Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX Falls as Bond Yields Jump; Gold and Oil Spike on Israeli Strikes in Iran

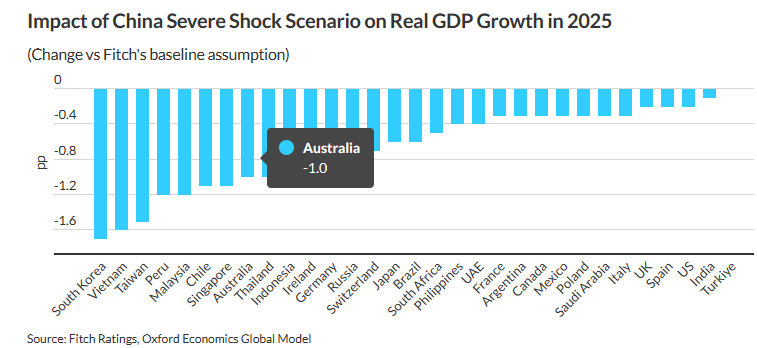

Fitch highlights potential ‘Shock Scenario’ and impact on Asia-Pacific

In its latest report, global rating agency Fitch sounded the alarm.

Fitch Ratings warns that a severe economic downturn in China would have significant ripple effects across the Asia-Pacific region and commodity-exporting nations

Source: Fitch

Their analysis, using economic modelling from Oxford Economics, identifies vulnerabilities for economies closely tied to China, such as South Korea and Australia, which it projects to impact 1pp of RealGDP growth in Australia in 2025 if the shock scenario eventuates.

The slim bright side here is the agency said more subdued demand from China would help ease global inflationary pressures. Fitch projects Brent crude prices could be 15% lower on average in 2024-2025 compared to their baseline, while metal prices could drop over 20% from current forecasts during that period

Macquarie Fined $10M for Inadequate Fraud Safeguards

In a ruling today, Macquarie Group has been ordered to pay a $10 million penalty after admitting to failing to implement sufficient controls to protect its customers from fraud. The financial giant faced legal action from the Australian Securities and Investments Commission (ASIC), which had sued Macquarie in April 2022.

The crux of the issue was Macquarie’s lack of proper screening for potentially fraudulent transactions made by third parties, such as financial advisers or stockbrokers, on client cash management accounts.

Despite having a “fee authority” system that allowed authorized third parties to withdraw funds from client accounts for advice or service fees, the bank did not adequately verify whether these fees were legitimate.

By neglecting robust verification processes, Macquarie left its customers vulnerable to exploitation by unscrupulous third parties, the ruling said.

Macquarie group shares are down by -2.25% at $182.08 per share in afternoon trading.

Market dumps as Israel strikes back at Iran

Breaking news reporting is flowing through with the first signs of strikes by Israel into Iran since the weekend barrage by Israel.

Early reporting is showing potential strikes were in Northern and Central Iran, targeting Tabriz, Isfahan, and its nearby Natanz.

Source: GoogleMaps

Locations such as Tabriz contain major airbases where it is reported some of the Iranian attacks came from, while Isfahan and Natanz are known to contain important facilities of Iran’s nuclear program.

Oil and gold prices are spiking as markets react to the initial news and renewed fears of a broader Middle East conflict spread.

Gold is up +1.82% to US$2,411 per ounce in trading so far today with a clear spike on the news seen below:

Source: Goldprice.org

Meanwhile, Oil has also raised sharply with Brent Crude up +3.60% so far, trading at US$90.25 per barrel.

While WTI Crude is up +3.86% to US$85.92 per barrel. The fear of a wider conflict could see these prices touch US$100 p/b if the conflict spirals from here.

Midday market update

The ASX 200 is down by -1.52% today in another heavy day of losses for the Australian benchmark after 10 of the 11 sectors sell-off today, with only Energy up +0.44% as oil prices jump on the latest news.

News coming in within the past half hour has early reports of supposed retaliatory strikes on Iran by Israel have begun, pushing concerns of a wider conflict in the region.

As a response, gold and oil are both up, with gold spiking +1.82% and oil up ~3% already.

Fed talk

It seems the Fed Presidents’ jawboning through the start of this year has finally paid off, with markets cowering in the past two weeks as the spectre of re-accelerating inflation has risen after a series of data that began with a hotter CPI print and a number of jobs reports that underline the strength of the US economy.

What was assumed to be a global rate-cutting cycle near the mid-point of this year is now looking more likely to be led by Central Banks in Europe or elsewhere outside of the US.

With the next Fed meeting in a fortnight, I thought it could be worth looking at their latest comments.

Reuters reporting on positions of Fed state presidents will give you an idea:

‘On Thursday, New York Fed President John Williams became the U.S rate-setter to embrace the “no rush” on rate cuts views articulated by Fed Governor Christopher Waller and since echoed by many of his colleagues.

“I definitely don’t feel urgency to cut interest rates” given the strength of the economy, Williams said at the Semafor’s World Economy Summit in Washington.

“I think eventually…interest rates will need to be lower at some point, but the timing of that is driven by the economy.”

Cleveland Fed President Loretta Mester, in comments late on Wednesday, also said the Fed will likely cut rates “at some point,” steering clear of the later “this year” language she – and Williams – had previously used.

Speaking in Fort Lauderdale, Florida on Thursday, Atlanta Fed President Raphael Bostic offered “the end of the year” as his view of the likely timing for a first rate cut, saying “I’m comfortable being patient.”

Minneapolis Fed President Neel Kashkari told Fox News Channel he also wants to be “patient,” with the first rate cut “potentially” not appropriate until next year.

As recently as a few weeks ago, many policymakers signalled they expected hotter-than-expected inflation in early 2024 would give way to cooler readings in the face of the Fed’s tight monetary policy, necessitating several rate cuts before the end of the year to prevent the policy from slowing the economy too much.

But strong growth in jobs, a third-month-in-a-row upside surprise on inflation in March, and robust retail spending among other recent economic indicators have convinced more central bankers that rate cuts ought to wait.

With Fed rhetoric shifting and the labour market data showing few signs of cracks, financial markets have also moved to price in fewer and later rate cuts.

Futures contracts that settle to the Fed’s policy rate now reflect expectations that the first reduction comes in September, versus June just a few weeks ago.’

Morning market update

Good morning. Charlie here,

The ASX 200 opened down -0.66% to 7,591.5 and looks likely to face its seventh fall in eight sessions as the spectre of the Fed’s interest rate decision looms over markets.

Overnight Wall St had a mixed session as US jobless figures moved little, adding to a week of strong reports on the US economy’s health.

The classic ‘good news-is-bad news’ problem has once again caused traders to postpone their bets on when the Fed is likely to cut rates.

The odds of a second rate cut by the end of the year have dropped to about 50-50, based on the CME FedWatch Tool. That’s a long way off the 6ish cuts expected at the start of the year.

While the rhetoric from Fed officials seems that they are happy at the level of jawboning that has been done to push the markets into such fearful and reactive posture.

Fed officials next meet 30 April and decide on May 1st and are widely expected to keep the policy rate in place at 5.25-5.5% range.

Wall Street: S&P 500 –0.22%, Dow flat, Nasdaq -0.52%.

Overseas: FTSE +0.37%, STOXX +0.46%, Nikkei +0.31%, SSE +0.10%.

The Aussie dollar fell -0.26% to US 64.21 cents.

US 10-year bond yields +4bps to 4.63%.

Australian 10-year bond yields -5bps to 4.33%.

Gold rose +0.40% to US$2,377.56, while Silver fell -0.15% to US$28.19.

Bitcoin rose +3.12% to US$63,122, while Ethereum rose +2.36% to US$3,053.

Oil Brent fell -0.24% to US$86.90, while WTI Crude fell -0.07% to US$82.67.

Iron ore rose +1% to US$165.55 a tonne.

Key Posts

-

3:20 pm — April 19, 2024

-

2:59 pm — April 19, 2024

-

12:23 pm — April 19, 2024

-

12:05 pm — April 19, 2024

-

10:28 am — April 19, 2024

-

10:17 am — April 19, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988