Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Slip; Woolworths and Fortescue Report; Nvidia Earnings Set to Shake Wall St

Market close update

The Australian share market closed flat today as a last-hour rally balanced out the sell-off of commodity and energy stocks that put pressure on the major benchmark through the session.

The ASX 200 closed flat at 8,071.4 as large-cap earnings today largely disappointed, while traders in other sectors took profits before the market mover Nvidia reports its earnings tonight.

Carrying the major benchmark today was outperformance by Zip Co, which gained 14% to close at $2.37. Perseus Mining was also a major contributor, gaining 5.7% after reporting a 14% gain in NPAT of US$364.8 million.

Expect big moves (either up or down) for markets tomorrow, as Nvidia’s earnings will drive traders to consider the length of the AI cycle and investments in the area.

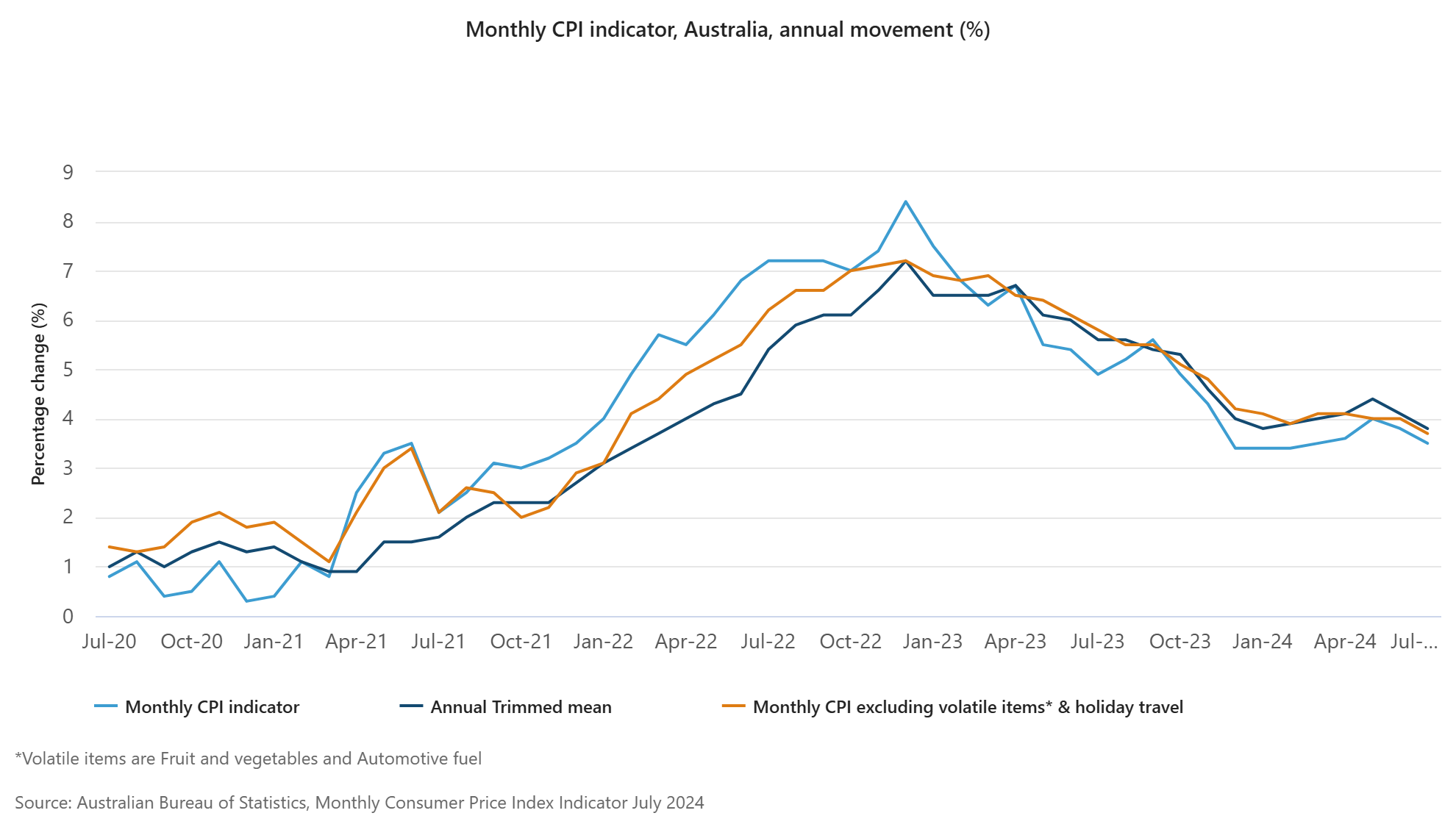

Today’s CPI numbers showed inflation falling slightly to 3.5% from 3.8% annualised last month.

That was still below the market’s expectations of a 3.4% figure and was largely driven by Federal Energy rebates that saw energy costs fall, while other items like rents continued to remain high, such as rental inflation, which remained around 6.9%.

As a response, money markets cut back expectations of cuts in November to a 50/50 call, while many economists pointed to cuts likely coming next year.

The Australian dollar jumped to around US68 cents before falling back to US67.88 cents.

In commodities, Crude oil edged slightly up through the session today after falling back around 2% yesterday as industry reports pointed to further declines in US crude stockpiles. WTI Crude is around US$75.54 per barrel.

This could signal further buying ahead for the US; however, so far, the Biden Administration has been very strategic in replenishing these stockpiles at points of peak weakness, so questions remain here.

Iron ore Futures remain around US$100 per tonne after falling back 0.84% on the Singapore exchange today. Both BHP’s reporting yesterday and industry comments from major Chinese steelmakers point to further short-term volatility expected as Asian market steel inventories remain high.

Gold spot prices fell by -0.67% through the session after two consecutive record closes for precious metals. Spot prices are currently around US$2,508.154 per ounce.

Copper fell a further -2.60 %, falling below US$4.2 per pound, a five-week high, as demand concerns remain as BHP slashed its forecasts for China demand this year, noting the spotty recovery in the economy.

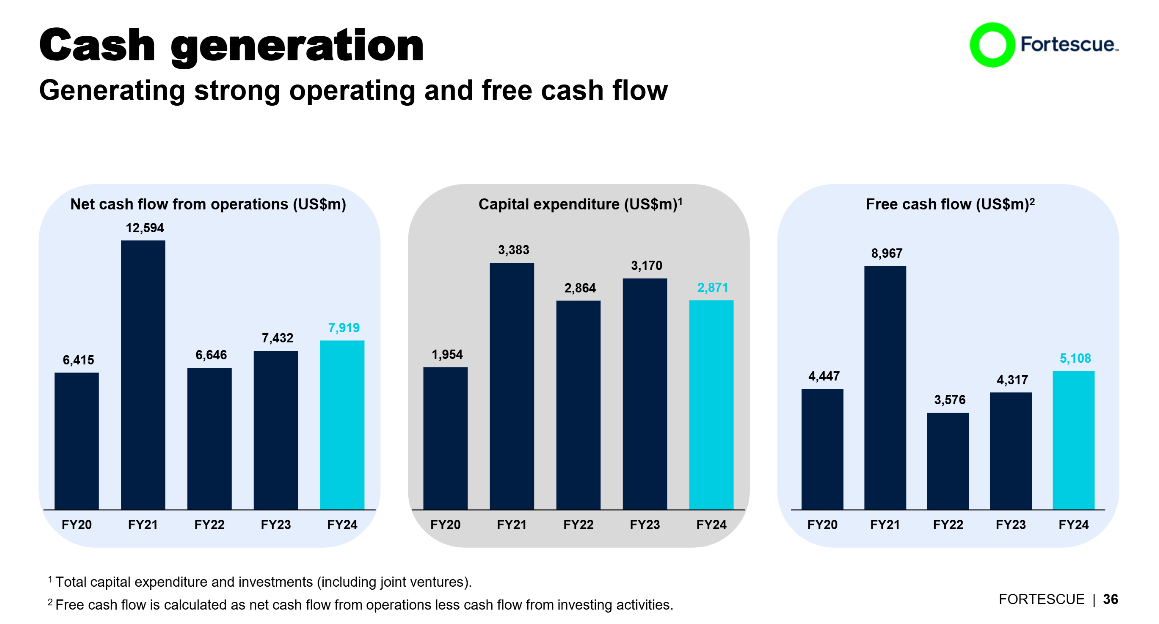

Fortescue’s FY 2024 results saw mixed reactions

Fortescue [ASX:FMG] shares are down by -2.1% mixed results for the year ending June 30.

Despite some solid growth and its achievement of its third-highest annual earnings, shareholders weren’t impressed.

FMG reported a 1% decrease in ore mined, while revenue rose 8% to US$18.22 billion.

Meanwhile, net profit after tax increased by 18% to US$5.66 billion. Here are those results compared to previous years:

Source:FMG

However, Fortescue shares haven’t seen a boost today, possibly due to an 11% reduction in the final dividend to 89 cents per share.

The full-year dividend of $1.97 per share represents a 70% NPAT payout, yielding 10.8% fully franked.

Fortescue said it had seen solid progress on its green initiatives, starting work on hydrogen projects in Arizona and Gladstone, with aims for liquid green hydrogen production by 2026.

The groups US$6.2 billion decarbonisation plan has hit some snags in its journey this year, with a revolving door of executives and unstable energy prices.

Energy CEO Mark Hutchinson said they were ‘realistic about the pace of the current global energy transition’.

While CEO Dino Otranto said:

‘The team has delivered another year of outstanding performance contributing to the third highest earnings in Fortescue’s history and free cash flow of US$5.1 billion…’

‘We celebrated a number of significant milestones including first ore from the Flying Fish and Hall Hub deposits as well as the commissioning of our gaseous and liquid hydrogen plant which is the largest of its kind on a mine site in Australia.’

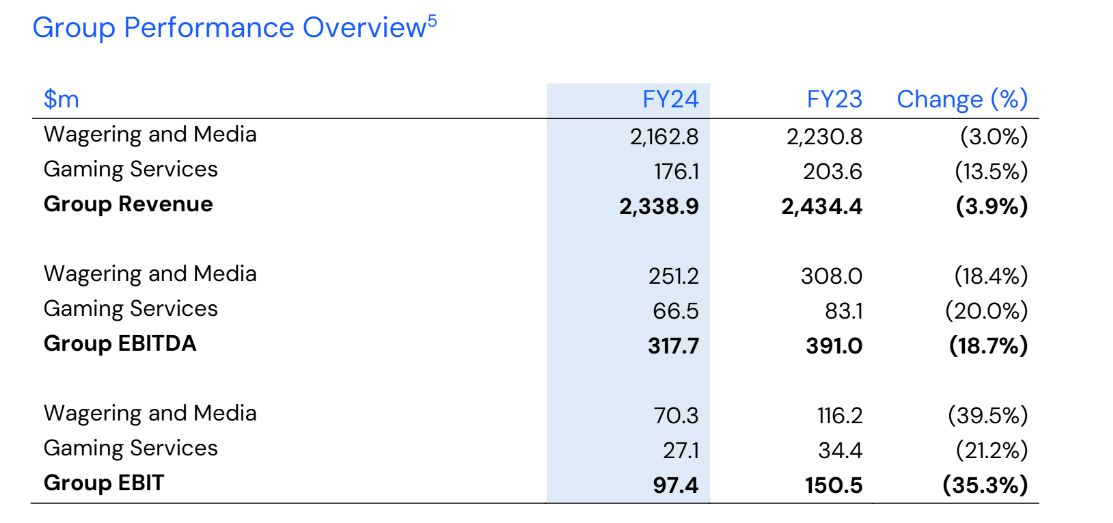

Tabcorp shares tumble as company posts $1.4 billion loss

Betting major player Tabcorp [ASX:TAH] has seen its shares drop over 13% to 49 cents in trading so far today after releasing its FY24 results.

The company acknowledged a ‘soft market’ as it saw total group revenue fall by -3.9% to $2.33 billion for the year ended 30 June 2024.

Earnings also took a massive hit, falling by 35.3% to $97.4 million for the financial year. Here are its segments broken down:

Source: Tabcorp

On top of these lower earnings, Tabcorp saw operating expenses rise by 6.3% to $614 million due to inflation costs and higher regulatory burdens.

That put its final net profit after tax at just $28 million, down 67%. However, that fell to a whopping $1.4 billion loss after including the double write-down of its NSW and South Australian assets this year.

The company recognised the challenges ahead, saying :

‘Recognising the changes in economic and regulatory conditions and company performance since demerger, the TAB25 targets will not be met.’

Despite the poor performance, CEO Gillon McLachlan maintained that Tabcorp was ahead of competitors in a struggling market, saying:

‘The Company has done a good job at building solid foundations since demerger and there is no doubt TAB is competing better in the market. The product is better, speed to market has improved, the retail offering is being revitalised and we’re achieving structural reforms that will make the company more competitive.’

‘The foundations to unlock value have been built.’

Shareholders were less than impressed today, with shares down around 13% in trading, putting its 12-month return at -54.6%.

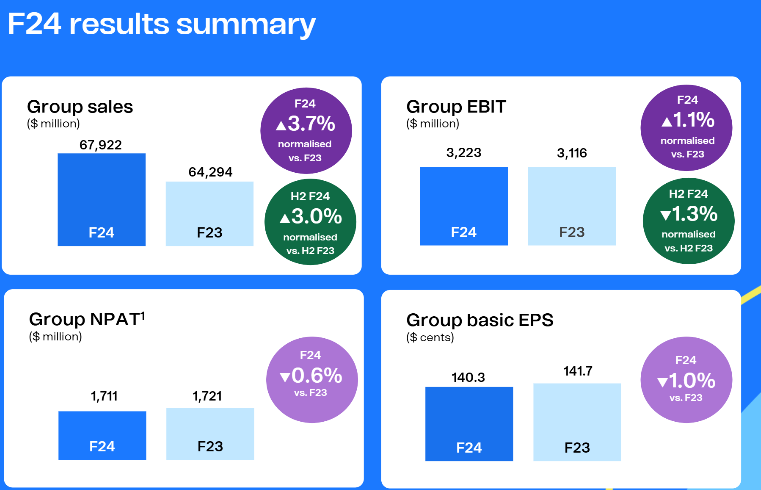

Woolworths shares rise on dividend reward

In the final report for controversial CEO Brad Banducci, Woolworths [ASX:WOL] has seen its growth stall when compared to its major rival Coles, who reported yesterday.

However, unlike Coles, the company has seen its shares climb today as investors reward the company for its special dividend payout, which we will get to soon.

For now, here are the top-line numbers:

Source: Woolworths

Looking at the supermarket chain only, Woolworths saw sales increase by 5.6% to $50.7 billion, while Coles reported 6.2% over the same period.

The groups sales were up by just 1.7% if Petstock Group were excluded, highlighting the challenges Woolworths has faced in the second half of this year as its public trust and brand took a hit amidst price gouging and interview controversies.

In their presentation to shareholders today, the company devoted six of the early slides to addressing the cost of living challenges and trying to dispel the complaints of price gouging.

But what seems to have pleased investors and shareholders most today was the announcement of a higher-than-expected 40-cent special dividend. With the combined final dividend of 57 cents, the group’s full-year dividend came to $1.44 per share.

For FY25, Woolworths forecasts operating capex at $2–2.2 billion and said Australian supermarket sales were up by ~3% in the first 8 weeks of FY25.

The company will be passing the torch to incoming CEO Amanda Bardwell next Monday, who will have a busy time catching back up to Cole’s growth and repairing the image of the largest supermarket in Australia.

Latest Fat Tail Daily Video

Here’s day three of our new Fat Tail Daily video series.

We’ve heard that you want more discussions with editors about market movements and their thoughts — and we’ve listened!

Publisher James ‘Woody’ Woodburn will be sitting down with our Fat Tail Daily editors to discuss the key trends and offer unique insights into market movements.

Expect more of these coming soon. Depending on schedules, we will aim to get at least three out a week, but it could also be more.

If you have any thoughts about the length, format, or topics you would like discussed, send us an email at support@fattail.com.au with the subject header: ‘Fat Tail Daily Video Feedback’.

Thanks, and enjoy today’s discussion with Australian Small-Cap Investigator and Small-Cap Systems Editor Callum Newman.

Midday market update

The ASX 200 is down by -0.38%, trading at 8,040.6 as the markets hold their breath for the upcoming Nvidia earnings results to drive the next move for the S&P 500 and Nasdaq.

Dragging the index down today is the Energy (-0.97%), Mining (-1.10%), and Telecom (-1.62%) sectors as major earnings reports disappoint from large caps Tabcorp (-12%) and Fortescue (-1.83%).

Crude oil prices falling over 2% overnight also hurt major producers, with Woodside Energy down -1%, while Santos fell -0.5%.

Major miners pulled back today, with BHP reversing yesterday’s gains, down by -1.81% in trading so far today, while Rio Tino fell by -1.37% to trade at $110.35 per share.

Consumer staples are outperforming so far today, with Woolworths up by +2.12% to $36.20 after offering shareholders a higher-than-expected special dividend of 40 cents per share. That took the full-year dividend payout to $1.44 per share.

July monthly CPI data shows inflation falling, but slower than expected

The annual headline inflation rate fell to 3.5% in July, down from 3.8% in June.

This figure was slightly above the expected rate of 3.4%, causing traders to push back bets of an interest rate cut slightly.

Money market bets show a 50% chance of a interest rate cut in November, that is down 10% from the 60% chance seen before the CPI data dropped.

As a response, the Australian Dollar rose to around US68 cents and the ASX 200 clawed back some of its losses seen this morning but remains down.

Of the items in the monthly indicator, Housing saw the most significant price rise (up 4%), Food and non-alcoholic beverages (up 3.8%), and Alcohol and tobacco (up 7.2%).

Source: ABS

Breaking those categories down further, the major outliers seeing price increases were:

Tobacco, up 13.9% from 13.8% in June.

Fruit and Vege, up 7.5% from 3.6% in June.

Gas and household fuels were up 2.7% from -0.6% in June.

While falling, we saw:

Electricity prices fell from an annualised 7.5% between June 23 and June 24 to -5.1% between July 23 and July 24.

Automotive fuel fell from an annualised 6.6% between June 23 and June 24 to a 4.0% rise between July 23 and July 24.

Dairy products fell from an annualised 1.6% between June 23 and June 24 to a -0.2% between July 23 and July 24.

Apa Group Reports

APA Group [ASX:APA] reported its FY24 results this morning, with a mixed reaction by the market. After initially rising 1.25%, the price is now trading down -1.5% at $7.87 per share.

APA reported a 9.7% rise in underlying earnings for the full year, capitalising on the expansion of its east coast gas pipeline network and an initial contribution from its recent Pilbara Energy acquisition.

The company’s statutory net income saw a significant increase, more than tripling to $998 million.

However, net profit before one-off items saw a -58.5%, falling to $119 million.

Here are the full results from the presentation this morning:

Source: Apa Group

APA Group had previously announced a final dividend of 29.5 cents, bringing the total payout for the full year to 56 cents per share.

APA’s guidance for the FY25 payout is set at 57 cents, a 1.8% increase from FY24.

In terms of underlying EBITDA earnings and guidance, the company reported $1.893 billion in earnings, within guidance. For the upcoming year, APA projects underlying EBITDA to grow to between $1.96 billion and $2.02 billion.

CEO Adam Watson characterised the result as ‘solid‘, saying:

“APA has delivered another solid financial and operating result in FY24, with revenue, earnings and distribution growth, the completion of key projects and ongoing execution of our growth strategy.”

“Over the last year we have successfully integrated the Pilbara Energy business and progressed key projects in the region, including the Port Hedland Solar and Battery Project which is nearing completion.”

“We’ve also executed a number of new agreements including an agreement to design and develop twin pipelines for CS Energy’s Brigalow gas peaking plant in Queensland, as well as a 20-year gas transport agreement with Senex Energy which is expected to support much needed additional gas supply into the east coast gas market from the end of 2025.”

Morning Market Update

Good morning. Charlie here.

The ASX 200 opened down -0.33% to 8,044.6 as traders begin today cautiously as we await Australia’s monthly CPI indicator at 11:30am and Nvidia’s earnings to determine the next catalyst for major US benchmarks (up or down).

Nvidia’s blockbuster earnings are expected this morning also so stay tuned for that. Options trading points to an expected US$300 billion swing on the results which could put it as the largest ever.

Gold prices rise again, marking a consecutive record close for spot gold prices as the road to interest rate cuts in the US is set for September.

The expectations of cuts have also driven the US dollar index down to a 13-month low, helping commodity traders at a time of weakness.

Today we have large-cap earnings reports from Fortescue, Woolworths, APA Group, and Flight Centre. Let’s dig in.

| Name | Value | % Chg | |

|---|---|---|---|

| Major Indices | |||

| S&P 500 | 5,625 | +0.16% |

| Dow Jones | 41,250 | +0.03% |

| NASDAQ Comp | 17,754 | +0.16% |

| Russell 2000 | 2,203 | -0.67% |

| Country Indices | |||

| UK | 8,345 | +0.21% |

| Germany | 18,681 | +0.35% |

| Euro | 4,898 | +0.05% |

| Japan | 38,288 | +0.47% |

| Hong Kong | 17,874 | +0.43% |

| Name | Value | % Chg | |

|---|---|---|---|

| Commodities (USD) | |||

| Gold | 2,525 | +0.36% | |

| Silver | 30.02 | +0.48% | |

| Iron Ore | 102.15 | +0.54% | |

| Copper | 4.2240 | +0.13% | |

| WTI Oil | 75.87 | -2.40% | |

| Currency | |||

| AUD/USD | 67.90¢ | +0.22% | |

| Cryptocurrency | |||

| Bitcoin (USD) | 59,354 | -5.66% | |

| Ethereum (USD) | 2,447 | -8.97% | |

Key Posts

-

4:33 pm — August 28, 2024

-

3:09 pm — August 28, 2024

-

2:54 pm — August 28, 2024

-

2:01 pm — August 28, 2024

-

1:36 pm — August 28, 2024

-

1:28 pm — August 28, 2024

-

12:04 pm — August 28, 2024

-

11:44 am — August 28, 2024

-

10:29 am — August 28, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988