Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Slip; Industrial Metals Climb; Bitcoin Continues to Slide

Market Close Update

The ASX 200 closed down -0.12% to 7,822.3 today to finish the week up 0.81%. Two days of losses weren’t enough for the ASX to eek gains thanks to renewed optimism on Wall St and climbing commodity prices.

With Wall St closed for Independence Day today, however, markets were left without a clear catalyst despite many overseas markets closing higher.

Mining was still the major driver on the Aussie benchmark as precious and industrial metals largely climbed through the week. The standout was Iron ore futures, which are up at two-month highs with renewed hopes of recovering demand from China.

BHP fell -0.85% to $44.39, Rio Tinto was down -1.13% to $122.87, and Fortescue closed down nearly -1% at $22.41.

Today, Healthcare was the top performer, up +0.74% thanks to gains from CSL +0.75%, Cochlear +1.03%, Sonic Healthcare +1.36%, and Pro Medicus +1.44 %.

That and a stronger Aussie dollar could be strong drivers for these major miners early next week, at a near-yearly high of US 64.30 cents.

But before then, we have a US Jobs report coming out tonight, which will be the next signpost for the Fed’s next move.

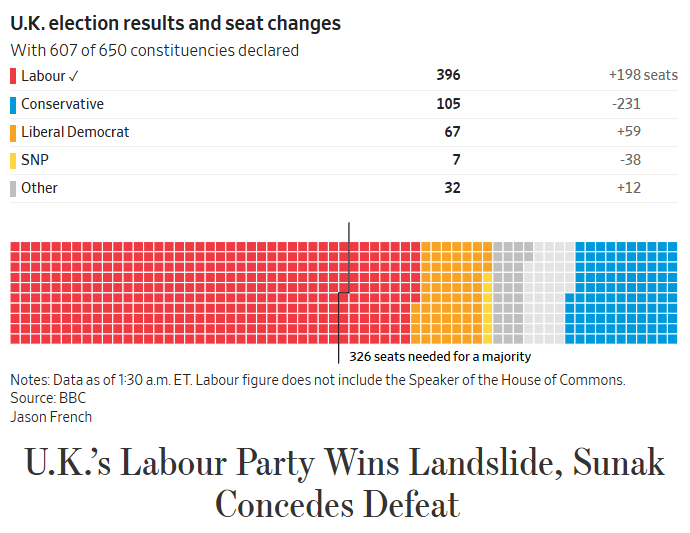

Labour Party wins UK election in landslide

Centre-left Labour leader Keir Starmer is set to become Britain’s new Prime Minister, while final results are expected to push the ruling Conservative Party to the worst election performance in its 190-year history.

Here are the seat changes for the House of Commons thanks to BBC and WSJ.

Source: WSJ – BBC

Prime Minister Rishi Sunak has conceded the election and apologised to his party for the size of the defeat, saying:

“The British people have delivered a sobering verdict tonight…and I take responsibility for the loss.”

Keir Starmer is working to reshape Labour’s economic image, moving away from perceptions of heavy taxation and spending. He is proposing only targeted tax increases and committing to manage government debt responsibly.

In key policy areas, Starmer plans to reduce bureaucracy to boost housing construction and aims to lower overall immigration numbers.

He’s also proposing a fund to accelerate green energy infrastructure development and focusing on improving access to medical appointments in the healthcare system.

So far, the Pound has held firm, with investors seeing stability in the changes despite the historic loss.

BHP Punishes Employees for Missed Targets

Mining giant BHP has announced a reduction in employee incentives across its global workforce following shortfalls in meeting internal performance benchmarks.

All the company’s targets for costs, production, safety, and gender equity were not achieved,

In the past two days, BHP informed tens of thousands of employees that they would receive only 80% of the short-term incentives originally offered for the 2023-24 period.

The impact was more pronounced for workers in BHP’s Queensland coal division. Due to two downward revisions in sales guidance and a fatal incident at the Saraji mine in the Bowen Basin, they will receive just 70% of their potential incentives.

This decision was made by the company’s leadership, who are currently under pressure for the future direction of the company after Anglo American’s failed takeover bid.

BHP shares are flat in the past 12 months, trading at $44.32 per share.

Bitcoin and wider crypto falls

Bitcoin’s value dropped approximately 7.5% in the past 24 hours, reaching $56,837, its lowest since May 1.

The decline follows the Federal Reserve’s hints that interest rate cuts are not imminent.

Despite hitting an all-time high above $70,000 in March after the approval of the first U.S. spot bitcoin ETF, the cryptocurrency has since been trading within a narrow range.

The Fed’s June meeting minutes revealed that officials are waiting for clearer signs of inflation moving towards their 2% target before considering rate reductions.

With Bitcoin down, most cryptocurrencies have followed suit, with the number two coin, Ethereum, down by over 10% in the past day.

Suncorp Ends Insurance Partnership with Berkshire Hathaway

Australian insurance giant Suncorp [ASX:SUN], has terminated its risk-sharing agreement with Warren Buffett’s Berkshire Hathaway, which had previously divided the exposure to extreme weather events in Queensland.

The Brisbane-based company, known for brands like AAMI and GIO, announced the change this afternoon, saying that the impact of major natural disasters was less severe than anticipated, although costs for some older claims had increased.

Suncorp maintained its forecast of underlying margins reaching approximately 11% for the fiscal year ending June 30.

Suncorp’s shares are flat at the moment after a slight dip after the announcement, shares are trading at $16.84.

Clinuvel Pharmaceuticals Jumps on Positive Results

Pharmaceutical group Clinuvel Pharmaceuticals [ASX:CUV] is the top performing stock on the wider ASX today as the company reported the final set of results from its clinical trial.

The trial results were from a study evaluating the DNA-repair capacity of afamelanotide on the skin of healthy volunteers exposed to ultraviolet (UV) radiation.

It brings hope of activating genes to help with skin repair after UV-damage as a possible treatment.

One of the Doctors involved in the trials, Dr Dennis Wright commented today, saying:

“The significance of these results evaluating the use of afamelanotide in reducing oxidative and inflammatory damage caused by UV is high for those at high risk of solar damage, sunburn and skin cancers, hence we will repeat and confirm these results in a final study.”

Shares in the company are up by nearly +15% in trading today, almost bringing the company back to flat for the past 12 months, trading at $17.38 per share.

Midday Market Update

The ASX 200 dipped -0.16% around midday as mining and real estate stocks retreated from earlier weekly gains.

However, the healthcare sector showed strength, rising 0.5% due to advances in key players CSL (+0.6%) and Cochlear (+0.85%).

Shortly after trading commenced, Saudi Aramco, the world’s largest oil company, refuted a Bloomberg report suggesting it was considering an acquisition of Australian gas producer Santos, which sent its shares falling slightly today.

The Australian dollar reached its highest point since January 2, trading at US$0.674, as investors speculate on later potential interest rate hikes by the RBA.

Iron ore futures climbed to a near one-month high, buoyed by expectations of increased Chinese demand.

U.S. markets were closed for Independence Day. In the UK, exit polls indicated a significant Labour victory in the general election, projecting 410 seats and a majority of 170.

Saudi Aramco Denies Reports of Potential Santos Bid

Saudi Aramco has refuted recent media reports suggesting it was considering an offer for Australian gas company Santos [ASX:STO].

Rumors began circulating yesterday after Bloomberg News reported that Saudi Aramco and Abu Dhabi National Oil Company (ADNOC) were contemplating bids for the Australian gas giant.

However, a spokesperson for Saudi Aramco has since dismissed these claims. In a short emailed statement, saying:

“With reference to recent media reports claiming that Aramco is considering an offer for Santos, the company can confirm that such claims are inaccurate.”

Santos shares are down by +0.81% in trading this morning at $7.93 per share.

Sundance Reaches Agreement with Congo Gov

Sundance Resources, a company previously listed on the ASX, informed its shareholders of a settlement with the Republic of Congo government regarding a dispute over an iron ore mine’s ownership rights.

The company initially sought compensation in the billions from the African nation. However, due to confidentiality clauses, the final terms of the agreement remain undisclosed.

In a joint statement, both parties announced:

“The Republic of Congo, Sundance Resources Limited, and Congo Iron Ore SA are pleased to confirm the successful conclusion of mediation efforts, resulting in a conditional binding confidential settlement agreement. This agreement resolves and terminates the ongoing dispute between the parties.”

Another Australian company, AVZ Minerals, continues its pursuit of compensation from the Democratic Republic of Congo in a separate dispute.

This case involves rights to what could potentially be the world’s largest hard rock lithium deposit. Earlier this year, AVZ Minerals was delisted from the ASX, leading to significant paper losses for its shareholders, estimated at around $2.8 billion.

Exit Poll Suggests Labour Poised for Landslide Victory in UK

According to a national exit poll, Keir Starmer’s Labour Party is on track to secure a massive majority of approximately 170 seats in the UK general election.

The poll indicates that Labour could win 410 out of 650 seats in the House of Commons, potentially ending 14 years of Conservative rule.

Prime Minister Rishi Sunak’s Conservative party is facing what could be its worst electoral defeat in history, with the poll suggesting they may retain only 131 seats. This outcome, if accurate, would represent a huge shift in British politics.

This projected result would mark a dramatic reversal of fortunes for both major parties, with Labour making significant gains and the Conservatives suffering substantial losses after their 14-year tenure in government.

Overnight, the UK’s FTSE gained +0.86%, while broader Euro stocks were also up, with the German DAX up +0.41% and the Euro 50 up +0.44%.

Morning Market Update

Good morning. Charlie here,

The ASX 200 looks to retrace today, with what looks to be a small drop on open as the Aussie benchmarks trade without Wall Street, which is closed today for 4th of July celebrations.

Elsewhere, the UK election results have begun trickling in and confirmed what many had already believed: a resounding victory for Labour looks on the cards.

The UK markets have responded positively, disliking uncertainty more than anything; the FTSE rose +0.86%.

European stocks also reacted positively to the news, while the ECB took a cautious tone, saying it needs additional reassurance that inflation is heading down before it cuts again, something they had warned would be likely before the first cuts, so markets are shrugging it off for now.

For Australian markets, industrial metals gained again overnight, with Iron ore Futures now at a two-month high. This, combined with a yearly high for the Aussie dollar, could give some tailwinds to the big miners.

| Name | Value | % Chg | |

|---|---|---|---|

| Major Indices | |||

| S&P 500 | 5,537 | Closed |

| Dow Jones | 39,308 | Closed |

| NASDAQ Comp | 18,188 | Closed |

| Russell 2000 | 2,036 | Closed |

| Country Indices | |||

| UK | 8,241 | +0.86% |

| Germany | 18,450 | +0.41% |

| Japan | 40,914 | +0.82% |

| Hong Kong | 18,028 | +0.28% |

| Euro | 4,987 | +0.44% |

| Name | Value | % Chg | |

|---|---|---|---|

| Commodities (USD) | |||

| Gold | 2,356.8 | -0.06% | |

| Silver | 30.36 | -0.53% | |

| Iron Ore | 113.95 | +0.70% | |

| Copper | 4.5665 | +0.73% | |

| WTI Oil | 83.89 | +0.83% | |

| Currency | |||

| AUD/USD | 67.26¢ | +0.27% | |

| Cryptocurrency | |||

| Bitcoin (USD) | 57,099 | -5.12% | |

| Ethereum (USD) | 3,068 | -6.91% | |

Key Posts

-

4:44 pm — July 5, 2024

-

3:43 pm — July 5, 2024

-

3:01 pm — July 5, 2024

-

2:38 pm — July 5, 2024

-

2:21 pm — July 5, 2024

-

1:08 pm — July 5, 2024

-

12:49 pm — July 5, 2024

-

11:45 am — July 5, 2024

-

11:36 am — July 5, 2024

-

11:31 am — July 5, 2024

-

9:58 am — July 5, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988