Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Slip; Earnings reports from Ampol, Lendlease, Nuix, Suncorp

Market close update

The Australian sharemarket closed slightly higher on a muted day of trading as investors digest a flurry of earnings reports and await the RBA’s latest meeting minutes tomorrow as the next major catalyst.

The ASX 200 closed up +0.12% to 7,980.4, recovering from the initial fall this morning as four of the eleven sectors closed higher.

Gains from energy utility giants Origin (+2.48%) and AGL Energy (+1.62%) helped lift the utility sector as the major gainer today, with the sector up +1.67%.

While falling behind, consumer staples fell by -0.83% as the a2 Milk Company fell by -18.5% after forecasting further trouble ahead in FY25 as the China market remains weakened.

In commodities gold miners were standout performers after the spot price of gold touched a fresh all-time high over the weekend, above US$2,500 per ounce.

Major miner Northern Star gained +2.23%, while Evolution Mining was up by +3.7% to trade at $4.22 per share at close.

On the wider ASX the stand-out performer today was Nuix , gaining +25.9% to trade at $4.38 after flipping a profit of $5 million, well above its FY23 loss of $5.6 million.

Lendlease falls on lower revenue

The property giant Lendlease [ASX:LLC] fell by -0.47% today after releasing its latest earnings report.

The headline news that drove the stock lower was a 10% decrease in its FY24 revenue compared to a year ago. Pulling in $9.4 billion in revenue.

After-tax losses increased to $1.5 billion from $232 million last year as the company’s refreshed strategy saw it sell off many of its foreign assets, including the major US military housing assets in Asia.

Group Chief Executive Officer, Tony Lombardo said:

“Our results for FY24 reflected challenging business conditions and the early actions from our refreshed strategy. We have made significant progress towards our target of recycling $2.8 billion of capital in FY25, with further cost savings realised as a result of our simplified management structure.”

The company said it would pay a final dividend of 9.5 cents per share.

Suncorp rise on earnings

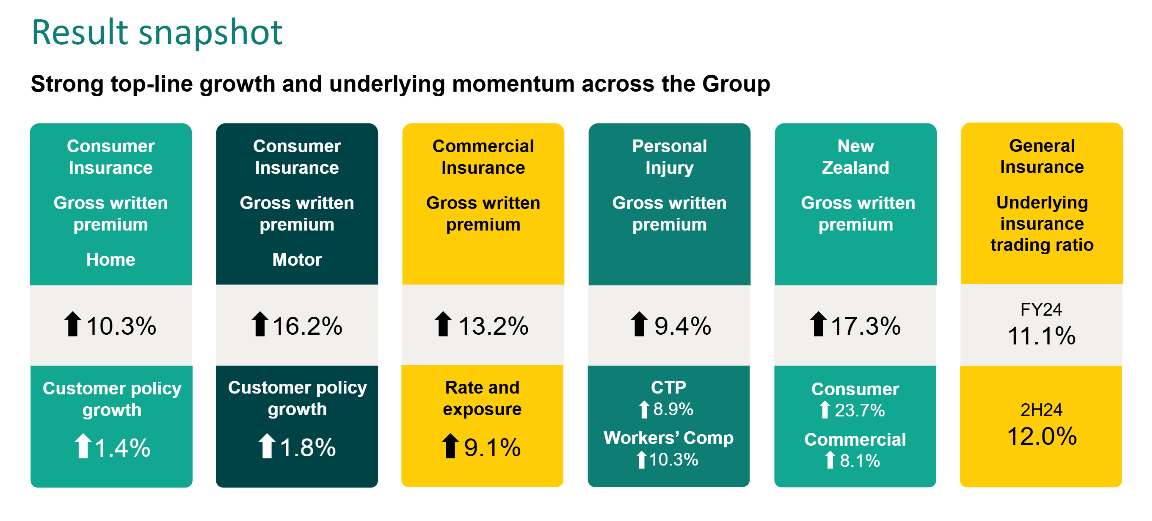

Suncorp [ASX:SUN] shares are up by 1.75% after reporting strong financial results for the full year.

The insurance and banking major reported its FY24 results, showing net profits up by 12% compared to the previous year, reaching $1.2 billion.

The company said higher insurance premiums primarily drove this improvement, with improvements across almost all of its segments.

Here’s a snapshot of the top-line results out today:

Source: Suncorp

Thanks to the strong performance, the company announced it would pay shareholders a fully franked annual dividend of 78 cents per share

Fed cut hopes the major thing to watch this week

Here’s a good video update from analyst David Scutt outlining Friday’s highly anticipated Jackson Hole speech.

Fed Chairman Jerome Powell is expected to deliver his outline for interest rate cuts at the speech at Jackson Hole, a Rocky Mountains Resort that is known for its meeting that is described as ‘the Davos for Central Banks’.

What are the chances of cuts, and what are the expectations?

David explains below:

Hopes the #Fed may go full-bore dove at Jackson Hole may be enough to spark another leg lower for $USD before Powell speaks on Friday. But I'm sceptical he will deliver. Data flow has been decent, there's major data ahead, and 2024 rate cut pricing comes across as rich https://t.co/TbtRJ7QgVf pic.twitter.com/nDw4WDiRm0

— David Scutt (@Scutty) August 19, 2024

Midday market update

The Australian share market has been fairly subdued today as investors assess a wave of profit results released on the ASX.

The ASX 200 is up slightly 0.14% to 7,982.1 this afternoon, recovering from earlier losses. This followed a 2.1% surge in the utilities sector, spearheaded by Origin gaining 3.1% and AGL climbing 2% after their selloffs last week. In contrast, the consumer staples sector was the poorest performer, declining 1.1%.

With lots of big earnings out today we’ve seen some sharp movements.A2 Milk plummeted 18.6% after reporting persistent challenging conditions in China and forecasting a further decline in market value for FY25. The dairy company projected mid-single-digit revenue growth in FY25.

Bathroom and plumbing products company Reece Group dropped 4.1% despite reporting an 8% increase in full-year net profit to $419.2 million in a difficult market, as renovators reduced spending.

Data investigator company Nuix jumped by 27% after flipping a $5 million profit, a huge increase from its $5.6 million loss last year.

In the commodities sector, gold stocks rallied after the precious metal reached a new record above US$2,500 a tonne. Newmont and Northern Star rose 1.1% and 1.8% respectively.

Stand out performances in gold stocks so far today were seen by Evolution Mining, up 3.2% and Emerald Resources, up by 4.3%.

Nuix jumps on turn to profit

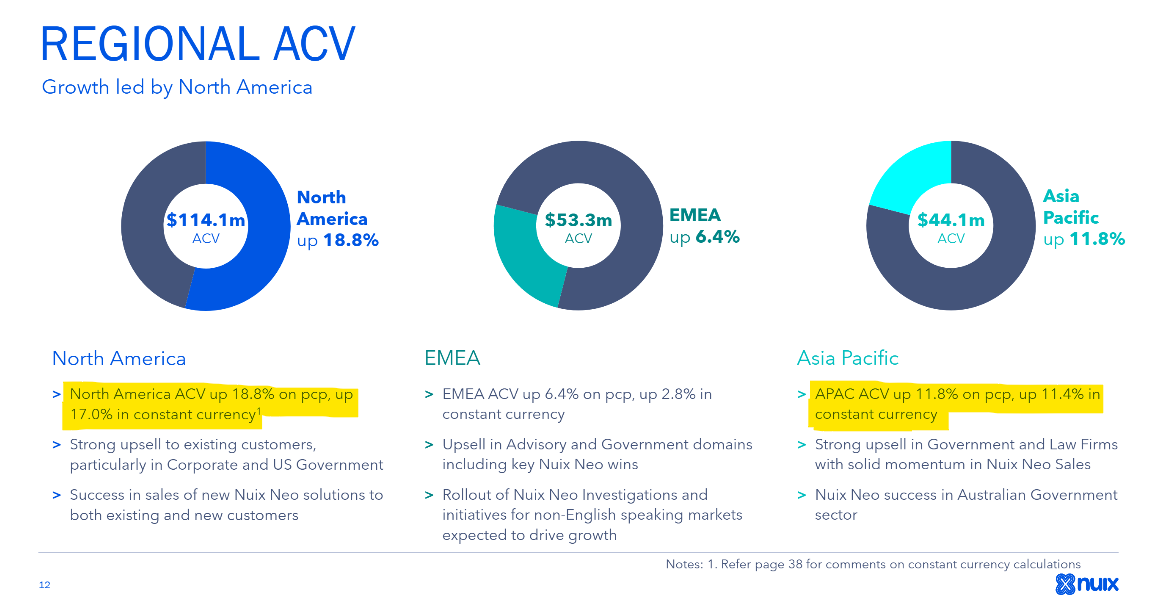

Nuix [ASX:NXL], a company known for developing investigative software used by banks, audit firms, and government agencies, has seen its shares jump over 20%.

The lift comes as the company moved into profit-making, posting a $5 million profit this year, well up from their $5.6 million lost last year.

The company’s earnings before interest, tax, depreciation, and amortization (EBITDA) for the 12 months ending June 30 reached $55.9 million, marking a 60% increase from the previous year.

Their underlying EBITDA, which doesn’t include legal costs, saw a 39% rise to $64.4 million.

The company saw solid growth within its American and Asia Pacific segments, seen below:

Source: Nuix

Nuix said its annualized contract value increased by 14% to $211 million, while its actual income grew by 21% to $220 million.

After this morning’s jump, the company’s shares are now worth $4.28 each, which is up 200% in the past 12 months. However, this is still far below their IPO price of around $10 when they first started selling shares to the public in December 2020.

For their full presentation today, click here.

Core lithium lobs bid for smaller player

Core Lithium [ASX:CXO] has suspended trading following news of its bid for fellow ASX-listed miner Charger Metals [ASX:CHR].

The all-scrip offer proposes 0.9 Core Lithium shares for each Charger share, valuing Charger at approximately $6.5 million, or close to 9¢ per share.

This offer comes at a time when Charger’s shares were trading around 7¢, near their all-time low after a significant 60% fall over the past year.

However, Charger’s board has expressed reservations about the offer, stating that it ‘does not fully reflect the company’s value and prospects.’

Despite this, they said they remain open to further discussions with Core. The board also revealed ongoing conversations with other potential bidders.

Charger’s shares have jumped 23.5% in trading today. Meanwhile, Core Lithium’s trading halt suggests potential upcoming announcements or adjustments related to this acquisition attempt.

Morning Market Update

Good morning. Charlie here.

The Australian share market is set to open slightly lower despite a positive lead from Wall St on Friday as we have another busy day of earnings on the ASX.

BlueScope, LendLease, Ampol, and Suncorp are the major companies reporting today. Early reads suggest that LendLease results are disappointing.

Beyond earnings, we’ve seen a slight drop across commodities over the weekend, but gold has surged to a new all-time high of US$2,500.

Overall it’s likely to be a quieter start to the week as traders await key Central Bank decisions in the Asian region and US jobless claims and economic data ahead.

Tomorrow, we also have the release of the latest RBA minutes, which should give traders some more clarity. After the RBNZ’s recent surprise rate cut, similar sentiments have been heard in Australia, with few believing the rhetoric out of the RBA for cut timings.

For the Fed, traders are expecting language out of the major Central Bank to greenlight cuts to come on 19 September but now the language will likely temper the idea that a ‘double-cut’ of 0.5% is likely.

It’s far more likely that instead, the Fed will take it slower with 0.25% cuts ahead for this year, but the next employment and economic data will land in a sensitive time for markets after the early month drop.

| Name | Value | % Chg | |

|---|---|---|---|

| Major Indices | |||

| S&P 500 | 5,554 | +0.20% |

| Dow Jones | 40,659 | +0.24% |

| NASDAQ Comp | 17,631 | +0.21% |

| Russell 2000 | 2,141 | +0.30% |

| Country Indices | |||

| UK | 8,311 | -0.43% |

| Germany | 18,322 | +0.71% |

| Euro | 4,840 | +0.68% |

| Japan | 38,062 | +3.64% |

| Hong Kong | 17,430 | +1.88% |

| Name | Value | % Chg | |

|---|---|---|---|

| Commodities (USD) | |||

| Gold | 2,503 | +1.82% | |

| Silver | 28.90 | -0.42% | |

| Iron Ore | 92.85 | +0.91% | |

| Copper | 4.1369 | -0.16% | |

| WTI Oil | 76.26 | -0.50% | |

| Currency | |||

| AUD/USD | 66.72¢ | +0.05% | |

| Cryptocurrency | |||

| Bitcoin (USD) | 58,972 | -0.68% | |

| Ethereum (USD) | 2,629 | +0.82% | |

Key Posts

-

4:26 pm — August 19, 2024

-

4:15 pm — August 19, 2024

-

3:12 pm — August 19, 2024

-

2:32 pm — August 19, 2024

-

2:25 pm — August 19, 2024

-

12:01 pm — August 19, 2024

-

11:46 am — August 19, 2024

-

9:54 am — August 19, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988