Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | XJO Jumps Following Wall St; NZ Inflation Growth Slows; Stocks to Watch: Rio, Hub, A2 Milk, Newcrest, Syrah

Market close update

The ASX 200 closed up 0.42% today at 7,056.1. Much of the early trading optimism from the Wall Street rally was lost by 11:30am when the RBA meeting minutes were released, potentially signalling a more hawkish tone by the RBA.

The main line many were worried about was the ending remarks, which said:

‘In reaching their decision, members noted that some further tightening of policy may be required should inflation prove more persistent than expected. The Board has a low tolerance for a slower return of inflation to target than currently expected.’

If this actually turns into actual interest rate hikes will largely depend on oil prices in the coming months. If we see further geo-political risk in the Middle East or elsewhere, we could see oil threaten US$100 per barrel again and pressure inflation on many goods, spurring the RBA to action.

For now, expectations are for the November meeting to be ‘live’, holding the potential for further hikes if the RBA feels inflation is embedded in the economy. However, our weak dollar may urge caution by the board.

In the ASX, Information Technology was the biggest gainer today, up 1.33%, followed by Real Estate, which gained 1.12%.

The worst performers on the benchmark were far and away Health Care, which fell -1.21%. Health Care is now down nearly 14% in 2023 as our biggest market cap player CSL (-1.21%) continues to struggle.

Other big movers today were Cromwell Property Group, up 9.72% and Bapcor, down -11.53%. TPG was also a strong gainer today, up 5.41%.

Market close update

The ASX 200 closed up 0.42% today at 7,056.1. Much of the early trading optimism from the Wall Street rally was lost by 11:30am when the RBA meeting minutes were released, potentially signalling a more hawkish tone by the RBA.

The main line many were worried about was the ending remarks, which said:

‘In reaching their decision, members noted that some further tightening of policy may be required should inflation prove more persistent than expected. The Board has a low tolerance for a slower return of inflation to target than currently expected.’

If this actually turns into actual interest rate hikes will largely depend on oil prices in the coming months. If we see further geo-political risk in the Middle East or elsewhere, we could see oil threaten US$100 per barrel again and pressure inflation on many goods, spurring the RBA to action.

For now, expectations are for the November meeting to be ‘live’, holding the potential for further hikes if the RBA feels inflation is embedded in the economy. However, our weak dollar may urge caution by the board.

In the ASX, Information Technology was the biggest gainer today, up 1.33%, followed by Real Estate, which gained 1.12%.

The worst performers on the benchmark were far and away Health Care, which fell -1.21%. Health Care is now down nearly 14% in 2023 as our biggest market cap player CSL (-1.21%) continues to struggle.

Other big movers today were Cromwell Property Group, up 9.72% and Bapcor, down -11.53%. TPG was also a strong gainer today, up 5.41%.

Bitcoin surges as it hits the limelight again

Bitcoin [BTC] has seen its volatility return to the fore as the primary cryptocurrency hits the mainstream press again.

Traders moved towards safe-haven assets after tensions in the Middle East grew, propelling the price of gold and the USD up as demand for bonds spiked.

These movements have calmed somewhat since their initial flurry, but BTC has maintained its momentum.

However, not all of the news has been true. As typical with the crypto space, a single false tweet by Cointelegraph, one of the major crypto news sites, sent the market spiking up and down.

The now-deleted tweet falsely asserted that the United States Securities and Exchange Commission had approved BlackRock’s iShares spot Bitcoin ETF. This news created a false spike that liquidated $100 million in shorts on the market.

Bitcoin is up 5.45% in the past five days and has broken important resistance lines but may struggle to continue this pace this far out from the halving coming mid-2024.

In a widely reposted video today, BlackRock’s Larry Fink compares BTC to Treasuries and gold as a ‘flight to quality’, emboldening BTC traders.

CEO of BlackRock, Larry Fink compares #Bitcoin to treasuries and gold as a “flight to quality”.

BlackRock manages $10 Trillion 🤯 pic.twitter.com/fAyd731Cdn

— The ₿itcoin Therapist (@TheBTCTherapist) October 16, 2023

Bitcoin surges as it hits the limelight again

Bitcoin [BTC] has seen its volatility return to the fore as the primary cryptocurrency hits the mainstream press again.

Traders moved towards safe-haven assets after tensions in the Middle East grew, propelling the price of gold and the USD up as demand for bonds spiked.

These movements have calmed somewhat since their initial flurry, but BTC has maintained its momentum.

However, not all of the news has been true. As typical with the crypto space, a single false tweet by Cointelegraph, one of the major crypto news sites, sent the market spiking up and down.

The now-deleted tweet falsely asserted that the United States Securities and Exchange Commission had approved BlackRock’s iShares spot Bitcoin ETF. This news created a false spike that liquidated $100 million in shorts on the market.

Bitcoin is up 5.45% in the past five days and has broken important resistance lines but may struggle to continue this pace this far out from the halving coming mid-2024.

In a widely reposted video today, BlackRock’s Larry Fink compares BTC to Treasuries and gold as a ‘flight to quality’, emboldening BTC traders.

CEO of BlackRock, Larry Fink compares #Bitcoin to treasuries and gold as a “flight to quality”.

BlackRock manages $10 Trillion 🤯 pic.twitter.com/fAyd731Cdn

— The ₿itcoin Therapist (@TheBTCTherapist) October 16, 2023

HUB24 sees strong Q1 growth

HUB24 shares are up after the company saw a 21% increase in its Funds Under Administration in the September quarter, reaching $82.7 billion.

The company also announced a new retirement solution that will be available on its platform by the end of the year.

HUB24 has a market cap of $2.8 billion and has spent much of its energy in the past two years attempting to gain more market share. In February last year, the company acquired cloud-based superannuation software platform Class in a deal valued at approximately $386 million as the company targeted super and trust accounts.

HUB24’s market share has increased to 6.3% — up from 5.4% last year— and is ranked in 8th place overall. HUB24 is ranked 2nd for quarterly and annual net inflows and has the fastest growth rate as a percentage of FUA based on annual net inflows.

The total number of advisers using the platform is up nearly 11% to 4,026.

HUB24’s CEO, Andrew Alcock, said today:

‘We are pleased with our strong start to FY24, with solid FUA growth and net inflows. This is a testament to the strength of our Platform proposition and the value we offer to our clients and advisers. We are also excited about the launch of our new features in November, which will further expand our Platform proposition and make it even more attractive to clients and advisers.’

HUB24 sees strong Q1 growth

HUB24 shares are up after the company saw a 21% increase in its Funds Under Administration in the September quarter, reaching $82.7 billion.

The company also announced a new retirement solution that will be available on its platform by the end of the year.

HUB24 has a market cap of $2.8 billion and has spent much of its energy in the past two years attempting to gain more market share. In February last year, the company acquired cloud-based superannuation software platform Class in a deal valued at approximately $386 million as the company targeted super and trust accounts.

HUB24’s market share has increased to 6.3% — up from 5.4% last year— and is ranked in 8th place overall. HUB24 is ranked 2nd for quarterly and annual net inflows and has the fastest growth rate as a percentage of FUA based on annual net inflows.

The total number of advisers using the platform is up nearly 11% to 4,026.

HUB24’s CEO, Andrew Alcock, said today:

‘We are pleased with our strong start to FY24, with solid FUA growth and net inflows. This is a testament to the strength of our Platform proposition and the value we offer to our clients and advisers. We are also excited about the launch of our new features in November, which will further expand our Platform proposition and make it even more attractive to clients and advisers.’

What does the weak Aussie dollar mean for the economy

In the latest Money Morning piece, we explore the implications of a weak AUD on our economy and how the position restricts the RBA’s next move.

In the latest RBA minutes, we see a more hawkish tone from the Reserve Bank Board, who say they are unwilling to tolerate long-term inflation, but how likely are they to actually raise rates in this environment.

Read our thoughts below,

What does the weak Aussie dollar mean for the economy

In the latest Money Morning piece, we explore the implications of a weak AUD on our economy and how the position restricts the RBA’s next move.

In the latest RBA minutes, we see a more hawkish tone from the Reserve Bank Board, who say they are unwilling to tolerate long-term inflation, but how likely are they to actually raise rates in this environment.

Read our thoughts below,

Midday market update

Australian shares are climbing higher at midday, mirroring strong gains on Wall Street and amid rising hopes that Middle East conflict may not spread.

For now Israel has delayed its plans to attack into Gaza after border skirmishes with Lebanon’s Hezbollah raised concerns of a full scale attack from there if they committed troops.

President Biden has also said he will fly into the Middle East to meet with leadership as he attempts to calm the reigon.

The ASX 200 is up 45 points, or 0.64%, higher to 7072, bouncing after two sessions of declines.

The tech sector is the best performing, up 1.3%, following a strong 1.2% gain on the tech-heavy Nasdaq, overnight.

Consumer staples are the worst performing of the 11 sectors, dragged by Coles and Woolworths, which both fell 0.6% following the release of the Reserve Bank of Australia’s latest monetary policy meeting minutes.

The minutes showed that central bank members considered hiking rates by 25 basis points before ultimately deciding to hold the rate at 4.1 per cent for a fourth time.

Overnight, both oil and gold eased on hopes that Israel’s response to the Hamas attacks will be more measured as Biden and US officials begin a strong dialogue with all parties.

Midday market update

Australian shares are climbing higher at midday, mirroring strong gains on Wall Street and amid rising hopes that Middle East conflict may not spread.

For now Israel has delayed its plans to attack into Gaza after border skirmishes with Lebanon’s Hezbollah raised concerns of a full scale attack from there if they committed troops.

President Biden has also said he will fly into the Middle East to meet with leadership as he attempts to calm the reigon.

The ASX 200 is up 45 points, or 0.64%, higher to 7072, bouncing after two sessions of declines.

The tech sector is the best performing, up 1.3%, following a strong 1.2% gain on the tech-heavy Nasdaq, overnight.

Consumer staples are the worst performing of the 11 sectors, dragged by Coles and Woolworths, which both fell 0.6% following the release of the Reserve Bank of Australia’s latest monetary policy meeting minutes.

The minutes showed that central bank members considered hiking rates by 25 basis points before ultimately deciding to hold the rate at 4.1 per cent for a fourth time.

Overnight, both oil and gold eased on hopes that Israel’s response to the Hamas attacks will be more measured as Biden and US officials begin a strong dialogue with all parties.

RBA minutes reveal rate rise considered before hold

The latest minutes from the Reserve Bank of Australia’s (RBA) cash rate decision show that members considered raising rates by 25 basis points before deciding to hold for a fourth time.

The minutes state that inflation remains well above target and is expected to do so for some time. Services price inflation remains sticky, and fuel prices are adding to headline inflation.

As the board said:

‘However, as was the case abroad, progress on reducing headline inflation had been temporarily delayed by higher fuel prices. The monthly CPI indicator had picked up in August. Nonetheless, headline inflation was still expected to decline over the second half of 2023, given the earlier slowing in growth in demand – particularly in the household sector – and the further decline in goods price inflation.’

However, the minutes also note that the labour market has reached a turning point, and output growth has slowed, albeit more gradually than previously expected.

‘Members observed that the labour market had reached a turning point as labour supply had picked up and labour demand had moderated. The unemployment rate remained at 3.7 per cent in August, slightly above the 50-year low of 3.5 per cent. Underemployment had risen a little more noticeably, as had the youth and medium-term (those unemployed for 1–12 months) unemployment rates.’

The board was also surprised by the resistance of the economy, with higher domestic consumption probably in part to the savings buffers of many households which is nearing its end.

‘Output growth in the first half of the year had been more resilient than expected. GDP expanded by 0.4 per cent in the June quarter, though GDP and household consumption both continued to decline in per capita terms. Domestic demand had been stronger than expected, as strong growth in business investment and public investment had more than offset weak growth in household consumption in the quarter.’

Importantly, the board tried to talk tough on potential further rate hikes if inflation proved embedded.

‘In reaching their decision, members noted that some further tightening of policy may be required should inflation prove more persistent than expected. The Board has a low tolerance for a slower return of inflation to target than currently expected.’

RBA minutes reveal rate rise considered before hold

The latest minutes from the Reserve Bank of Australia’s (RBA) cash rate decision show that members considered raising rates by 25 basis points before deciding to hold for a fourth time.

The minutes state that inflation remains well above target and is expected to do so for some time. Services price inflation remains sticky, and fuel prices are adding to headline inflation.

As the board said:

‘However, as was the case abroad, progress on reducing headline inflation had been temporarily delayed by higher fuel prices. The monthly CPI indicator had picked up in August. Nonetheless, headline inflation was still expected to decline over the second half of 2023, given the earlier slowing in growth in demand – particularly in the household sector – and the further decline in goods price inflation.’

However, the minutes also note that the labour market has reached a turning point, and output growth has slowed, albeit more gradually than previously expected.

‘Members observed that the labour market had reached a turning point as labour supply had picked up and labour demand had moderated. The unemployment rate remained at 3.7 per cent in August, slightly above the 50-year low of 3.5 per cent. Underemployment had risen a little more noticeably, as had the youth and medium-term (those unemployed for 1–12 months) unemployment rates.’

The board was also surprised by the resistance of the economy, with higher domestic consumption probably in part to the savings buffers of many households which is nearing its end.

‘Output growth in the first half of the year had been more resilient than expected. GDP expanded by 0.4 per cent in the June quarter, though GDP and household consumption both continued to decline in per capita terms. Domestic demand had been stronger than expected, as strong growth in business investment and public investment had more than offset weak growth in household consumption in the quarter.’

Importantly, the board tried to talk tough on potential further rate hikes if inflation proved embedded.

‘In reaching their decision, members noted that some further tightening of policy may be required should inflation prove more persistent than expected. The Board has a low tolerance for a slower return of inflation to target than currently expected.’

New Zealand CPI growth eases

New Zealand’s consumer price index (CPI) growth slowed to 5.6% in the year to June 2023, down from 6.0% in April-June. This is a positive step for NZ, but it remains well above the Reserve Bank of New Zealand’s (RBNZ) target band of 1-3%.

Food was the largest contributor to inflation in the September quarter as prices of dairy products, eggs, and bread continued to climb.

‘Prices are still increasing, but are increasing at rates lower than we have seen in the previous few quarters,’ said Nicola Growden, NZ Stats consumers prices senior manager.

The RBNZ is expected to continue to keep interest rates on hold. However, the slowdown in CPI growth is a welcome sign that the RBNZ’s monetary policy tightening is starting to have an effect.

NZ Q3 CPI +1.8%qoq/5.6%, slightly less than mkt at +1.9%qoq and RBNZ at +2.1%. Down from +6% in Q2.

Given that Sept is strong seasonally and the drop out of subsidies/higher fuel added ~1%pt this is a good outcome.

(JP Morgan chart) pic.twitter.com/iqsYEA6Tx5— Shane Oliver (@ShaneOliverAMP) October 17, 2023

New Zealand CPI growth eases

New Zealand’s consumer price index (CPI) growth slowed to 5.6% in the year to June 2023, down from 6.0% in April-June. This is a positive step for NZ, but it remains well above the Reserve Bank of New Zealand’s (RBNZ) target band of 1-3%.

Food was the largest contributor to inflation in the September quarter as prices of dairy products, eggs, and bread continued to climb.

‘Prices are still increasing, but are increasing at rates lower than we have seen in the previous few quarters,’ said Nicola Growden, NZ Stats consumers prices senior manager.

The RBNZ is expected to continue to keep interest rates on hold. However, the slowdown in CPI growth is a welcome sign that the RBNZ’s monetary policy tightening is starting to have an effect.

NZ Q3 CPI +1.8%qoq/5.6%, slightly less than mkt at +1.9%qoq and RBNZ at +2.1%. Down from +6% in Q2.

Given that Sept is strong seasonally and the drop out of subsidies/higher fuel added ~1%pt this is a good outcome.

(JP Morgan chart) pic.twitter.com/iqsYEA6Tx5— Shane Oliver (@ShaneOliverAMP) October 17, 2023

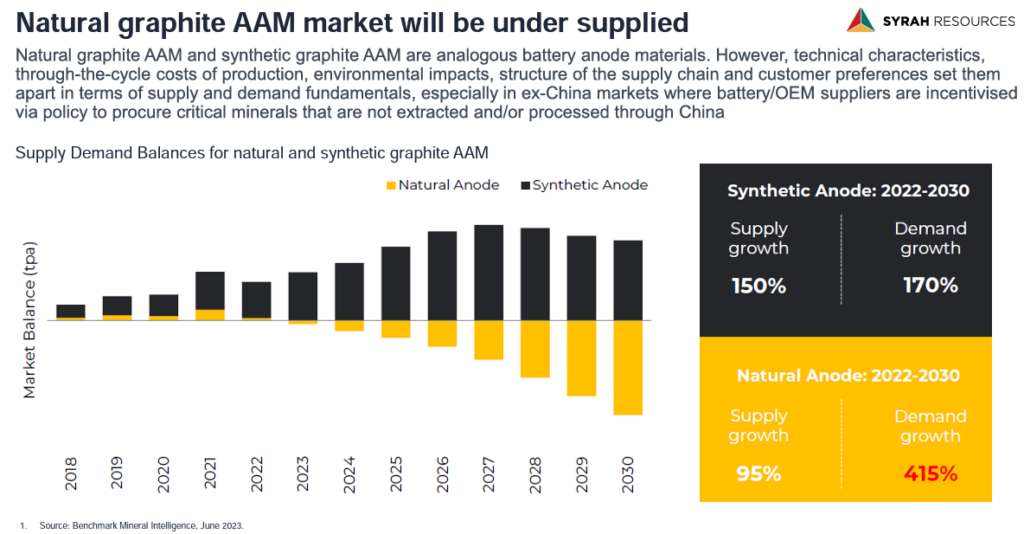

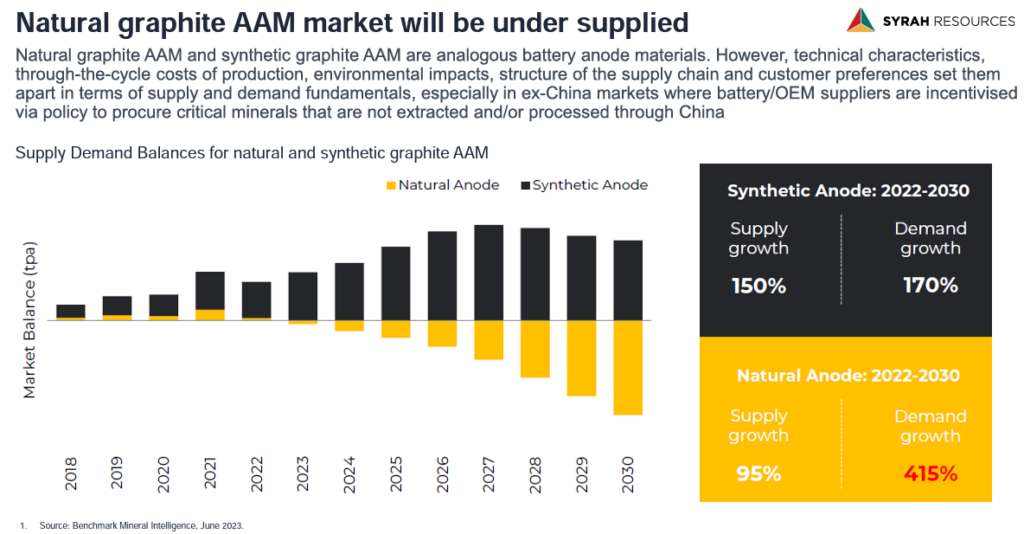

Syrah Resources quarterly report signals strong demand

Syrah Resources [ASX:SYR] is up by 4.26% this morning after its latest quarterly report showed demand for its natural anode is strong while its operations have shown improved recovery to 82% producing 18,000 tonnes.

The company has also begun committing its loans from the US government to progress its Vidalia Further Expansion Project. So far the company has taken a $32m advance from its $102 million loan from the Department of Energy. It has also received a conditional loan commitment from the US International Development Finance Corporation.

Here is a significant slide from the presentation outlining where Syrah believes its strong growth will come from.

EV makers and battery suppliers outside of China desire the Natural Anode for its ESG environmental benefits, and so far, demand is forecasted to outstrip supply.

Source: Syrah Resources Quarterly Report 17/10/23

Syrah Resources quarterly report signals strong demand

Syrah Resources [ASX:SYR] is up by 4.26% this morning after its latest quarterly report showed demand for its natural anode is strong while its operations have shown improved recovery to 82% producing 18,000 tonnes.

The company has also begun committing its loans from the US government to progress its Vidalia Further Expansion Project. So far the company has taken a $32m advance from its $102 million loan from the Department of Energy. It has also received a conditional loan commitment from the US International Development Finance Corporation.

Here is a significant slide from the presentation outlining where Syrah believes its strong growth will come from.

EV makers and battery suppliers outside of China desire the Natural Anode for its ESG environmental benefits, and so far, demand is forecasted to outstrip supply.

Source: Syrah Resources Quarterly Report 17/10/23

Rio Tinto cuts production guidance

Rio Tinto [ASX:RIO] has cut its outlook for its Iron Ore Company of Canada company after issues at the site extended downtime.

In its quarterly update today, guidance for IOC’s full-year production was reduced to 9.3-9.8 million tonnes, from 10-11 million.

Rio blamed conveyor belt failures and slow recovery following the Canadian wildfires that affected northern Quebec in the previous quarter.

Full-year guidance for Pilbara iron ore production was left unchanged in the update at 320-335 million tonnes.

A2 Milk dispute with Synlait heads to arbitration

A2 Milk Company [ASX:A2M] and Synlait Milk [ASX:SM1], two long-time supply partners, ongoing spat now heads to arbitration after last month A2 cancelled their exclusive manufacturing and supply rights for the group’s infant formula that Synlait supplied.

The ongoing dispute continues as both companies face huge share price losses this year, with A2 down 20% for the year and Synlait down 55%.

The companies have struggled with growth after the pandemic slowed its Chinese market, with both companies forecasting low-end revenue growth and high supply chain and financing costs.

China makes up more than half of the world’s infant formula market, valued at around $28 billion.

A2 Milk dispute with Synlait heads to arbitration

A2 Milk Company [ASX:A2M] and Synlait Milk [ASX:SM1], two long-time supply partners, ongoing spat now heads to arbitration after last month A2 cancelled their exclusive manufacturing and supply rights for the group’s infant formula that Synlait supplied.

The ongoing dispute continues as both companies face huge share price losses this year, with A2 down 20% for the year and Synlait down 55%.

The companies have struggled with growth after the pandemic slowed its Chinese market, with both companies forecasting low-end revenue growth and high supply chain and financing costs.

China makes up more than half of the world’s infant formula market, valued at around $28 billion.

Good morning

Good morning all,

The ASX 200 opened up +0.43%, 7,056.5, following Wall Street after a strong rally overnight.

Oil prices have eased slightly after spiking 5.7% over the weekend. Brent Crude is just holding above $90, at US$90.16, while WTI crude sits at US$86.93 after dropping 0.31%.

The Dow +0.93%, Nasdaq +1.20%, S&P 500 +1.06%. Strong rallies across Wall St as the move towards safe-haven assets abated on Monday as fears of a broader conflict in the Middle East fell as the US became heavily involved in the Israeli conflict and urged restraint on the fiery rhetoric from the Israeli government and military.

Gold is down -0.69%, ending its substantial weekend gains of around 5.40%, which puts the last 30 days flat after being down.

Iron Ore is up at US$118.57 as talks of China stepping in to aid its ailing property sector continue without details.

The Aussie dollar is up +0.74% after falling over the weekend, reaching US63.37 cents.

Bitcoin is up 5.21% to US$28,497 as it soars after passing the tricky US$27,000 resistance.

RBA Minutes will be released at 11:30 a.m. AEST to give us an insight into the next rate decision.

Stay tuned.

Good morning

Good morning all,

The ASX 200 opened up +0.43%, 7,056.5, following Wall Street after a strong rally overnight.

Oil prices have eased slightly after spiking 5.7% over the weekend. Brent Crude is just holding above $90, at US$90.16, while WTI crude sits at US$86.93 after dropping 0.31%.

The Dow +0.93%, Nasdaq +1.20%, S&P 500 +1.06%. Strong rallies across Wall St as the move towards safe-haven assets abated on Monday as fears of a broader conflict in the Middle East fell as the US became heavily involved in the Israeli conflict and urged restraint on the fiery rhetoric from the Israeli government and military.

Gold is down -0.69%, ending its substantial weekend gains of around 5.40%, which puts the last 30 days flat after being down.

Iron Ore is up at US$118.57 as talks of China stepping in to aid its ailing property sector continue without details.

The Aussie dollar is up +0.74% after falling over the weekend, reaching US63.37 cents.

Bitcoin is up 5.21% to US$28,497 as it soars after passing the tricky US$27,000 resistance.

RBA Minutes will be released at 11:30 a.m. AEST to give us an insight into the next rate decision.

Stay tuned.

Key Posts

-

4:28 pm — October 17, 2023

-

4:28 pm — October 17, 2023

-

3:29 pm — October 17, 2023

-

3:29 pm — October 17, 2023

-

2:48 pm — October 17, 2023

-

2:48 pm — October 17, 2023

-

2:40 pm — October 17, 2023

-

2:40 pm — October 17, 2023

-

12:13 pm — October 17, 2023

-

12:13 pm — October 17, 2023

-

11:48 am — October 17, 2023

-

11:48 am — October 17, 2023

-

11:36 am — October 17, 2023

-

11:36 am — October 17, 2023

-

11:16 am — October 17, 2023

-

11:16 am — October 17, 2023

-

10:48 am — October 17, 2023

-

10:42 am — October 17, 2023

-

10:42 am — October 17, 2023

-

10:17 am — October 17, 2023

-

10:17 am — October 17, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988