Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Slip as Iron Ore and Oil Fall; REA Group weighs $8.5b bid for Rightmove

Market close update

The Australian share market edged closer to its record today, with the ASX 200 finishing 0.22% higher at 8,109.9 points, just shy of its all-time closing high set in late July.

Major banks led the gains, balancing our the losses seen in the mining sector. Commonwealth Bank reached a new record, climbing 1.6% to $141.77. National Australia Bank rose 1.3% to $38.65, ANZ increased 0.9% to $30.66, and Westpac gained 1.2% to $31.60.

Signs of potential interest rate cuts in the US bolstered the banking sector today, pulling the ASX 200 from early losses into positive territory in late afternoon.

Banks saw investors buying as the US personal consumption expenditures price index, the Fed’s preferred inflation measure, showed a 0.2% increase in July. That move was in-line with expectations and is considered the nail in the coffin for interest rate cuts in the US.

That coffin has a lot of nails in it by now, as we have covered the expectation of cuts in September extensively here.

From my own reading, the figures will likely push down the chance of a ‘double-cut’ in September, an interest rate cut of 0.5 basis points.

Some market movers had been hoping for that, so we can probably say that interest rate cuts are priced in by this point.

Back to the ASX, Mining stocks underperformed due to a weak outlook for China, with iron ore futures in Singapore dropping 3% to US$98 per tonne.

This led to declines for BHP (down 1.1% to $40.33) and Rio Tinto (down 1.4% to $109.94).

The communications sector also fell 0.9%, dragged down by REA Group’s 5.3% drop to $207.44 following news of a potential bid for UK-listed Rightmove.

Other notable movements included Bellevue Gold posting its first full-year profit but seeing shares fall 9.1% to $1.15.

Imugene jumping 9.7% to 6.8 cents on promising cancer treatment trial results. Smartgroup was the top performer, rising 5.4% to $8.44 after receiving a buy rating from Morgans.

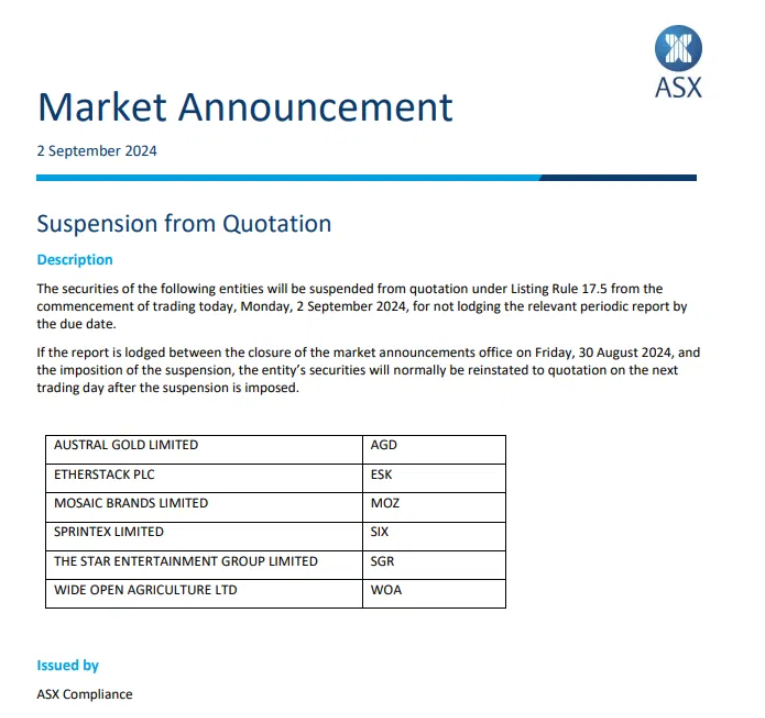

Star Entertainment’s shares were suspended from trading due to a delay in publishing its full-year results, as the casino operator grapples with raising cash and managing the aftermath of a critical operational review released last Friday.

Bendigo Bank’s New CEO Reshapes Executive Team

Richard Fennell, the newly appointed CEO of Bendigo & Adelaide Bank [ASX:BEN], has wasted no time in reorganising the bank’s leadership on his inaugural day at the helm.

So far, the key changes include:

- Taso Corolis, formerly chief risk officer, now heads the consumer bank as chief customer officer

- Sarah Bateson steps up to chief marketing officer

- Xavier Shay, previously CEO of UP (Bendigo’s digital bank), becomes chief digital officer

- The bank is also seeking a replacement for Louise Tebbutt, the former chief people officer who left recently.

These appointments come as Fennell takes over from Marnie Baker, who departed last Friday. In a staff communication today, Fennell outlined his vision:

‘We have entered this new financial year with positive momentum and strong growth, which was acknowledged by the market last week. I want us to stay focused on continuing to grow our market share as we build the scale of our organisation and leverage the investments we have made and our digital capability to strengthen our competitive position and drive greater productivity.’

Shares are down by -1.66% in trading so far today, with shares at $11.85.

Latest Fat Tail Daily Video

This the second week of our the new Fat Tail Daily video series.

Publisher James ‘Woody’ Woodburn will be sitting down with our Fat Tail Daily editors to discuss the key trends and offer unique insights into market movements.

If you have any thoughts about the length, format, or topics you would like discussed, send us an email at support@fattail.com.au with the subject header: ‘Fat Tail Daily Video Feedback’.

Thanks, and enjoy today’s discussion with Crypto Capital and Alpha Tech Trader Editor Ryan Dinse.

Building approvals jump 10% in July

Housing approvals jumped 10.4% in July a positive sign after some slower months.

However its good to remember the building approvals dataset is a notoriously varied series, the rise is good news for the housing sector, particularly after the 6.4% slump in June

“Private dwellings excluding houses rose 32.1 per cent after a low June result, ” ABS head of construction statistics, Daniel Rossi, said.

“Private sector house approvals also rose by 0.6 per cent.

“Despite the bounce in July, total dwellings approved remain 5.1 per cent lower than the five-year average.” Mr Rossi said.

Alex Joiner, chief economist at IFM Investors, said the rebound may mean the market is turning up.

Building approvals rebound sharply in July seems like approvals, particularly of detached homes, have turned – perhaps developers looking to the RBA's easing cycle to come pic.twitter.com/0jkqdOTwGu

— Alex Joiner 🇦🇺 (@IFM_Economist) September 2, 2024

Midday market update

The ASX 200 is down by -0.22% around midday in the first session of this month as Telecoms and Mining drag the major benchmark down, while Financials and Energy stocks remain positive in trading so far today.

With few macro stories moving markets beyond signs of strong US consumer behaviour, local markets have fallen on sliding commodity prices.

Gold miners have seen their stocks sell down this morning as the price of gold slid over the weekend, while energy stocks bucked the lower oil prices to trade higher this morning.

REA Group is one of the large caps weighing on the index so far today, with its shares down by -6.5% after acknowledging it was considering a takeover bid on UK-based Rightmove in a deal that could cost around $8.5 billion.

Downer EDI is once again carrying the ASX 200 with another strong day, up +3.8% in trading so far after a strong swing to profit in its results on Friday.

Immugene and Cettire are also seeing heavy buying in trading so far today with both up almost 20%. Immugene has announced positive results in its latest Azer-Cel Phase 1 trial.

While Cettire continues to see positive trading after its financial results last week showed an 81% increase in revenues and its active customers growing by 64%.

REA Group considers bid for Rightmove

REA Group [ASX:REA] shares are down by nearly 6% in trading this morning after the stock left a trading halt.

The resumption comes as the company announced it was considering a ‘cash and share‘ takeover bid for the UK’s largest online real estate website, Rightmove.

Rightmove was founded in 2000 and is now worth approximately $8.5 billion as the UK’s top real estate portal.

In the morning announcement, REA’s board described the bid as a ‘Transformational opportunity.’

They went on to say:

‘The REA Board believes that there are clear similarities between REA and Rightmove in terms of their leading market positions in the core residential business, continued expansion and innovation of offerings across adjacent segments, leading audience share and strong brand awareness, as well as highly aligned cultural values.’

There is still no guarantee that the offer will actually take place, but so far, investors have hit the sell button as the price tag raises some concerns.

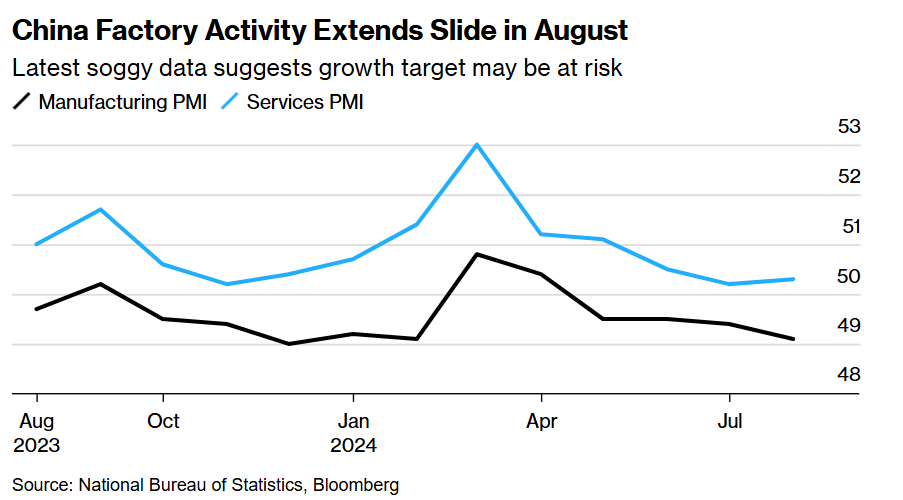

Latest data adds to China worries

The latest manufacturing and service data pointed to continued contraction for the second-largest economy, putting downward pressure on oil and iron ore prices again over the weekend.

Iron ore is down -0.13% in trading this morning to hover around US$100.90 per tonne.

Meanwhile, WTI crude oil is down -5.3% in a week to trade at US$73.35 on Chinese weakness, and news is that OPEC+ will progress with its plan to lift output from October.

According to the National Bureau of Statistics, the official manufacturing purchasing managers index (PMI) fell to 49.1 from 49.4 in July.

That was below the 50 level, which separates growth from contraction, and also below the expected 49.5 reading many had hoped to see.

Source: Bloomberg

Services PMI saw a slight uptick to 50.3 as the summer season’s holiday consumption helped lift the index the statistics office said.

While within the struggling property sector, things weren’t quite as rosy. The value of new-home sales from the largest 100 real estate companies fell 26.8% from a year earlier. That was up from the 19.7% decline in July.

The hope of further stimulus from Beijing seems to be the major thing China watchers are hoping for next.

Leaders are apparently mulling allowing homeowners to refinance as much as $5.4 trillion of mortgages to lower borrowing costs for millions of homeowners in an attempt to boost consumption.

Overall, however, it looks to be another banking tweak for China instead of the full-throated stimulus many have wanted, as China’s fiscal policy remains tight.

Theme of the morning: Share suspension

It seems Star Entertainment isn’t the only one sitting out the market this morning. Star requested voluntary suspension on Friday after a damning report put in question its ability to regain its Sydney casino license.

Meanwhile, this morning, the ASX extended that suspension as the Star also failed to release its earnings report by the end of August.

But it wasn’t the only one:

Source: ASX

Also on the list of slow reporters suspended this morning we have; Austral Gold, Etherstack, Mosaic Brands, Sprintex, Wide Open Agriculture.

And then as I’m typing we’ve seen the addition of REA Group as it readies a statement on a potential $8.5 billion takeover bid for Rightmove, the UK’s largest online real estate portal.

Other stocks on halt worth noting are NT Minerals, Anagenics, ERA, and Lotus Resources, which says it’s pending an ‘offtake and funding announcement’, so that could be one to watch.

Morning Market Update

Good morning. Charlie here.

The ASX 200 opened down -0.47% to 8,054.2 as weakness in commodity prices over the weekend pressured the local share market this morning.

Over on Wall St, the major benchmarks finished August higher with a strong finish that saw the indices finish the month at:

Dow Jones +1.7%, Russell 2000 -1.6%, Nasdaq +0.6%, S&P 500 +2.2% for August.

The major news helping lift US markets was the stronger-than-expected GDP figures last week of 3.0% quarter-on-quarter, staving off fears of recession.

July core PCE also came out last Friday with in-line figures. Core PCE is the Fed’s preferred inflation gauge, so the market watches it closely. Figures for July came in at 2.6%.

Over on the ASX, be on the lookout for Star Entertainment to exit its trading halt today.

Its shares are expected to fall sharply after a damning report on Friday that took aim at leadership. The NSW Independent Casino Commission (NICC) handed down its final report, noting that insufficient changes had been made to likely regain its Sydney casino license.

Woolworths has sold its remaining shares in Endeavour Group at $5.23 per share, a 2.1% discount to its last close.

Goodman Group has captured attention, with suggestions a Chinese state-owned investor group could be testing the market to sell down its $5bn-plus interest in the $62bn Australian industrial property powerhouse.

| Name | Value | % Chg | |

|---|---|---|---|

| Major Indices | |||

| S&P 500 | 5,648 | +1.01% |

| Dow Jones | 41,563 | +0.55% |

| NASDAQ Comp | 17,713 | +1.13% |

| Russell 2000 | 2,217 | +0.67% |

| Country Indices | |||

| UK | 8,376 | -0.04% |

| Germany | 18,906 | -0.03% |

| Euro | 4,957 | -0.17% |

| Japan | 38,647 | +0.74% |

| Hong Kong | 17,989 | +1.14% |

| Name | Value | % Chg | |

|---|---|---|---|

| Commodities (USD) | |||

| Gold | 2,502 | -0.03% | |

| Silver | 28.83 | -0.09% | |

| Iron Ore | 100.60 | -0.43% | |

| Copper | 4.1570 | +0.11% | |

| WTI Oil | 73.12 | -0.58% | |

| Currency | |||

| AUD/USD | 67.70¢ | +0.09% | |

| Cryptocurrency | |||

| Bitcoin (USD) | 57,374 | -2.67% | |

| Ethereum (USD) | 2,426 | -3.46% | |

Key Posts

-

4:48 pm — September 2, 2024

-

3:53 pm — September 2, 2024

-

2:26 pm — September 2, 2024

-

2:23 pm — September 2, 2024

-

12:45 pm — September 2, 2024

-

11:18 am — September 2, 2024

-

11:02 am — September 2, 2024

-

10:37 am — September 2, 2024

-

10:16 am — September 2, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988