Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX Unsteady as Commodities Fall; GDP Figures Due Today

Immutep drops on capital raise

Biotech company Immutep [ASX:IMM] is down by -8.33% today following a capital raise by the company.

The share price has slumped to 41.3 cents, putting its past 12 months’ return at +35.25%.

Immutep successfully raised $89.6 million in institutional and $10.6 million from retail to total $100.2 million at 38 cents per share.

According to the recent investor presentation, which can be found here, the company will use the funds to help it progress its late-stage trials of its lung cancer treatment, Efti.

The company has signed with another top-selling cancer treatment, Merck’s Keytruda, which has shown success when both are combined with chemotherapy.

Immutep’s Chief executive, Marc Voigt, told investors at the presentation day that the total market for the drug was around US$24 billion ($36 billion), and said that if it was successful, it had ‘potential massive return.’

Mr Voigt said Immutep had two pathways to commercialisation, saying:

“On one side, you have the drug development and clinical trials, this is the last stage before the drug is approved [and] we can apply for approval in early 2027,” he said.

Xero prices convertible notes

Kiwi-software company Xero [ASX:XRO] has seen its shares drop by -4.6% to $125.96.

The move comes after the company priced US$925 million ($1.4 billion) worth of convertible notes.

Xero CFO Kirsty Godfrey-Billy said:

“Weʼre pleased with the response and the very strong demand for this offer. This will provide us with flexibility as we continue to execute our strategic priorities.”

The company said it expects to realise net new proceeds of US$234 million from the issue.

Medibank faces huge fine for breach

Australia’s privacy watchdog is suing Medibank [ASX:MPL] over its massive data breach in 2022.

Health insurance giant Medibank will be facing a theoretical maximum fine of up to $20 trillions of dollars due to the sheer size of the breach.

Modern changes to this law put the cap at $50 million. However, the breach occurred before then, so it could possibly go higher.

While the fine will obviously not get anywhere near this number, it highlights the scale of the breach, which exposed some 10 million Australians’ personal data, the largest such breach in our history.

This sensitive data included details of individuals who had undergone abortions, as well as a vast array of other private information such as names, addresses, dates of birth, phone numbers, email addresses, and Medicare numbers (without expiry dates) for customers of Medibank’s budget brand, ahm.

The commissioner of the watchdog has accused Medibank of ‘failing to take reasonable steps to protect their personal information.’

Medibank’s shares are down by -1.60% today, trading at $3.70 per share.

Treasury Wine’s jumps after reaffirming guidance

Treasury Wine Estates [ASX:TWE] shares are up by 6.4% to $12.12 in early afternoon trading after the company reaffirmed its FY24 projections.

The Penfolds owner expects its recently acquired Daou Vineyards to generate $US24 million in EBITS despite the rocky start to the opening of the Chinese wine tariffs.

Treasury Wines maintained its overall forecast of mid-to-high single-digit EBITS growth for the entire company.

For Treasury Americas, it expects FY24 EBITS in the range of $223-228 million as its luxury portfolio continues to grow.

The recent $1.6 billion acquisition of Daou Vineyards in late 2023 was mentioned as showing signs of contributing to the company’s growth, however more details were expected at the company’s US investor day.

Midday market update

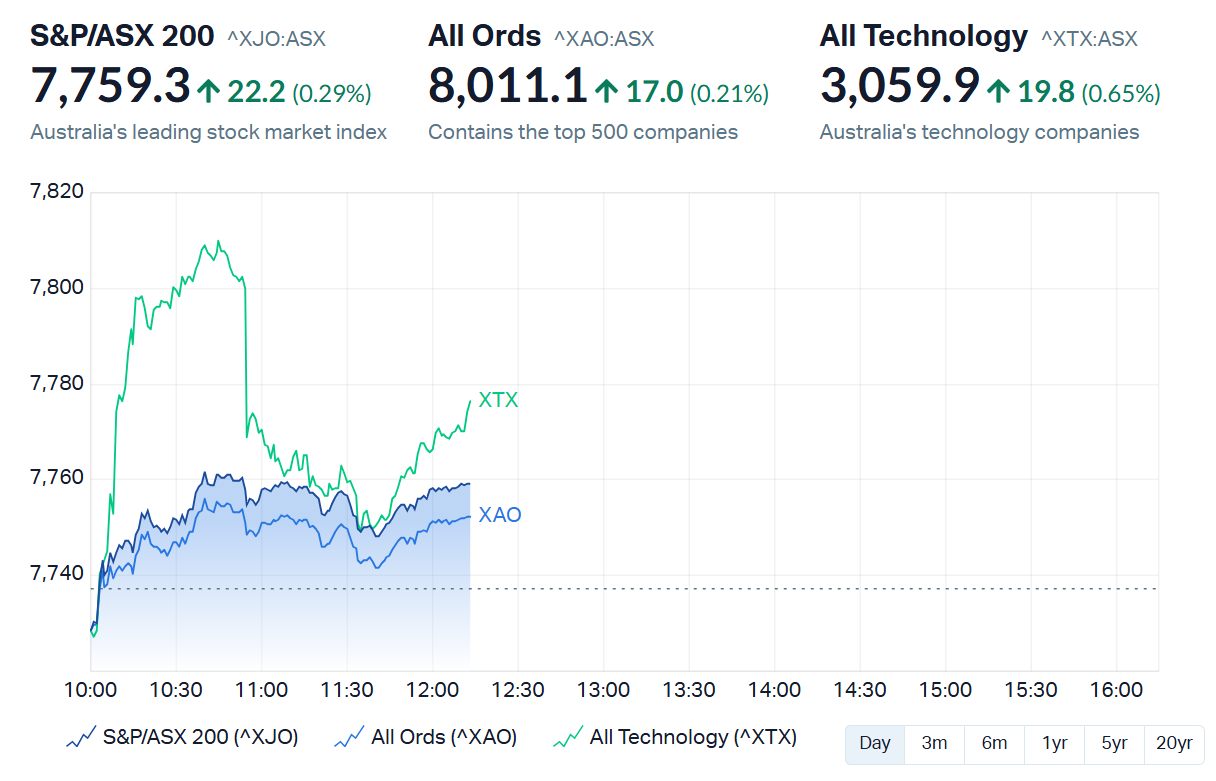

The ASX 200 is climbing after the awaited11:30 am GDP data which painted a dim picture of Australia’s growth (more on that below).

But like many things on the stock market, ‘bad news is good news,‘ as traders brought forward their expectations of interest rate cuts from the RBA on the bearish news.

At noon, 8 of the 11 sectors are in the green, with the interest rate-sensitive Real Estate sector leading today, up by nearly 2%.

The mining sector was this morning’s worst performer as gold, silver, and other commodities saw sharp falls overnight.

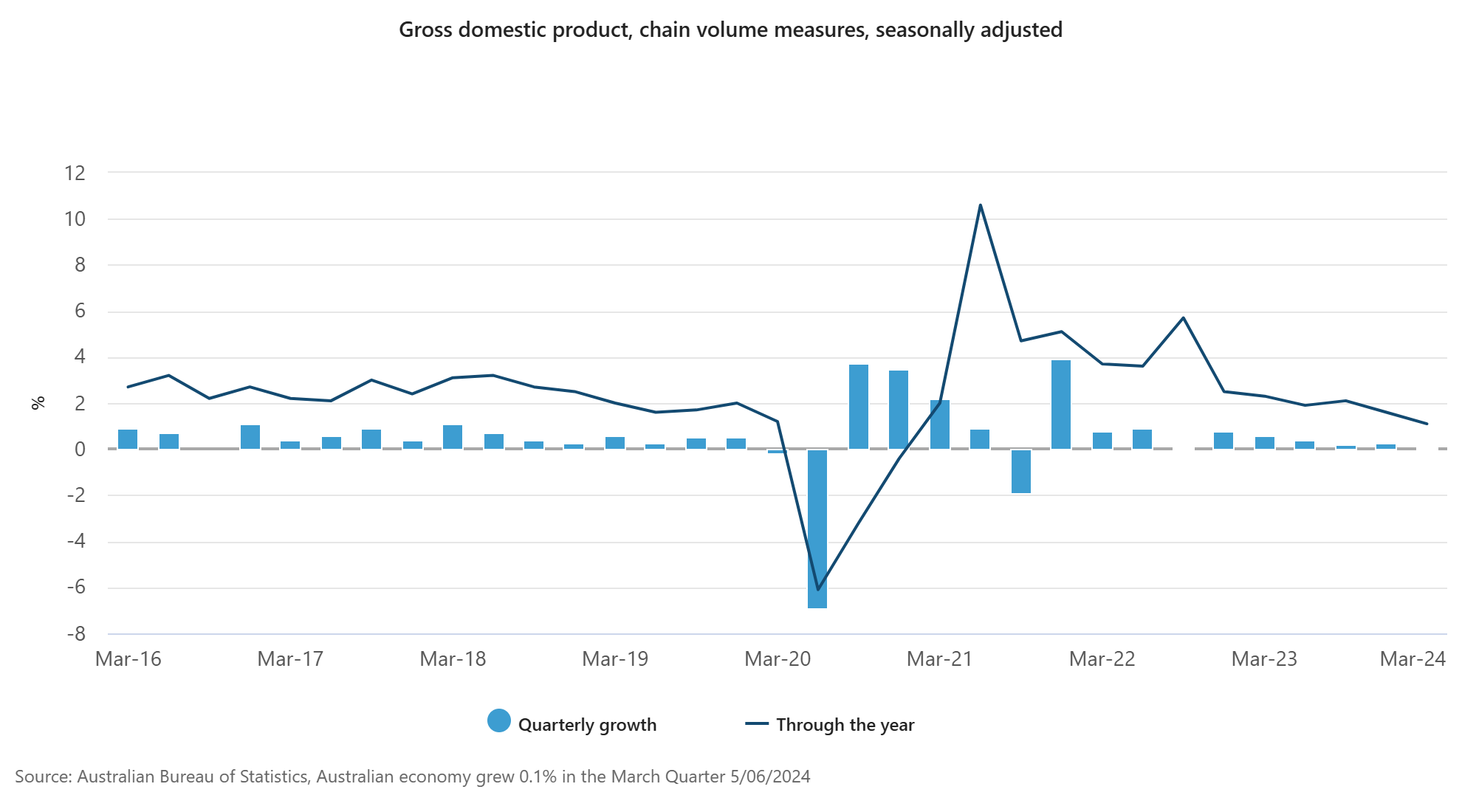

GDP growth anemic at 1.1%

The Australian economy grew at a snail’s pace and below estimates at 0.1% for the quarter on the back of government spending and weak consumer spending.

On an annual basis, economic growth was only 1.1%, below market expectations and the weakest Australia has seen since 1991.

Its worth noting that the weaker number was already being propped up by the recent surge in immigration, so a number this low is troubling.

On a per capita basis, the Australian economy contracted for the fifth consecutive quarter, and economic output was down -1.3% per person compared to 2023.

Treasurer Jim Chalmers said today’s figures showed that the budget’s approach had been the right one, saying:

‘These new numbers show we got the Budget right,’

‘This justifies the Government’s approach to fighting inflation without smashing the economy, when growth was already soft and people were already under pressure.’

Source: ABS

Morning market update

Good morning. Charlie here,

The ASX 200 opened flat this morning and has slowly climbed through this moring. Its currently up by +0.28% to 7,758.5, but expect it to move soon as the markets eagerly awaits the latest GDP data from Australia at 11:30 am AEST.

The Australian dollar fell sharply overnight, down by -0.65% to US 66.46 cents, reversing yesterdays similar gain.

It was another weaker finish in the US overnight, with the small-cap Russell 2000 falling -1.25% while the major benchmarks closed slightly higher.

Softer-than-expected labour data continued to push bond yields down overnight, giving equities some room to run.

However, falling commodities countered any share price growth in many sectors, as oil, gold, and silver tumbled.

Wall Street: S&P 500 +0.15%, Dow +0.36%, Nasdaq +0.17%.

Overseas: FTSE -0.37%, STOXX -1.00%, Nikkei -1.09%, SSE +0.41%.

The Aussie dollar fell -0.65% to US 66.46 cents.

US 10-year bond yields -6bps to 4.33%.

Australian 10-year bond -16bps to 4.21%.

Gold fell -1.03% to US$2,326.49, while Silver fell -4.10% to US$29.48.

Bitcoin rose +2.63% to US$70,786, while Ethereum rose +1.66% to US$3,818.

Oil Brent fell -1.1% to US$77.73, while WTI Crude fell -1.2% to US$72.94.

Iron ore fell -2.1% to US$107.65 a tonne.

Key Posts

-

3:26 pm — June 5, 2024

-

2:59 pm — June 5, 2024

-

2:49 pm — June 5, 2024

-

1:22 pm — June 5, 2024

-

12:23 pm — June 5, 2024

-

12:10 pm — June 5, 2024

-

11:14 am — June 5, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988