Investment Ideas From the Edge of the Bell Curve

ASX News Live | CBA Half-Yearly Sends Bank Shares Lower; US Inflation Hotter Than Expected

Goodbye for now as the ASX plunges 1%

It was an eventful Wednesday.

US inflation data.

Philip Lowe’s Senate committee appearance.

Commonwealth Bank tanking on its half-yearly results, sending other banks lower.

Brainchip hitting a 52-week low on a big drop triggering an ASX price query (Brainchip didn’t know why the stock fell over 10% on no news).

Tomorrow is going to be eventful, too, I gather, as investors collect their thoughts and digest everything that happened.

Before I go, though, a brief word on Elon Musk.

If you use Twitter, you may have seen a lot more of Elon Musk, whether you follow him or not.

It turns out this wasn’t a glitch … but a request from Mr Twitter himself.

US-based tech news outlet Platformer reported that after his Superbowl tweet received less engagement than US President Joe Biden’s, Elon Musk ordered his staff to make ‘major changes to the algorithm’.

Here’s an excerpt:

“Biden’s tweet, in which he said he would be supporting his wife in rooting for the Philadelphia Eagles, generated nearly 29 million impressions. Musk, who also tweeted his support for the Eagles, generated a little more than 9.1 million impressions before deleting the tweet in apparent frustration.

“In the wake of those losses — the Eagles to the Kansas City Chiefs, and Musk to the president of the United States — Twitter’s CEO flew his private jet back to the Bay Area on Sunday night to demand answers from his team.

“Within a day, the consequences of that meeting would reverberate around the world, as Twitter users opened the app to find that Musk’s posts overwhelmed their ranked timeline. This was no accident, Platformer can confirm: after Musk threatened to fire his remaining engineers, they built a system designed to ensure that Musk — and Musk alone — benefits from previously unheard-of promotion of his tweets to the entire user base.”

Elon Musk ordered major changes to Twitter this weekend after … President Biden's tweet about the Eagles got higher engagement than his did.

Inside the secret system that's showing you all his tweets first, from @zoeschiffer and me. https://t.co/iaNaYxkR0Y pic.twitter.com/bYKjIjJe72

— Casey Newton (@CaseyNewton) February 15, 2023

Retail favourites Brainchip and Lake Resources skid

Retail favourites Brainchip (ASX:BRN) and Lake Resources (ASX:LKE) are selling off on Wednesday.

Chip developer Brainchip is down over 11% in late Wednesday trade while lithium developer Lake Resources is down around 5%.

Both stocks are down over 15% year to date and over 50% in the past six months.

Interestingly, both BRN and LKE were in the top ten most-tipped small caps for 2022 by Livewire Markets readers.

Over the past 12 months, Brainchip is down 63% and Lake Resources is down 25%.

Source: Livewire Markets

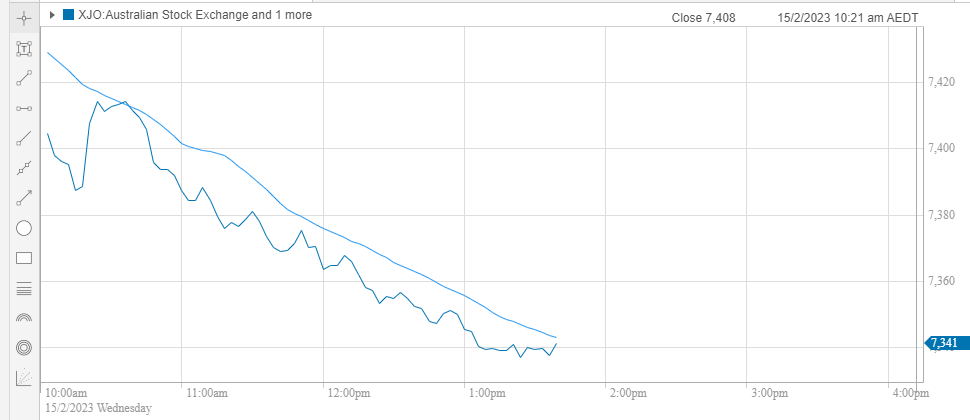

Banks drag ASX 200 down

The ASX 200 is down 1.25%, falling steadily throughout the day.

Source: CommSec

The biggest drag on the benchmark index are the big banks.

At the time of writing, the Big Four banks are all well down:

- Commonwealth Bank is down 6%

- Westpac is down 4.7%

- NAB is down 4.2%

- Bendigo and Adelaide Bank is down 4%

- ANZ is down 3.9%

- Bank of Queensland is down 2.7%

Bank investors were spooked by the latest half-yearly from the CBA, who expects business credit growth to moderate.

Rising competition to secure switching customers will also work against any boon to net interest margins from further expected RBA rate hikes.

Henry Ford’s failed city and the limits of supply chains

American businessman Henry Ford is famous for founding Ford Motors, and for introducing the moving assembly line.

Perhaps less well-known is one of his failed projects: Fordlandia.

In the 1920s, Ford decided to build the ideal city based on Ford’s company values. So, he scooped up 5,625 square miles of land and started building.

Fordlandia had hospitals, schools, stores, a golf course, telephones, and, much like every other model US town, it even had a water tower with Ford’s logo.

But the most surprising thing about Fordlandia was that it wasn’t built in the US, but in the middle of the Amazon, in Brazil.

You see, Ford was worried about rubber supply for his automobile production.

At the time, Britain was one of the largest rubber producers in the world, through its Asian colonies. But after the First World War, demand for rubber had dropped, collapsing prices.

To bump up prices, the British decided to cut production through the ‘Stevenson Plan’.

So, in an effort to secure rubber supply for his automobiles, Ford thought of setting up a city in Brazil to grow his own rubber supply. Rubber produced in Fordlandia would be shipped to Ford’s factories in the US.

It made sense.

Brazil had a long history producing rubber.

In fact, the rubber tree, the hevea brasiliensis, was discovered in Brazil. For years, Brazil had controlled much of the world’s rubber production. That is, until Henry Wickam smuggled out some hevea seeds to England…

As I said, though, the plantation failed, mainly due to a combination of cultural differences with the locals, the fact that they weren’t able to produce much rubber from the plantation, and the rise of synthetic rubber.

Ford shut off the whole project in 1945. Although, some traces of the plantation still remain.

Although the project failed, one thing to understand is that Ford was a big fan of securing supply chains and vertical integration.

Ford had suffered through shortages and raw material price increases during the First World War.

That’s why Ford had gone to great efforts to buy railroads, coal mines, secure timber supply, and even bought a fleet of ships to carry iron ore.

He understood that supply chains, much like rubber bands, can break down when they are overstretched.

https://www.moneymorning.com.au/20230215/understanding-the-limits-of-supply-chains.html

IAC: the world was priced for perfection in 2022

Large holding company IAC Inc. — owning over 100 brands — just released its latest shareholder letter, which is often read widely for its insight on the state of the markets.

In its 4Q22 letter, IAC said 2023 is a year to get ‘back to basics’ following the extravagance of last year.

In 2022, the world was ‘priced for perfection’ with companies focused on ‘growth at all costs’.

“We’d been expecting what we’d consider a healthy market correction for so long we’d almost forgotten, and the environment made it difficult to see mistakes. A comforting lull set in when everything but interest rates moved in only one direction: up.

“Our mistakes, however, weren’t a product of stretching too far on valuations in allocating capital during a rosy market, but rather a result of underappreciating the tailwinds that the pandemic and rollicking market had invisibly provided to make execution look so easy. We’ll not dwell on our failures (nor accomplishments) in this letter as I think we covered them reasonably well last quarter. Across IAC everyone is now focusing 2023 back on basic, fundamental execution. And so far, it’s working.”

IAC said that as a capital allocator first and foremost, it is finding the current environment ‘attractive’ as prices for growing companies with risk ‘once again reflect an opportunity to create value when we get the thesis right.’

IAC is now looking at three main categories of opportunities:

- “Unloved public companies: whether former SPACs or small IPOs, markets are littered with companies facing little coverage or interest, similar to Care when we acquired it.

- “Diamonds in the rough: the excesses of the last few years have led many companies to pursue too many initiatives with too much spending, losing sight of the “Basics”. Investors have little patience for companies to rationalize their costs, but we can look through muddled P&L’s and see real value, like we see at Angi.

- “Small-ish private companies will face increasing liquidity challenges as the year progresses and could offer attractive opportunities for both investments and acquisitions, just as Turo did when we invested in 2019.”

RBA’s Lowe addresses Senate committee

The Reserve Bank of Australia’s Philip Lowe is currently fronting a Senate committee on all things inflation, interest rates, living costs, and lunches with Barrenjoey.

If you would like to livestream it, you can do so here.

ABC News has also been live updating Lowe’s responses here.

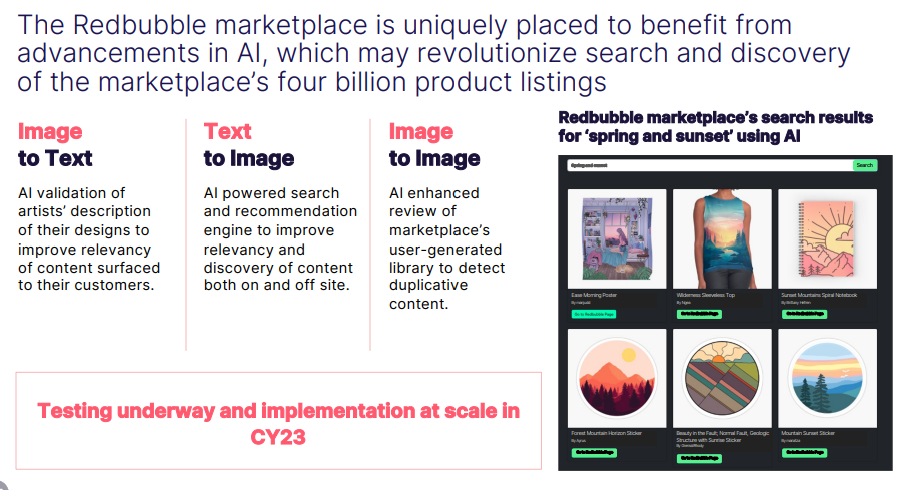

Can AI rejuvenate Redbubble?

Betteridge’s law of headlines would say otherwise, but can artificial intelligence rejuvenate Redbubble and breathe new life into its business model?

Redbubble management thinks so.

Chief executive Michael Ilczynski said Redbubble is testing AI technology to enhance its marketplace experience and improve content quality on the platform.

“Enhancing the Redbubble marketplace’s content quality and search and discovery is a primary focus for the Group to ensure customers can find products among four billion listings which appeal to their specific interests and needs. We are uniquely positioned to benefit from recent improvements in AI, which could revolutionize search and discovery of artists’ content and greatly enhance new and existing customers’ experience. Early signs are positive and we expect to roll-out implementation of this technology at scale this calendar year.”

Redbubble thinks it is ‘uniquely positioned to benefit from recent improvements in AI’, saying:

“Enhancing the Redbubble marketplace’s content quality and search and discovery is a primary focus for the Group to ensure customers can find products among four billion listings which appeal to their specific interests and needs. The Group is uniquely positioned to benefit from recent improvements in AI, which could revolutionise search and discovery of artists’ content and greatly enhance new and existing customers’ experience. Early signs are positive and we expect to roll-out implementation of this technology at scale this calendar year.”

Source: Redbubble

Although could the release of AI art generators like DALL-E 2, Stable Diffusion and Midjourney have a negative effect on Redbubble’s business?

Instead of hopping on Redbubble’s platform to seek out art, customers could instead prompt an AI art generator to create art or an image exactly to their specifications.

Redbubble revenue flat as a pancake

Online marketplace Redbubble (ASX:RBL) saw total revenue for the half-year ended December 2022 rise by less than a percentage point.

1H23 total revenue was $$343.8 million, up from $341.6 million in 1H22.

Despite flat revenue, Redbubble’s net loss ballooned 2,880% to $30 million.

Redbubble’s struggles with growing revenue again led it to lean on promotional activity.

RBL increased its promotional activities in the half, which drove marketplace revenue 3% higher in 2Q23.

However, the marketplace said this promotional activity led to gross profit after paid acquisition costs margin to fall 4.1% to 17.9%.

Is that a sound trade-off?

Probably not.

Looking forward, Redbubble said it will focus on ‘improving GPAPA margin and accelerate the return to cash flow positive’. Of course, one way to improve GPAPA margin is to halt promotional activity.

Redbubble did say that in an effort to cut costs it will ‘suspend investment in the Redbubble brand awareness project’.

But what will that do to its revenue growth, which is already being barely sustained by promotional activity Redbubble seeks to curb?

Redbubble’s soft performance has led to another FY23 guidance revision.

RBL now expects its marketplace revenue to be ‘slightly below FY22’.

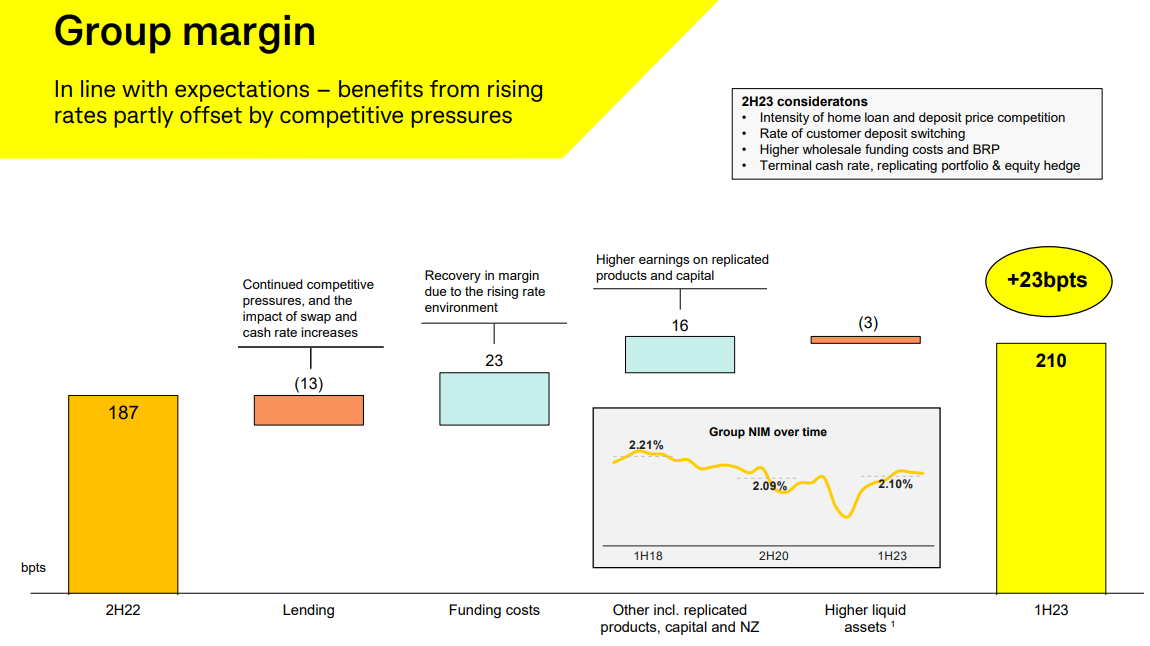

CBA results highlight market’s discounting nature

The market never looks back, always forward.

Nothing better highlights this than the reaction to the Commonwealth Bank’s record half-year profit.

CBA posted a cash net profit after tax of $5.2 billion for the six months ended December 2022, up 9% on 1H22 and an interim dividend of $2.10 a share, fully franked.

But CBA shares are down 3.3% in late morning trade.

Yes, the performance was stellar. But that’s the past. The market is not sure if the stellar performance can continue.

Just look at the latest readings from the Westpact consumer sentiment index we mentioned earlier.

It showed a highly pessimistic Australian consumer, worried about finances, worried about the future.

Barrenjoey’s banking analyst Jonathan Mott said CBA’s net interest margin looks to have peaked and downgrades on profit margins could be coming:

“CBA reported a result that met expectations with Pre-Provisions Profit and NPAT broadly in-line. However, it was concerning to see monthly NIM peaked in October and the exit NIM is falling (slide 23). This will lead to NIM downgrades.

“Given CBA is trading on 19x P/E, we expect the shares to be soft today.”

Source: Commonwealth Bank

Australian attitudes towards major household purchases fourth lowest in 48 years

The Westpac-Melbourne Institute Consumer Sentiment Index fell 6.9% to 78.5 in February, falling to near historic lows.

Cost of living pressures and interest rate rises are weighing heavy on Australian households.

Source: Westpac

The current consumer pessimism only rivals the mood during the start of the pandemic, the Global Financial Crisis, and the recession of the early 1990s.

Worryingly, the latest figures showed a ‘big deterioration’ in household views on family finances, so much so that Westpac called it ‘disturbing’:

“Most disturbing is the size of the hit to current finances. The ‘family finances vs a year ago’ sub-index dropped 8% in February, to just 62.1 – marking the weakest reading since the depths of the early-1990s recession. The index read amongst consumers with a mortgage was just 55.4, down 14.4% since January. These are amongst the bleakest responses on this question in the history of the survey, which goes back to the mid-1970s. Consumers see no let-up in the year ahead. The ‘family finances, next 12 months’ sub-index recorded a 6.7% fall to 86.8. The mortgage belt again featured, with expectations for family finances in this sub-group dropping nearly 15% to just 78.9.”

"The ‘family finances vs a year ago’ sub-index dropped 8% in February, to just 62.1 – marking the weakest reading since the depths of the early-1990s recession. The index read amongst consumers with a mortgage was just 55.4, down 14.4% since January."

1/2 pic.twitter.com/0LKQ9SXkH4

— Fat Tail Daily (@FatTailDaily) February 14, 2023

Dallas Fed President: 2% inflation target hinges on labour market

Dallas Fed President Lorie Logan crisply summarised the importance of the labour market and why its continued strength poses problems for central banks.

While prices for goods are coming down, prices for services remain elevated.

That’s an issue because services inflation is tied to the labour market:

“[B]ecause services prices depend substantially on labor costs, the outlook for sustainably returning inflation to 2 percent hinges in large part on what happens in the labor market.”

Logan also outlined why the current wages growth poses a problem for the Fed’s inflation target. If wages growth remains steady at 5%, productivity must rise to offset any inflationary spillover. But the productivity required to sustain wages growth of that sort is hardly achievable.

“But for 5 percent wage growth to be consistent with 2 percent inflation on a sustained basis, productivity would have to rise at a 3 percent annual rate. Yet output per hour worked grew at an annual rate of only 1 and a quarter percent from 2012 through 2019, and there is little indication it has accelerated meaningfully since then.

“Absent a dramatic rise in productivity, it seems likely that sustainably returning inflation to 2 percent will require substantially lower wage growth. That may take time. Respondents to the Dallas Fed’s Texas Business Outlook Surveys expect more than 5 percent wage growth in 2023, which is down significantly from what they saw in 2022 but still quite elevated. Wage pressures have moderated somewhat in the latest national reports on average hourly earnings and employment costs. I’d need to see a lot more data, though, to be convinced the labor market is no longer overheated.

“To achieve better balance, labor supply will have to increase, or labor demand will have to decrease.”

In a speech delivered at @PVAMU, Dallas Fed President Lorie Logan discussed the importance of continuing to increase the federal funds rate until inflation is on track to return to 2 percent in a sustainable and timely way. Read the full remarks: https://t.co/JmWpxH91b4 pic.twitter.com/ESs0fY7eB9

— Dallas Fed (@DallasFed) February 14, 2023

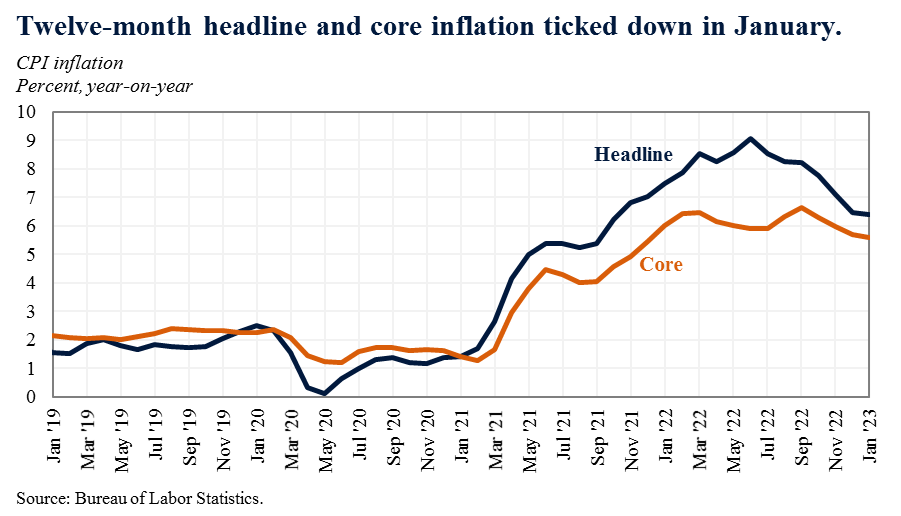

US Fed officials — inflation stickier than many think

Following the release of the US CPI print, Dallas Fed president Lorie Logan delivered an address at Prairie View A&M University.

Her comments were very interesting … and telling about the direction of future interest rates.

Logan made the point that recent progress on inflation is nice but the real concern for monetary policy is whether the progress will continue. The lodestar for the US central bank and ours is 2% inflation:

“Now, there has been some progress on inflation in recent months. But the question for monetary policy is not whether there has been some progress, but rather whether the progress will continue. Will inflation return all the way to our 2 percent target, and will it sustainably remain there over time?

“To answer those questions, I find it helpful to break down some of the components of inflation.

“As it happens, for the last three months of 2022, headline PCE inflation slowed to an annualized rate of 2.1 percent. However, a good bit of that drop in inflation was due to falling prices of oil and other commodities. Energy prices, as measured by the PCE price index for energy goods and services, fell at a 16 percent annual rate over the last three months of 2022. But while it’s a relief to see lower prices at the gas pump, energy prices can’t keep falling at this rate forever.

“Core inflation, which excludes volatile food and energy prices, has historically been a better guide to where overall inflation will go in the future. And core PCE inflation was nearly 3 percent annualized for the last three months of 2022, which is significantly higher than the inflation rate the public is counting on us to deliver.”

Logan then pinpointed services inflation as the real villain of the inflation story. Goods inflation has come down with easing supply chain pressures. But since ‘supply chains can’t recover twice’, she doesn’t see the recent deflation in core goods as sustainable.

The real action will be in services.

The following excerpt from Logan’s address contained ample clues on the mindset of the US Fed:

“The larger concern is with services other than housing. Core services inflation excluding housing has been running in a range of 4 to 5 percent for close to two years, with little sign of improvement. You could say this is the core of the inflation problem.

“If core services inflation excluding housing remained in its current range, while other categories returned to their prepandemic pace, total inflation going forward would settle much closer to 3 percent than to our 2 percent goal. And depending on how the U.S. and world economies evolve, inflation could be even higher. For example, the Dallas Fed’s business contacts tell us that China’s rapid transition out of zero-COVID policies could drive up commodity prices this year by more than what most people currently expect.

“Broad-based and persistent services inflation is not the result of special circumstances like supply-chain disruptions that will eventually go away. Rather, I see it as a symptom of an overheated economy, particularly a tight labor market, which will have to be brought into better balance for the overall inflation rate to return sustainably to 2 percent.”

US inflation cools … but not as much as expected

The latest US CPI print has just dropped. It was almost as hotly anticipated as a Taylor Swift album.

And the CPI report didn’t disappoint in packing a punch.

US headline inflation rose at an annual rate of 6.4% in January, down from December’s 6.5%. However, wonks expected headline inflation to come in at 6.2%.

Core inflation — which jettisons volatile items like energy and food — rose at an annual rate of 5.6%, above the forecasted 5.7% and only slightly below the 5.7% rise in December.

Good morning!

Good morning, investors.

It’s a huge day on the markets.

US inflation data just dropped. And it was hotter than expected.

Markets are now pondering whether their bets on the terminal interest rates were too optimistic.

Locally, we’ve got a big day of earnings, headlined by the Commonwealth Bank. The CBA posted a record half-year profit of over $5 billion.

And RBA’s Philip Lowe is set to front the cameras today and cop a grilling from the Senate Economics Legislation Committee.

Key Posts

-

4:52 pm — February 15, 2023

-

2:42 pm — February 15, 2023

-

1:46 pm — February 15, 2023

-

1:36 pm — February 15, 2023

-

1:15 pm — February 15, 2023

-

1:00 pm — February 15, 2023

-

11:53 am — February 15, 2023

-

11:42 am — February 15, 2023

-

11:15 am — February 15, 2023

-

10:50 am — February 15, 2023

-

10:12 am — February 15, 2023

-

9:53 am — February 15, 2023

-

9:31 am — February 15, 2023

-

9:02 am — February 15, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988