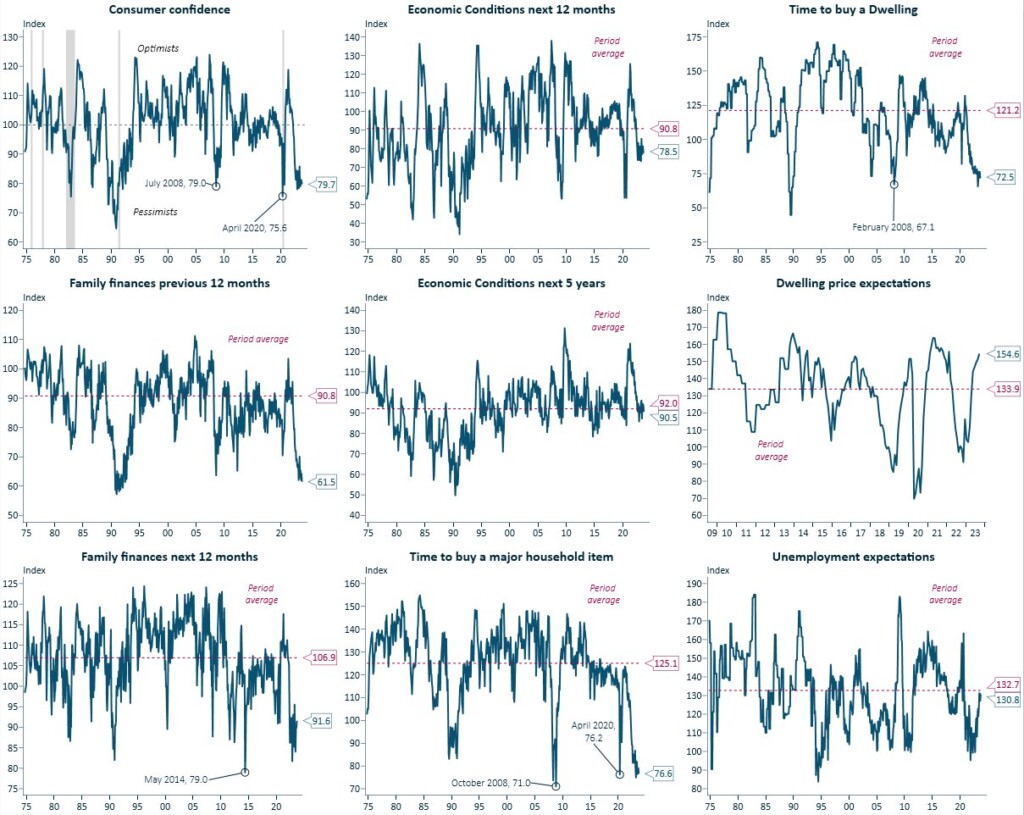

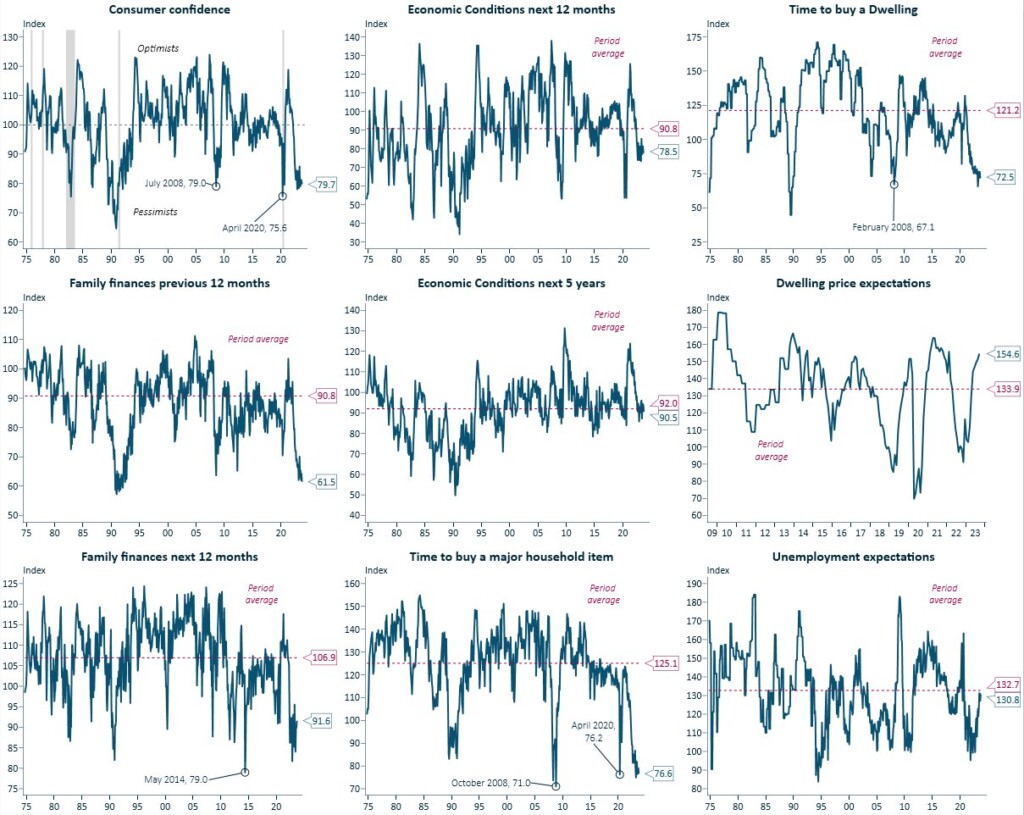

Detailed Breakdown of Sentiment

Here’s a more detailed breakdown on consumer sentiment after the latest results were released by the Westpac-Melbourne Institute survey today.

Consumer Sentiment slipped 1.5% to 79.7 in September from 81.0 in August on persisting pessimism, even as fears of further interest rate rises by the Reserve Bank have eased.

Confidence of mortgage holders bounced 7.8% last month, but the gain was offset by a 6.1% drop in the confidence of renters and a 5.8% fall in the confidence of consumers who own their homes outright.

Source: Westpac-Melbourne Institute

Detailed Breakdown of Sentiment

Here’s a more detailed breakdown on consumer sentiment after the latest results were released by the Westpac-Melbourne Institute survey today.

Consumer Sentiment slipped 1.5% to 79.7 in September from 81.0 in August on persisting pessimism, even as fears of further interest rate rises by the Reserve Bank have eased.

Confidence of mortgage holders bounced 7.8% last month, but the gain was offset by a 6.1% drop in the confidence of renters and a 5.8% fall in the confidence of consumers who own their homes outright.

Source: Westpac-Melbourne Institute

Midday Market Update

The ASX 200 is slightly down -0.14% at 7,182.5

The ASX 200 remains in the red but edges closer to flat at midday. After opening up, mirroring Wall St this morning, the XJO quickly reversed to a 0.64% low.

The Materials and Health Care sectors are the only two sectors firmly in the green this afternoon, while Energy is the worst performer, down 1.41% by midday.

The Aussie Dollar has posted its best daily gains in six weeks after jumping 0.9% to US 64.31 cents on Monday.

The bounce was driven by positive sentiment of China’s increasing rhetoric on defending the price of the depreciating yuan.

The People’s Bank of China (PBOC) issued a warning, saying regulators would take ‘resolute actions’ against ‘one-way and pro-cyclical’ bets in the market.

The Aussie Dollar is often used as liquid proxy for the yuan as China remains the biggest importer of Australian commodities.

Midday Market Update

The ASX 200 is slightly down -0.14% at 7,182.5

The ASX 200 remains in the red but edges closer to flat at midday. After opening up, mirroring Wall St this morning, the XJO quickly reversed to a 0.64% low.

The Materials and Health Care sectors are the only two sectors firmly in the green this afternoon, while Energy is the worst performer, down 1.41% by midday.

The Aussie Dollar has posted its best daily gains in six weeks after jumping 0.9% to US 64.31 cents on Monday.

The bounce was driven by positive sentiment of China’s increasing rhetoric on defending the price of the depreciating yuan.

The People’s Bank of China (PBOC) issued a warning, saying regulators would take ‘resolute actions’ against ‘one-way and pro-cyclical’ bets in the market.

The Aussie Dollar is often used as liquid proxy for the yuan as China remains the biggest importer of Australian commodities.

China shows signs of stability

China’s economic outlook is showing signs of improvement, offering a glimmer of hope after a recent downturn. Several positive developments have emerged, including increased credit demand, a reduction in deflationary pressures, and a strengthened yuan.

Recent steps to bolster the real estate market may be starting to work as household demand for mortgages and corporate loans picked up. Consumer prices also returned to gains after a drop in July, albeit by the slimmest of margins.

Source: Bloomberg, PBOC

The benchmark CSI 300 Index rose 0.7% on yesterday, snapping a four-session losing streak.

The yuan also rallied after falling to its weakest since 2007 against the dollar last week.

The government’s annual growth target of about 5% is still at risk, but the improvement in the August data suggests that the worst of the slump may be over.

China shows signs of stability

China’s economic outlook is showing signs of improvement, offering a glimmer of hope after a recent downturn. Several positive developments have emerged, including increased credit demand, a reduction in deflationary pressures, and a strengthened yuan.

Recent steps to bolster the real estate market may be starting to work as household demand for mortgages and corporate loans picked up. Consumer prices also returned to gains after a drop in July, albeit by the slimmest of margins.

Source: Bloomberg, PBOC

The benchmark CSI 300 Index rose 0.7% on yesterday, snapping a four-session losing streak.

The yuan also rallied after falling to its weakest since 2007 against the dollar last week.

The government’s annual growth target of about 5% is still at risk, but the improvement in the August data suggests that the worst of the slump may be over.

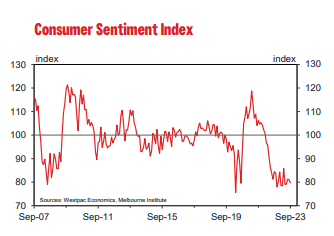

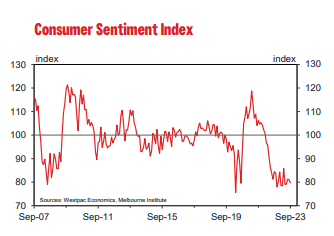

Consumer confidence falls

Consumer confidence has taken another dive despite the Reserve Bank pausing interest rates for the third month in a row at 4.1% and painting a picture of the peak of this cycle’s rate hikes.

The Westpac-Melbourne Institue survey of consumer sentiment fell by 1.5% to 79.7 in September from 81 in August.

Source: Westpac

With the hike pause firmly in place, the confidence of mortgage borrowers was up 7.8% over August, but confidence for renters fell -6.1%, and people who own their homes outright fell -5.8%.

Westpac chief economist Bill Evans commented today, saying pessimism has languished at deeply pessimistic levels for over a year.

He went on to say:

‘Persistent permission has continued despite easing fears of further interest rate rises.’

‘The strong message from survey detail is of ongoing intense pressures on family finances.’

Consumer confidence falls

Consumer confidence has taken another dive despite the Reserve Bank pausing interest rates for the third month in a row at 4.1% and painting a picture of the peak of this cycle’s rate hikes.

The Westpac-Melbourne Institue survey of consumer sentiment fell by 1.5% to 79.7 in September from 81 in August.

Source: Westpac

With the hike pause firmly in place, the confidence of mortgage borrowers was up 7.8% over August, but confidence for renters fell -6.1%, and people who own their homes outright fell -5.8%.

Westpac chief economist Bill Evans commented today, saying pessimism has languished at deeply pessimistic levels for over a year.

He went on to say:

‘Persistent permission has continued despite easing fears of further interest rate rises.’

‘The strong message from survey detail is of ongoing intense pressures on family finances.’

Morning Market Update

US stocks end higher: Investors await inflation data, which could influence Fed’s rate decision.

Tesla surges: Morgan Stanley upgrades stock, says Dojo supercomputer could boost value by $US600 billion.

ECB interest rate decision in doubt: ECB faces increasing pressure from inflation, but is also concerned about the impact of higher rates.

European Commission downgrades growth forecasts: EU economy is expected to grow by 0.8% in 2023 and 1.4% in 2024, down from 1% and 1.6%, respectively.

Consumer confidence and business confidence surveys due today: Westpac-Melbourne Institute Consumer Sentiment survey expected to show decline in September, while National Australia Bank business survey expected to show unchanged confidence.

- ASX 200 flat -0.007% at 7,187.5

- $AUD down -0.10% at 64.24 US cents

- ASX futures down -026% to 7,184.5

- S&P 500 up +0.67%

- NASDAQ up +1.14%

- DOW up +0.25%

- FTSE up +0.25%

- STOXX up 0.18%

- SSE up +0.84%

- Bitcoin down -2.65% to $US 25,172.80

- Spot gold up +0.14% to $US 1,921.64

- Iron ore down -0.43% to $US 116.90

- Brent Crude flat -0.03% to $US 90.61pb

All figures shown are from 10:18am AEST

Morning Market Update

US stocks end higher: Investors await inflation data, which could influence Fed’s rate decision.

Tesla surges: Morgan Stanley upgrades stock, says Dojo supercomputer could boost value by $US600 billion.

ECB interest rate decision in doubt: ECB faces increasing pressure from inflation, but is also concerned about the impact of higher rates.

European Commission downgrades growth forecasts: EU economy is expected to grow by 0.8% in 2023 and 1.4% in 2024, down from 1% and 1.6%, respectively.

Consumer confidence and business confidence surveys due today: Westpac-Melbourne Institute Consumer Sentiment survey expected to show decline in September, while National Australia Bank business survey expected to show unchanged confidence.

- ASX 200 flat -0.007% at 7,187.5

- $AUD down -0.10% at 64.24 US cents

- ASX futures down -026% to 7,184.5

- S&P 500 up +0.67%

- NASDAQ up +1.14%

- DOW up +0.25%

- FTSE up +0.25%

- STOXX up 0.18%

- SSE up +0.84%

- Bitcoin down -2.65% to $US 25,172.80

- Spot gold up +0.14% to $US 1,921.64

- Iron ore down -0.43% to $US 116.90

- Brent Crude flat -0.03% to $US 90.61pb

All figures shown are from 10:18am AEST

Key Posts

-

4:27 pm — September 12, 2023

-

4:07 pm — September 12, 2023

-

4:07 pm — September 12, 2023

-

2:34 pm — September 12, 2023

-

2:34 pm — September 12, 2023

-

12:58 pm — September 12, 2023

-

12:58 pm — September 12, 2023

-

12:50 pm — September 12, 2023

-

12:50 pm — September 12, 2023

-

12:23 pm — September 12, 2023

-

12:23 pm — September 12, 2023

-

11:23 am — September 12, 2023

-

11:23 am — September 12, 2023

-

11:18 am — September 12, 2023

-

11:18 am — September 12, 2023

-

10:19 am — September 12, 2023

-

10:19 am — September 12, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988