ASX News LIVE | XJO Flat; A2 Milk, Synlait, Brickworks Feature as Christmas Break Looms

13cabs operator A2B up 20% on takeover offer

13cabs operator A2B Australia is up 20% after receiving a $182 million takeover offer from Singapore giant ComfortDelGro. ComfortDelGro currently owns 9.25% of A2B.

A2B’s board unanimously recommends the ‘compelling’ offer. It represents a 31% premium to the stock’s three-month adjusted volume weighted average.

But the company also declared a special fully franked dividend after $105 million worth of property sales.

So factoring in the declared dividend and ones already announced early this year, if the takeover offer goes through, A2B will ‘deliver a total shareholder return of 77%, or 100% including the full value of franking credits).

The company also said today it’s reaffirming FY24 guidance of $22 million EBITDA.

ABS: household wealth is up 2.3% in September quarter

Household wealth rose for the fourth straight quarter in September, up 2.3%.

Total household wealth totalled $15.3 trillion in the September quarter, 7% higher than a year ago.

The Australian Bureau of Statistics said this was largely driven by residential land and dwellings, the Aussie way.

Mish Tan, ABS head of finance statistics, said:

“Household wealth is supported by house prices which have continued to grow despite increases in interest rates.”

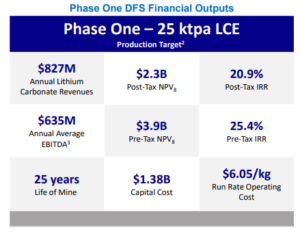

Core Lithium’s review of operations throws Lake Resource’s DFS assumptions in doubt

We got some big updates in the lithium sector this week.

First Lake Resources finally released its long-delayed DFS. And today Core Lithium announced a review of operations that may involve suspending mining operations.

But the gloom of Core’s announcement flies in the face of optimistic assumptions in Lake’s DFS.

While Core is floating the idea to suspend mining operations due to collapsed lithium prices, Lake is assuming sky-high prices as the base case for its DFS.

Lake’s DFS assumes an average price of US$33,000 per tonne of lithium carbonate equivalent over the 25-year life of the mine.

The January LCE futures contract is around US$15,000.

Fastmarkets earlier this week quoted a Chinese lithium producer, who said:

“We, along with many major lithium producers, are no longer offering spot lithium salts because spot demand is muted and spot prices are too low. We are only delivering regular long-term orders,” a Chinese lithium producer source said. “Some traders are offering lithium carbonate at competitively low prices, but they will recoup the loss from the spot sales with their positions in the futures market. For majority of major producers, they won’t sell at similar price levels due to no margins.”

So how did Lake arrive at the figure? A ‘bespoke study’:

‘Economics based on average price of $33,000 per tonne LCE over the LoM, derived from forward price projection provided in a bespoke study commissioned by the Kachi project with Wood Mackenzie and delivered in December 2023.’

To be fair to Lake, it’s not expecting full production until 2030. So it is hoping the supply-demand balance skews in its favour by then.

However, Lake did say in its 116-page DFS that a 15% cut in the base price forecast of US$33,000 will reduce its Kachi project’s post-tax NPV by 28% to US$1.67 billion.

‘Project cash flows are most sensitive to changes in lithium carbonate selling price, where a 15% change in price resulted in a 28% change to the Post-Tax NPV8. Lithium price impact can be limited/mitigated by the pricing mechanisms to be put in place with potential offtakers. Production volume fluctuations are expected to have similar effect as price fluctuations on NPV8.’

It’s a similar impact on the project’s IRR:

‘The IRR is equally highly sensitive to the lithium price due to future cashflows being directly impacted by the linear relationship between lithium volumes and lithium sales price. Other factors considered were capital expenditures and operating expenditures, with Post-Tax IRR being more sensitive to Capex than Opex.’

A 15% cut to its base forecast of $33,000/tonne of LCE reduces the project’s post-tax IRR from 20.9% to 6.5%.

That’s a huge reduction.

Would you want to fund or invest in a project with an internal rate of return in the single digits?

It could even get worse.

Mining is hard. Cost blow-outs are par for the course.

Well, Lake Resources said a 15% increase in capex reduces the IRR by 9.2%. Here is a bad-case scenario:

If lithium prices are at least 15% lower than forecast and capex is 15% higher, Kachi’s IRR goes negative.

$LKE's Kachi project's IRR could go negative if the forecast lithium price declines 15% AND the capex forecast rises 15%.

Kachi's post-tax IRR is 20.9% but falls to 6.5% if lithium price is 15% below assumed level.

IRR falls to -2.7% if capex is also above assumed level. pic.twitter.com/U6oSoWnxuf

— Fat Tail Daily (@FatTailDaily) December 22, 2023

AI stocks surge

The broad market rally in recent months has been especially kind to AI stocks.

Earlier this week, the AI-INDEX 15 hit an all-time high.

The index comprises 15 firms that ‘design, create, integrate or provide artificial intelligence in the form of products, software or systems’.

The 15 stocks are:

- Dynatrace

- DocuSign

- iFlytek

- Palantir

- Splunk

- Veeva Systems

- Ansys

- theTradeDesk

- CrowdStrike

- Fortinet

- NICE

- Cadence Design Systems

- Synopsys

- Palo Alto Networks

- ServiceNow

Core Lithium sinks 20%, initiates review of operations that may include suspending mining operations

New lithium producer Core Lithium [ASX:CXO] is down ~20% after initiating a review of operations following the collapse of lithium prices.

Core Lithium said the strategy review will ‘address the deterioration in lithium market conditions’. Spodumene concentrate prices fell more than 80% year to date, just as Core began producing.

Options canvassed include suspending mining operations.

Core elaborated:

‘The Company has now been producing concentrates for ten months and has seen improvement in mine productivity and plant performance over that period. However, the current decline in the spodumene price has caused the Company to investigate a range of options to lower costs and increase productivity. Options being considered include changes to the mining strategy and plan, such as prioritising ore mining and possible temporary curtailment of mining operations, commercial solutions and reductions in exploration and other discretionary expenditures. Over recent months, the Company has built a significant ROM (run-of-mine) stockpile and will continue processing ore and making spodumene concentrate during the wet season.’

Core Lithium $CXO is down 20%. $CXO.AX initiated a review of operations after spodumene concentrate prices fell more than 80% YTD.

Options canvassed include 'possible temporary curtailment of mining operations'. pic.twitter.com/TEGkWihAUw

— Fat Tail Daily (@FatTailDaily) December 22, 2023

OpenAI’s Sam Altman in reflective mood

Here come the ‘looking back on the year that was’ posts.

OpenAI’s CEO (cult leader?) Sam Altman got in early. Although this was less a reflection, more a manifesto in bullet points.

Bullet point #7:

‘Fight bullshit and bureaucracy every time you see it and get other people to fight it too. Do not let the org chart get in the way of people working productively together.’

I wonder what that was referring to…

what i wish someone had told me:https://t.co/1nEaYimzXG

— Sam Altman (@sama) December 21, 2023

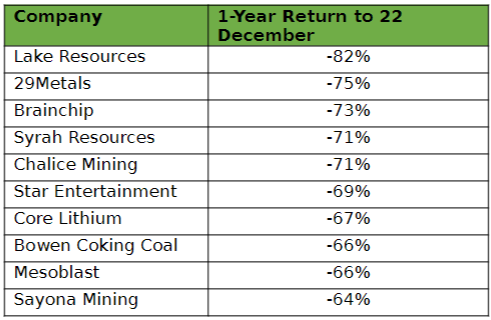

2023’s ten worst performing stocks on the ASX

2024 is days away.

And as the new year approaches, it encourages reflection on the current year.

For markets, that usually means assessing performance.

Who were the winners? Who were the losers?

Today, we’ll look at 2023’s duds and their lessons.

Below, the duds.

Read on for the analysis.

Brickworks: property market experience ‘significant dislocation’

Brickworks’ independent valuation process for its property trust assets is finished.

The independent valuation resulted in the average capitalisation rate increasing to 5%.

Brickworks managing director Lindsay Partridge said the property market is going through a ‘significant dislocation’:

‘The property market is currently experiencing significant dislocation in response to economic volatility, rising interest rates and tighter credit conditions and this is driving a change in external valuation methods.’

Partridge then made an interesting comment on changing valuation methods due to low property transactions in recent weeks:

‘With limited property transactions taking place in the market, traditional valuation methods based on comparable sales have been replaced by methods focussed on discounted cashflow (taking into account increasing interest rates) and initial yield. Under this methodology, the valuation outcome across our portfolio varied significantly by property, with long lease assets that are unable to realise the immediate benefit of increased market rent, being significantly impacted.’

Good morning and good cheer

Good morning from sunny Melbourne!

Kiryll here reporting for duty on Fat Tail’s last office day for the year.

To those not yet on holiday, thanks for tuning in.

Let’s cover some market news.

Although … will there be anything of substance to report?

Synlait and a2 Milk and Brickworks seem to have some interesting updates out this morning. Let’s get to them now.

Key Posts

-

1:41 pm — December 22, 2023

-

1:20 pm — December 22, 2023

-

12:41 pm — December 22, 2023

-

12:19 pm — December 22, 2023

-

11:10 am — December 22, 2023

-

10:49 am — December 22, 2023

-

10:36 am — December 22, 2023

-

10:27 am — December 22, 2023

-

10:12 am — December 22, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988