Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | XJO Falls; Santos, Woodside, Sigma Feature

Sahm Rule in Australia well below recession level

I said I’d calculate the Sahm Rule (a new recession indicator established by economist Claudia Sahm) for Australia earlier.

Well, I dug out the monthly labour force numbers from the ABS.

(Drumroll)

The Aussie Sahm Rule is 0.20%. So well below the 0.50% that triggers a recession signal.

Make of that what you will.

Have a good weekend!

Watch latest episode of What’s Not Priced In!

Latest episode of WNPI is out!

– November's 'bullshit rally'

– From 'higher for longer' rates to 'lower and sooner'

– Big moves in #gold and #Bitcoin

– Lithium stocks and EV adoption paradox

– Coal stocks: cheap or value trap?

– $SOL's bid for $PPT https://t.co/fFUkubyn5k— Fat Tail Daily (@FatTailDaily) December 8, 2023

Dusk denies takeover overtures

Home fragrance retailer Dusk [ASX:DSK] denied takeover rumours aired in the Australian Financial Review on Thursday.

Dusk said:

‘Dusk advises that it has not been approached by any prospective buyer or advisor in relation to a privatisation or takeover. Ord Minnett are acting on their own initiative and do not have a mandate or arrangement with dusk in relation to this matter. We have not seen or contributed to the content of any document purported to have been prepared by Ord Minnett.’

Ord Minnett is acting on its own initiative?

What is going on here?

The AFR’s Street Talk column reported this:

‘Street Talk understands stockbroker Ord Minnett is shopping around the ASX-listed candle and diffuser retailer, putting an investment opportunity flyer in front of potential acquirers.

‘The 43-page deck, dubbed “Project Dawn”, outlines the business’ financial performance, its abysmal trading performance since December 2021, the make-up of its register and how best to mount a takeover.

‘Ords recommends a scheme of arrangement via a full cash offer, which it calls a “friendly approach”, because of the strong representation of the board and management on the register.

‘“Early engagement with board and management who together own around 9.6 per cent of Dusk will be critical,” Ords argues.’

Why did Lake Resources CFO depart?

More on the sudden departure of Lake Resources CFO Peter Neilsen.

Why did he depart? And why depart just before the scheduled release of the Kachi DFS?

According to the FY23 report, Neilsen’s contract did not expire until July 2024. His contract also had a three-month notice period.

Lake did not let it be known that Neilsen was departing in those three months.

LKE did have the right to ‘choose whether the executive works his notice period or is paid in lieu of notice’. So did Neilsen give his notice this week and Lake decide to pay him in lieu?

Lake’s other major executive departure was … rocky.

Lake Resources appoints new CFO weeks before scheduled DFS

Lithium hopeful Lake Resources [ASX:LKE], down over 80% this year, appointed a new chief financial officer, ‘effective immediately’.

While Lake described the announcement as a ‘CFO transition’, the immediate nature of Don Miller’s appointment is more abrupt.

Outgoing CFO Peter Neilsen got a brief mention from LKE CEO Peter Dickson:

‘”I want to thank Peter for his efforts on behalf of Lake Resources, during our shift from exploration through to the final stages of a bankable Definitive Feasibility Study (DFS) for one of the world’s leading lithium projects. We are grateful for his contributions to the Company and wish him great success in his future endeavours.”‘

Lake did not reveal the reason for Neilsen’s departure, only saying he ‘will be moving on from the Company’.

The appointment of a new CFO is surely … inconvenient, what with Lake saying it expects to release the crucial DFS this month.

Calculate your own Sahm Rule

The Sahm Rule is a new recession metric popularised by economist Claudia Sahm.

It’s used to determine when an economy has entered a recession by comparing the difference between the current 3-month average unemployment rate to the lowest 3-month average of the past twelve months.

A difference of over 0.50% heralds a recession.

Claudia Sahm just published a step by step guide on calculating the Sahm rule for yourself.

Maybe I can calculate one for the Aussie economy later today.

The Sahm rule: step by step.

Tomorrow is Job's Day, and we will learn what the unemployment rate was in November. So, it'll also be time to update the Sahm rule, my recession indicator. pic.twitter.com/TD8fm6i3dJ

— Claudia Sahm (@Claudia_Sahm) December 7, 2023

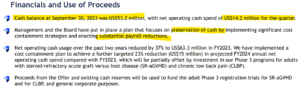

Mesoblast continues to fall, as retail component of entitlement offer opens

Mesoblast [ASX:MSB] is one of the worst performers on the ASX today, down around 6%.

Today’s slump follows a heavily discounted equity raise announced earlier this month to fund trials … and working capital.

According to Ownership Matters, MSB has raised $1.1 billion from investors since listing in 2004. In that time, its net operating cash outflow hit $1 billion.

Gotta raise money to make (lose) money, right?

Mesoblast opened the retail component of the tin rattling today and shared a 90-page retail offer booklet to boot.

Anything interesting in it?

1) Look at that dilution:

2) How long will the raised cash last?

Nvidia, competition, and toasters

Bruce Greenwald famously wrote that in the end, everything is a toaster.

More precisely:

‘On the other hand, if technological change slows down as an industry matures, then rivals will eventually acquire the learned efficiencies of the leading incumbents. In the 1920s, RCA, manufacturing radios, was the premier high-tech company in the United States. But over time, the competitors caught up, and radios became no more esoteric to make than toasters. In the long run everything is a toaster, and toaster manufacturing is not known for its significant proprietary technology advantages, nor for high returns on investment.’

It looks like Nvidia’s high-tech chips are on the road to becoming no more esoteric to make than toasters.

From the Financial Times:

‘Chip designer AMD has launched sales of a product it hopes will break Nvidia’s dominance of the artificial intelligence processor market, which it forecast to be worth $400bn by 2027. AMD’s MI300X chip is “the most advanced AI accelerator in the industry”, chief executive Lisa Su said at an event in San Jose, California, on Wednesday, claiming it outperformed Nvidia’s current offering.’

Magnis Energy suspended

The ASX suspended trading in Magnis Energy [ASX:MNS] with immediate effect.

The ASX said trading in MNS will remain suspended until it is ‘satisfied with MNS’ compliance with the Listing Rules (including its ability to comply with Listing Rule 3.1 and its periodic reporting obligations on an ongoing basis).

It’s not been a great year for Magnis.

And it’s not looking like it’ll get better any time soon.

ASX’s Listing Rule 3.1 refers to disclosure of material information, specifically:

‘Once an entity is or becomes aware of any information concerning it that a reasonable person would expect to have a material effect on the price or value of the entity’s securities, the entity must immediately tell ASX that information.’

Trading in $MNS is suspended until the ASX is 'satisfied with $MNS.AX's compliance with the Listing Rules (including its ability to comply with Listing Rule 3.1 and its periodic reporting obligations on an ongoing basis).' pic.twitter.com/cdGs95MCUg

— Fat Tail Daily (@FatTailDaily) December 8, 2023

Some contrarian wisdom

Investing is as much about expectations as it is about fundamentals.

'Here I turn to a common sense distinction that I would argue is the single most common error in the investment business: failure to distinguish between the fundamentals of the situation (for example, the fundamentals of a company in the case of stocks) and the expectations…

— Fat Tail Daily (@FatTailDaily) December 8, 2023

Good afternoon!

Good afternoon!

Kiryll here after some technical issues prepping the What’s Not Priced In podcast.

Catch the latest episode in a few hours. Greg returns to talk gold, coal, lithium, and the ‘bullshit rally’.

Now onto today’s news…

Key Posts

-

5:36 pm — December 8, 2023

-

3:57 pm — December 8, 2023

-

3:42 pm — December 8, 2023

-

3:33 pm — December 8, 2023

-

2:09 pm — December 8, 2023

-

1:51 pm — December 8, 2023

-

1:22 pm — December 8, 2023

-

12:50 pm — December 8, 2023

-

12:24 pm — December 8, 2023

-

12:16 pm — December 8, 2023

-

12:14 pm — December 8, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988