Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX Braces for CPI Data; Rex Enters Administration; Rio Tinto Reports

Market close update

The Australian share market rallied 1.8% today following softer-than-expected inflation data that reduced expectations of an interest rate hike by the RBA at its meeting next week.

The ASX 200 gained 139.1 points to close at 8092.3, with all 11 sectors in the green despite mixed overnight results on Wall Street.

Inflation data (CPI) released midday showed trimmed inflation, the RBA’s preferred measure, cooled to 3.9% annually in the June quarter, down from 4%. Quarterly core inflation came in at 0.8%, lower than the previous 1%.

Consumer discretionary stocks were top performers, climbing 2.3%. Wesfarmers rose 2.8%, JB Hi-Fi 4.3%, and Harvey Norman 5.3%.

Energy stocks rose with oil prices as tensions in the Middle East once again spiked between Hezbollah and Israel.

WTI Crude is up 2.14% at US$76.31. As a result, Woodside Energy was up 2.7%, and Santos gained 2%.

The materials sector recorded sharp gains of 2.2%, bolstered by Rio Tinto’s 2.5% increase after reporting $5.8 billion in half-year profit after tax, with $12.1 billion in underlying EBITDA and $7.1 billion net cash.

Origin Energy drops on quarterly report

Origin Energy’s [ASX:ORG] stock price has declined 1.9% today.

The drop came as the company’s overall financial performance for the fiscal year 2024 showed a 12% decrease in revenue compared to the previous year.

Origin Energy attributed this annual decline primarily to lower commodity prices in the energy market.

The drop was despite its quarterly reporting showing a 2% increase in revenue from its Australia Pacific LNG operations, which reached $2.6 billion in the June quarter.

Electricity sales volumes in FY24 remained steady compared to the prior year, as higher retail sales were offset by a decrease in business volumes.

Meanwhile, FY24 gas volumes declined by 10% in the prior year, primarily due to lower short-term wholesale gas sales.

This will be interesting to watch as LNG prices have spiked around 14% in trading today after traders raised bets of increased demand from the heatwave in the US.

Oil rises on geopolitics

Oil prices saw an uptick, with West Texas Intermediate (WTI) crude rising 1.7% to reach US$75.98 per barrel.

This increase came after three consecutive sessions of decline and was primarily driven by heightened geopolitical tensions in the Middle East.

The market reacted to news of escalating conflict as Israel said it killed a senior Hezbollah commander with an airstrike on Beirut in response to an attack in the Golan Heights that left 12 young people dead over the weekend.

Despite this recent uptick, crude oil is still on track for its largest monthly decline this year.

The market has been pressured by concerns over weak demand in China, the world’s largest oil importer. However, oil futures remain modestly higher for the year, supported by OPEC+ supply restrictions and anticipation of potential interest rate cuts by the Federal Reserve in the near future.

Midday market update

The Australian benchmark is markedly higher at midday after in line CPI numbers eased traders concerns of another interest rate hike by the RBA.

The monthly figures showed that inflation held steady at a 1% gain in the three months through June and has risen by 3.8% in the year to June, in line with consensus polls of economist expectations.

While the 3.8 was higher that the 3.6% reading last quarter, many had feared a higher number and so the market took today’s result as a big win and cut their bets of an interest rate raise next week by the RBA.

The ASX 200 is currently trading up +1.3% at 8,056.6, with all 11 sectors firmly in the green.

Interest rate sensitive sector Technology is leading today, up +1.77% along with Energy stocks up 1.77%.

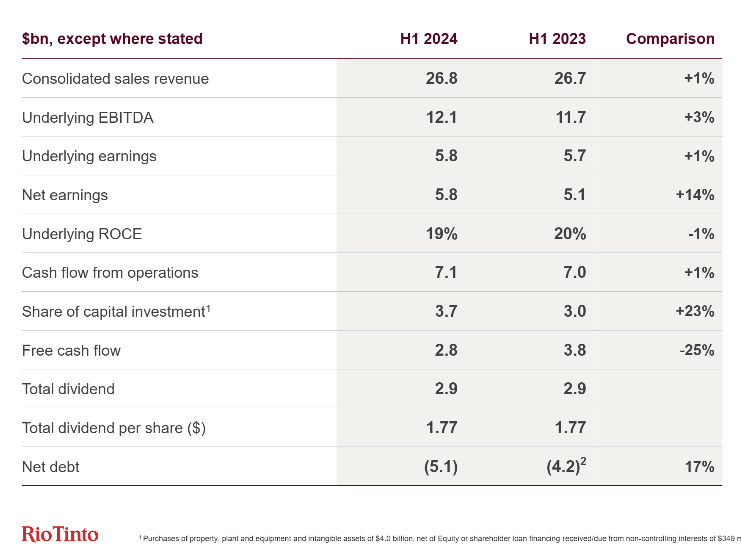

Rio Tinto’s stock rose 2.7% following its half-year financial report. The mining giant recorded a $5.8 billion profit after tax and underlying earnings before interest, taxes, depreciation, and amortisation of $12.1 billion.

The company’s net cash position stood at $7.1 billion and Rio Tinto declared an interim ordinary dividend of US177¢ per share.

The other big news today was the announcement of Rex Airline beginning voluntary administration, with the company suspended on the ASX and it grounding all of its major Boeing 737 airplanes.

CPI comes inline with forecast

The latest Consumer Price Index (CPI) data released by the Australian Bureau of Statistics reveals that annual inflation has picked up in the second quarter of the year, reaching 3.8% from the previous 3.6%.

This increase aligns with market forecasts, sending the ASX 200 higher on the news. The ASX 200 is now up by +1.13% trading at 8,042.8 after the release.

For the June quarter, the CPI remained steady at 1%, matching the rise observed in the March quarter. This quarterly figure also met market consensus, giving traders some feeling of predictability in short-term inflationary pressures.

Core inflation, measured on a trimmed basis, showed a slight cooling to 3.9% year-on-year, down from 4% previously. The quarterly core inflation rate came in at 0.8%, a decrease from the previous 1%.

These figures were slightly below market expectations of 1% for the quarter and 4% year-on-year.

This CPI data comes as the RBA convenes next week to decide on monetary policy. While some economists had predicted a chance of another hike by the RBA, these figures will likely quell those voices and likely mean another pause at the next meeting on August 5-6th.

Rio Tinto sees uptick in share price on strong half-year results

Mining giant Rio Tinto [ASX:RIO] ‘s share price increased 1.9% following the release of its half-year financial results.

The company reported a solid profit after tax of $5.8 billion for the period. Rio Tinto’s underlying earnings before interest, taxes, depreciation, and amortization (EBITDA) reached $12.1 billion, while its net cash position stood at a healthy $7.1 billion.

Here is how the half-year performance compares to the same time last year:

Source: Rio Tinto 31/07/24

Free cash flow was notably lower as the company saw its investments increase by 34% compared to the prior corresponding period.

The company announced an interim ordinary dividend of US 177 cents per share, which is likely to please shareholders.

With today’s gains the company’s share price is slightly above flat in the past 12 months, trading at $116.86 this morniing.

Rio Tinto Chief Executive Jakob Stausholm said:

‘Rio Tinto is both consistently very profitable and growing. This is being driven by the disciplined investments we are making to strengthen our operations and progress major projects for profitable organic growth.’

‘Our overall copper equivalent production is on track to grow by around 2% this year, and our ambition is to deliver around 3% of compound annual growth from 2024 to 2028 from existing operations and projects.’

Rex Airlines enters voluntary administration

Regional Express, commonly known as Rex Airlines, has entered voluntary administration, sending shockwaves through Australia’s aviation industry.

The ASX has suspended trading of Regional Express Holdings shares, grounded all of its Boening 737 aircraft, and cancelled flights between major airports.

In an effort to mitigate disruptions, Rex has announced that eligible customers will be offered re-accommodation on Virgin Australia flights.

The situation has drawn attention from the highest levels of government, with Treasurer Jim Chalmers stepping in as criticisms mount.

When asked about the possibility of the Labor government taking an equity stake in Rex, Chalmers remained noncommittal, stating, ‘I don’t really want to preempt those sorts of discussions.’

EY has been appointed to act as the administrator. Meanwhile, Virgin Australia has moved swiftly to capitalise on the situation, securing leases for three aircraft from the struggling airline.

Morning Market Update

Good morning. Charlie here,

The ASX 200 is more uncertain today, with ASX Futures pointing to a slight rise before the June Quarterly Inflation data, due at 11:30 am AEST.

Also, today, we have June’s retail data, which, combined with the latest CPI, should give us a snapshot of the Australian economy’s health.

The market is anticipating inflation to fall from 4.0% in May to 3.8% in June. However, we’ve seen this monthly figure jump around, so any upset here could send the markets down as the chance of interest rate hikes is still within the window of possibility for the RBA.

On Wall St, there was another mixed session as the market braces fro Fed’s next rates decision, due Thursday US time.

This is widely expected to be a hold, but traders will be looking for signals of cuts coming later this year.

Many (myself included) predict those are likely to come in September, but the language used after the meeting will be heavily studied for any sign.

In earnings, Microsoft fell -2.77% in after-hours trading as its cloud growth slowed in its latest quarterly.

The company’s total revenue increased 15% to US$64.7 billion, slightly above analyst estimates, but all eyes have been on its Azure Cloud as the main driver for future revenues and were disappointed.

US 2 and 10-year Treasuries closed at their lowest level since February 2024 as the market increases its bets of cuts around the corner.

Also in big movers today, we have Rio Tinto’s half-year earnings report. A first glance at the results shows things are fairly flat, with Net Cash Generated up 1% and Free cash flow down -25% on some big-ticket spends, but we’ll dive deeper into the full earnings later this morning.

Rex Airlines officially moves into voluntary administration, with the stock suspended on the ASX and pressure mounting on the Federal government to buy a stake in Rex to save the regional airline.

China’s purchasing managers index (PMI) came in below what was forecast, at 49.3, down from June’s reading of 49.5, according to the median forecast of 31 economists in the poll. The 50-point mark separates growth from contraction in activity, so another bad sign for Australian exporters.

| Name | Value | % Chg | |

|---|---|---|---|

| Major Indices | |||

| S&P 500 | 5,436 | -0.50% |

| Dow Jones | 40,743 | +0.50% |

| NASDAQ Comp | 17,147 | -1.28% |

| Russell 2000 | 2,243 | +0.35% |

| Country Indices | |||

| UK | 8,274 | -0.22% |

| Germany | 18,411 | +0.49% |

| Japan | 38,525 | +0.15% |

| Hong Kong | 17,002 | -1.37% |

| Euro | 4,841 | +0.53% |

| Name | Value | % Chg | |

|---|---|---|---|

| Commodities (USD) | |||

| Gold | 2,409 | +1.19% | |

| Silver | 28.36 | +1.94% | |

| Iron Ore | 99.95 | +0.87% | |

| Copper | 4.0746 | -0.24% | |

| WTI Oil | 75.23 | -0.78% | |

| Currency | |||

| AUD/USD | 65.41¢ | -0.22% | |

| Cryptocurrency | |||

| Bitcoin (USD) | 66,207 | -0.90% | |

| Ethereum (USD) | 3,275 | -1.32% | |

Key Posts

-

4:37 pm — July 31, 2024

-

3:52 pm — July 31, 2024

-

3:06 pm — July 31, 2024

-

1:00 pm — July 31, 2024

-

12:00 pm — July 31, 2024

-

11:26 am — July 31, 2024

-

10:32 am — July 31, 2024

-

9:57 am — July 31, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988