Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Slip; Earnings Season in Full Swing with AMP & MGR Reporting

Market close update

The ASX 200 closed down -0.23% to 7,682.0 as the market recovered slightly from this morning’s losses.

Five of the eleven sectors closed in the green as Real Estate (+1.89%) and Mining (+1.82%) dragged down the major benchmark as commodity prices and uncertain rate cuts weighed on trader sentiments.

The stand-out performer today was AMP which jumped +13.5% after releasing its 1H24 earnings, which showed total profits increasing 5.4% despite its banking arm recording a loss of $22 million.

On the other end of the market, property developer Mirvac fell by -8.53% after weaker profits and flagging further challenges ahead for FY25 as higher costs eat into their apartment development margins.

In other major news today, former Qantas CEO Alan Joyce saw his severance package docked by $9.2 million after the board’s investigation concluded that his actions caused ‘significant reputational and customer service issues’.

Looking ahead for the rest of the week, we have News Corp, Nick Scali, REA Group, QBE and Life360 reporting tomorrow so stay tuned for that.

Rent increases slow across Australia

Interesting charting from Antipodean Macro visualising the latest info from CoreLogic’s rental data across Australia.

After prior surges in rents seen across all of Australia, it seems only major cities Perth, Melbourne, and Adelaide saw rents increase.

This is the lowest pace of rental increases we’ve seen since August 2020, with rents up just 0.1% in July.

Click below to zoom in on the charting.

CoreLogic advertised rents data backing up the weakness in SQM asking rents figures. pic.twitter.com/EHxNUXXCwK

— Antipodean Macro (@AntipodeanMacro) August 7, 2024

Former Qantas CEO Alan Joyce sees bonuses docked

Former Qantas [ASX:QAN] chief executive Alan Joyce is set to forfeit over $9 million in bonuses following a board-commissioned review.

The investigation revealed that management mistakes led to ‘significant reputational and customer service issues’ for the airline.

After his departure, $11 million of Joyce’s salary was initially under scrutiny, with many reporters and politicians attacking the payout.

Today, Qantas informed investors that the company had decided to withhold a long-term bonus and certain short-term incentives, amounting to $9.26 million.

John Mullen, the incoming chairman of Qantas, talked about the board understanding ‘what went wrong’ during the tumultuous post-COVID-19 pandemic period.

He acknowledged that ‘we let Australians down’ and stressed the need to learn from past mistakes.

So, how bad was the reputational damage to Qantas?

Here’s Roy Morgan’s recent polling on Qantas’ current standing with the public… it ain’t great. It’s now Australia’s third most distrusted brand.

First place is Optus as most distrusted brand in Australia after its massive data breach and runner up is Meta (facebook) with few surprises there.

Source: Roy Morgan

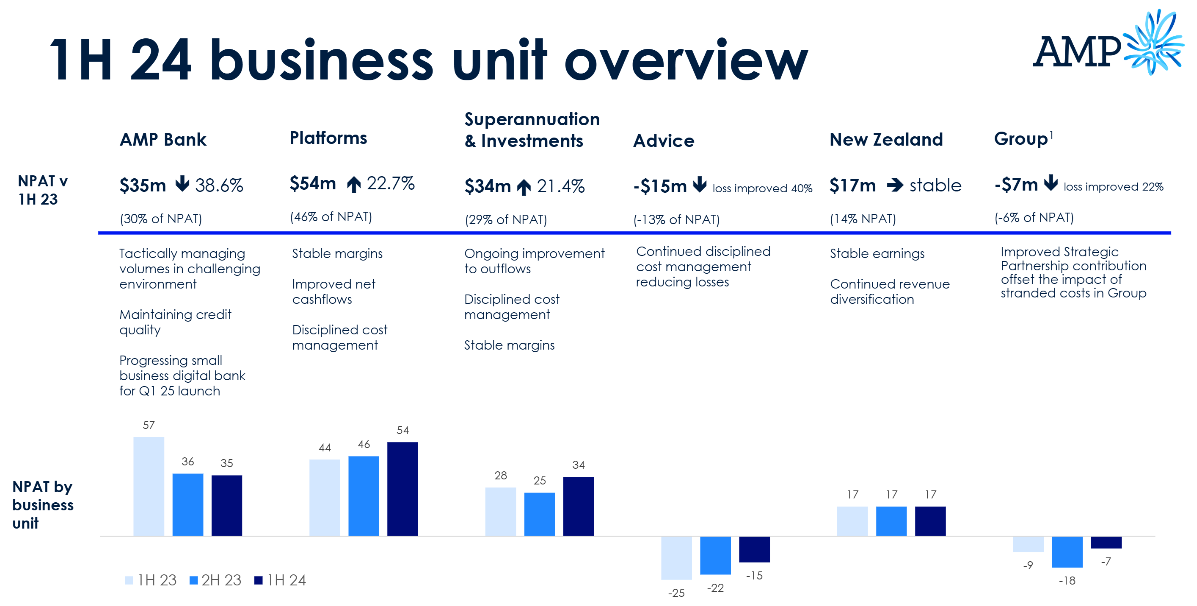

AMP shares jump on 1H24 results

Shares in banking and superannuation giant AMP are up by +12.8% in trading today as the company reported a solid jump in profits for the half.

AMP’s 1H24 results saw the group’s underlying NPAT jump +5.4% to $118 million, while ‘controllable’ costs were brought down -6.4% to $339 million for the half.

This meant while total revenues were down by 4% to $641 million, the company’s earnings per share were up 15.8% to $4.4.

For a good overview of the different business units performance, see below:

Source: AMP

AMP Chief Executive Alexis George said:

‘We have made good progress this half on our key strategic commitments, and we have positive momentum heading into the second half of the year. We have continued to deliver on simplification and cost reduction, while also driving growth in our wealth businesses and returning capital to shareholders.’

With today’s jump, the company’s 12-month return is +15.91%, and the stock is trading at $1.275 per share.

Midday market update

The ASX 200 is down by -0.36%, trading at 7,671.8 around midday, as six of the eleven sectors sit in positive territory.

Large losses in mining (-1.84%) and real estate (-2.03%) are holding the major benchmark down so far today, with large caps controlling the sway.

BHP is down by -2.10%, Fortesuce is down by -0.62%, while Rio Tinto has tumbled -2.10% in mining.

In real estate, Goodman Group is down by -2.30%, while Scentre Group is down -0.74%, and Stockland is down -1.34%.

Also, in real estate, Mirvac Group has fallen by -9% after forecasting lower earnings and distributions in FY25 as higher costs cut into its margins on apartment projects in its latest earnings results for FY24.

Also in big news today, poly-metals and lithium producer IGO is down by -2.7% after flagging that it is considering selling its nickel mining assets after entering an exclusivity deal with Medallion Metals to potentially acquire its Cosmic Boy processing facility.

During FY25 IGO will transition its Forrestania nickel mine in WA into care and maintenance as low nickel prices squeeze margins across Australian producers as Indonesian nickel floods the market.

Latest speech of RBA Governor starts soon

If you want to hear the latest thoughts from Reserve Bank of Australia Governor Michelle Bullock, her next speech starts soon, click the link below.

Live broadcast of Governor Michele Bullock's speech to the Rotary Club of Armidale starts in 15 minutes: https://t.co/tsO5SjLNlp pic.twitter.com/NBg4iuO5HX

— Reserve Bank of Australia (@RBAInfo) August 8, 2024

Myer drops after trading update

Retail giant Myer [ASX:MYR] is down by -8.3%, trading at 77 cents per share after its latest trading update flagged falling profits.

Expected net profit is now between $50-54 million for FY24. That’s down from $71.1 million for the prior year.

The company blamed ‘challenging trading conditions’ with inflationary pressures and the impact of store closures.

Myer’s new Executive Chair, Olivia Wirth, commented today:

“The second half sales performance demonstrates resilience in the face of a difficult trading environment for Myer and the wider retail sector, coupled most notably with the closure of our Brisbane CBD store and the underperformance of the sass & bide, Marcs and David Lawrence brands.

“In the current challenging trading conditions, we are acutely focused on optimising operational performance including tightly managing costs, inventory, and margins and fully leveraging our MYER one loyalty program.”

Shares in Myer are still up by +21% in the past 12 months of trading after a strong jump in late June after being approached by rival Solomon Lew’s Premier investments for a possible merger.

A strategic review is currently underway to consider the proposal, with no clear timeline for now.

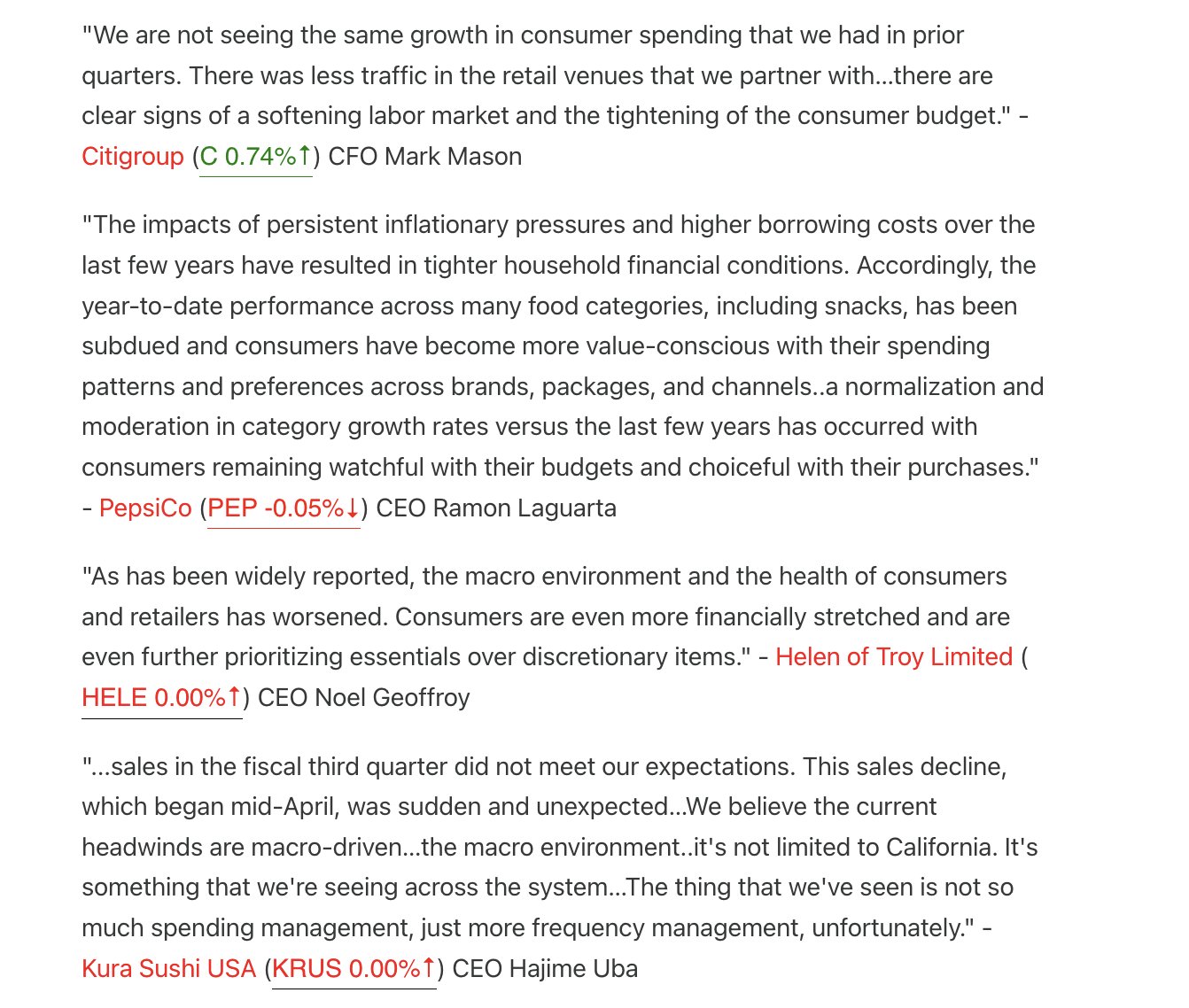

Earnings transcripts adding to the bearish chorus

US consumer spending has been in the spotlight since the weak jobs report last week sent markets spiralling. Traders feared the Fed had missed its window for a soft landing of the US economy.

Next week, we will have US CPI data out late Wednesday night AEST, plus US and Chinese retail spending on Thursday.

These three data points come at a time of increased sensitivity for the markets, but they should also give markets a better idea of the health of the two major economies.

Here are some transcripts of earnings reports from large banks and retailers in the US we’ve heard in the past fortnight:

Source: X.com

Morning Market Update

Good morning. Charlie here.

The Australian share market is set to slip today, with ASX 200 Futures pointing to a slightly lower opening, down 0.4% to 7,597.0 around 9.30 am.

On Wall St last night, shares fell across the major benchmarks as several warnings from companies’ earnings statements were widely circulated showing US consumers are pulling back on spending.

After the volatility seen since last Friday, markets will likely remain sensitive to any bearish news for the next few weeks until a clearer sign of cuts or a path to a soft landing is seen.

European markets closed with a strong session of gains, while most Asian stocks continued to regain losses seen earlier in the week.

In commodities, copper prices continued to slide, sitting around a five-month low as traders remain sensitive to the idea of a looming recession for the US.

Meanwhile, natural gas and oil spiked overnight, with WTI Crude jumping 3% as the latest EIA report showed US inventories falling faster than expected.

Rising fossil fuel prices have also been driven up by supply-side concerns around the ratcheting tensions in the Middle East after Iran said that Israel must be ‘punished’ for its assassination of Hamas political leader Ismail Haniyeh in Tehran last week.

For Australia, earnings season is now in full swing in its second week, with earnings out today from AMP, News Corp, and Transurban, among others.

For the full earnings season calendar, check out CommSec’s list here.

| Name | Value | % Chg | |

|---|---|---|---|

| Major Indices | |||

| S&P 500 | 5,199 | -0.77% |

| Dow Jones | 38,763 | -0.60% |

| NASDAQ Comp | 16,195 | -1.05% |

| Russell 2000 | 2,035 | -1.41% |

| Country Indices | |||

| UK | 8,166 | +1.75% |

| Germany | 17,615 | +1.50% |

| Euro | 4,668 | +2.03% |

| Japan | 35,089 | +1.19% |

| Hong Kong | 16,877 | +1.38% |

| Name | Value | % Chg | |

|---|---|---|---|

| Commodities (USD) | |||

| Gold | 2,384 | +0.04% | |

| Silver | 26.64 | -0.75% | |

| Iron Ore | 102.00 | +1.05% | |

| Copper | 3.9201 | -2.64% | |

| WTI Oil | 75.47 | +3.10% | |

| Currency | |||

| AUD/USD | 65.16¢ | -0.08% | |

| Cryptocurrency | |||

| Bitcoin (USD) | 55,403 | -1.52% | |

| Ethereum (USD) | 2,363 | -4.37% | |

Key Posts

-

4:33 pm — August 8, 2024

-

3:32 pm — August 8, 2024

-

2:38 pm — August 8, 2024

-

2:27 pm — August 8, 2024

-

12:49 pm — August 8, 2024

-

12:31 pm — August 8, 2024

-

12:29 pm — August 8, 2024

-

9:55 am — August 8, 2024

-

9:41 am — August 8, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988