Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | Nvidia Saves The World; Global Stock Markets Hit New Highs; Block, Brambles, Vulcan Energy Feature

Not everyone is hyped about Nvidia

This time IS different.

Versus.

Those who don’t learn from history are bound to repeat it.

That’s the crux of the debate around Nvidia.

Adam Taggart is the latter camp, citing Scott McNealy’s famous quote about price to sales.

Below is Scott McNealy's famous 'What were you thinking?' rant to investors for bidding Sun Microsystems' stock price up to 10x sales during the DotCom bubble

Keep in mind that $nvda is now trading at over 40x sales…😬 pic.twitter.com/CAaUiBweW8

— Adam Taggart (@menlobear) February 22, 2024

Nvidia earnings growing faster than the stock

Bloomberg’s Carmen Reinicke and Ryan Vlastelica published a great piece overnight following Nvidia’s barnstorming result.

Here’s a snippet:

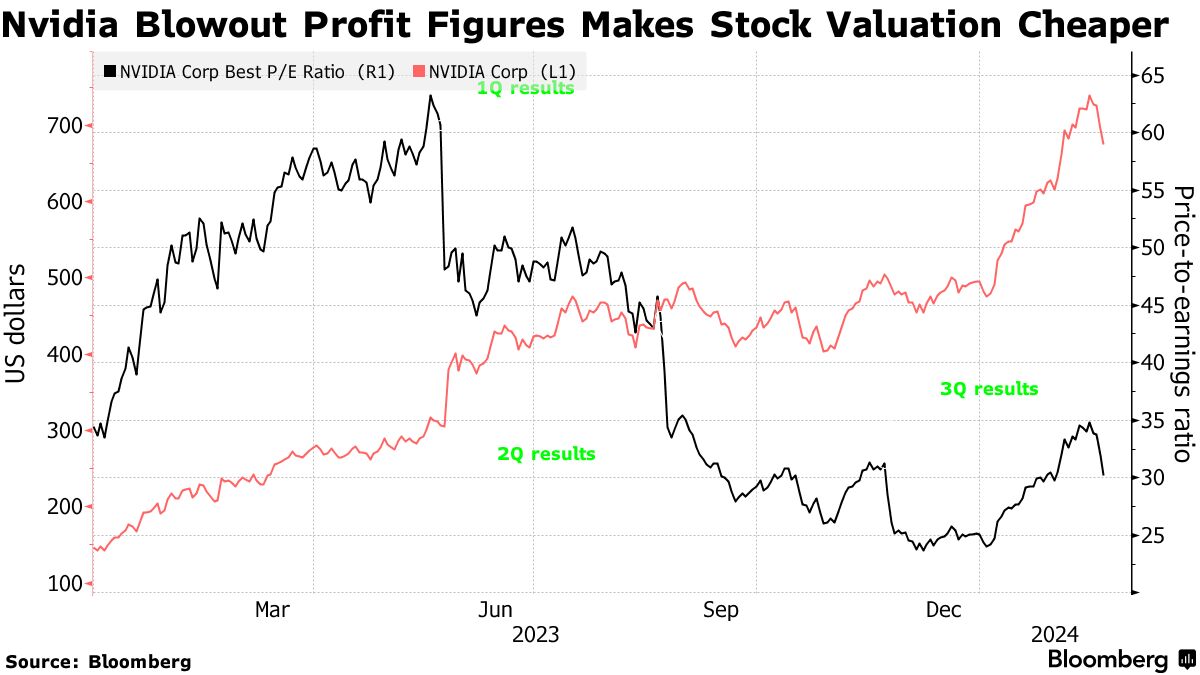

‘“Some investors have been scared to buy because they think the stock is too expensive, but that’s been a huge mistake,” said James Demmert, chief investment officer at Main Street Research. “Every time it reports, the P/E shrinks because the E ends up being so much stronger than people expect.”

‘Put another way, Nvidia’s earnings have been growing even faster than the stock.’

Vulcan Energy touts potential European Investment Bank financing

Vulcan Energy — once the pinnacle of speculative lithium plays — updated investors on the ‘proposed involvement’ of the European Investment Bank (EIB) to partially finance VUL’s Zero Carbon Lithium project in the Upper Rhine Valley, Germany.

The update was well-received.

But it’s couched in qualifications.

After ‘preliminary due diligence’, Vulcan said its project ‘appears potentially suitable’ for EIB financing. The project advanced to the ‘Under Appraisal’ stage…

So it’s not approved. It’s under appraisal.

Is this really news then?

The qualifications continued.

EIB’s potential funding could amount to up to $825 million, ‘pending completion of due diligence, credit approval and legal agreement, and subject to EIB’s governing body’s approval.’

Gmail is here to stay, apparently

Dusk trading at 0.46 trailing price/sales ratio

Something caught my eye with Dusk.

Dusk is worth about $60 million.

But its 1H24 total sales came in at about $78 million. Its 2H23 sales were ~$52 million.

So Dusk is trading at a trailing Price/Sales ratio of 0.46.

Is that common?

What is the market implying with that low metric? That sales are expected to fall off a cliff? Or that these sales are irrelevant because margins will collapse and, so too, profits?

I went to TradingView to check what other stocks are trading at similar P/S ratios.

Only 40 stocks on the All Ords are trading with a P/S under 0.50.

Dusk is one of them.

It’s joined by the likes of:

- NRW Holdings at 0.49

- K&S Corp at 0.48

- Humm at 0.48

- Southern Cross Media at 0.48

- SRG Global at 0.48

- Healius at 0.48

- Resimac at 0.47

- Australian Finance Group at 0.45

- AGL Energy at 0.45

- Baby Bunting at 0.45

- Inghams at 0.41

- Elders at 0.41

- Eagers Automotive at 0.41

- Lendlease at 0.41

- The Star Entertainment at 0.40

Out of interest, the All Ords stock with the lowest P/S ratio?

Coronado Global Resources.

Home fragrance retailer Dusk continues to struggle on 1H24 results

Now onto local shores. Forget Nvidia and Bitcoin for a minute.

This morning, home fragrance retailer Dusk [ASX:DSK] released its 1H24 results. Shares are down over 5% right now.

Why?

- Total sales fell 9.7% vs pcp to $77.8 million

- Total like-for-like sales down 15.8%

- Online sales down 14.3%, falling to 5.3% of Dusk’s total sales

- Gross margin down 9.8% to $50.2 million

- Pro forma EBIT down 40% to $11.5 million

So, key metrics are all down. Dusk is dealing with falling demand and concomitant margin pressures. Never a good combo for a retailer.

European Central Bank’s Bitcoin tweet gets a community note

More on that ECB Bitcoin blog.

The Bank shared its views on Twitter. Backlash soon followed in the form of a community note.

A community note, according to Twitter, lets ‘contributors leave notes on any post and if enough contributors from different points of view rate that note as helpful, the note will be publicly shown on a post.’

Bitcoin has failed to become a global decentralised digital currency, instead falling victim to fraud and manipulation.

The recent approval of an ETF doesn’t change the fact that Bitcoin is costly, slow and inconvenient, argues #TheECBBloghttps://t.co/e9Ek01Dism pic.twitter.com/ddBFsv4g0w

— European Central Bank (@ecb) February 22, 2024

The note, as it currently stands, is this:

‘1. BTC is not preferable for criminals; fiat, like €/$, is:

https://www.chainalysis.com/blog/2024-crypto-crime-report-introduction/ https://transparency.eu/priority/financial-flows-crime/ https://home.treasury.gov/system/files/136/2022-National-Money-Laundering-Risk-Assessment.pdf‘2. Bitcoin is an open monetary protocol and a decentralized store of value:

https://www.imf.org/en/Publications/fintech-notes/Issues/2023/12/05/Macro-Financial-Implications-of-Foreign-Crypto-Assets-for-Small-Developing-Economies-541440 https://ledger.pitt.edu/ojs/ledger/article/view/167‘3. The euro is losing its purchasing power against Bitcoin constantly:

https://tradingeconomics.com/eurbtc:cur‘4. Bitcoin is good for the environment:

https://www.sciencedirect.com/science/article/abs/pii/S1364032120308054 https://www.sciencedirect.com/science/article/pii/S0928765523000313 https://www.sciencedirect.com/science/article/pii/S266679242300015X https://ieeexplore.ieee.org/document/9588243 https://www.sciencedirect.com/science/article/abs/pii/S1364032115000672 https://ledger.pitt.edu/ojs/ledger/article/view/278 https://link.springer.com/article/10.1007/s12599-021-00686-z https://www.sciencedirect.com/science/article/pii/S235248472202039X https://www.mdpi.com/1996-1073/16/3/1200 https://linkinghub.elsevier.com/retrieve/pii/S0360544220309506′

European Central Bank: Bitcoin has failed on its promise

If you’re not talking about Nvidia, what else are you talking about?

Bitcoin.

And we’ve got some juicy news on that front.

The European Central Bank published a post decrying Bitcoin’s social utility. The Bank thinks the cryptocurrency failed on its promise and should be worthless. In fact, the ECB ‘reiterated … that the fair value of Bitcoin is still zero’.

Punchy!

A snippet:

-

‘Today, Bitcoin transactions are still inconvenient, slow, and costly. Outside the darknet, the hidden part of the internet used for criminal activities, it is hardly used for payments at all. The regulatory initiatives to combat the large-scale use of the Bitcoin network by criminals have not been successful yet. Even the full sponsoring by the government in El Salvador which granted it legal tender status and tried hard to kick off network effects through an initial Bitcoin gift of $30 in free bitcoin to citizens could not establish it as successful means of payment.

-

‘Likewise, Bitcoin is still not suitable as an investment. It does not generate any cash flow (unlike real estate) or dividends (stocks), cannot be used productively (commodities), and offers no social benefit (gold jewellery) or subjective appreciation based on outstanding abilities (works of art). Less financially knowledgeable retail investors are attracted by the fear of missing out, leading them to potentially lose their money.

-

‘And the mining of Bitcoin using the proof of work mechanism continues to pollute the environment on the same scale as entire countries, with higher Bitcoin prices implying higher energy consumption as higher costs can be covered by miners.’

European Central Bank: 'We … reiterate that the fair value of #Bitcoin is still zero. For society, a renewed boom-bust cycle of Bitcoin is a dire perspective.' pic.twitter.com/M34QXXysep

— Fat Tail Daily (@FatTailDaily) February 22, 2024

Was Nvidia’s latest quarter a ‘referendum on AI’?

Was Nvidia’s quarterly a ‘referendum on AI’?

It’s a catchy way of putting it.

But Financial Times’ Lex column pushed back with some great points:

‘End users are still getting to grips with AI tools. The extent of their impact is up for debate.

‘Instead, Nvidia’s earnings show the strength of spending on infrastructure by companies and countries determined not to be left behind while AI is still in development. If you listened to other tech earnings you would already know this. Amazon, Alphabet and Microsoft, all Nvidia customers, said capex would rise. Meta’s Mark Zuckerberg went further. In January, he declared that his company would have 350,000 of Nvidia’s H100 AI chips by the end of the year. Nvidia does not specify their price but it is estimated that they are up to $40,000 apiece. Even if Meta paid half that, it would mean $7bn. This sort of demand makes up for the fact that US government intervention has curbed Nvidia’s sales to China.’

‘Because Nvidia designs chips instead of making them, gross margins are high at 76 per cent. While infrastructure spending at other companies is booming, Nvidia’s own spending increase is modest next to revenue growth. Hence cash flow from operating activities for the fourth quarter of $11.5bn, up from just over $2bn a year ago. Nvidia may be thinking about ways to put that to work via mergers and acquisitions.’

Nvidia hits record high on massive earnings beat

Here are some of the crazy figures associated with Nvidia’s latest quarter.

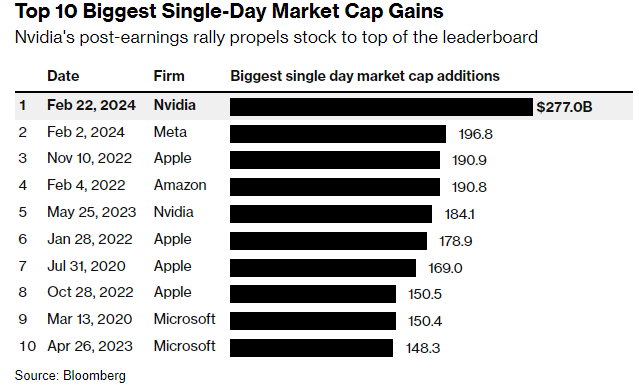

- Nvidia surged to its all-time high overnight, with its market cap nearing US$2 trillion

- Nvidia’s surge yesterday was the biggest single-session increase in market value in history

- Morgan Stanley analysts said they’ve never seen quarterly revenue guidance beat expectations by over US$2 billion until Nvidia, which has now done so for a few quarters

nvidia Nvidia NVIDIA

Well…

What is there to say?

Nvidia just saved the world. Nvidia just sent stock markets across the world to new highs. Nvidia just ….

The superlatives are facetious but not really.

It’s not farfetched to say that Nvidia’s latest earnings beat has reinvigorated investors and renewed their recent bullishness.

So let’s spend some time today going through it all.

Key Posts

-

1:45 pm — February 23, 2024

-

1:28 pm — February 23, 2024

-

1:18 pm — February 23, 2024

-

12:48 pm — February 23, 2024

-

12:33 pm — February 23, 2024

-

11:38 am — February 23, 2024

-

10:50 am — February 23, 2024

-

10:32 am — February 23, 2024

-

10:25 am — February 23, 2024

-

10:15 am — February 23, 2024

-

10:02 am — February 23, 2024

-

9:49 am — February 23, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988