Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Rise; Telstra, Origin, Wesfarmers and Treasury Wines Report

Wesfarmers shares rise

Bunnings owner Wesfarmers [ASX:WES] held steady in the first half of the financial year, reporting stable profit and revenue despite a softening outlook for its lithium division.

Net profit climbed 3% to $1.4 billion for 1H24, while revenue edged up 0.5% to $22.7 billion.

The retail division saw solid growth in sales at Kmart, gaining 7.8%, while Target saw its sales fall -5.1% over the same period.

Officeworks and Bunnings sales saw marginal gains, up 1.8% and 1.7% respectively.

Wesfarmers’ foray into battery minerals has so far not paid off for the group, with low lithium prices weighing on their performance.

Their lithium division WesCEF saw sales fall 21.2%, with their report saying:

‘At current spodumene prices,sales will not contribute positive earnings in FY24 due to the higher cost of production while volumes ramp up towards full capacity.’

Treasury Wines shares up despite troubled profits

Penfolds owner Treasury Wines [ASX:TWE] shares are currently trading at $11.36, up by 2.7% today after the company’s latest half-year earnings.

TWE saw earnings before interest and taxes fall 5.8% compared to the PCP at $289.8 million. Its EBITS margin also fell slightly, down 1.4 points to 22.6%.

Net profit after tax also fell 5.9% to $182.3 million, as its budget brands saw lower volumes from cash-strapped consumers.

Chinese tariffs have also weighed heavily on the company as the Penfolds brand was popular among Chinese consumers.

TWE say they hope the tariffs to be lifted by March this year, but so far, we haven’t heard any talk of progress.

A brighter spark in Treasury’s portfolio was its luxury brands. The company has seen continued positive momentum in its brands in America, with its NSR per case increasing 9.1% as it continues to invest toward the more expensive end of the market.

TWE completed the acquisition of DAOU for US$900 million, a large brand within the US Napa Valley wine region.

Telstra trims guidance

Telecom giant Telstra is down by 1.50% today, trading at $3.93 per share as it cut its full-year guidance in the midst of a revamp.

The company is targeting cost reductions of up to $500 million by FY25 with a big overhaul of its IT operations and spending.

For the 1H24, Telstra saw EBITDA of $4.0 billion, up 3.8%, while full revenues were $11.7 billion, up 1.2%.

Net profits came in at $1.0 billion, up 11.5%, giving it 8.4 earnings per share, a 12% gain.

While the profits looked positive, the company was honest about its struggles in Network Applications & Services (NAS), saying revenues were ‘far away from where they needed to be‘.

NAS were impacted by competition and technology change, with revenues down in the half as enterprises failed to renew.

Telstra said it expected the rate of decline to slow but still trimmed its FY24 guidance.

Full-year guidance was dropped to $8.2-8.3 billion from its prior $8.4 billion top.

Unemployment rises

Australia only added 500 jobs in January, following a drop of 65,100 in December.

The jobless rate rose to a seasonally adjusted rate of 4.1% from 3.9% this month with 22,300 extra unemployed people.

The expectation was for 30,000 new jobs created and for unemployment to only rise to 4%.

While the month-to-month data is often noisy and hard to draw too many conclusions from, it is safe to say the first signs beyond consumer spending show the economy is straining.

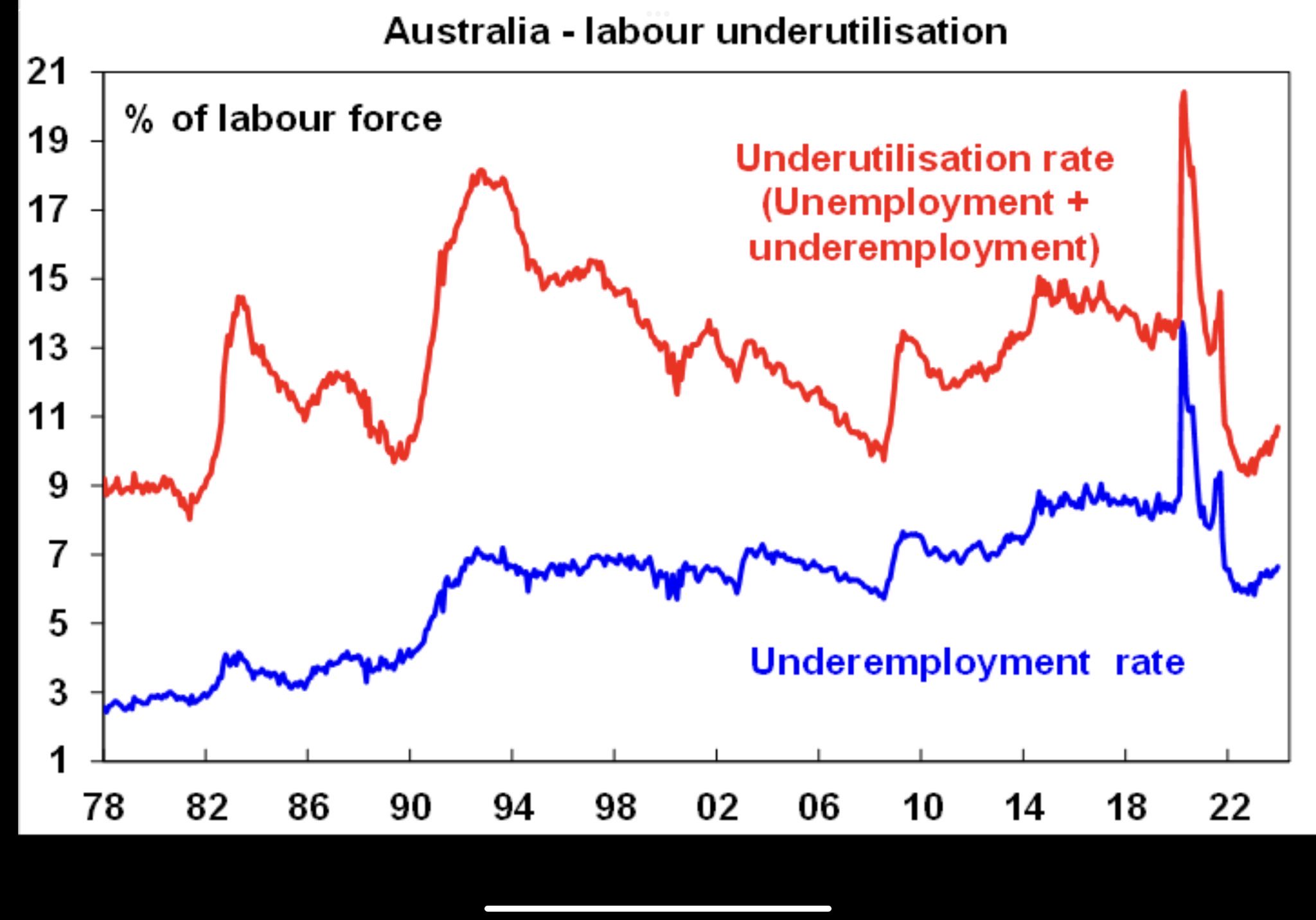

Here is what the underutilisation rate looks if we zoom out a bit.

Source: ABS.

Leading indicators like job placer sites SEEK, and Indeed both have data that show job vacancies are falling and rising applicants per job.

With unemployment starting to shift we are now well up from its low of 3.4% in October 2022.

This picture definitely looks like one where the RBA will need to cut this year.

Midday market update

The ASX 200 is up by +0.65% to 7,596.9 around midday as the market bounces from yesterday’s heavy selloff.

Eight of the eleven sectors are in the green around noon, with Tech, the biggest gainer, up 5.88%, followed by Discretionary, +2.57%.

After announcing it will be acquired by Japanese microchip maker Renesas, the Aussie software company Altium is the big carrier for the tech industry today.

Altium is up by 28.33%, trading at $65.78 per share today, giving an implied value of $9.1 billion for the company.

In bigger macro news, Australia’s unemployment rate has ticked up more than expected. Reaching 4.1%, more on this soon.

Origin Energy Reports

Ex-takeover target Origin Energy [ASX:ORG] reported its first earnings since the offer from North American consortium Brookfield-EIG fell through.

Shares are up by +2.74% this morning, trading at $8.80 per share as the company reported half-year results.

The energy giant posted a statutory profit of $995 million, an increase from $399 million in the PCP.

Underlying profits saw a 17-fold increase of $747 million, up from $44 million in 1HY23.

Underlying EBITDA was also up at $1,995 million from $1,059 million in the PCP.

Origin CEO Frank Calabria said:

“It’s pleasing to report a strong result for the first half, which reflects good operating performance and growth across our Integrated Gas, Energy Markets and Octopus Energy businesses.

“Australia Pacific LNG continues to deliver very good cash flow to Origin and our Integrated Gas team was able to lift production compared with the prior corresponding half through effective well optimisation activity and by bringing more wells online. Importantly, Australia Pacific LNG continues to be one of the largest gas suppliers to the east coast domestic market.”

Origin flagged that it expects earnings from its energy market segments are likely to be lower in the next financial year as tariffs decline.

It also issued an interim dividend of 27.5 cents per share, up from 16.5cps for the period ending December 2022.

Morning market update

Good morning. Charlie here

The ASX 200 opened up +0.57% to 7,590.8 this morning as markets recovered from yesterday’s inflation-triggered selloff.

Slightly higher than expected CPI data in the US was enough for traders to bat back expectations of cuts. The market is now pricing in four rate cuts this year, down from six.

Meanwhile, Bitcoin passed the US$50k mark at speed overnight. Bitcoin has passed the US$1 trillion market cap level for the first time in two years. BTC is now up 20% in the past week.

Wall Street: Dow +0.40%, Nasdaq +1.30%, S&P 500 +1.48%.

Overseas: FTSE +0.75%, STOXX +0.43%, Nikkei -0.69%, SSE +1.28%

The Aussie dollar rose +0.57% to US 64.92 cents.

US 10-year bond yields fell -6bps to 4.26%.

Australian 10-year bond yields rose +4bps to 4.21%.

Gold is up +0.08% to US$1,993.09, while Silver is up 1.39% to US$22.37.

Bitcoin rose +4.67% to US$51,848, while Ethereum rose 5.46% to US$2,781.

Oil Brent eased -1.51% to US$81.52, while WTI Crude fell -1.64% to US$76.59.

Iron ore rose +0.2% to US$128.80 a tonne.

Key Posts

-

4:21 pm — February 15, 2024

-

2:57 pm — February 15, 2024

-

1:54 pm — February 15, 2024

-

1:36 pm — February 15, 2024

-

12:30 pm — February 15, 2024

-

10:54 am — February 15, 2024

-

10:34 am — February 15, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988