Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Rise while Gold Breaks New Record High

Market close update

The ASX 200 closed the session up +0.31% to 7,848.5 in a relatively subdued session as markets anxiously await US CPI data which is due tonight AEST.

Little changed from midday with eight of the eleven sectors in the green, with Real Estate (+1.18%) and Health Care (+1.03%) leading today.

Beyond that on the ASX, we saw strong performance in the mining sectors as Gold continued to touch fresh highs, while Iron ore prices continued to recover from their brief stint below US$100 per tonne.

The current price of Iron ore futures on the Singapore exchange is US$106.35, falling 1.07% through the session today, but markedly better than last week as Chinese demand starts to rise.

According to ANZ strategists Brian Martin and Daniel Hynes, ‘April and May are China’s busiest period for construction. Output from some blast furnaces is already starting to pick up in anticipation.’

Tomorrow expect the mood of the market to be determined by the CPI print and resulting US treasury prices, until then have a great evening.

Silvercorp accepts Perseus’s offer for OreCorp

Perseus Mining [ASX:PRU] announced today that Canadian Silvercorp Metals has finally accepted the off-market takeover bid for the Tanzania-based gold hopeful OreCorp.

The deal is worth $270 million, and will see Silvercrop give up a 15.6% OreCrorp stake, bringing Perseus’ total interest to just shy of 75%

The moves came after Perseus declared the latest offer ‘best and final’ on Monday this week. They went on to say:

‘The offer provides compelling benefits and value to OreCorp shareholders, as well as the opportunity for OreCorp shareholders to realise certain and expedited value for their OreCorp shareholdings.’

‘Senior executives from Perseus are scheduled to visit Tanzania in the very near future to continue the process of building relationships in country with key government and industry stakeholders as well as existing employees and associates of OreCorp and to prepare the way for the commencement of the development of the Nyanzaga Gold Project.’

Perseus has seen its shares fall by -2.16% in trading today, trading at $2.27 per share.

Market update

Sorry for the late reply, I was just in a meeting that went long exploring new ideas to bring to our readers so stay tuned.

The ASX 200 is up by +0.31% to 7,848.5 this afternoon as eight out of the eleven sectors are in the green.

Healthcare (+1.12%) and Materials (+1.02%) lead today while Financials (-0.50%) and Tech (-0.75%) are the major drag on the benchmark today.

The biggest gainers so far today on the ASX 200 are Stanmore Resources up by nearly +6%, followed by Sigma Healthcare gaining +5.4%.

Leading the losses today on the major benchmark is Westgold Resources, down -5.25%, reversing much of the gains seen since its April 2nd peak of $2.77 to trade at $2.08 per share.

Drubber pulls rip cord in emergency move

Call recording software company and rising junior on the tech ASX Dubber Corp [ASX:DUB] has come out of its radio silence with a bang.

The company has been in a trading halt since early March after announcing that it had uncovered the disappearance of $30 million of company money.

The money which was meant to be held by a third party trustee in a term deposit, now appears after an internal investigation to have been ‘misused by either or both the Company’s Managing Director and CEO Steve McGovern and the trustee.’

In the update today the board went on to say:

‘From the investigation conducted to date, it is alleged that Mr McGovern and the trustee were likely involved in the unauthorised use of those funds, including for purposes which were not for the company’s benefit.’

As of today, the company has sacked Mr McGovern who was previously suspended. The board also expects further investigations will continue in efforts to return the lost funds.

Executive Director Peter Pawlowitsch will remain in the role of acting CEO until a permanent CEO is found.

In a stunning turn, the company has now released a cash call of $24 million in its attempts to raise the cash lost.

The raise will include a $3.1 million placement and a $20.9 million accelerated non-renounceable rights issue on a one-for-one basis.

The offer is an amazing 77.3% discount to the last traded price of 22 cents, at only 5 cents per share.

Bitcoin and major cryptos drop in the runup to the halvening

The price of Bitcoin and Ethereum dropped back overnight as market volatility returned to cryptocurrencies.

Bitcoin is down -3.22% to US$68,730, while Ethereum is down -5.26% to US$3,481.

After an incredible run-up in the post-ETF approvals at the beginning of 2024, the next major crypto event is just 10 days away.

Here is what Bitcoin looks like on a monthly basis:

Source: TradingView

This incredible run might not be done as we now look towards the next major event, The Halvening. What’s that?

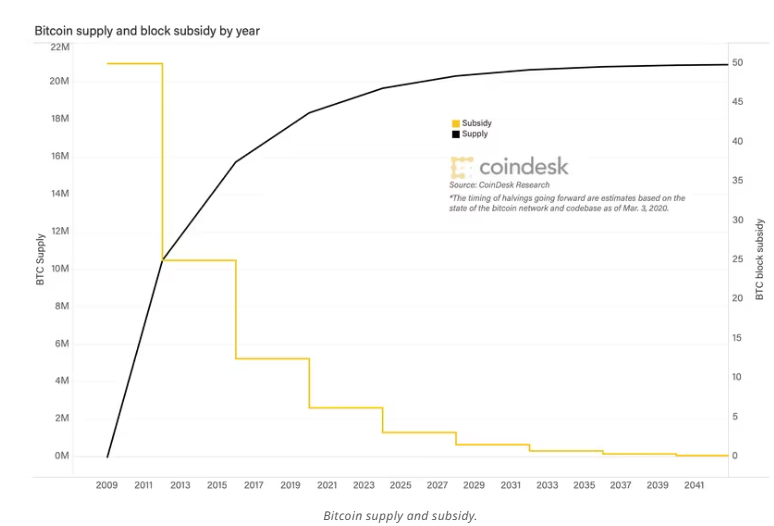

In the Bitcoin network, user transactions are grouped in blocks and recorded to a digital public ledger called a blockchain. Miners are in charge of this task and receive a mining reward in the form of bitcoins for each recorded block.

The amount of bitcoins rewarded for each block decreases with time: it is halved every 210000 blocks or roughly 4 years. This event, the moment when the mining reward is divided by 2, is commonly called ‘Bitcoin halving’ or ‘The Halvening’.

When Bitcoin was created in 2009, the initial reward was 50 bitcoins. In November 2012, it dropped to 25 BTC after the first halving. Then, it reached 12.5 BTC after halvening #2 in July 2016. Halvening #3 brought it down to 6.25 BTC.

Source: Coindesk

Source: Coindesk

So if you’re not a miner why does The Halvening matter to you?

This reduction of supply in the past has predictably put pressure on the price of BTC and led to the start of bull runs in the past.

Our local Cryptocurrency expert Ryan Dinse has been predicting this moment as well as prior moves from the coin and he has a collection of crypto’s that he thinks will also benefit from these latest moves.

He’s hosting a major event on the 15th of April to highlight to readers what coins he thinks are worth your time before the big day.

Click here to learn how to sign up for the FREE event and ride the wave of the 4th Halving.

Morning market update

Good morning. Charlie here,

The ASX 200 opened up +0.38% to 7,854.2 following Wall Street’s moves overnight that saw modest gains across most sectors except financials as markets there await critical US CPI data that is due tonight AEST.

S&P 500 closed at best levels from starting session lows of -0.80% as the battle between bears and bulls continues over the Fed’s timing and depth of potential interest rate cuts.

JP Morgan’s CEO Jamie Dimon’s gargantuan letter to shareholders was released yesterday. In it the market veteran said he was ‘prepared for a wide range of interest rates, from 2% to 8%, or even more’ he cited a range of ‘persistent inflationary pressures’ that were weighing on the economy, such as higher energy costs, and climbing defence spending in the face of geopolitical risks.

He also spoke out on the market’s obsession with monthly inflation figures that— as we have noted here many times— tend to be lumpy and not worth delving into too deeply.

For us, the market reaction to tonight’s CPI print will again be a similar dance between new Fed rhetoric and market knee-jerk moves.

In commodities, almost all energy commodities are down today, while precious metals continue to climb, with gold touching a new record high of US$2,365.09/oz while industrial metals like Iron ore and Platinum continue to recover.

Wall Street: S&P 500 +0.14%, Dow flat, Nasdaq +0.32%.

Overseas: FTSE -0.11%, STOXX -1.09%, Nikkei +1.08%, SSE flat.

The Aussie dollar rose +0.35% to US 66.28 cents.

US 10-year bond yields -6bps to 4.36%.

Australian 10-year bond yields -9bps to 4.11%.

Gold rose 0.66% to US$2,354.18, while Silver rose 1.00% to US$28.16.

Bitcoin fell -3.5% to US$69,129, while Ethereum fell -5.12%% to US$3,05.

Oil Brent fell -0.87% to US$89.59, while WTI Crude rose +0.16% to US$85.37.

Iron ore rose +0.33% to US$106.20 a tonne.

Key Posts

-

4:37 pm — April 10, 2024

-

4:29 pm — April 10, 2024

-

3:08 pm — April 10, 2024

-

11:34 am — April 10, 2024

-

11:21 am — April 10, 2024

-

10:16 am — April 10, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988