Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX Tumbles as Recession Fears Spread

Market chat with editors

Here is a bonus video between some editors here at Fat Tail to explain the market moves today.

Market close update

The Aussie share market saw its worst two-day sell-off in four years as it joined global markets in a heavy and panicked risk-off move as weaker manufacturing and jobs data from the US sent ripples through markets.

The major fear pressing this move was the thought that central banks, and especially the Fed, had left cutting rates too late to avoid a recession.

Recent US unemployment figures have activated the ‘Sahm Rule‘, a historically accurate recession indicator, prompting major banks to increase recession probability estimates.

It is worth noting that the creator of the Sahm Rule, Claudia Sahm has spoken out against the widespread panic.

In a recent Fortune article published two days ago, she said:

‘I am not concerned that, at this moment, we are in a recession,’ she told Fortune, adding that ‘no one should be in panic mode today, though it appears some might be.’

European, North American, and Asian stocks were down heavily, with the Japanese stock market the worst hit as the Nikkei 225 saw its worst one-day slump in yen terms ever.

Looking ahead to the US tonight, we see S&P 500 Futures pointing to an opening drop of -2.3%, while Nasdaq Futures show a doozy, with the tech-focused index poised to drop -4.6% on open.

The ASX 200 fell by -3.70% to 7,649.6 today. That puts the losses from the last two sessions at around 5%, something we haven’t seen since the pandemic.

All 11 sectors were in deep red today, with the Tech sector taking the worst hit, down by -6.61%.

Large market cap tech stocks Wisetech closed down -9%, Xero finished -5.6% lower, and NextDC finished -6.8% lower at $15.76 per share.

Only 5 stocks closed higher on the major benchmark, with Resmed taking the top spot, gaining +3.09% to $32.72 on close.

The Big Four banks also took a big hit today with ANZ and Westpac down -4.26%, NAB fell -4.56%, and Com bank dropped -4.9% to $125.59 per share.

Resmed bucks down day

One of the few stocks on the ASX seeing green today is biotech company Resmed [ASX:RMD] which is currently only one of nine stocks on the ASX 200 who have gained today.

Resmed is currently up by +3.68% at $32.97 per share and is the top performer on the main benchmark today as its better-then-expected margin growth across the fourth quarter has kept selling at bay.

The company also recently upped its earnings guidance in its latest fourth quarter update, saying its the ‘clear market leader‘.

‘Our fourth quarter and full-year fiscal year 2024 results demonstrate strong performance across all sectors of our business,’ said Mick Farrell, Chairman & CEO of ResMed

Resmed has seen prior pressure from short sellers betting that anti-obesity drugs such as Ozempic would squeeze earnings.

However its latest quarter shows those earnings and margins have remained healthy so far, with gross margins up 350 bps to 58.5% and revenues up 9% to $1.2 billion.

Some bullish perspective on a red day

If you’re concerned about a larger correction looming, then here is one data point that might help you sleep better at night.

A fantastic chart by Charlie Biello at Creative Planning showing similar VIX index spikes in the past and the S&P 500 in the proceeding years.

Remember, VIX is the Volatility Index, which tracks call and put options within the S&P 500 to track market volatility.

We’ve seen it shoot higher in the past few weeks thanks to unease in the Mag 7 stocks and a shaky earnings period.

Now with recession fears creeping back, this could give you a less bearish perspective on stocks moving forward.

The $VIX has increased by 88% over the past 3 weeks, the 15th biggest 3-week spike ever. Here's a look at how the S&P 500 has fared following big $VIX spikes in the past… pic.twitter.com/KABAwRldQR

— Charlie Bilello (@charliebilello) August 5, 2024

Update by veteran trader

Here is a great daily update from a veteran daily FX trader, Chris Weston.

While his updates are very short-term focused, I thought it’s worth having a listen to what Pepperstone traders are thinking about on a volatile day like this.

📽️Trader Thoughts on some very lively market moves – what's going down in markets?

A lot of questions being asked and few immediate answers. With such limited visibility the market wants urgency from the Fed and central banks, but will they get it? 🤔

We look at moves in Asia,… pic.twitter.com/XIIXodsB10

— Chris Weston (@ChrisWeston_PS) August 5, 2024

Crypto takes huge hit as risk-off mood spreads

In the past 24 hours, Bitcoin has experienced its largest weekly decline since the FTX collapse in 2022, driven by a wave of risk aversion sweeping global markets.

The leading cryptocurrency briefly plunged over 10%, eventually stabilizing around US$54,333 ($83,590).

Over the past week, Bitcoin has shed 21.3% of its value, marking the steepest drop since the FTX bankruptcy period.

Other crypto assets are also down sharply, with the second largest crypto, Ethereum is also down today, shedding -18.45% to US$2,378.

The cryptocurrency market’s downturn coincides with a broader sell-off in global stocks, reflecting growing concerns about economic prospects and scepticism surrounding the potential of AI investments.

Midday market update

The Australian share market is experiencing its worst two-day selloff in years as fears of a US recession have accelerated sell-offs since Friday’s harsh sell-down.

Weak US jobs data combined with anemic manufacturing data last week pushed US investors to rethink the possibility of a soft landing for the world’s largest economy.

The ASX 200 is down by -2.80% at 7,720.6 around midday as all sectors are firmly in the red.

Worst performers so far today are tech stocks, with the XTX tech index down by -5.06% as Wisetech is down -6.23%, Xero has fallen -5.83% and Afterpay owner Block is down by nearly 10% today.

The big banks are also in the crosshairs today, with the Big Four seeing large losses. Commonwealth is down by -3.62%, NAB is down -3.86%, while Westpac and ANZ are down by -3.69%.

Ramsay Health Care Earnings Update

Ramsay Health Care [ASX:RHC] announced its latest expectations for earnings in FY24.

The hospital giant expects net profit after tax to be between $884 and $889 million.

This figure includes the after-tax profits of its sale of Ramsay Sime Darby (RSD) of $618 million.

FY24 net profit after tax and operations is expected to be between $265–270 million. That’s down from the prior corresponding period’s $278.2 million and is expected to include impairments and write-downs from its underperforming Ramsay Santé and UK region.

The full audited release of FY24 results is expected on 30 August, and an outlook for FY25 is expected.

The release comes as Ramsay shareholders adjust to last week’s news that its long-serving CEO, Craig McNally, will retire at the end of June 2025.

Woolworth’s head of supermarkets, Natalie Davis, has been appointed to replace Mr McNally at a challenging period for the company.

Shares in RHC are down by -2% in trading to at $44.48 per share.

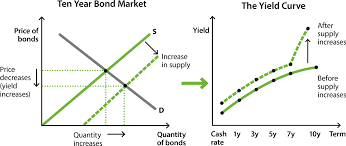

Bond market rallies hard on recession worries

Australian government bond yields sharply declined today as traders became increasingly concerned about an impending recession.

Remember, falling yields mean that the demand for bonds has increased. In this case, traders are searching for a safe haven amidst the volatility.

Source:RBA

The three-year bond yield has dropped significantly, falling 25 basis points to 3.43%.

The 10-year yield has also decreased, though less dramatically, by 4 basis points to 4.05%.

Meanwhile, in the US, 10-year bond yields fell an astonishing 22 basis points to 3.75%.

Money markets have now boosted their bets that the RBA and other central banks will cut at its next meeting.

Current market pricing suggests a 13% probability of the RBA implementing a rate cut as early as tomorrow, with the likelihood increasing to one-in-three by September.

The odds of a rate cut in November are now priced at 75%, while a December cut is considered almost certain. In fact, traders are now factoring in a 36% chance of a substantial 50 basis point reduction by year-end.

Japan’s stock market remains sharp end of global sell-off

Japanese stocks continue their downward spiral for the third consecutive day as investors anticipate further interest rate increases.

The Tokyo Exchange, the Nikkei 225, plummeted over 5% at the start of trading.

Meanwhile, the yen strengthened, and government bond prices rose, reflecting expectations that the Bank of Japan will continue its rate-hiking trajectory following Wednesday’s increase.

As Fat Tail Editor Ryan Dinse explains in his latest article on the changing landscape, the Japanese yen and market have broader implications, due to the famous Japanese ‘carry-trade’.

What is that? Ryan explains below:

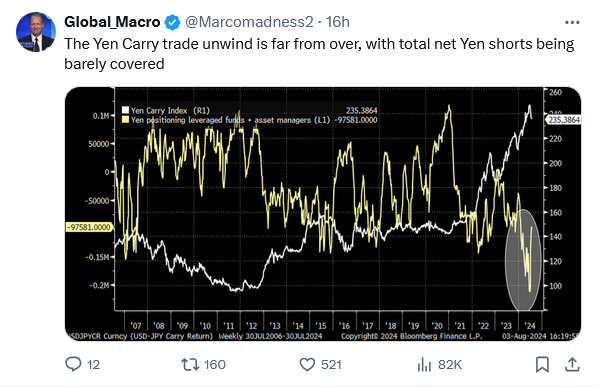

It appears the famous Japanese ‘carry-trade’ strategy is starting to unwind.

The ‘carry trade’ is when investors borrow in Japanese Yen at low interest rates and invest it at higher rates of return in other countries (or just in Japan too).

For a long time, Japan has kept rates close to zero, supporting this strategy.

At the same time, surging US tech stocks (like the Mag 7) and high-yielding US government bonds provided great returns for carry trade investors.

Think about it…

Until last week, a global hedge fund could borrow at close to zero in Japan and earn around 5% in ultra-safe US government bonds.

Or if they wanted a bit more risk, 16% this year so far in the US Nasdaq index.

It’s money for jam!

Until it isn’t….

You see, things changed sharply last week.

On Wednesday, the Japanese central bank increased rates for only the second time in 17 years. From 0.1% to 0.25%.

The Japanese Yen rallied 3% further on Friday against the dollar on this news and is up almost 8% in just three weeks.

This makes things even worse for carry trade investors.

Remember, because they’ve borrowed in Yen, their loans get more expensive to pay back when the Yen rises in value versus whatever currency they’ve invested in.

In a double whammy, as the stock markets fall, carry trade investors in equities start to lose money on their investments, too.

In short, the interest rate, the exchange rate and the investment returns are all going the wrong way for carry trade investments.

Right now, it’s a mad rush for the exits for hedge funds caught in this bind!

Unfortunately, as chief investment officer Ben Emons noted, there’s still a fair way to go:

Source: X.com

It could get ugly this week.

As Kinsale Trading noted in a report on Friday:

‘The yen carry trade has been used to fund bull markets in virtually every asset over the years,” … and if it is “starting to reverse, it has negative implications for stocks and other risk assets.’

That ‘forced’ selling can partially explain last week’s violent stock sell-offs.

This market behaviour reflects a rapid shift in investor sentiment, moving away from the previously held belief that the Federal Reserve could achieve a ‘soft landing’ for the U.S. economy.

Recent data has fueled these concerns.

Friday’s employment report showed U.S. non-farm payrolls posting one of their weakest gains since the pandemic.

On top of that, the unemployment rate unexpectedly rose for the fourth straight month, reaching 4.3% – surpassing the Fed’s year-end projection. This increase has triggered a closely monitored recession indicator, further stoking economic anxiety.

Morning Market Update

Good morning. Charlie here on a very red day.

The Australian share market is experiencing its most severe two-day decline in two years, driven by mounting concerns over a potential US recession that has intensified the sell-off that began on Friday.

The ASX 200 has opened down 2.7% 7,724.3, following Friday’s 2.1% drop. This puts the index down more than 4% over the past two sessions, marking its worst two-day performance since June 2022.

The downturn was triggered by disappointing US jobs data released on Friday, which showed new job numbers falling short of estimates and unemployment rising faster than anticipated.

These figures stoked fears of an impending recession, with Goldman Sachs raising its recession probability indicator from 15 to 25%.

On the ASX, Banking stocks continue to suffer, with Westpac and ANZ each declining by another 3%, mirroring their losses from the previous session.

The global market sell-off on Friday was further fueled by concerns that investments in AI-focused big tech companies may be overvalued.

Adding to the market uncertainty, news broke on Sunday that investor Warren Buffett had sold $116 billion worth of stocks in the second quarter, his largest quarterly sell-down.

On the ASX, the technology sector has been hit hardest, dropping more than 4%. Afterpay owner Block leads the decline, with its shares plummeting 9% to $91.13, while large-cap tech stocks Wisetech and Xero are both down by over 4%.

| Name | Value | % Chg | |

|---|---|---|---|

| Major Indices | |||

| S&P 500 | 5,346 | -1.87% |

| Dow Jones | 39,737 | -1.51% |

| NASDAQ Comp | 16,776 | -2.43% |

| Russell 2000 | 2,109 | -3.52% |

| Country Indices | |||

| UK | 8,171 | -1.31% |

| Germany | 17,661 | -2.33% |

| Japan | 33,600 | -6.43% |

| Hong Kong | 16,945 | -0.00% |

| Euro | 4,638 | -2.67% |

| Name | Value | % Chg | |

|---|---|---|---|

| Commodities (USD) | |||

| Gold | 2,429 | -0.53% | |

| Silver | 28.29 | -1.03% | |

| Iron Ore | 103.00 | -0.78% | |

| Copper | 4.0622 | -1.00% | |

| WTI Oil | 73.17 | -0.46% | |

| Currency | |||

| AUD/USD | 64.95¢ | -0.21% | |

| Cryptocurrency | |||

| Bitcoin (USD) | 56,771 | -6.22% | |

| Ethereum (USD) | 2,615 | -10.31% | |

Key Posts

-

5:04 pm — August 5, 2024

-

4:31 pm — August 5, 2024

-

3:25 pm — August 5, 2024

-

3:04 pm — August 5, 2024

-

2:55 pm — August 5, 2024

-

2:21 pm — August 5, 2024

-

12:52 pm — August 5, 2024

-

12:12 pm — August 5, 2024

-

11:59 am — August 5, 2024

-

11:08 am — August 5, 2024

-

10:58 am — August 5, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988