Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Slide with Weakening Iron Ore while Gold and Copper Rise

Market Close Update

The ASX 200 fell 59.1 points, or 0.76% lower, to 7763.2 points today as Miners were the worst-performing sector, down -1.8%, after a slump in iron ore futures over the weekend extended into trading today.

Iron ore futures in Singapore fell a further -2.2 % to $107.90 per tonne today after falling -3 % in the previous session amid growing concerns about Chinese demand and signs of oversupply.

BHP fell 2.1% to $43.48, mirroring similar falls in other iron ore majors, Fortescue and Rio Tinto.

Energy stocks fell 1.7%, with Woodside slipping 1.8% to $28.74 and Santos edging 2.1% lower to $7.82.

Brent crude slipped 1% in its final session of last week after rallying in previous sessions on concerns surrounding Hurricane Beryl in the Gulf of Mexico. The oil price drifted another 0.4% lower in trading today to $US86.18 a barrel.

Only Discretionary (+0.33%) and Tech (+0.29%) remained out of the red today, as nine other sectors fell.

While Gold miners were a bright spot in trading today as higher gold prices over the weekend helped buoy the XGD, which gained +0.96%.

Bitcoin and Crypto Continue to Slide

Bitcoin’s downward trend continues this week, following its worst weekly performance since August 2023, during which it fell by approximately 10%.

The cryptocurrency’s current slide has been attributed to two main factors:

#1. Mt. Gox repayment concerns: Investors are apprehensive about a potential influx of Bitcoin from the defunct Japanese exchange, Mt. Gox. According to Reuters, the exchange, which collapsed a decade ago, may soon begin returning Bitcoin to its creditors. These creditors are viewed as probable sellers, given that Bitcoin was valued at only a few hundred dollars when Mt. Gox failed in 2014.

#2 Profit-taking by leveraged holders: Following Bitcoin’s recent strong performance, some investors who had taken highly leveraged positions are expected to sell to secure their gains.

While both of these are speculative at this point, the trend for major cryptocurrencies has certainly been down in the past week. BTC has lost 12%, while Ethereum has fallen 15%.

Boeing Admits Criminal Fraud in Fatal 737 MAX Crashes

Aircraft manufacturing giant Boeing has agreed to plead guilty to criminal fraud conspiracy charges related to two deadly crashes involving its 737 MAX aircraft.

The plea agreement, which is pending approval from a federal judge, could hamper the company’s ability to secure government contracts in the future, although this is still a large unknown in the case.

The charges stem from two catastrophic accidents involving Boeing 737 MAX planes: one in Indonesia and another in Ethiopia. These crashes, occurring within a five-month span in 2018 and 2019, resulted in the deaths of 346 people. In the aftermath, families of the victims have been pushing for Boeing to face criminal prosecution.

As part of the settlement, the company will pay a criminal fine of US$243.6 million.

Boeing also agreed to invest at least $455 million over the next three years to strengthen its safety and compliance programs, according to the filing.

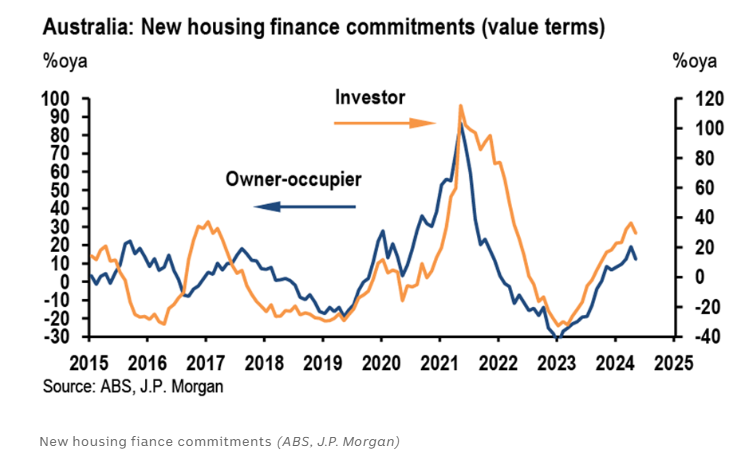

Housing market hints at weakness

The latest ABS data for new home loans was released today, showing further indications that Australia’s housing market is softening.

The total value of Aussies new housing loan commitments dropped -1.7% in May, well below the expected +1.8% growth economists had picked.

Both owner-occupier and investor loans were down, with investors falling -1.3%, while owners fell -2%.

Source: ABS

The drop surprised many, especially investor loans, which had steadily risen since around 2023.

J.P Morgan’s economist Jack Stinson commented that he thought the drop should be read with other indicators to read general weakness such as the falling clearance rates at auction.

“Both auction clearance rates and sales turnover, which are a good leading indicators of house price growth, have eased and suggest dwelling price growth will decline in 2H24.”

“The value of new owner-occupier loan commitments tends to follow house price growth reasonably closely, so we expect owner-occupier loan growth will soften relative to the heady pace at the start of the year.

“Investor loan growth may be a bit more resilient, with tailwinds still coming from elevated rental yields and greater borrowing capacity compared to owner-occupiers.”

Midday Market Update

The ASX is starting the week on a downward trend, primarily due to a sell-off in iron ore miners and energy stocks.

As of early trading, the ASX 200 has dipped 0.48%, to 7784.7 points. The mining sector is dragging down the index, following a weekend decline in iron ore prices.

Iron ore futures in Singapore dropped 3% to $US110.25 per tonne, with concerns about Chinese demand and potential oversupply. However, prices have stabilized somewhat in today’s Singapore trading, regaining 0.5%.

Energy stocks are also struggling, with the sector down 1.2%. Major players Woodside and Santos have both slipped around 1.4%.

This downturn comes despite a strong performance on Wall Street, where both the tech-heavy Nasdaq and the benchmark S&P 500 reached new record highs on Friday, fueled by US jobs data showing moderated hiring and an unemployment rate of 4.1% – the highest since 2021.

In response, traders have fully priced in two US rate cuts this year, starting in November, and increased the probability of a September reduction to 72%, up from 58% a week ago.

Interestingly, gold miners are bucking the downward trend, with four of the top five performers on the ASX 200 this morning being gold stocks.

Rex Minerals flys on Indonesian buyout offer

Rex Minerals [ASX:RXM], a South Australian copper and gold developer, has seen its stock jump by 61% in trading so far following a potential acquisition bid for $393 million.

The takeover offer is by MACH Metals Australia, a subsidiary of the influential Indonesian Salim family’s business empire. It’s worth noting that MACH Metals Australia already owns a 15.8% stake in Rex Minerals.

The proposed purchase price is 47¢ per share, representing a substantial 79% premium over Rex’s stock price prior to the announcement.

This offer has sparked intense investor interest in Rex Minerals, which holds two key assets: the Hillside project in South Australia and the Hog Ranch project in the United States.

The full details of the offer can be found here.

Ramelius Resources Hits Upper End of Guidance

Gold producer Ramelius Resources [ASX:RMS] has announced its gold output for the 2024 financial year, reaching just over 293,000 ounces.

This figure nearly meets the top end of the company’s upgraded guidance range of 285,000 to 295,000 ounces, which was revised earlier in the year.

Today’s update also said that its full-year all-in sustaining costs (AISC) are expected to be at the lower end of the previously communicated range of $1,550 to $1,650 per ounce.

The stock is up by +2.75% in trading this morning at $1.95 per share. Ramelius is expected to release its complete June quarter results later this month.

Market Open Update

The ASX 200 opened down -0.40% to 7,791.0 as the mega-cap miners and energy stocks dragged down the market this morning.

With Iron ore futures falling -3% over the weekend we’ve seen mining as the worst hit this morning, BHP -1.05%, Fortescue -1.75%, Rio Tinto -1.5%.

So far, Tech has been the bright spot, with the sector up +0.3%, with Wisetech gaining +1.2% and NextDC +0.6%.

Encounter Resources continues its meteoric rise, up +15.75% in trading so far today. This stock has jumped an incredible +141.5% in the past month alone.

Gold stocks are also having a good morning, with most midcaps gaining this morning.

Grosvenor Coal Mine Fire: Update

An underground fire at Anglo American’s Grosvenor coal mine in central Queensland continues to burn more than a week after ignition. The blaze, sparked by a methane leak and subsequent explosion, remains active despite containment efforts.

Anglo American reported progress in their containment strategy over the weekend. In a statement released on Facebook, the company announced:

“We have now sealed shaft 5, which was our last major source of oxygen ingress. This means the mine continues to move to a more stable position.”

Anglo American has committed to paying full-time employees and embedded contractors through the end of August.

However, the mine’s shutdown is expected to be prolonged. A similar incident in May 2020 led to a nearly two-year closure of the mine.

On the ASX, we’ve seen strong gains from local coal producers, with Yancoal up +10.7% and Whitehaven gaining +17.25% in just a week.

Click through the top symbols below to see some of the gains seen in the past 3 months.

Morning Market Update

Good morning. Charlie here,

As we kick off another week of trading, the ASX 200 appears poised for a subdued opening, with futures pointing to a slide at opening. That’s despite a strong finish on Wall Street last Friday, with both the S&P 500 and Nasdaq reaching new highs, the ASX futures are currently trading down 0.1%.

The lacklustre start may be attributed to a late slide in iron ore prices during Friday’s session, with mining megacaps likely to drag things down.

While the global markets painted a largely positive picture last week, with the MSCI global index closing at a record high, the ASX seems to be marching to its own beat this morning.

Wall Street was buoyed by strong performances from tech heavyweights Teslsa (+2.0%), Meta (+5.8%), Alphabet (+2.4%), and Amazon (+2.1%) as well as encouraging jobs data that hinted at potential rate cuts this year.

However, it’s not all doom for the Australian market, gains in other commodities like copper and gold over the weekend could provide some support. Gold’s recent uptick (although down slightly this morning), driven by U.S. dollar weakness, might offer a silver lining for Australian gold miners in trading this week.

| Name | Value | % Chg | |

|---|---|---|---|

| Major Indices | |||

| S&P 500 | 5,567 | +0.54% |

| Dow Jones | 39,375 | +0.17% |

| NASDAQ Comp | 18,352 | +0.90% |

| Russell 2000 | 2,026 | -0.49% |

| Country Indices | |||

| UK | 8,203 | -0.45% |

| Germany | 18,475 | +0.14% |

| Japan | 40,912 | Flat |

| Hong Kong | 17,799 | -1.27% |

| Euro | 4,979 | -0.16% |

| Name | Value | % Chg | |

|---|---|---|---|

| Commodities (USD) | |||

| Gold | 2,386.26 | -0.23% | |

| Silver | 31.14 | -0.31% | |

| Iron Ore | 110.25 | -3.00% | |

| Copper | 4.6616 | +0.01% | |

| WTI Oil | 83.23- | -0.24% | |

| Currency | |||

| AUD/USD | 67.47¢ | Flat | |

| Cryptocurrency | |||

| Bitcoin (USD) | 56,416 | -3.50% | |

| Ethereum (USD) | 2,940 | -4.45% | |

Key Posts

-

4:36 pm — July 8, 2024

-

4:23 pm — July 8, 2024

-

3:39 pm — July 8, 2024

-

2:14 pm — July 8, 2024

-

12:09 pm — July 8, 2024

-

11:39 am — July 8, 2024

-

11:30 am — July 8, 2024

-

10:46 am — July 8, 2024

-

10:00 am — July 8, 2024

-

9:47 am — July 8, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988