Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | XJO Falls with Global Markets as Traders Slash Bets for Early Interest Rate Cuts

Bell Potter reportedly readying raise for FBR

Street talk AFR is reporting that Bell Potter is prepping a capital raise for Perth-based bricklaying robotics maker FBR [ASX:FBR].

Shares of Fastbrick (FBR) are currently in halt awaiting the announcement, but they last traded at just $0.027 per share.

Last year wasn’t the easiest for the start-up, with shares falling 28% in the past 12 months.

But the new raise could help expand its next-generation Hadrian X robot, which the company claims is faster than a tradie at laying bricks.

Here’s an overview of the bricklayer in action here.

Midday market update

The ASX 200 is down -0.67% at 7,343.7 around 1pm as the market continues to decline as markets absorb the bearish news from around the globe.

Almost all indexes are down overnight as markets pare back their bets on Central Banks cutting interest rates earlier in the year.

All sectors were in the red around midday, with the worst losses seen in Real Estate (-1.39%) and Energy (-1.34%).

Meanwhile, Financials (-0.18%) and Staples (-0.29%) were the best performers today, with Netwealth Group lifting financials, up 1.57%.

While Select Harvests is holding up staples today, up 4.84%.

For the remainder of the market, the big news is falling commodity prices, as iron ore continues to slide today, down -2.7%.

BHP is down by -1.40% even as the miner said its WA iron ore production was up 5% quarter-om-quarter. It did warn, however, that it would not be immune to falling nickel prices.

Gold also sits a bit above US$2k, with spot prices at US$2,011.83 after drops in the market there.

Australian employment falls but there’s a catch

The latest job figures are out, with a couple of interesting tidbits in the details.

Australian employment fell by 65,100 people in December, a fairly sizable drop.

Here are the details of the latest figures. See anything strange?

Source: IFM Investors-ABS

For the sharp-eyed out there, you may have noticed that despite a solid fall in employment, the unemployment rate stayed the same.

This rather strange state was because of the massive drop in participation rate which fell -0.44%.

While that might not sound like a lot, it’s a pretty sizable drop. Here is a better chart to see those participation figures.

Source: Indeed-ABS

It was the largest monthly change since the pandemic and will be worth watching when the next figures arrive on January 31st.

Those will come in just before the RBA’s next cash rate meeting on the 6th of February and will be significant for the RBA’s next moves.

The RBA Rate Tracker has the market giving a 3% chance of a rate increase, but widely it is considered that rates will remain on hold until later this year.

Infratil [ASX:IFT] top performer on ASX 200 today

Infrastructure investment company Infratil [ASX:IFT] is up by +2.3% today, shrugging off the market sell-off.

Investor interest peaked after the company announced the signing of contracts that totalled 110 megawatts of capacity.

In both October and earlier this month, the company accelerated its construction and development planning through its portfolio company, CDC.

CDC has gained both Australian and NZ customers, which the company say will be supported through the expansion of CDC’s existing data centres. Combined with prior contracts, CDC’s total contracted capacity has increased by over 200MW over the past year.

Infratil’s CEO Jason Boyes said:

“It is pleasing to announce the conversion of advanced customer conversations into contracted capacity in line with the accelerated growth expectations we announced in October 2023 and January 2024. This progress has been reflected in the material increase in the independent valuation of CDC over the course of this financial year and reinforces our confidence in CDC’s future growth prospects.”

The bears come out of the woods for iron ore prices

Iron ore prices are again taking a hit today after weak economic data from China pours cold water on hopes of a recovery for its ailing property sector.

The latest quarter’s GDP growth for China came in at 5.2%. Above the conservative target of 5% but disappointing many.

Data from new home prices for December also cut hopes of increasing demand for iron ore as prices had their steepest declines since February 2015, while property sales fell 23% from a year earlier.

Many had hoped for a step in from China’s central bank to lower the reserve requirement ratio (RRR) of big banks to allow them to lend to building developers, but nothing has come through, despite hints from PBOC leaders.

Now, the latest steel mill production has come in with production down -13.5% on a yearly basis, almost a six-year low.

/1

No way to 'sugarcoat' it, that's just very weak Chinese steel production data for Dec. And it can't be explained away by seasonal factors either as Dec is 'normally' a stronger month. Weakest steel production in almost 6 years & on a yy basis -13.5%; -4.1% on a 3myy basis. pic.twitter.com/hFL0k3jVNi— Robert Rennie (@Robert__Rennie) January 17, 2024

Albemarle cuts back lithium plans in WA

American chemicals giant Albemarle has substantially cut back its Australian growth initiative.

The company, which has faced pressure with falling nickel prices, has scrapped part of its proposed $4 billion dollar plan to build a fourth lithium hydroxide processing train at Kemerton in WA.

The news comes just months after the company announced the plans to double the capacity at the site from two to four.

The critical minerals industry has faced a number of setbacks, with low nickel and lithium prices leading to job losses in the sector.

BHP gave some early indication this week that losses from Nickel may stack up, saying that its WA nickel business was ‘not immune to these challenges‘.

‘Operations are being actively optimised and options are being evaluated to mitigate the impacts of the sharp fall in nickel prices.’

Albemarle part owns Australia’s largest lithium mine at Greenbushes with Tianqi and IGO and is expected to decide soon if they will scale back production as a response to weaker lithium prices.

The end goal for Albemarle is a cutback of annual spending of US$95 million, with its future capital budgets $300-500 million lower than prior statements.

Morning market update

Good morning. Charlie here

The ASX 200 opened down -0.28% at 7,372.1, as global markets had a tough night. Only Bonds, the Yen and Oil were in the green, with almost everything else down.

For the ASX, the important news of today will be job numbers due out at 11:30am, so stay tuned for that.

Disappointing economic data out of China led to sell-offs in the Hong Kong Hang Seng (-3.7%) and Shanghai (SSE -2.09%).

China’s Q4 GDP growth was 5.2% vs Q3’s 4.9%.

This was higher than the conservative official target, but the recovery showed serious weakness that scared investors and analysts alike.

‘Any true acceleration (this year) will require either a major global upside surprise or more active government policy,’ said China Beige Book, the international data collector.

Meanwhile, China’s new home prices in December had their steepest declines since February 2015, while property sales fell 23% from a year earlier.

Europe fell overnight as higher-than-expected UK inflation figures meant traders there cut back their interest rate cut bets.

European Central Bank leaders also spoke overnight, firmly pushing back any hopes of earlier cuts.

ECB Policymaker Bostjan Vasle remarked that it is ‘absolutely premature to expect a cut at start of Q2…labour market are still strong and need caution on wages.’

Similar sentiment was echoed across the Atlantic, as Federal Reserve Governor Christopher Waller cautioned about expecting earlier cuts, saying:

‘With economic activity and labour markets in good shape and inflation coming down gradually to 2%, I see no reason to move as quickly or cut as rapidly as in the past.’

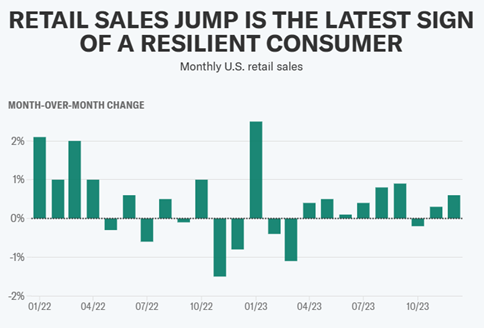

Meanwhile, an upside surprise in retail sales for December in the US also poured cold water on hopes of earlier cuts by markets.

Source: Yahoo finance – U.S Census Bureau

Iron ore prices fell again overnight, down -2.7% to US$125.80 tonne after the Chinese underperformance and production output up by BHP and Rio Tinto.

Wall Street: Dow -0.25%, Nasdaq -0.59%, S&P 500 -0.56%.

Overseas: FTSE -1.48%, STOXX -0.98%, Nikkei -0.40%, SSE -2.09%

The Aussie dollar fell -0.45% to US 65.53 cents.

US 10-year bond yields fell +4 at 4.10%.

Australian 10-year bond yields 136bps to 4.28%.

Gold down -1.08% to US$2,006.36. Silver fell -1.58% to US$22.55.

Bitcoin fell -1.70% to US$42,591, while Ethereum fell -3.16% to US$2,519.

Oil Brent rose +0.34% to US$78.02, while WTI Crude rose +0.62% to US$72.85.

Iron ore fell -2.7% to US$125.80 a tonne.

Key Posts

-

2:19 pm — January 18, 2024

-

1:09 pm — January 18, 2024

-

12:12 pm — January 18, 2024

-

11:57 am — January 18, 2024

-

11:07 am — January 18, 2024

-

10:58 am — January 18, 2024

-

10:05 am — January 18, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988