Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | XJO Opens Up Bouncing Off Yearly Low; US GDP Hot But Wall St Not

Have a great weekend

That’s all from me this week.

Things to keep an eye on for next week we have:

- Australian Retail Sales for September on Monday morning

- German GDP and CPI data Monday

- Chinese PMI across all its sectors Tuesday

- Euro inflation data Tuesday night

- NZ Employment and Australian Housing Data Wednesday

- US PMI, Jobless and Oil Data Thursday

- Australian exports/imports and home loan data Thursday

- Australian Services PMI and RBA speeches on Friday

- Finally, more employment data for the US Friday night

Phew, lots to look forward to. For now, enjoy your weekend!

Market close update

The ASX 200 closed up 0.21% at 6,826.9, holding onto its small gains made this morning as market sentiment is in the balance. Many concerns loom about potential rate hikes in November as well as GDP data from America showing short-term strength but long-term concern for recession around the corner.

The ASX 200 closed this week down -2.22%, putting the past 12-month performance at -0.27% and down -3% for 2023.

For today, the sectors were fairly evenly split, with six sectors in the green while five were down. The best-performing sectors today were Consumer Staples (+1.33%) and Utilities (+0.91%).

Woolworths gained +0.91%, while Coles was up +2.20%. In Utilities, APA Group gained +2.21%, while AGL Energy was up 1.21%.

The biggest movers today were WA1 Resources, gaining +15.27% after posting strong assay results from their West Arunta Project.

Patriot Battery Metals was up 9.28%, trading on results from earlier in the week, which also showed strong lithium intercepts at its Corvette property in Quebec, Canada.

The worst performer on the ASX 200 today was Ioneer Ltd, down -9.38% and Deep Yellow, falling 7.97%.

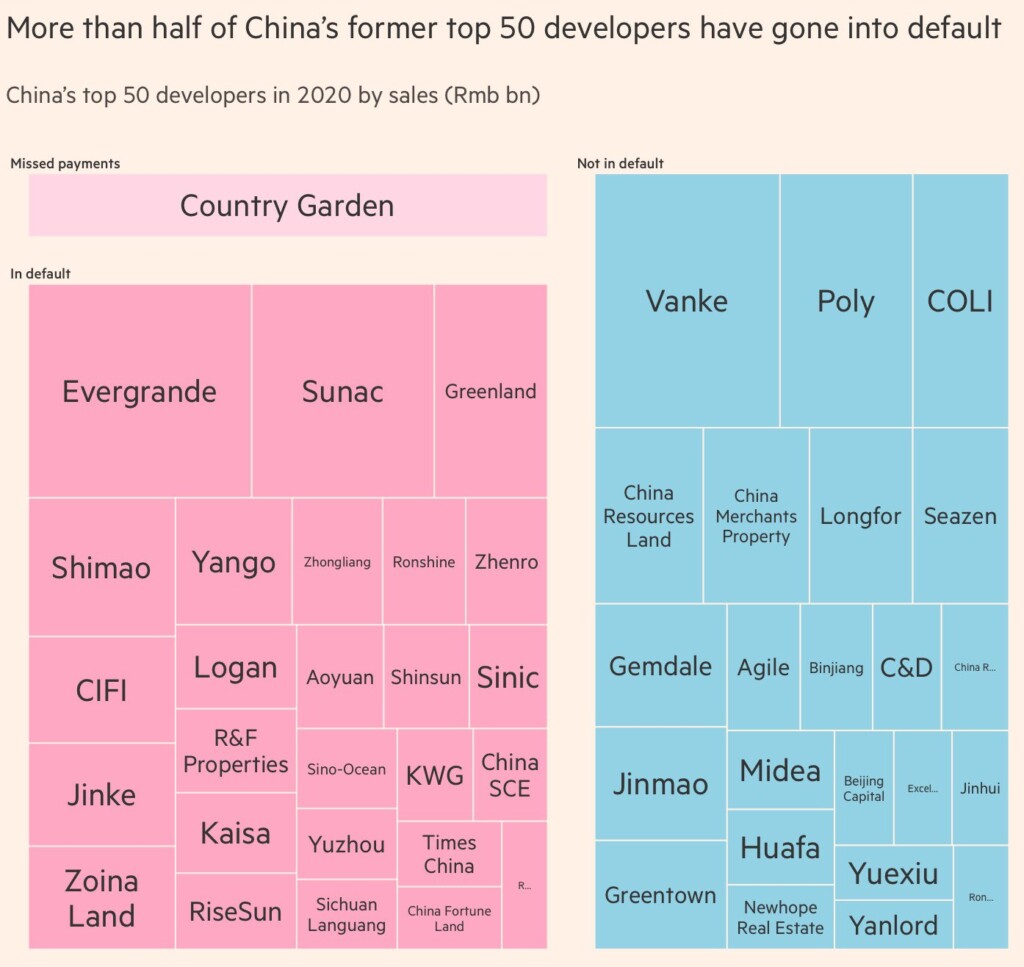

China’s housing crisis visualised

Over half of China’s top property developers have now gone into default. That’s a $62 trillion sector that is at the core of the problems in the Chinese economy.

The property developer Evergrande owes more than $325 billion and has now defaulted. The founder and former CFO are under house arrest, but that won’t fix the problem.

The majority of the money Evergrande owes is to creditors in China, including ordinary homeowners, suppliers and banks but some overseas creditors have tried to file in Hong Kong courts with little success.

So what happens from here, China’s leaders will decide?

“A lot of the Chinese system is still modelled on the Soviet Union and there were no bankruptcies in the Soviet Union,” says Logan Wright, director of China Market Research at Rhodium Group.

“The banking system in China is still almost exclusively state-run,” says Dexter Roberts, senior fellow at the Atlantic Council. “So if Beijing tells those banks to find a way to roll over the debt, then they’re going to do that. Ultimately, they answer to the state and they’re well aware of that.”

So what’s next for giants like China? BBC article here is worth a read.

Lithium prices cause for concern

Mineral Resources says lithium markets are being manipulated to suppress prices in a sector still dominated by battery chemical makers in China.

Lithium prices have fallen around 30% in a fortnight to around US$22,600 dollars. This has put pressure on the sector as many are still in early development phase and trying to cost out production.

Companies that are producing today are also under pressure. Pilbara Minerals is currently the most shorted stock on the ASX and its shares have fallen 4.88% this month and is down nearly 24% this year. MinRes also faced an uphill battle as it jostles with Gina Rinehart and the world’s lithium giants and hopefuls for more ground in Western Australia to mine the key battery ingredient.

MinRes Executive General Manager James Bruce said there was nothing fundamentally wrong with demand and that ‘market manipulation’ was a factor in softer pricing.

‘There’s a lot of paper trading in the [lithium] market right now,’ he commented in an analyst call earlier in the week.

Now, high interest rates appear also to be derailing the ambitions of automakers to switch quickly to EVs as signs of slowing demand are creeping in. This was underscored on Wednesday this week when GM scrapped its $5 billion proposed partnership with Honda to make low-cost EVs together.

“We’re taking immediate steps to enhance the profitability of our EV portfolio and adjust to slowing near-term growth,” GM CEO Mary Barra told analysts.

Battery maker LG Energy Solutions also said on Wednesday that global uncertainty was playing a factor, warning:

“EV demand next year could be lower than expectations,” said Lee Chang-sil, chief financial officer at LG Energy.

Elon Musk echoed the concerns on an investor call last week, explaining why he was slowing plans for a Mexico factory,

“I am worried about the high interest rate environment that we’re in,” he said on Tesla’s earnings conference call.“

“As I just can’t emphasize this enough that the vast majority of people buying a car is about the monthly payment. If interest rates remain high or if they go even higher, it’s that much harder for people to buy the car.”

With interest rate’s pressing down on EV demand, it may be a tough road ahead for lithium miners as more supply comes into the market.

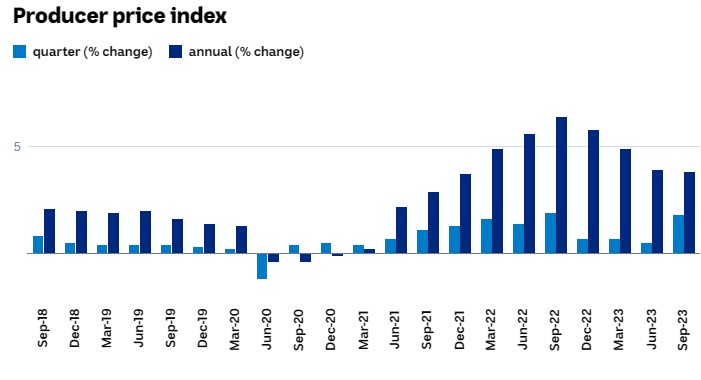

Latest Producer Price Index data out today

The Australian Bureau of Statistics released its PPI numbers today, showing its measure up 1.8% for the quarter and up 3.8% over the past year.

The PPI measures the average change over time in selling prices received by domestic producers of goods and services. PPIs measure price change from the perspective of the seller rather than the consumer-based CPI data, which came out on Wednesday.

Source: ABC-ABS

The PPI is a significant economic indicator because it can provide early warning signs of inflation. When the PPI is rising, it means that producers are paying more for their inputs, such as raw materials and labour. This increased cost is often passed on to consumers in the form of higher prices for goods and services.

As you can see above, the figure is the second-highest in recent years. The ABS outlined what the biggest causes of this increase were. To no one’s surprise, fuel was at the top of the list.

Here’s what they said:

“Higher prices for construction outputs, petroleum and energy were compounded by broad-based price increases in services, particularly health and childcare services,” the ABS noted.

“New financial year contract negotiations, indexation clauses, annual wage cost reviews and increasing operating costs contributed to price rises across services industries.”

For some market analysts, this adds to the case for an interest rate hike in November, as these higher input costs are likely to move onto consumers in the near term.

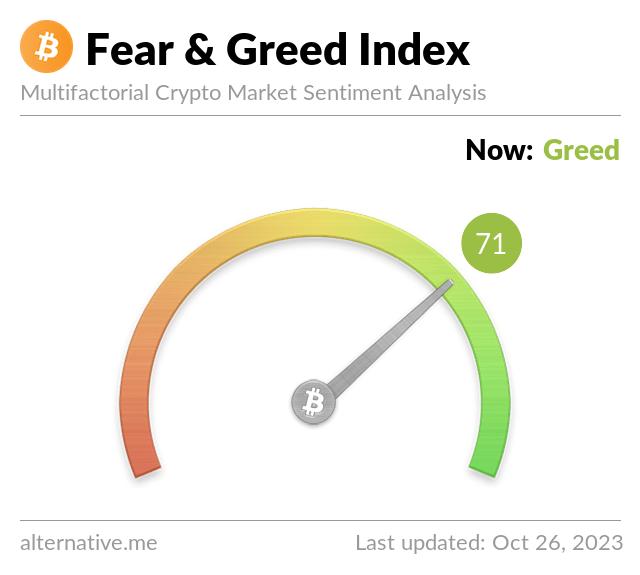

Bitcoin market back into bullish phase

Bitcoin, the world’s largest cryptocurrency, appears to be moving into a bullish phase. The asset has been on a steady rise in recent weeks, breaking through key resistance levels. This bullish momentum is expected to continue in the coming months as investors anticipate the next Bitcoin halving event and growing adoption of the cryptocurrency as the Blackrock ETF may be within reach.

One of the key factors driving Bitcoin’s bullish outlook is its limited supply. There will only ever be 21 million Bitcoins in circulation, and the next halving event, which is scheduled for April 2024, will reduce the number of new Bitcoins mined each block by 50%. This will further reduce the supply of Bitcoin, which is expected to drive up prices over time.

BlackRock’s ETF bitcoin has been added to the eligibility file, according to the clearing house DTCC.

With an ETF on the horizon. The bulls are back in town.

Source: alternative.me

Money Morning Editor Ryan Dinse has been predicting this bull run back in October 2022 when everyone said crypto was dead. It was a daring video at the time, but everything he said has come to pass.

The question is, is this really the biggest crypto bull run it history in 2024?

Watch how his Bitcoin to US$1 million timeline is shockingly accurate so far.

Midday market update

The ASX 200 has held onto its morning gains, up 0.31% at 6,833.2 as Consumer Staples carry the market today, up +1.25%, followed by Real Estate at +0.65%.

Woolworths is up +1% at midday, while Coles gained +2.44%. Endeavour Group gained +2.31%, while Treasury Wines also gained +0.71%.

The worst performer at lunch was Technology stocks, down -0.35% as some concerns around the next interest rate hike put pressure on that rate-sensitive sector.

The latest data from the ABS showed the Producer Price Index rose 1.8% in September compared to the previous quarter, in annualised terms that was 3.8% in the 12-months.

The ABS pointed to higher energy, fuel and construction costs as the main drivers for the increase.

Latest ‘Whats Not Priced In’ episode live

In this week’s podcast episode, Greg takes you through the latest research report from Lacy Hunt. A legend in the world of macro and monetary analysis.

His latest offering shows that a US recession is all but inevitable. Which means a rapid slowdown is underway.

And he has the monetary analysis that readers come here for, the other side of the story.

‘The current widely held view that fiscal policy can remain stimulative and inflationary is not supported by scholarly research. The fiscal multiplier is positive for the first four to six quarters after an action. Estimates from econometric studies of highly indebted industrialized economies indicate the multiplier is negative after three years.’

Listen to the latest episode below.

https://www.moneymorning.com.au/20231027/recession-comingtime-to-buy-whats-not-priced-in.html

Why the Magnificent Seven move the market

Here’s a good overview of the S&P 500’s moves this year and how gravity is finally catching up with the large tech stocks.

The correction since the July 31st peak is now -8.76%. The largest since the October 12, 2022 low.

Source: Bianco Research

This week has been significant because we have seen the ‘Magnificent Seven’ (Apple, Alphabet, Amazon, Microsoft, Meta, Nvidia, and Tesla) all reporting. Many reported double beats but still saw wipeouts as the market now needs more than beating revenues to warrant buying into these expensive stocks, especially with bond yields still near 5%.

Here’s what the S&P 500 looks like without the big seven (in blue).

Source: Bianco Research

Through 2010-2020, when the Fed put interest rates down to 0 and qualitatively eased, it created an unnatural state that can be thought of as a sugar high.

Now that interest rates are back and rising, the sugar has gone away, and now businesses want it back. It’s now a hypoglycemic economy.

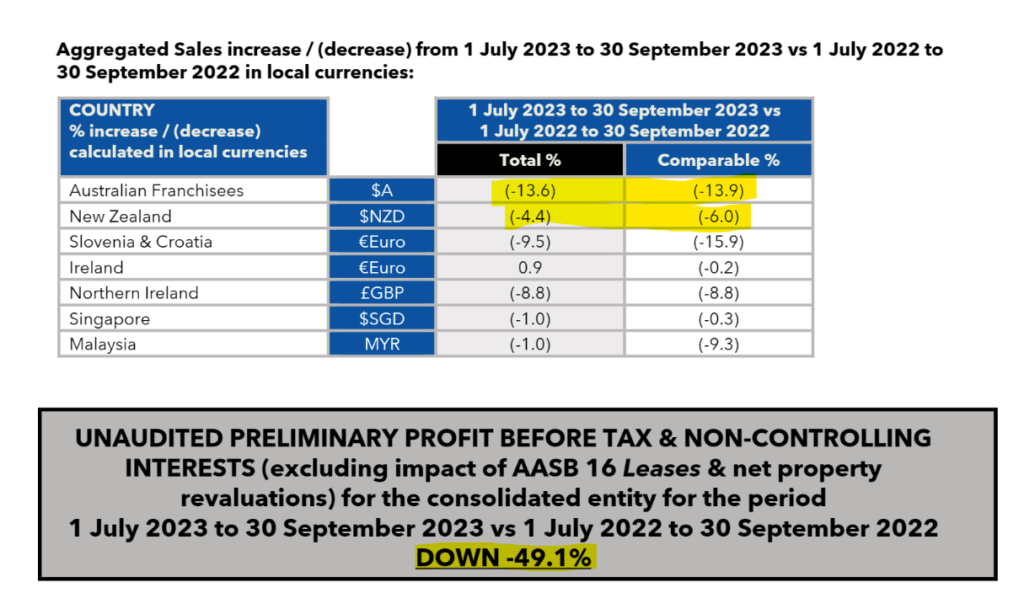

Harvey Norman reports Q1 profits down

Australia’s largest home retailer, Harvey Norman [ASX:HVN] is facing the sharp end of the consumer slowdown in household spending, with its latest trading update today showing the company’s Q1 profits are down nearly half.

Shares were down nearly 3% on open but have recovered since, currently up 0.56%, but it will be a choppy day of trading for the company.

Source: Harvey Norman

Good morning

Good morning all, Charlie here

The ASX 200 opened up slightly +0.13% to 6,821.2, likely to have a choppy day of trading as tech stocks once again dragged the S&P 500 down overnight, which is now trading at its lowest point since May after its seventh decline in eight sessions.

As predicted last week, the Magnificent Seven’s reporting week has been a troubling time for Wall St, with Apple, Alphabet, Amazon, Microsoft, Meta, Nvidia, and Tesla all reporting and have collectively lost approximately $450+ billion in valuation.

Meta was the latest of the bunch to face the ire of the streets despite a double earnings beat, falling -3.7% after signalling ad spending downturn from Middle East events.

US GDP saw its fastest third-quarter growth in two years. Annualised, the growth was 4.9%, as well as signs inflation was easing.

Meanwhile, in Europe, the European Central Bank kept rates on hold overnight after a barrage of rate hikes that totalled 4.5% since July 2022 to combat inflation.

ECB Head Christine Lagarde talked about the move, saying:

‘Sometimes inaction is action.’

‘The economy is likely to remain weak for the remainder of this year,’ said Ms Lagarde. ‘But as inflation falls further, household real incomes recover and the demand for euro area exports picks up, the economy should strengthen over the coming years.’

Wall Street: The Dow -0.76%, Nasdaq -1.76%, S&P 500 -1.18%, Russell 2000 -0.34%.

Overseas Markets: FTSE -0.81%, STOXX -0.59%, Nikkei -2.14%, SSE +0.48%

US 10-year bond yields fell -11bps to 4.84%, and Australian 10-year gained +9bps to 4.80%.

Gold prices gained +0.13% to US$1,985.44. Silver was flat at US$22.83.

Bitcoin’s upward surge has eased with a -1% fall to US$34,241.14.

Oil prices swung up again with large volatility within the markets at the moment as supply disruptions eased in WTI while Brent spots still faced buying pressure.

Iron ore is up 0.25% to US$118.48

Brent Crude is down -2.19%, at US$88.16, while WTI crude is down -0.23% at US$83.40, both very volatile at the moment.

The Aussie dollar is up 0.34%, to US63.29 cents, after also bouncing off yearly lows.

Key Posts

-

4:53 pm — October 27, 2023

-

4:37 pm — October 27, 2023

-

4:23 pm — October 27, 2023

-

4:03 pm — October 27, 2023

-

3:31 pm — October 27, 2023

-

3:18 pm — October 27, 2023

-

12:42 pm — October 27, 2023

-

11:47 am — October 27, 2023

-

11:18 am — October 27, 2023

-

10:42 am — October 27, 2023

-

10:29 am — October 27, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988