Investment Ideas From the Edge of the Bell Curve

ASX News Live | Nuix, Origin, Humm, Treasury Wines Report Results

Food crisis could spur opportunity in this new food trend

As Australians, most of us are pretty familiar with the devastation that comes from droughts.

We have a huge agricultural industry that has had many struggles with the tough seasonal shifts in rainfall. And I’m not talking on a year-by-year basis because droughts are often part of much bigger and longer climate trends.

Whether you buy into manmade climate change or not, history shows us that extreme weather events have been a staple across the globe for centuries. And when it comes to an extreme lack of rainfall, it can often lead to extreme upheaval.

After all, without rain there is no way to grow crops. Without crops, there is no way to sustain livestock. And without either, societies often begin to run out of food…

Right now, that is exactly what we’re seeing across much of the Northern Hemisphere.

Europe, in particular, has been a focal point in recent headlines. Rivers are running dry as a lack of water squeezes farmers amidst an already tough economic backdrop.

It may be the worst drought the region has endured in 500 years!

Despite this devastating claim, the bigger problem is likely further to the east. Because while Europe’s problems are dire, the situation in China may have much bigger consequences…

Read full article here.

https://www.moneymorning.com.au/20220818/how-the-food-crisis-could-spur-opportunity-in-this-new-food-trend.html

ASX opens 0.35% lower, Regis Resources falls 8% on NPAT hit

The S&P/ASX 200 opened 0.35% lower on Thursday.

The biggest decline in early trade was suffered by gold miner Regis Resources following a brief company update.

Regis expects to report a statutory net profit after tax in the range of $10 million to $20 million.

In FY21, RRL reported a net profit after tax of $146 million.

Meaning Regis expects its NPAT to fall by 85-93% in FY22.

Regis cited the “prevailing inflationary cost environment”, revised cost assumptions, and a write-down of exploration and evaluation assets as drivers of the NPAT decline.

Regis Resources was one of the most shorted stocks on the ASX in early August according to data from ASIC.

Most shorted #stocks on the #ASX at the end of July:

– $FLT with 15.2% shares reported as short

– $BET with 12.1%

– #SQ2 with 11.4%

– $NAN with 11.4%

– $LKE with 10.2%

– $RRL with 9.4%

– $ZIP with 9%

– $EML with 8.5%

– $MSB with 8.2%

– $PNV with 8.2%— Fat Tail Daily (@FatTailDaily) August 4, 2022

Is the Fed getting cold feet in inflation fight?

Joseph Wang, former Federal Reserve insider, thinks the Fed is getting cold feet in its fight to curb inflation following the release of the Fed’s meeting minutes.

Wang pointed to the Fed’s careful wording of a risk the central bank could ‘tighten the stance of policy by more than necessary to restore price stability.’

In the meeting minutes, the Fed did reaffirm its ‘strong commitment to returning inflation to the Committee’s 2 percent objective.’

Fed seems to be getting cold feet. It's beginning to worry about overtightening when inflation is still at 8.5%. Policy always has trade offs, if the fear of economic weakness is very great then the outcome will be biased towards higher inflation pic.twitter.com/Wts1zL0YdK

— Joseph Wang (@FedGuy12) August 17, 2022

Here is the relevant section from the Fed’s meeting minutes in full (emphasis added):

“In light of elevated inflation and the upside risks to the outlook for inflation, participants remarked that moving to a restrictive stance of the policy rate in the near term would also be appropriate from a risk-management perspective because it would better position the Committee to raise the policy rate further, to appropriately restrictive levels, if inflation were to run higher than expected.

“Participants judged that a significant risk facing the Committee was that elevated inflation could become entrenched if the public began to question the Committee’s resolve to adjust the stance of policy sufficiently. If this risk materialized, it would complicate the task of returning inflation to 2 percent and could raise substantially the economic costs of doing so.

“Many participants remarked that, in view of the constantly changing nature of the economic environment and the existence of long and variable lags in monetary policy’s effect on the economy, there was also a risk that the Committee could tighten the stance of policy by more than necessary to restore price stability. These participants highlighted this risk as underscoring the importance of the Committee’s data-dependent approach to judging the pace and magnitude of policy firming over coming quarters.

“Participants reaffirmed their strong commitment to returning inflation to the Committee’s 2 percent objective. Participants agreed that a return of inflation to the 2 percent objective was necessary for sustaining a strong labor market. Participants remarked that it would likely take some time for inflation to move down to the Committee’s objective. Participants added that the course of inflation would be influenced by various nonmonetary factors, including developments associated with Russia’s war against Ukraine and with supply chain disruptions. Participants recognized that policy firming could slow the pace of economic growth, but they saw the return of inflation to 2 percent as critical to achieving maximum employment on a sustained basis.“

Shipping rates ‘in freefall’

Global shipping rates continue to fall this year.

The cost of sending a 40 foot container from Shanghai to Los Angeles is down 45% from its peak.

That said, shipping rates are still well above pre-COVID levels.

Shipping rates remain in freefall this year, with cost of sending 40ft container from Shanghai to Los Angeles down by 45% from peak pic.twitter.com/3SdctPyJTz

— Liz Ann Sonders (@LizAnnSonders) August 17, 2022

ASX tipped to follow Wall Street lower

The S&P/ASX 200 is expected to open lower on Thursday, following overnight moves on Wall Street.

The S&P 500 finished 0.7% lower at 4274.04.

The Dow Jones Industrial Average closed 0.5% lower at 33980.32.

And the Nasdaq Composite fell 1.3% to 12938.12.

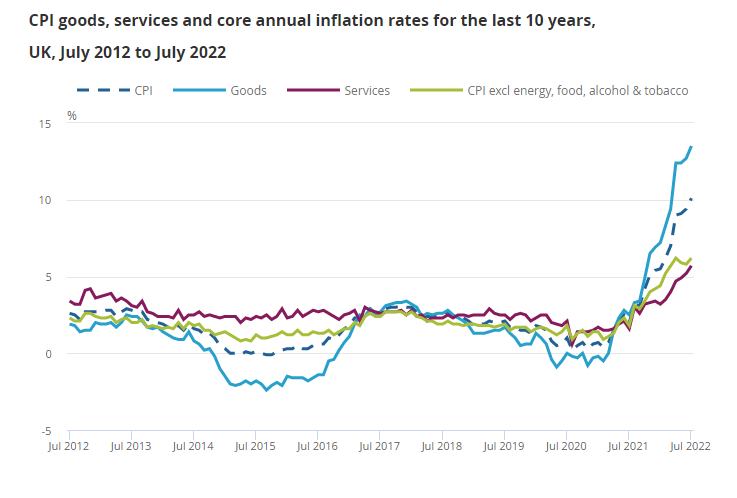

UK inflation hits 10.1%

Overnight, the UK Office for National Statistics released consumer price inflation data for the month of July.

The data was grim.

The UK Consumer Price Index rose by 10.1% in the 12 months to July 2022, up from 9.4% in June.

The July CPI figure was the highest annual CPI inflation rate in the National Statistics series, which began in 1997.

Initial modelling suggests a CPI rate higher than 10.1% was last seen around 1982.

The Office for National Statistics reported that the largest movements in the annual CPI inflation rate in July came from food.

US retail spending steady in July but rises 0.7% ex-gasoline and auto

Overall US retail sales — purchases at stores, online, and in restaurants — were flat in July compared to June’s 0.8% increase, reported the US Commerce Department overnight.

But a measure of retail sales filtering out gasoline and auto sales rose 0.7% last from from June.

Chief economist at Pantheon Macroeconomics told the Wall Street Journal that consumer spending appeared to have gotten off to a ‘pretty good start’ in the third quarter:

“We’ve had nine weeks of gas prices falling; the evidence from this is that people saw the drop in gas prices and said, ‘This is good news, let’s go shopping.”

Earlier this week Target Corp’s executive Christina Hennington told analysts that consumers still possessed spending power but it was shifting to lower-cost items:

“They still have spending power, but they’re increasingly feeling the impact of inflation. While the recent reduction in prices at the gas pump have been encouraging, guest confidence in their personal finances continues to wane.”

No compressive analysis of today’s retail sales data from me, just this presented without comment. pic.twitter.com/uj6nPPa4Ik

— Jason Furman (@jasonfurman) August 17, 2022

Another big reporting day as Nuix, Humm, Treasury Wine, Origin all feature

Reporting season continues on Thursday with a slew of stocks reporting results today.

- Nuix

- Humm

- Origin

- Transurban

- Treasury Wine

- IRESS

- Medibank

- Evolution Mining

- Blackmores

- Auckland Airport

Key Posts

-

12:30 pm — August 18, 2022

-

10:21 am — August 18, 2022

-

9:53 am — August 18, 2022

-

9:38 am — August 18, 2022

-

9:34 am — August 18, 2022

-

9:26 am — August 18, 2022

-

9:12 am — August 18, 2022

-

9:02 am — August 18, 2022

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988