Investment Ideas From the Edge of the Bell Curve

ASX News Live | ASX Up; Whitehaven, REA, Pushpay, NAB Feature; Bitcoin Sinks on Crypto Chaos

Things are tight in the commodities sector

The war in Ukraine…supply chain disruptions…inflation…COVID.

With all these crises, resource shortages are worsening every day. We’ve seen a run-up in conventional energy commodity prices such as oil, gas, and coal.

But also, we could be facing shortages of critical materials needed for the energy transition.

As electric vehicle demand continues to increase, we will also need to expand our supply and refinement of critical minerals such as lithium, graphite, nickel, and cobalt…by a lot.

Just to give you an idea, check out the chart below:

Source: Financial Times

But it’s not just for electric vehicles. Wind farms, solar farms, stationary batteries…you name it.

Demand for critical materials is set to soar as countries continue to move through the energy transition.

Yet as my colleague Kiryll Prakapenka pointed out yesterday, there’s been a lack of investment when it comes to new mining supply.

All that could lead to a growing disconnect between supply and demand. As Fatih Birol from the International Energy Agency put it last year (emphasis added):

‘The data shows a looming mismatch between the world’s strengthened climate ambitions and the availability of critical minerals that are essential to realising those ambitions.

‘Left unaddressed, these potential vulnerabilities could make global progress towards a clean energy future slower and more costly — and therefore hamper international efforts to tackle climate change. This is what energy security looks like in the 21st century.’

Indeed.

And with scarcity looming, competition for critical materials is intensifying.

https://www.moneymorning.com.au/20221109/redrawing-the-lines.html

News Corp down 10% on 1Q23 update

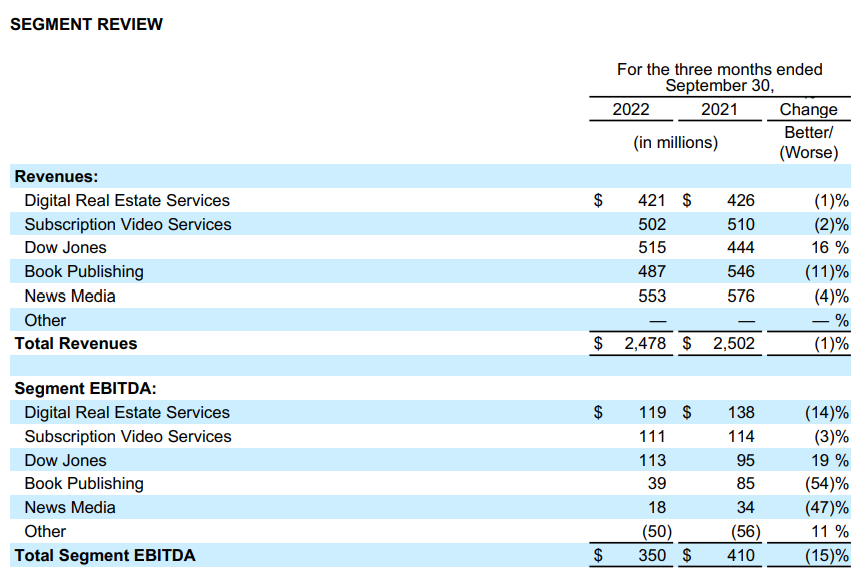

News Corp reported a drop in revenue and net income in 1Q23, blaming foreign currency fluctuations and lower revenues from the Book Publishing segment due to lower physical book sales from Amazon.

Revenues in the quarter fell 1% to $2.48 billion. Adjusting for currency fluctuations, revenues actually rose 3%.

However, net income for the quarter fell 75% to $66 million from $267 million in the prior year.

EPS fell 79% to 7 cents a share, down from 33 cents a share in the prior year.

Chief Executive Robert Thomson commented:

“While the macro environment is patently more volatile, the results highlight the resilience of News Corp and the potential for sustained growth and increased profitability.

“Headline revenues were down one percent to $2.5 billion, but the decline was obviously a consequence of foreign currency fluctuations. On an adjusted basis, our revenues grew a healthy three percent, building on the robust results from last year.

“Profitability for the quarter was $350 million, down 15 percent, although that reflects the forex headwinds and a fundamental reset by Amazon of its book inventory levels and warehouse footprint. We view neither factor as reflective of core business conditions or of our long-term potential.”

Small-cap fintech Douugh up 10% — launches first phase of ‘super app’

Small-cap fintech Douugh (ASX:DOU) is up 10% after soft launching the first phase of its ‘super app’ in Australia on iOS and Android.

Douugh’s soft launch — concerning around 27,000 current customers and 15,000 on a waitlist — centers on micro-investing.

DOU said the micro-investing feature will help customers invest “in a diversified set of core portfolios managed by BlackRock.”

ASX investing will be available in Q3 with crypto investing to follow.

DOU shares are down 70% over the past 12 months.

New hierarchy in commodity stocks

In October, the Australian Department of Industry released its latest Resources and Energy Quarterly for the three months to September 2022.

Unsurprisingly, the report found global high energy prices and a strong US dollar are ‘driving a surge in export earnings’.

After a record $422 billion in 2021–22, the Department expects Australia’s commodity export earnings to rise even further in 2022–23 to $450 billion.

And despite its tight pandemic restrictions, China remained the dominant destination for Australian commodities in 2021–22.

Source: Department of Industry

But the boffins in government departments don’t think the commodities boom will last.

The record export earnings of $450 billion expected in 2022–23 mark the peak, according to the Department of Industry.

The following year, 2023–24, export earnings are expected to slump to $375 billion.

But while some commodities are expected to see a drop in price on lower demand — like steel and iron ore — some commodities are on the rise.

‘Green’ metals like nickel, copper, and lithium. Metals that are essential for the world’s energy transition.

As the Department of Industry noted:

‘Metals central to the global energy transition (copper, nickel, lithium) are set to earn $33 billion in 2022–23, double what they earned in 2020–21.’

Miners ramp up spending on battery tech metals

Analysis from BDO shows that Australian total exploration spending in the June 2022 quarter rose 25% from the March 2022 quarter to $1.04 billion.

BDO trawls ASX commodity stocks’ quarterly reports and collects their aggregate exploration spending data.

BDO said the June quarter’s exploration spending was the first time since BDO began its analysis in June 2013 that exploration spending surpassed $1 billion.

Source: BDO

https://www.moneymorning.com.au/20221108/commodity-stocks-new-hierarchy.html

BNPL Openpay secures $110 million receivables facility

BNPL firm Openpay (ASX:OPY) secured a $110 million receivables facility to fund growth.

Openpay said the new facility marks a “material uplift” in committed receivables funding from the previous $55 million.

The funding will be provided by existing financier GCI Commercial Finance Fund and Fortress Investment Group.

OPY said it remains on track to deliver cash EBITDA profitability by June 2023.

Dion Appel, Openpay CEO, said:

“Openpay has been experiencing significant growth in receivables due to consistent and strong market demand. This increased facility reflects the confidence our long-term funding partners GCI have in the quality of our book and execution of our business model. Clubbing together with Fortress, it delivers the upsize in funding facility required to meet the growth we are experiencing, and our commitment to achieve cash profitability by June 2023.”

Openpay did not outline the details of the funding arranging, only saying the facility is subject to “customary conditions precedent.”

Whitehaven Coal down 6% on lowered guidance

Flooding has hampered production at Whitehaven Coal’s open cut mines, forcing the coal producer to lower its FY23 guidance.

WHC has ‘moderated its expectation’ for FY23 run-of-mine (ROM) coal production at its open cut operations.

Flooding and wet weather hampered production at $WHC's open cut mines, forcing the #coal producer to lower FY23 guidance. $WHC 'moderated its expectation' for FY23 ROM coal production at its open cut operations. #ausbiz #ASX #CoalTwitter pic.twitter.com/0ER9T1tWza

— Fat Tail Daily (@FatTailDaily) November 9, 2022

Medibank: criminal releases customer data on dark web

The criminal responsible for the widespread cyber attack on Medibank has released some customer data on a dark web forum, Medibank admitted today.

The criminal released files containing “personal data such as names, addresses, dates of birth, phone numbers, email addresses, Medicare numbers for ahm customers (not expiry dates), in some cases passport numbers for our international students (not expiry dates), and some health claims data.”

Medibank believes the release was partial and the criminal will continue to release more files.

$MPL #Medibank cyber attack update: "Criminal has released files on a dark web forum containing customer data that is believed to have been stolen from Medibank's systems …. We expect the criminal to continue to release files on the dark web." #ausbiz #auspol pic.twitter.com/rzZ1Uzi8dz

— Fat Tail Daily (@FatTailDaily) November 8, 2022

ASX gold stocks rallying

ASX gold stocks are rallying on Wednesday. The best performing gold stocks so far on the All Ords:

- SSR Mining (ASX:SSR) up 8.5%

- Gold Road Resources (ASX:GOR) up 7%

- Resolute Mining (ASX:RSG) up 7%

- Capricorn Metals (ASX:CMM) up 6.3%

- Challenger Exploration (ASX:CEL) up 6.3%

ASX #gold stocks are rallying on Wednesday.

– $SSR up 8.5%

– $GOR up 7%

– $RSG up 7%

– $CMM up 6.3%

– $CEL up 6.3%

– $RRL up 6%

– $EVN up 6%

– $DEG up 6%

– $SBM up 6%

– $NST up 5.5%#ASX #ausbiz #miners— Daily Reckoning Au (@DRAUS) November 8, 2022

Key Posts

-

1:09 pm — November 9, 2022

-

12:52 pm — November 9, 2022

-

11:40 am — November 9, 2022

-

11:32 am — November 9, 2022

-

11:27 am — November 9, 2022

-

11:16 am — November 9, 2022

-

11:08 am — November 9, 2022

-

11:04 am — November 9, 2022

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988