Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Rise with Earnings Season in Full Swing; JB-HiFi in Focus

Market close update

The Australian sharemarket saw its fifth day of gains, buoyed by a better-than-expected earnings report from JB Hi-Fi in a busy week of corporate results.

The ASX 200 added 36 points, or 0.46%, to 7,813.7 at the closing bell, tracking a rebound on Wall Street as global markets continue to stabilise after last week’s heavy falls triggered by US recession fears.

On the ASX, nine out of the 11 sectors are trading in the green, led by the consumer discretionary and information technology sectors, both increasing by 1.9%.

Technology stocks were also among the best performing as sector heavyweight WiseTech climbed 2.7% to $91.90. Xero gained 1.4% to $133.62.

JB Hi-Fi jumped 8.3% to $72.98 after the goods retailer declared a special dividend of 80¢ a share and reported better-than-expected profits, albeit with low expectations already set.

Meanwhile, the heavyweight materials sector recorded losses, tracking a lower iron ore price. Iron ore futures slumped 2% to $US98.80 a tonne on the Singapore exchange. BHP Group lost 0.5% to $40.64, while FMG fell -1.08%.

Other Stocks in focus: Online vehicle marketplace business CAR Group rose 4.5% to $35.14 after reporting a 41% jump in revenue to $1.1 billion for FY24.

Rail haulage group Aurizon lost 8.8% to $3.30 after it posted a soft FY25 guidance.

Beach Energy shares tumbled 12.6% to $1.245 after a big downgrade at its new Enterprise gas field in south-east Australia. The mid-cap oil and gas producer also swung to a full-year net loss of $475.3 million, down from a $400.8 million net profit the previous year.

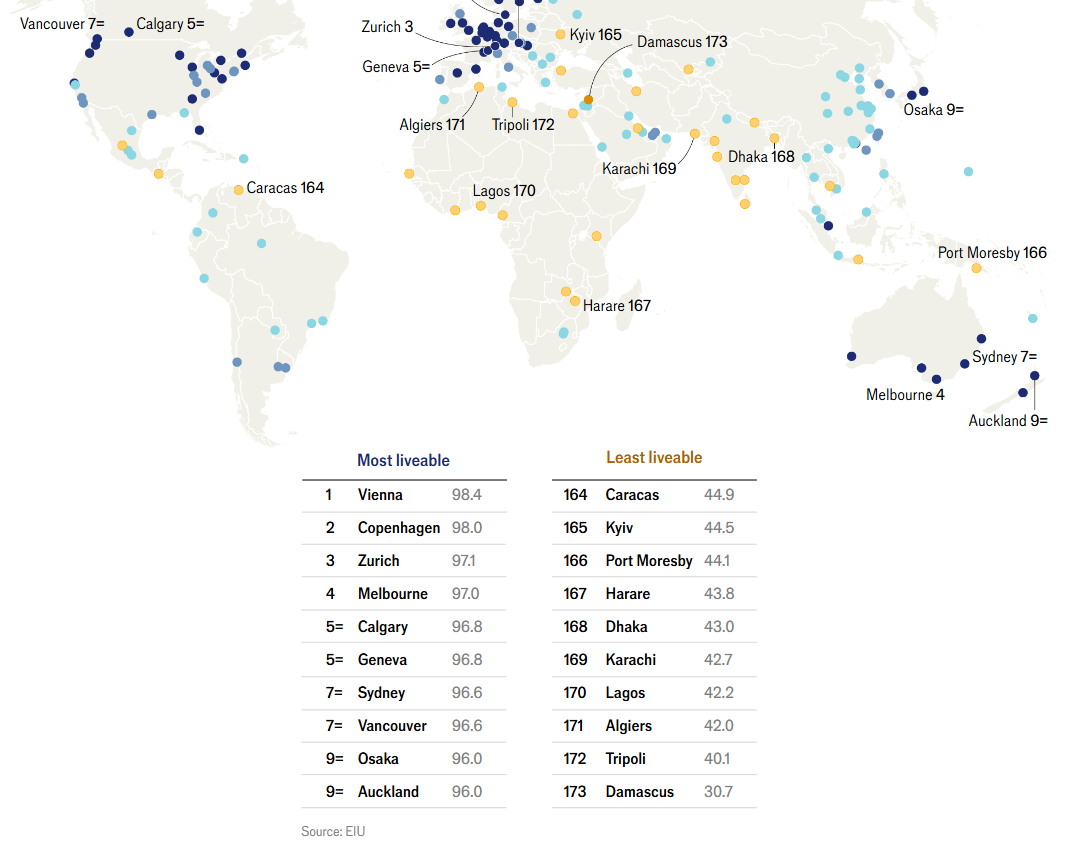

The Economist releases its ‘world’s most livable cities list’

Here is this year’s list of the most livable cities in the world.

The list, which is released every year, has seen Australian cities in its top 10 for many years.

However, during the pandemic, many lost their top positions.

In the 2024 list, Melbourne came in at number 4, while Sydney was 7th, which is equal to Vancouver.

Source: The Economist

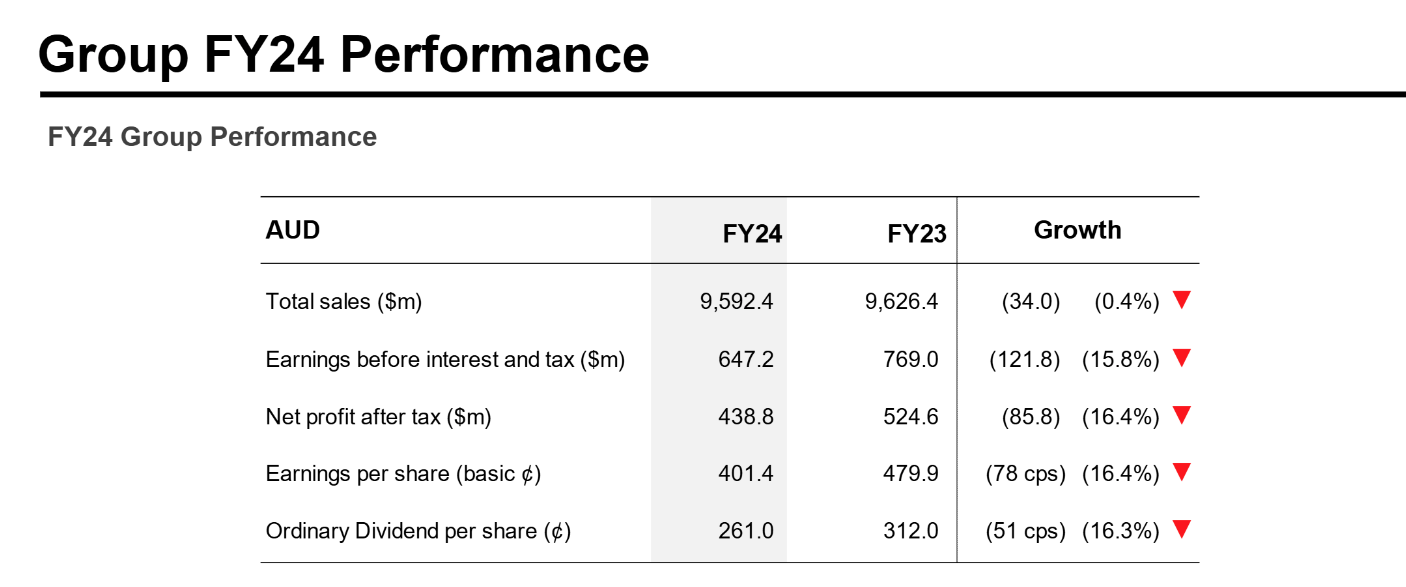

JB HiFi Stocks rise despite weakness in reporting today

JB Hi-Fi’s [ASX:JBH] financial report today was a fairly mixed bag overall.

The reporting revealed a slight dip in total revenue and more substantial declines in earnings and dividends.

Despite these seemingly weak results, the company’s stock surged nearly 10% this morning, with the stock now easing back to +8.6%, trading at $73.18 per share. Today’s gains push its 12-month share price moves above +55%.

So what did the market see beyond these results?

Source: JB HiFi

This surprising market reaction can be attributed to several factors. Firstly, the company announced an 80 cent special dividend that more than compensated for the reduced ordinary dividend.

Probably more importantly, the financial results (though negative), outperformed market expectations, with net profit exceeding consensus by about 4%.

The company also gave a more positive outlook ahead, reporting solid trading in July, with like-for-like sales growth in its Australian division significantly outpacing the previous half-year’s performance.

Group CEO, Terry Smart said:

“We are pleased to report our FY24 results, with sales remaining solid thanks to the strength of each brand’s core categories. In this tough retail environment where customers are seeking value, our brands continue to resonate strongly driven by the trust customers have in our low–price best value proposition.”

Midday market update

The ASX 200 is up by +0.59% at 7,823.6, with 9 of the 11 sectors gaining today as a busy reporting season is now in full swing.

Discretionary stocks lead today as strong earnings from JB HiFi have seen their stock rise by +8.61% in trading so far today.

While other earnings today have widely disappointed, with Beach Energy (-11%) and Aurizon Holdings (-7.8%) both dropping sharply after downgrades.

On the benchmark today, we’ve seen solid gains from the Big Four banks, with ANZ gaining +1.2%, ComBank and Westpac up +0.83%, and NAB gaining +1.35% so far today.

Beach Energy plummets following reserves downgrade

Beach Energy’s [ASX:BPT] shares have sharply declined following a significant downgrade in its new Enterprise gas field located in southeast Australia.

Enterprise, situated 3.5km from Port Campbell, had been touted by Beach as a crucial new gas source that would support the East Coast market for years to come.

But today, Chief Executive Brett Woods expressed his extreme disappointment in having to deliver further bad news on the site, particularly given that the company had already reported reserve revisions just two months prior.

Enterprise, which only began production in June, had been downgraded by approximately 34%, with Managing Director and Chief Executive Officer Brett Woods, explaing today:

‘Disappointingly, over recent weeks we have observed pressure decline at Enterprise which is consistent with a smaller reservoir than originally estimated. We have moved rapidly to assess the impact. This has resulted in a reserves revision which has been included in our annual reserves statement and audited by external experts. There is no impact to production guidance [for FY25].’

Enterprise gas volumes were reduced by 11.5 million barrels of oil equivalent (compared to the initial reserve estimate of 34 million boe). The news caught investors off guard, prompting an immediate sell-off of Beach shares in early trading.

For the full results presentation, click here.

Beach Energy shares are currently down by -11%, trading at $1.26 per share.

Market Update

G’day, Charlie here.

The Australian share market is climbing today despite Wall Street’s weaker lead on Friday, as most major benchmarks posted modest gains.

The ASX 200 opened around +0.5% and has maintained much of that lead throughout this morning’s trading, with it currently sitting up +0.49% at 7,815.8.

Around midday today, we’re seeing nine of the eleven sectors in the green, with the Discretionary sector leading the charge, up +1.55% thanks to strong reporting by JB HiFi, which we will cover shortly.

Prices remain weak across most major commodities as fears of slower global growth continue to press on industrial metals and even precious metals in today’s session.

Crude oil is gaining this session after Israel’s recent airstrike on a school-turned-shelter killed at least 80 and has hurt hopes of a near-term ceasefire in the region.

Looking ahead this week, we have a big decision day for the RBNZ on Wednesday, which could be their first cut. as well as inflation data from the US and UK that evening.

On Thursday, we have more Chinese retail data and industrial production as well as retail sales data from the US.

Finally on Friday we will have Japan’s latest GDP data which could further impact the yen, something that is being closely watched by traders at the moment.

| Name | Value | % Chg | |

|---|---|---|---|

| Major Indices | |||

| S&P 500 | 5,344 | +0.47% |

| Dow Jones | 39,497 | +0.13% |

| NASDAQ Comp | 16,745 | +0.51% |

| Russell 2000 | 2,0.80 | -0.17% |

| Country Indices | |||

| UK | 8,168 | +0.28% |

| Germany | 17,722 | +0.24% |

| Euro | 4,675 | +0.14% |

| Japan | 35,025 | +0.56% |

| Hong Kong | 17,025 | -0.38% |

| Name | Value | % Chg | |

|---|---|---|---|

| Commodities (USD) | |||

| Gold | 2,425.05 | -0.25% | |

| Silver | 27.24 | -0.82% | |

| Iron Ore | 98.80 | -2.22% | |

| Copper | 3.9655 | -0.69% | |

| WTI Oil | 77.036 | +0.25% | |

| Currency | |||

| AUD/USD | 65.74¢ | +0.03% | |

| Cryptocurrency | |||

| Bitcoin (USD) | 59,036 | -3.39% | |

| Ethereum (USD) | 2,575 | -1.64% | |

Key Posts

-

4:42 pm — August 12, 2024

-

4:04 pm — August 12, 2024

-

2:21 pm — August 12, 2024

-

1:03 pm — August 12, 2024

-

12:45 pm — August 12, 2024

-

12:15 pm — August 12, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988