Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Set for Sharp Fall as Commodity Prices Retreat

Market close update

The ASX closed down by over a per cent today, succumbing to the shift in sentiment seen on Wall Street as markets adjusted to interest rate expectation shifts thanks to the latest PMI data.

The ASX 200 finished the session down -1.08% at 7,727.6. That put the ASX 200 down -1.95% for the week.

Some could consider today’s reaction excessive considering the revisions we’ve seen in past PMI data, but perhaps last night’s sell-off was pre-primed with the FOMC meeting notes which showed the Fed concerned about lumpy inflation rising again.

Again traders pushed back their expectations of cuts this year, sending treasury yields higher and squeezing equity markets.

On the wider Aussie benchmark, all eleven sectors closed in the red, with Discretionary the hardest hit, falling -2.45%.

In individual stock performances, Playside Studio was one of the notable top performers on the wider ASX, finishing the session up 9.5% trading at 92.50 cents per share as it announced a new agreement with Warner Bros Interactive to develop a Game of Thrones video game.

Accent Group was also a strong performer today, closing up +5.13% to trade at $1.85 per share after posting better-than-expected FY24 half-year results.

Meanwhile, today’s laggard was Fletcher Buildings which closed down -6.10% trading at $2.77 per share.

The generational divide of the cost of living crisis

Here is an interesting chart from the Head of Investment Strategy & Chief Economist for AMP, Shane Oliver.

Below we have the Commonwealth Bank’s credit and debit card transaction data which highlights just how much younger Australians are cutting back spending compared to their baby boomer parents.

With retail spending still anemic in Australia there may need to be a discussion on how to recover a lost generation’s wealth.

CBA credit and debit card transactions data shows real spending cuts continue to be skewed to younger age groups reflecting the relative hit of higher mortgage rates and rents on their disposable income versus older age groups.

(CBA and chart via Macquarie Macro Strategy) pic.twitter.com/iFvg5IPil2— Shane Oliver (@ShaneOliverAMP) May 24, 2024

Goldman Sachs says RBA cuts could come sooner

According to economists at Goldman Sachs, the money market’s pricing for Australian interest rate cuts over the next 12 months is ‘too conservative‘.

They predict that cooling inflation and rising unemployment will compel the Reserve Bank of Australia (RBA) to act sooner than anticipated by the market.

While traders expect the RBA to maintain the cash rate at the current 4.35% for approximately another year, with the first cut projected in July 2025, Goldman Sachs forecasts three rate reductions by then, bringing the cash rate down to 3.6%.

‘Financial markets are pricing too shallow of an easing cycle over the medium term,’ stated the Goldman Sachs economists in a research note.

‘Our base case is for the RBA to start easing in November 2024, following softer inflation data over the coming quarters, an ongoing cooling in the labour market, and the likelihood of easing cycles across key G-10 peers.’

The RBA has held its cash rate at a 12-year high at 4.35%, where it’s been since last November.

While the Central Bank has maintained that its next move will be data-dependent, with inflation still above the 2-3% target, it has also signalled that the bar for any further increases is quite high.

When the next cuts actually arrive is likely tied closely to unemployment levels, but it’s also worth noting that Australia’s retail sales volumes have declined in five of the past six quarters.

Another point to note is the position that some analysts and notably many AFR writers have maintained, which is the risk of re-accelerating inflation is higher than many expect.

The Goldman team disagreed, saying:

‘The latest high-frequency data and our bottom-up analysis leave us confident that the underlying disinflationary trend remains in place.‘

Goldman Sachs noted that the rise in mortgage rates for Australians has outpaced global peers in both speed and magnitude.

‘This mirrors the signal from our proprietary measure of financial conditions, which has tightened further in the past month alongside the rise in the real trade-weighted currency and remains a materially larger headwind to growth than in the US.’

Market update

Australian shares stumbled today, weighed down by declining commodity prices and a Wall Street selloff.

The ASX 200 shed 1.18% as investors digested weakness in these commodity and key export markets.

Iron ore futures dipped below $119 per tonne, while gold prices retreated under $2,340 an ounce amid rising bond yields and diminishing bets on U.S. rate cuts.

The moves dragged on major resource stocks, with mining giant BHP falling -0.3% to $44.74. Mineral Resources lost -2.8%, and gold miner Emerald Resources declined -4.35% to $3.68.

Elsewhere, the yield on 10-year Australian government bonds jumped 9 basis points to 4.36%, pressuring interest rate-sensitive technology and banking shares. Commonwealth Bank dropped -1.9%, and National Australia Bank fell -1.7%.

The overnight U.S. session saw all major indexes finish lower as stronger-than-expected purchasing manager data stoked fears of a longer rate hike cycle.

In news today, filings revealed fund manager Perpetual increased its stake in embattled casino operator Star Entertainment to 8.8% on May 21 amid takeover interest. Star shares were flat at 48 cents. Online labour firm Appen jumped 4.3% after forecasting an operating breakeven in fiscal 2024.

Ethereum passes first regulatory hurdle for spot ETF

Ethereum [ETH] has bounced back after a brief dip yesterday as the Securities & Exchange Commission (SEC) approved the first section of filing for spot ETH ETFs.

In a surprising u-turn, US lawmakers had written to SEC chair Gary Gensler asking him to approve the ETFs while similar discussions were occurring with regulators in Hong Kong.

Mr Gensler who is well known as an anti-crypto bulldog appears to have caved to the first stage of approval.

When asked by reporters to preview the SEC’s decision last night, Mr Gensler declined to comment.

The nitty-gritty of the filing is rather dull but significant for moving forward.

The agency has approved eight 19b-4s filings for spot ETFs, including BlackRock, Bitwise, Grayscale, Van Eck, Ark 21 Shares, Fidelity, Fraklin Templeton, and Invesco Galaxy.

The 19b-4 filings are what national exchanges like the NASDAQ or the New York Stock Exchange (NYSE) submit to the SEC to seek approval for listing new products on their platforms.

Fidelity and Grayscale also notably updated their applications to remove any language related to staking. Many people have weighed in saying that the SEC would likely reject applications that include the feature as Mr Gensler and others strongly oppose the idea.

Before the spot ETH ETFs can be officially approved and launched the SEC must approve another regulatory filing known as S-1.

That filing could be weeks or maybe even months from now, the details of that are still unknown but could become clearer in a week or so.

Appen shares rise after positive GM

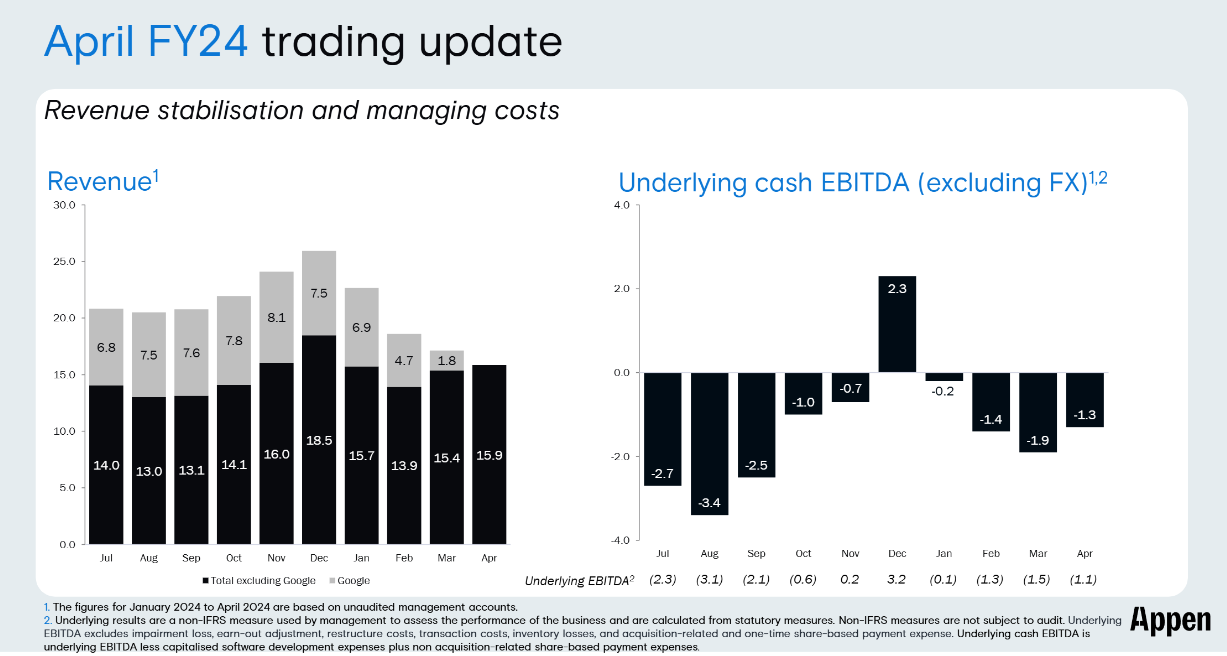

Shares in online labour hiring platform Appen [ASX:APX], saw its stock rise by 5.9% after informing investors at the annual general meeting that it anticipates achieving operational break-even in the financial year 2024.

This was after a disappointing result in FY23 where the company saw revenues decline by around 30% to $273 million.

The company also announced a series of initiatives to capture ‘market opportunity’ around AI, saying that generative AI would have a ‘significant impact on Appens total addressable market’.

For FY24 group level revenue fell again. The company said this was due to a termination of its Googe contract, which ended on 19th March.

Excluding Google, the company said revenues had stabilised and that they were ‘pleased to see revenue levels in March and April that are well above the non-Google revenue in Q3 2023′.

For FY24 outlook the company expects to reach cash EBITDA positive on a run-rate basis in the early second half of FY24.

Source: Appen

Playside Studios shares up on new deal with Warner Bros

Melbourne-based video game developer Playside Studios [ASX:PLY] shares are bucking the downtrend this morning as the company announced a new agreement with Warner Bros Interactive to develop a Game of Thrones video game.

Playside is Australia’s largest game developer and is known for its multi-platform production which includes VR and mobile games.

Recently it has made concerted steps into the PC and console video game market as it moves to create larger titles.

Playside’s CEO, Gerry Sakkas said today:

‘This agreement is a groundbreaking moment for PlaySide, the culmination of years of effort building relationships with Hollywood studios and investing in our PC and Console development expertise. It is also consistent with our plans to develop larger titles.’

The studio said the development will begin immediately and a joint announcement on details of the game will be released in the first half of calendar 2024.

The company’s shares are up by 138% in the past 12 months and are currently trading at 89.5 cents per share.

PYC Therapeutics jumps in early trading

PYC Therapeutics [ASX:PYC] is quick out of the gate this morning, with its shares up by 8.70% as the company announced progress in its drug pipeline.

PYC has today received an Orphan Drug Designation (ODD) from the US Food and Drug Administration (FDA) giving the company several benefits as it progresses through clinical trials.

ODD is given to drug candidates designed to treat rare diseases. Benefits of an ODD include tax credits for qualified clinical trials, exemptions from some regulatory fees and the potential for 7 years of market exclusivity post-approval.

The designation is for the drug candidate known as PYC-001 for the treatment of a rare form of vision loss. The drug is set to commence a phase 1 clinical trial for patients with a blinding eye disease called Autosomal Dominant Optic Atrophy (ADOA) later this year.

Autosomal Dominant Optic Atrophy (ADOA) is a progressive and irreversible blinding eye disease. ADOA affects approximately 1 in every 35,000 people representing a market size

of ~$2 billion per annum according to PYC.

PYC’s shares are up by 120% in the past 12 months and are currently trading at 12.5 cents per share.

Morning market update

Good morning. Charlie here,

The ASX 200 is down by -0.43% to 7,778.1 as investors took profits in the continued pullback in commodity prices. We also saw a strong pullback on Wall Street as treasury yields climbed after two data points rumbled markets.

Precious metals were down over -2%, while Iron ore futures and natural gas also retreated sharply overnight.

Traders again pushed back their expectation of cuts as both the Fed’s minutes and a surprise to the upside in PMI data hinted at remaining strength in the US economy.

The US S&P Global Composite PMI rose to 54.4 in May’s flash estimate, up from 51.3, indicating that business activity in the US private sector continued to grow.

Meanwhile, the S&P Global Manufacturing PMI increased to 50.9 from 50.0 over the same period, signalling an expansion in the manufacturing sector. Additionally, the S&P Global Services PMI rose to 54.8 from 51.3.

This has been absorbed by traders as another reason the Fed is likely to keep rates on hold even though the beat wasn’t by much.

In other news, Nvidia saw a US$218 billion dollar rally after it opened trading, crossing over the US$1000 mark for the first time. The company’s shares finished the session up by nearly 10% at US$1,037.99 per share.

Wall Street: S&P 500 -0.74%, Dow -1.53%, Nasdaq -0.39%.

Overseas: FTSE -0.37%, STOXX -0.25%, Nikkei +1.26%, SSE -1.33%.

The Aussie dollar fell -0.21% to US 66.05 cents.

US 10-year bond yields +5bps to 4.48%.

Australian 10-year bond +2bps to 4.30%.

Gold fell -2.06% to US$2,333, while Silver fell -2.32% to US$30.2.

Bitcoin fell -1.83% to US$67,899, while Ethereum rose +0.68% to US$3,764.

Oil Brent fell -0.18% to US$81.51, while WTI Crude fell -0.1% to US$76.91.

Iron ore fell -0.74% to US$119.90 a tonne.

Key Posts

-

4:36 pm — May 24, 2024

-

2:56 pm — May 24, 2024

-

2:40 pm — May 24, 2024

-

2:05 pm — May 24, 2024

-

11:45 am — May 24, 2024

-

10:45 am — May 24, 2024

-

10:34 am — May 24, 2024

-

10:23 am — May 24, 2024

-

10:05 am — May 24, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988