Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX Rebounds to Record High on Lowest Quarterly CPI Since March 2021; Google, AMD and Microsoft Kick Off Earnings Season

Local game developer Playside Studios up 23% on December quarterly

ASX-listed game developer Playside Studios is up over 20% in late trade after posting its December quarter results.

- Record quarterly revenue of $20.7 million, up 106% on pcp

- Record original IP revenue of $11.1 million, up 245% on pcp

- Record work-for-hire revenue of $9.6 million, up 41 on pcp

- EBITDA of $8 million

- Record net cash balance of $38.3 million

The share price jump likely also had something to do with the FY24 upgraded outlook.

Playside upgraded its FY24 revenue guidance to $60m-$65m, from $55m-$60m.

It did say FY24 earnings will be skewed to 1H24, expecting 2H24 EBITDA ‘to be roughly breakeven’, especially since headcount will rise in the second half. FY24 EBITDA is guided at $11m-$13m.

ASX 200 currently sits at record high

Well.

Did you see this coming?

The ASX 200 is currently up 1.03% in late trade at 7,678 points. If that’s where the index ends up at market close, it will mark a new all-time high.

Astounding!

Aussie shares at record highs

Chart shows number of attempts made to breach record highs over past five years.

S&P/ASX 200 index now 7,639.6#ausecon #auspol #commsec @CommSec https://t.co/x7T8hwCo2l pic.twitter.com/7HNtORhQfn— CommSec (@CommSec) January 31, 2024

Update on spot Bitcoin ETF inflows

Update for the #Bitcoin ETF Cointucky Derby after Friday (11 days). $5 billion out of $GBTC. Newborn 9 still offsetting those outflows with gross flows of $5.8 billion. Giving us net inflows of $759 million. Volume continued to slow. pic.twitter.com/QTJqqI4aoA

— James Seyffart (@JSeyff) January 29, 2024

Why Syrah Resources is struggling, in management’s words

So why is Syrah Resources down 80% in the last 12 months and is the second-most shorted stock on the ASX?

Syrah’s management offered some reasons in the December quarterly. Here are the excerpts below.

SYR thinks Chinese producers flooded the market to clear inventories before China’s export controls came into effect in December:

‘There was a major immediate disruption to global natural graphite and anode material markets with the announcement and implementation by the Chinese Government of export licence controls for designated graphite products. Following this announcement in late October 2023 and ahead of implementation on 1 December 2023, there was a significant increase in exports of potentially impacted graphite products from China to clear supplier inventories and build ex-China stockpiles. Exports of natural graphite were more than three times normal monthly levels in November 2023, and exports of spherical graphite and anode materials were four and two times normal levels, respectively, significantly reducing stock of finished products in China.

‘However, Chinese and global trade activity in these products evaporated in December 2023 to the lowest monthly levels in several years with uncertainty over the Chinese Government’s intent, and lack of clarity on the licenses process and implementation. Limited export licences were granted for December 2023 shipments by significant AAM and anode precursor suppliers exporting to certain countries including South Korea but not US, Japan and most European countries. Customer feedback is that licences for shipments have been also denied for various reasons. Producers and consumers faced major concern about supply beyond inventory accumulated. Chinese customers tempered orders of imported natural graphite, including from Syrah, whilst awaiting progress in licences to export spherical graphite and anode material products from China to ex-China markets. Syrah expects Chinese exports of these products to be moderate in January 2024 and to increase from February 2024 assuming granting of licences continues to increase.’

SYR thinks synthetic graphite active anode material production growth in China ‘has been significant and misaligned with demand’:

‘As noted throughout 2023, synthetic graphite AAM production capacity growth in China has been significant and misaligned with demand. Aggressive pricing as new entrants seek market share to allow production continuity continued to cause intense domestic competition amongst new and incumbent synthetic graphite AAM producers. The sustainability of current prices (which for low density synthetic graphite AAM, in some cases, remain at or below the cost of production) appears challenging and is most prevalent in the Chinese domestic market, rather than ex-China export markets, where customers continue to demand a broadly unchanged blend of natural and synthetic AAM products. The ongoing convergence of prices for low-end synthetic graphite AAM and natural graphite AAM appears to be unsustainable, and any increase in power, graphitisation, or coke costs from present levels is expected to immediately drive higher synthetic graphite AAM prices. Syrah continues to expect that underutilisation of expanded synthetic graphite AAM capacity and loss-making prices caused by intense competition will ultimately lead to consolidation or rationalisation of marginal synthetic graphite AAM supply capacity, which will ultimately support higher pricing for both synthetic graphite and natural graphite AAM.’

Syrah Resources continues to struggle in latest quarterly

Graphite producer Syrah Resources — down 80% in the last 12 months — didn’t turn the corner in the December quarter.

It was more of the same for Syrah.

Graphite market remains in the doldrums. And its Mozambique graphite mine continues to produce graphite at a loss.

Despite a suspension of mining activities during the quarter, Syrah still managed to leak cash.

In the December quarter, net cash outflows from operating activities totalled US$22.7 million and US$72 million in the last 12 months (yikes).

A further US$37 million went out the door during the quarter on investing activities (US$125.6 million in the last 12 months, again, yikes).

Thanks to convertible note issues and borrowings, Syrah was able to end the quarter with US$84.9 million in the bank, having started with US$80.9. But the heavy financing activities paper over giant cracks.

Will Syrah ever be self-sufficient? And when will the financing dry up?

Lake Resources nearing cash calamity

Lake Resources’s accounts say the lithium hopeful has 2.5 quarters of funding available.

That’s not a lot in itself.

But it is probably even less than that.

Lake had $31.3 million in cash at the end of December. Total outgoings during the December quarter totalled $27.3 million. Based on that, LKE has 1.1 quarters of funding available.

The only reason the accounts say 2.5 quarters is the murky funding facility with Acuity Capital.

But that funding facility is protean … and heavily reliant on LKE’s share price.

In fact, Lake recently reduced how much it can feasibly draw down from the facility. LKE’s share price fell so much that it now can’t draw down the remaining notional amount of $206 million because that would exceed how many shares it can issue without shareholder approval.

Here is Lake’s explanation:

‘The Company has determined that the total unused amount available under the Agreement at the December quarter end is approximately $36.2 million as follows. The current standby equity capital available under the Agreement without issuing further shares to Acuity is approximately $8.5 million based on shares currently held as collateral by Acuity pursuant to the terms of the Agreement at the prevailing share price of $0.13 on 29 December 2023.

‘The maximum standby equity capital available under the Agreement without requirement of shareholder approval is approximately $27.7 million based on the prevailing share price of $0.13 on 29 December 2023. There is no guarantee that the Company will be able to execute a utilisation under the Agreement, which is subject to, for example, market conditions and the prevailing share price.

‘In comparison to the approximate $36.2 million unused amount available under the Agreement at quarter end (as per the above calculation), over the past quarter, the unused amount available, based upon the high and low share price of $0.205 and $0.115 over the same quarter, would have ranged from $57.1 million to $32.0 million (notwithstanding that the Maximum Option Size under the Agreement is the remaining notional amount of $206.2 million).’

$LKE has 2.5 quarters of funding available, *if* one includes a finance facility with Acuity Capital.

But that funding facility is not iron clad and depends on the 'prevailing share price' of $LKE.AX. $LKE used 13c as the share price anchor. $LKE currently trades at 9.2c. pic.twitter.com/5hl32mVU6P

— Fat Tail Daily (@FatTailDaily) January 31, 2024

Lake Resources manages to spend $18.4 million on corporate costs in December quarter

Down ~90% in 12 months.

Delayed full production of lithium to 2027.

Once a $1 billion company, now a $130 million small-cap.

Yet it still runs up quite the corporate tab.

In the December quarter, Lake Resources spent $18.4 million on admin & corporate costs … despite being years away from booking any revenue.

It spent less on exploration, being $9.3 million.

What exactly is the Lake board paying itself for?

$LKE managed to pay more in admin & corporate costs than $SYA in the December quarter.

That's despite $SYA.AX producing lithium product during the quarter. $LKE.AX is still years away. pic.twitter.com/ZzQQnnGFvU

— Fat Tail Daily (@FatTailDaily) January 31, 2024

How much Aussie households spend on major items in dollar terms

Beer gets a separate category!

So does tobacco.

Table shows estimates of major items of household spending in dollar terms.#ausecon #auspol #commsec @CommSec pic.twitter.com/9I4MTlkbvY

— CommSec (@CommSec) January 31, 2024

Sayona management: ‘It was a strong operational quarter’

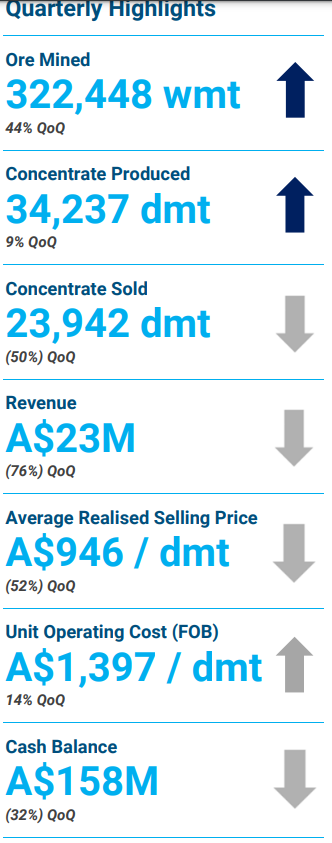

Despite selling concentrate at a steep loss, Sayona Mining management was upbeat.

Management described the December quarter as ‘strong’:

‘It was a strong operational quarter for Sayona, with ore mined and concentrate production at NAL increasing compared to the prior quarter. NAL produced 34,237 dry metric tonnes (dmt) of concentrate at the target quality of 5.5% Li2O, up 9% on the previous quarter, while major capital projects such as the Crushed Ore Dome were advanced.’

Despite the ‘strong operational quarter’, Sayona is going ahead with an ‘operational review’ of its cost structure at NAL:

‘Post-quarter, Sayona announced on 25 January 2024 an operational review is underway to optimise NAL’s cost structure in response to rapidly changing conditions in the global lithium market. The review is focusing on opportunities to reduce NAL’s cost base, manage cash flow and preserve the operation’s financial sustainability. The review is expected to be completed by the end of the first quarter of calendar 2024, with the outcome to be announced to the market.’

Sayona Mining down 10% as mining costs outpace sales

A picture is worth a thousand words. And this picture isn’t pretty.

Revenue is 76% quarter on quarter despite mining 44% more ore and producing 9% more concentrate.

Concentrate sold fell 50% QoQ.

And the biggest doozy…

The unit operating cost rose 14% to $1,397/dmt while the average realised selling price fell 52% to $946/dmt.

Sayona is selling at a loss.

No wonder it is one of the most shorted stocks on the ASX.

Goods and services inflation both slowing

Annual goods inflation fell for a fifth consecutive quarter in December.

In fact, some goods are experiencing deflation.

Prices for clothing, footwear, furniture and household appliances are lower now than they were 12 months ago.

In good news, services inflation is also coming down.

Annual services inflation fell for the second straight quarter.

Aussie CPI rose 0.6% in the December quarter, smallest quarterly rise since March 2021

Australia’s Consumer Price Index rose 0.6% in the December quarter, up 4.1% annually. This was lower than the September quarter rise of 1.2% and was the smallest quarterly rise since the March 2021 quarter.

But that’s headline inflation.

Australia, Consumer Price Index (CPI, Q4 23):

Headline: 0.6% QTR, 4.1% YR (survey: 0.8% QTR, 4.3% YR, prior 5.4% YR).

Trimmed Mean (core): 0.8% QTR, 4.2% YR (survey: 0.9% QTR, 4.3% YR, prior 5.1%).

Monthly CPI indicator: 3.4% YR (prior: 4.3% YR). #ausecon #auspol @CommSec— CommSec (@CommSec) January 31, 2024

Core inflation, excluding volatile items, rose 0.8% in the December quarter and 4.2% annually.

Did Google and Microsoft’s results underwhelm?

Did $MSFT and $GOOGL quarters underwhelm?

— Fat Tail Daily (@FatTailDaily) January 30, 2024

Weebit Nano down 6% on latest quarter, admits royalty revenue is far off

Semiconductor memory technology developer Weebit Nano is down over 6% after the market did not take well to its December quarter.

Weebit burned through over $12 million in the quarter, booking only $457,000 in customer receipts.

WBT shrunk its cash balance to $72 million.

Weebit said ‘factors outside [its] control have delayed the signing of first customer agreements’ but it is working to have ‘these issues resolved’.

Chief executive Coby Hanoch then admitted steady revenue inflows may take time to materialise:

‘Licensing fees and non-recurring engineering fees will account for the majority of Weebit’s revenue in the short-term with royalty revenues scaling over time. In general, it normally takes three years from signing a licensing agreement with a foundry before their first customer commences mass production. This timeframe is why Weebit has prioritised securing new agreements with foundries and IDMs, as each such agreement triggers multiple customer opportunities and provides the foundation for long-term royalty revenue growth.’

Weebit then explicitly said that no royalty payments are expected in CY2024.

Hanoch then said his company is still in the early stages and will require ‘continuous investment in R&D … over the coming years’:

‘“ReRAM is still very much a new technology and will require continuous investment in R&D to improve baseline parameters over the coming years. This will be true for all ReRAM providers. Weebit is uniquely positioned as the leading independent provider of ReRAM. We have world-class talent across the four key ReRAM disciplines – device physics, process and materials, analog and digital design and algorithms, and test and characterisation – providing us with significant competitive advantages within the rapidly growing embedded emerging NVM market. The quality of our team and our singular focus on ReRAM ensures we are best placed to become the leader in the ReRAM domain – a segment that is expected to account for 37% of a US$2.8 billion market by 2028.”

Key macroeconomic updates today and tomorrow

Wednesday AEDT

11.30am Inflation

11.30am Private sector credit

12.30pm China purchasing managers index

4pm Japan consumer confidence, housing starts

6pm German retail sales

6.45 French inflation

….

Thurs Feb 1 AEDT

6am US Fed decision #ausecon #auspol #commsec @CommSec— CommSec (@CommSec) January 30, 2024

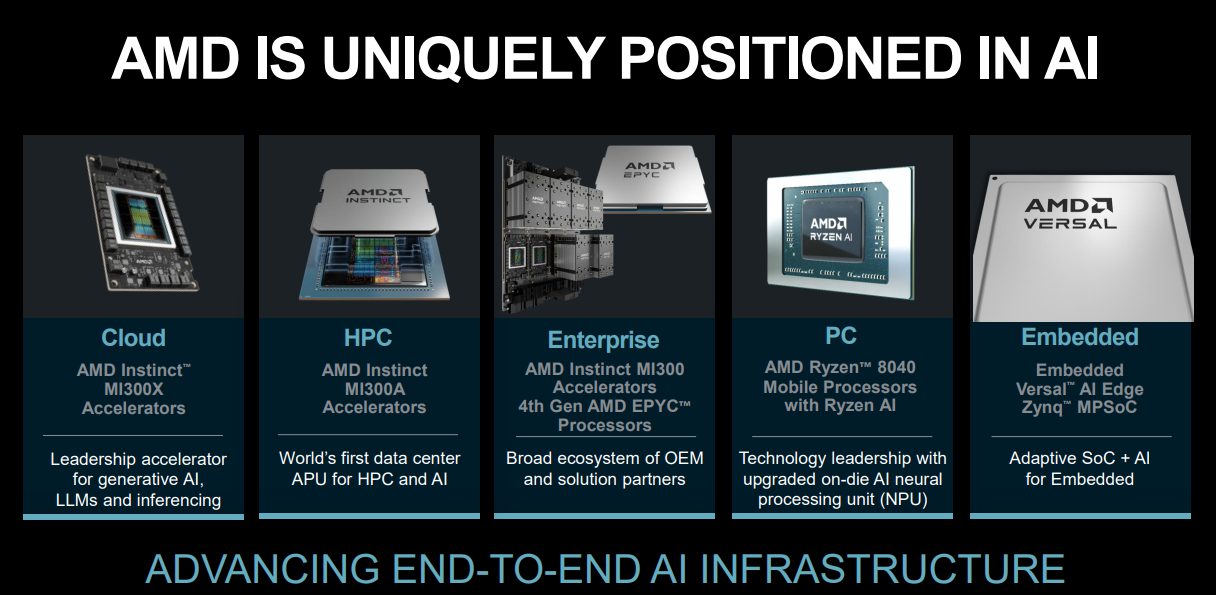

How many times will AI be mentioned this reporting season?

Google, Microsoft and AMD released their fourth quarter results overnight.

All three mentioned AI.

In AMD’s case, its news released mentioned AI 23 times.

AMD chief executive Dr Lisa Su said this is an ‘incredibly exciting time as AI re-shapes virtually every part of the computing market’. That wasn’t enough to bump AMD’s revenue forecasts above market expectations, though.

Its presentation was even more AI-focused.

Latest Mauboussin article on increasing returns is out!

Gather round, Michael Mauboussin just published a new investment research piece.

If you know me, you likely know I love reading Mauboussin’s work. He collates all the best investment wisdom and research into compact articles. He then publishes these articles for free! FOR FREE.

Anyway, here’s the latest one, on increasing returns.

Babe, wake up, new Mauboussin paper just dropped. https://t.co/HuRIGKC2eQ pic.twitter.com/ukH2k5gw7d

— Conor Mac (@InvestmentTalkk) January 30, 2024

AMD’s revenue projections underwhelm market, shares slip

Big-name chipmaker AMD is down over 6% in after-hours trading after disappointing the market with softer than expected revenue projections.

AMD booked revenues of US$6.2 billion in the last quarter, up 10% year-on-year.

But the chipmaker forecast revenue to be US$5.4 billion next quarter, despite all the AI buzz. Analysts pegged next quarter’s revenue at US$5.7 billion.

AMD blamed flat data centre sales and falling revenue from gaming.

Did this have any effect on Nvidia? Did the market glean from AMD’s performance anything about Nvidia’s? We’ll delve into that more, but Nvidia’s stock did fall 2% after hours.

ICYMI: picking AI stocks

In case you missed it: how to pick winning AI stocks, the podcast.

Latest WNPI is out. The #AI Special!

✅Is AI ‘the most profound technology humanity is working on’?

✅Best ways to play the AI theme as investors

✅Methodology to picking AI stocks

✅Can AI ever be commoditised with competition?

✅Economics of AIhttps://t.co/eXK2px9A0l— Fat Tail Daily (@FatTailDaily) January 27, 2024

Good morning!

Good morning! Kiryll here.

A big day ahead! And plenty to discuss.

Results from Google, Microsoft and AMD.

Upcoming CPI data.

And more earnings confessions from ASX firms.

Let’s get to it!

Key Posts

-

4:00 pm — January 31, 2024

-

3:32 pm — January 31, 2024

-

3:08 pm — January 31, 2024

-

3:04 pm — January 31, 2024

-

2:51 pm — January 31, 2024

-

2:12 pm — January 31, 2024

-

1:49 pm — January 31, 2024

-

1:26 pm — January 31, 2024

-

1:20 pm — January 31, 2024

-

1:15 pm — January 31, 2024

-

11:39 am — January 31, 2024

-

11:34 am — January 31, 2024

-

11:29 am — January 31, 2024

-

11:08 am — January 31, 2024

-

10:29 am — January 31, 2024

-

10:27 am — January 31, 2024

-

10:10 am — January 31, 2024

-

9:55 am — January 31, 2024

-

9:45 am — January 31, 2024

-

9:43 am — January 31, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988