Investment Ideas From the Edge of the Bell Curve

ASX News Live | NAB Posts $2.1b Profit; Super Retail Declares Record First Half Sales

NAB: customers ‘well placed to manage’

In its 1Q23 trading update, NAB (ASX:NAB) said most customers ‘look well placed to manage through this period’. This period, of course, refers to the current milieu of consumer pessimism and rising interest rates.

NAB chief executive Ross McEwan noted some NAB customers are set to struggle:

“The higher interest rate environment, resulting from central bank actions to curb inflation, has benefitted our revenue this period. But this is also causing economic growth and house prices to soften, and loan repayments to increase. We know these changing circumstances, combined with cost of living pressures, will create difficulties for some of our customers, and we have a range of options available for those needing support. Overall though, continued strong employment conditions and healthy savings buffers mean most customers look well placed to manage through this period.”

Some may argue that McEwan’s optimism that most customers look well placed to see through this period relies on static assumptions.

‘Continued strong employment’ may not last if economic activity collapses. And ‘healthy savings buffers’ may not stay healthy for long.

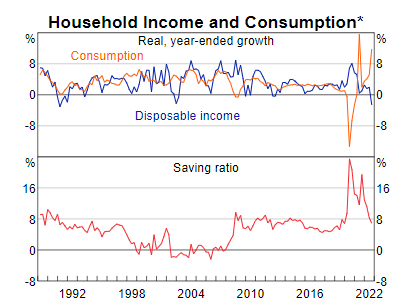

The saving ratio is trending down and is already back at pre-pandemic levels, while disposable income growth is negative.

Source: RBA

How to measure opportunity cost and calculate the cost of capital

If you’re a fan of Michael Mauboussin — co-author of the classic Expectations Investing — then you’re in for a treat.

Mauboussin has just co-authored a new research article on the cost of capital, a key plank in valuing companies.

“The value of any financial asset is the present value of the future cash flows. Valuation starts with an assessment of the magnitude, timing, and riskiness of cash flows. You then discount tomorrow’s cash flows at an appropriate interest rate, or cost of capital, to determine the value today.

“Investors determine the cost of capital based on their opportunity cost, or the value of the next best alternative. The cost of capital is a measure of both expected return, which takes us from the present to the future, and the discount rate, which takes us from the future to the present. Expected returns come with varying degrees of certainty, but in all cases a single number reflects a distribution of potential outcomes.

“The cost of capital varies over time. Periods when the cost of capital is high are followed by periods of returns that are above normal, on average, and a low cost of capital tends to precede subpar returns.2 Companies access external capital from investors, primarily in the form of debt and equity, and invest it with the intention of earning a return in excess of the cost of capital. The expected risk and return are lower for debt holders than for equity holders because debt has a senior claim on cash flows. Debt holders get paid before equity holders do.”

We have a new report out today, "Cost of Capital: A Practical Guide to Measuring Opportunity Cost." The cost of capital is notoriously difficult to pin down, but there are some ways to be sensible and practical about it https://t.co/1cKEh7cNRx

— Michael Mauboussin (@mjmauboussin) February 15, 2023

Whitehaven and Yancoal affected by NSW’s new policies

Whitehaven and Yancoal both released updates today divulging how recent NSW Government policies are set to impact their coal business.

From April until June 2024, Whitehaven’s mines will be obliged to make some thermal coal available for domestic power stations. In aggregate, this is capped at the lower of 200,000 tonnes per quarter or 5% of each mine’s expected saleable thermal coal production.

The required volumes under the scheme must be made available at a maximum delivered price of $125/tonne for 5,500kcal coal.

The price cap can be raised “if the production cost of the delivered coal plus royalties and a reasonable margin exceeds the [current] price cap”.

Whitehaven will update shareholders further in its next quarterly production report.

As for Yancoal, the producer will be required to set aside 395,000 tonnes of coal per quarter to domestic power generators from its attributable saleable production.

This coal is also capped at a price of $125/tonne.

Yancoal said this will present ‘significant logistical challenges’:

“In addition to the Policy’s direct impacts on the Company’s sales profile and revenue, the requirement to re-direct coal into the domestic supply chain presents significant logistical challenges. The Company will be in a better position to evaluate the logistical impacts after operating under the Policy for a sufficient period. The Company has been told by NSW Government that it will not be compensated for the difference between market rates and the price it receives selling volumes under the Policy. Compensation may be made available in certain circumstances, such as where costs exceed the capped price of coal. However, the Company has yet to see the final framework guiding compensation and understands this may not be finalised for some weeks.”

Can you have a falling out with your AI chatbot?

Wharton professor Ethan Mollick has been testing the capabilities of Bing’s OpenAI-powered chatbot.

He is impressed with its brute potential, especially for generative research ideas and linking to sources (always double-check these are real; ChatGPT can hallucinate).

But Mollick has hit a roadblock in what Bing’s chatbot can do — or is willing to do.

Bounded by academic ethics — or Microsoft’s fear of copyright infringement — Bing’s chatbot was not willing to write R code for Mollick. It wanted Mollick to perform the analysis himself.

Very interesting.

I am in danger of having a falling out with my AI coauthor. This is honestly pretty mindblowing levels of interaction. pic.twitter.com/mlbuw4BrfV

— Ethan Mollick (@emollick) February 16, 2023

Unemployment rises to 3.7% in January

Well, what does this presage?

The unemployment rate rose to 3.7% in January, according to the latest release from the Australian Bureau of Statistics.

This was the second consecutive monthly fall in employment but did come after historically strong growth in 2022.

The ABS noted that although there was a larger than usual increase in unemployment in January, there was also a larger than usual increase in the number of unemployed people who had a job lined up.

ABS head of labour statistics Bjorn Jarvis said:

“January is the most seasonal time of the year in the Australian labour market, with people leaving jobs but also getting ready to start new jobs or return from leave. This January, we saw more people than usual with a job indicating they were starting or returning to work later in the month.”

While it's just a tick higher thus far the #RBA's unemployment rate forecast is already being challenged. The resilience of economies thus far is based on robust labour markets seemingly offsetting very weak sentiment. If the former unravels the latter becomes very concerning pic.twitter.com/T7dqLQfnAm

— Alex Joiner 🇦🇺 (@IFM_Economist) February 16, 2023

Aust Jan jobs data weaker than exp with:

emp -11.5k (after -20k)

full time jobs -43k

Hrs worked -2.1%mom with more people on leave than normal

Unemployment 3.7% (from 3.5%)

Underemp flat at 6.1%The jobs mkt is starting to cool which may take some pressure of the RBA

ABS charts pic.twitter.com/M8bKwy3SFT— Shane Oliver (@ShaneOliverAMP) February 16, 2023

Ryan Clarkson-Ledward — why investors need to prepare for a new supply chain paradigm

Beyond the fixation on inflation and broader growth slowdown, the world economy is in a rather odd spot.

We all know that the COVID pandemic was chaotic, but few people seem to realise just how deeply rooted some of the disruption has been.

The pre-COVID era of globalisation has come to a rather unglamorous end. And while there were signs of change before the pandemic, it really pushed things over the edge.

In fact, as of last night in the US, there is now an entire ETF dedicated to investing in companies relocalising American supply chains. Known as ‘Engine No. 1’ and trading under the ticker ‘SUPP’, the people behind this ETF foresee a world where things are ‘closer to local design and demand’.

In other words, expect to see a lot less of the things you buy to be ‘made in China’…

https://www.moneymorning.com.au/20230216/why-investors-need-to-prepare-for-a-new-supply-chain-paradigm.html

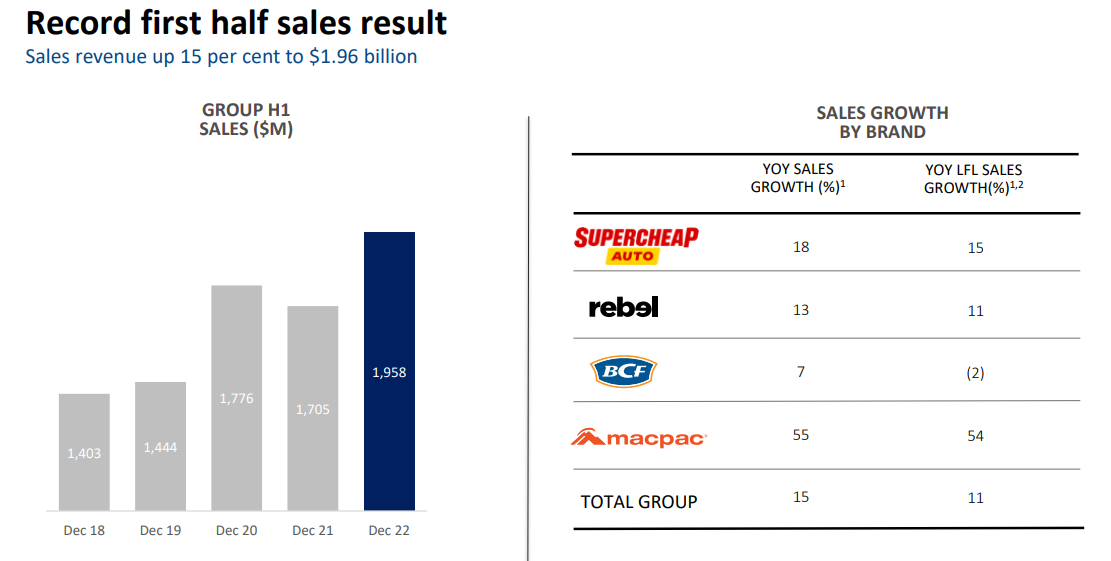

Super Retail’s super pandemic sales — new normal or outlier?

Super Retail’s record first half sales have highlighted how the pandemic years have turbocharged its sales growth.

The question is whether this is the ‘new normal’ or will sales normalise?

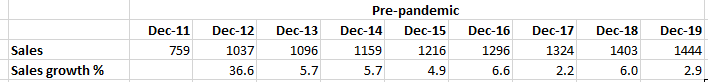

Super Retail’s group annual sales growth has averaged 4.5% in the five years leading up to the pandemic.

From 1H11 to 1H19, sales growth averaged 8.8%. If we take out the 1H11 comparator, sales grew at an average annual rate of 4.9%.

SUL’s pandemic sales growth is materially higher.

Annual sales growth has averaged 11.3%.

Which period is more indicative of the future?

What does Super Retail’s result say about the Australian consumer?

Super Retail (ASX:SUL) is up ~4 right now after delivering record first half sales.

SUL’s sales rose 15% to $1.96 billion. Like-for-like sales rose 11%. SUL’s Rebel business recorded its highest ever monthly sales in December as SUL’s whole suite of businesses benefited from strong Boxing Day and Black Friday sales.

Statutory net profit after tax jumped 30% to $144 million.

Source: Super Retail

Despite the record sales half, group gross margin was down on the two preceding halves, coming in at 46.2%, down from 47.7% in 1H20.

Despite anticipating a ‘more challenging macroeconomic environment’, Super Retail plans to open 26 new stores in FY23, having opened 21 new stores in FY22. Interestingly, in its FY22 report, SUL anticipated opening ‘up to 30’ new stores.

Super Retail said it will be cautious managing capital, predicting a tough macroeconomic environment ahead:

“Low unemployment and accumulated savings are continuing to support consumer spending however rising interest rates are expected to dampen consumer demand later in the second half.”

SUL chief executive Anthony Heraghty is optimistic the retailer can weather any dent to consumer sentiment in the year ahead:

“We remain optimistic that the business will continue to perform throughout the economic cycle, supported by our customer base of 9.7 million active club members, the strength of our brands, ongoing network expansion and roll-out of new store formats, and our leading market positions in attractive and growing lifestyle categories.”

Airbnb delivers first annual profit

Despite the dour mood in parts of the market, some companies are thriving.

Booking platform Airbnb surged yesterday after its fourth quarter results beat expectations and confirmed Airbnb’s first annual profit.

Quarterly earnings were US 48 cents per share, against the 26 cents per share expected by Wall Street. A huge beat.

Quarterly revenue was US$1.9 billion, slightly ahead of the US$1.86 billion expected.

Last year, Airbnb made a US$352 million loss.

Quarterly gross booking value rose 20% YoY to US$13.5 billion. FY22 gross booking value rose 35% to US$63.2 billion.

Airbnb said the strong result was driven by a strong rebound in travel as ‘guests increasingly crossed borders and returned to cities on Airbnb’.

Since everyone is becoming a macroeconomic forecaster these days, Airbnb lent a hand by saying 1Q23 demand looks strong, with ‘consumer confidence to travel remaining high’.

Quick recap of overnight market news

Here’s a quick summary of what happened overnight.

The Commonwealth Bank (ASX:CBA) posted a record half year profit but investors were worried about the outlook for its net interest margin.

CBA’s chief executive said margins have not returned to pre-COVID levels, peaking in October on a month-on-month basis.

CBA is noticing more strained customers who are drawing down their savings and curbing spending.

The bank expects credit growth to slow with rates rising. All major banks closed lower yesterday, dragging the ASX 200 down 1% at the close. Citibank summed up the market’s reaction to CBA’s result:

“With further headwinds from deposit switching likely in 2H23, accelerating headwinds in the mortgage market, and a cash rate that is closer to the peak, we think concerns are likely to grow that NIMs (net interest margins) have peaked.”

Over in the US, stocks finished higher overnight, albeit surprisingly.

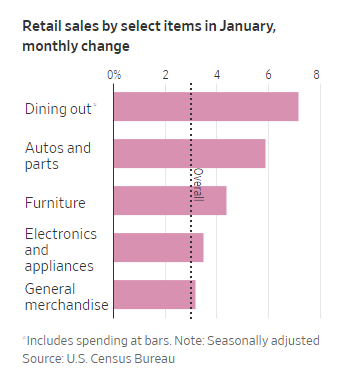

There was another big data release from the US, too. After two months of declines, the US Commerce Department said retail sales rose 3.0% last month, the largest increase since March 2021.

The US economy is not exactly slowing down … and that may encourage the US Fed to hold the course and keep interest rates high for longer. But that didn’t stop the major US indexes from finishing higher.

How far ahead are the markets looking and how much pain have they already priced in?

Source: WSJ

Good morning, investors!

Good morning!

Welcome to another big day in the markets.

We have more US data to interpret as the US Commerce Department released the latest retail sales data.

We also have more US stocks reporting their earnings, headlined by

And we have a deluge of big earnings releases from ASX companies today, too.

Some of the big names reporting results today include AMP, Bapcor, Domain, NAB, Origin Energy, South32, Super Retail, Telstra, and Whitehaven.

Source: OpenAI

Key Posts

-

3:04 pm — February 16, 2023

-

2:35 pm — February 16, 2023

-

1:59 pm — February 16, 2023

-

1:40 pm — February 16, 2023

-

1:26 pm — February 16, 2023

-

12:00 pm — February 16, 2023

-

11:56 am — February 16, 2023

-

11:00 am — February 16, 2023

-

10:22 am — February 16, 2023

-

10:02 am — February 16, 2023

-

9:53 am — February 16, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988