Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | XJO Falls, Powell Adjusts Tone, RBA’s Latest Statement

Yes, mortgage payments at record high relative to disposable income, but…

Building on the last post.

Mortgage payments were the bogeyman for household consumption. Plenty has been said about historically high charges relative to disposable income.

In today’s Statement, the RBA said scheduled mortgage payments rose to ~10% of household disposable income in the September quarter. A new high.

But…

The RBA noted Australia’s stock of personal debt fell ‘substantially’ in the last 15 years. The overall debt servicing burden for households ‘appears to be lower than in 2008’.

Interesting!

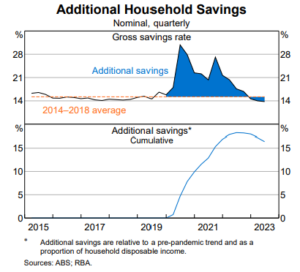

Key chart from RBA’s November Statement

I think this is a vital chart, excavated from the latest Statement on Monetary Policy.

Inflation’s intransigence stumped many. The RBA itself was taken aback by underlying inflation’s stickiness, evidenced by its revised forecasts.

But this chart may explain why.

We accumulated enormous savings during the pandemic. For many, these additional savings — savings above what you’d expect prior to the pandemic — still remain.

The RBA said:

‘More broadly, there has been a small drawing down of the additional savings accumulated during the pandemic in recent quarters, as measured by the deviation of the savings rate from its pre-pandemic average. The extent to which households draw down on their savings to smooth consumption remains a key uncertainty for the consumption outlook.’

What’s not priced in is the true risk of recession

Journalists have the Five Ws. Who? What? Where? When? Why? Five questions to find the truth.

Investors only need one.

What’s not priced in?

Searching for the answer will direct you to all the right areas.

The reason is simple.

Investing is about differentiated insight. Be right and set yourself apart from the crowd.

You don’t want to join the crowd. You want the crowd to join you.

The market is a giant decentralised bookie.

It assigns odds to countless outcomes — recessions, rallies, individual stock performance…

And like legendary punter Steve Crist said, the path to consistent profit lies in exploiting the ‘discrepancy between the true likelihood of an outcome and the odds being offered’.

In this episode of What’s Not Priced In, Greg Canavan takes us through why the market is still underpricing the risk of recession.

The likelihood of recession is not certain.

But it’s higher than the bookie thinks.

Journalists have the Five W questions.

Investors only need one.

What's not priced in?

The search for the answer will direct you to all the right areas.

In this episode, @gcanavan2 argues recession risk is still underpriced by the market.https://t.co/8eb04HhKKE

— Fat Tail Daily (@FatTailDaily) November 10, 2023

Magnis Energy sinks 40% on iM3NY default notice

From hype stock to penny stock.

Magnis Energy [ASX:MNS] is down 43% at midday after its subsidiary was slapped with a default notice.

Magnis owns a 73% stake in aspiring lithium battery maker Imperium3 New York (iM3NY).

But lithium battery making is expensive.

iM3NY is hungry for cash.

Now debtors are hungry for what iM3NY owes them.

Magnis’s wordy statement — dense with legalese — couldn’t hide the bad look.

iM3NY creditors have set an ultimatum. iM3NY has until the 14th of November to get things sorted.

Among the alleged events that triggered the default notice was this doozy:

‘An allegation that approximately 50% of the equipment at the Battery Facility is not performing to specification.’

RBA: Consumer demand propped up by tourists and international students

RBA:

‘While the growth of consumption by permanent residents has been weak, growth of total consumer spending in Australia – which includes spending by temporary residents – remains around its pre-pandemic average (Graph 2.12). This has supported demand conditions for Australian businesses. In particular, total spending has been supported by strong growth in international students and tourists over the past year. This includes a large contribution from Chinese tourists and students since the start of 2023, despite a slowing economic recovery in China. Total spending, rather than consumption, determines the demand conditions that feed into the pricesetting behaviour of consumer-facing firms. However, an increase in international students also supports the supply side of the economy as many students participate in the labour force.’

RBA chart – Residents pulling back on consumption, non-residents keeping growth ticking over. Retailers can be thankful for strong population growth where other sections of the economy aren't so taken with it. pic.twitter.com/YgJZArhN7C

— Alex Joiner 🇦🇺 (@IFM_Economist) November 10, 2023

OpenAI’s Sam Altman takes jab at Elon Musk’s Grok chatbot

OpenAI’s Sam Altman took a jab at Elon Musk’s new chatbot Grok.

Musk overreaction incoming.

GPTs can save a lot of effort: pic.twitter.com/VFIrGzPuMN

— Sam Altman (@sama) November 10, 2023

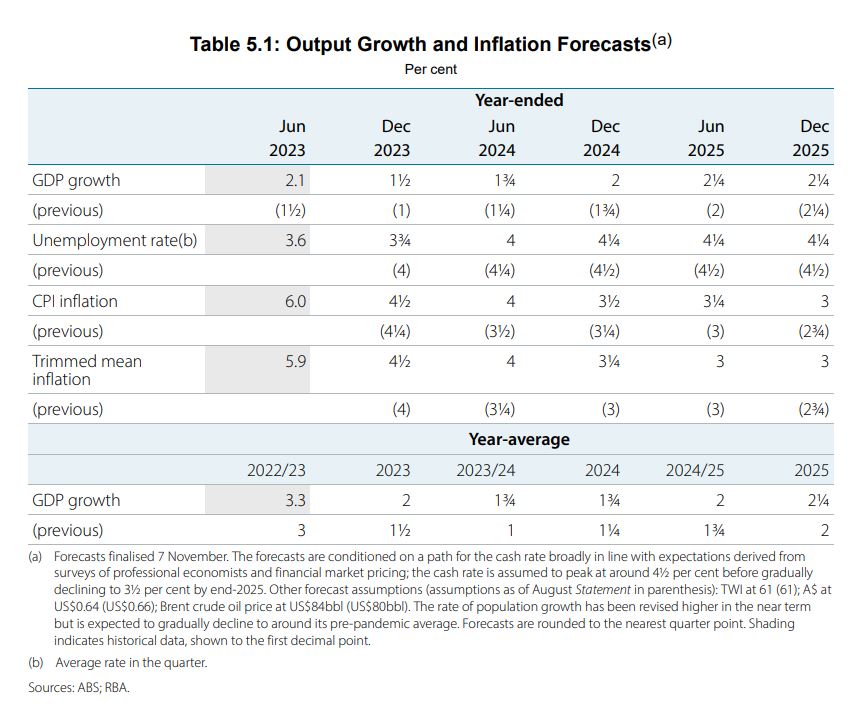

RBA: deflation slower than anticipated three months ago

The Reserve Bank admitted its revised inflation forecast implies a ‘more gradual’ decline in inflation than anticipated just three months ago.

Domestic inflationary pressures are ‘dissipating more slowly than previously thought’.

Inflation is now expected to be 3.5% by the end of 2024 and a tad below 3% by the end of 2025.

Disinflation’s ‘last mile’ really is a slog.

RBA: cash rate to peak at ~4.5%

The Reserve Bank expects the cash rate to peak at around 4.5% and then fall to around 3.5% by the end of 2025.

This is a higher forecast for the cash rate than assumed in the August Statement.

#RBA expects the cash rate to peak at around 4.5% and then fall to around 3.5% by the end of 2025.

This is a higher forecast for the cash rate than assumed in the August Statement.#ASX #auspol $XJO

— Fat Tail Daily (@FatTailDaily) November 10, 2023

RBA: underlying inflation higher than anticipated

The RBA admitted underlying inflation has been higher than anticipated a year ago.

Partly, that’s due to higher than expected population growth.

‘Headline inflation and the unemployment rate have evolved broadly as expected a year ago. But underlying inflation has been higher than anticipated, as high services inflation has persisted in an environment of strong domestic cost pressures and still-robust levels of aggregate demand. Population growth has been substantially stronger than expected following the reopening of the border; however, the net effects on the aggregate inflation outlook and the unemployment rate have been relatively small because the increase in population has added to both aggregate supply and aggregate demand in the economy.’

Reserve Bank’s latest Statement out

Hello! Kiryll here. The Reserve Bank’s latest Statement on Monetary Policy is out!

I will update the most important revelations below.

Key Posts

-

3:50 pm — November 10, 2023

-

3:24 pm — November 10, 2023

-

3:17 pm — November 10, 2023

-

12:42 pm — November 10, 2023

-

12:24 pm — November 10, 2023

-

11:56 am — November 10, 2023

-

11:52 am — November 10, 2023

-

11:38 am — November 10, 2023

-

11:35 am — November 10, 2023

-

11:33 am — November 10, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988