Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Rise, Red Sea Attacks Spike Oil Prices; Wall St Enters ‘Extreme Greed’ Sentiment

Market close update

The ASX 200 closed up 0.82% today, with all sectors in the green after another positive day of trading on Wall St.

The biggest performing sector was Utilities, up 1.82% after Origin Energy gained 3.06% after announcing it was spending a further $530 million to increase its stake in British energy retailer Octopus Energy.

Australian markets were undeterred by the RBA minutes today that showed that the Central Bank considered raising rates in its December meeting.

A rise in oil prices lifted major players Santos (+0.9%) and Woodside Energy (+1.5%) while their ongoing merger talks continue.

Shares in Fortescue Metals (+0.94%) and Rio Tinto (+0.61%) came close to their record highs on today’s gains, shrugging off falling Singapore iron ore futures, which fell 0.3% to US$132.15 a tonne.

Lithium players also jumped today, with Azure Minerals increasing 1.4% after Chilean giant SQM and Gina Rinehart’s Hancock Prospecting increased their $1.6 billion bid to $3.70 per share.

Liontown Resources was also up 11.26% today, while lithium brine developer Lake Resources gained 3.85% after releasing its DFS and maiden ore resource for its flagship Kachi project in Argentina.

Origin Energy jumps

Origin Energy [ASX:ORG] is once again in the spotlight after its shares jumped 3.18% today.

The utilities have been front and centre since the failed $20 billion takeover bid by North American consortium Brookfield-EIG.

Its shares fell sharply in early December as the deal looked less and less likely, but have begun to recover.

Today, it announced it was boosting its stake in British energy retailer Octopus Energy, spending $530 million.

That would increase its stake to 23% and values Octopus at £6.2 billion, with Origin’s stake at £1.43 billion.

Oil trader’s sentiment hits all time low

It seems only a geopolitical threat can raise the price of Oil recently, with the prices of crude bouncing slightly after Houthi militants in Yemen sent further drone attacks on ships in the Red Sea.

BP has said it has halted passage through the Suez Canal due to the increased risk, while the US has created a new task force to try to quell concerns.

Meanwhile, Iran Oil Minister Javad Owji said on Monday that an Israeli-led cyberattack caused a nationwide disruption to petrol stations.

Elsewhere, US officials said on Monday that they will push shippers to disclose more information about their Russian oil dealings amid efforts to enforce sanctions.

Currently, Brent prices are up 0.12% to US$78.04, while WTI is down -0.15% to US$72.36 in today’s session.

Meanwhile, sentiment in traders is at an all-time low if we consider the net speculative length.

Sentiment has now reached its lowest level in recent history, as measured by net speculative length. Traders are now more bearish than during the COVID lockdowns that resulted in the biggest demand shock in history, and the paper market is now only net long 12 hours of oil… pic.twitter.com/IlBEeKbsjW

— Eric Nuttall (@ericnuttall) December 18, 2023

RBA Minutes for December

The RBA’s December minutes were released today, showing the Central Bank considered raising rates.

However, they did note that ‘consumption growth had been quite weak‘.

Overall, the picture is one of a dovish position, which points to likely holds next year with cuts coming later.

Here’s a post from AMP’s Head of Investment Strategy and Chief Economist Shane Oliver.

RBA minutes noted RBA considered hiking again but opted to hold given no material change to the outlook, risk of higher unemp & faster global disinflation. The RBA reiterated its softer data dependent tightening bias. We continue to see RBA on hold in Feb & first cut mid next yr, pic.twitter.com/pdDQswrRCF

— Shane Oliver (@ShaneOliverAMP) December 19, 2023

Lake Resources jump on DFS

Lake Resources [ASX:LKE] has seen its share price jump today as the company released its DFS and maiden ore reserve.

Shares were up by 7.7% in trading today at 14 cents, as the DFS indicated the economic potential of the site.

Lake has seen its shares fall by more than 80% in the past 12 months. These heavy falls began in June after they delayed the project by six years.

The maiden Ore Reserve is a critical milestone for LKE, combining prior studies done between 2022–23. Lake completed extensive modelling and extraction tests in the past 18 months.

These show the viability of a 25,000 tonnes per annum (ktpa) lithium carbonate operation over a 25-year life of mine (LoM).

‘The modelling demonstrates that the feed grade will average above 245mg/L with minimal dilution and that the operation can be developed in an environmentally responsible manner,’ commented Michael Gabora, Director of Geology and Hydrogeology.

The DFS added further fuel to the fire, estimating a post-tax net present value (NPV) of US$2.3 billion and an internal rate of return (IRR) of 21%.

Sales estimates for the battery-grade lithium were US$21 billion and US$16 billion in EBITDA over the 25-year LoM.

That would be an annual average EBITDA of US$635 million and a solid EBITDA margin of 76%.

However, a project of this scale comes with steep upfront costs.

Lake Resources estimates an initial capital expenditure of US$1.38 billion for phase one, requiring hefty capital raising.

The company has enlisted Goldman Sachs to help find a partner for its next phase of development.

Midday market update

The ASX 200 is up by 0.63% around midday, trading at 7,473.3.

All sectors are up today, with the top performers being Real Estate (+1.18%) and Utilities (+0.87%).

Minutes of the December meeting of the RBA showed the central bank did consider raising rates but was largely happy with progress on falling inflation.

The AUD is holding onto its five-month high, up 0.12% at US 67.14 cents.

Top performers at midday are Liontown Resources, up 9.04% and Neuren Pharmaceuticals, up 6.31%.

While falling today after strong gains yesterday were Tabcorp Holdings, down -6.91%

Azure Minerals approves SQM and Hancock bid

Lithium explorer and popular takeover target Azure Minerals has entered a binding deed for Chile’s SQM and Gina Rinehart’s Hancock Prospecting.

The scheme would see the two buy all the shares for a cash amount of $3.70 per share. If the off-market deal fails, that would drop to $3.65 per share.

This is a sweetened bid from the $3.52 bid made in October as the interest in the company heats up.

The Azure board unanimously recommends the offer to shareholders.

Commenting on the Transaction, Azure’s Managing Director, Tony Rovira, said:

‘The Transaction delivers a fantastic outcome for Azure shareholders, including a significant uplift in value from the Original SQM Transaction despite elevated market volatility and the recent deterioration in lithium prices.

The Transaction also represents a great outcome for wider stakeholders in Andover, who will benefit from the significant financial strength and expertise of one of Australia’s largest and most well-respected mining and exploration companies, Hancock, combining with SQM to oversee the successful development of Andover.’

Fear and Greed

The CNN Fear and Greed Index has reached ‘Extreme Greed’ for the first time since August.

Source: CNN

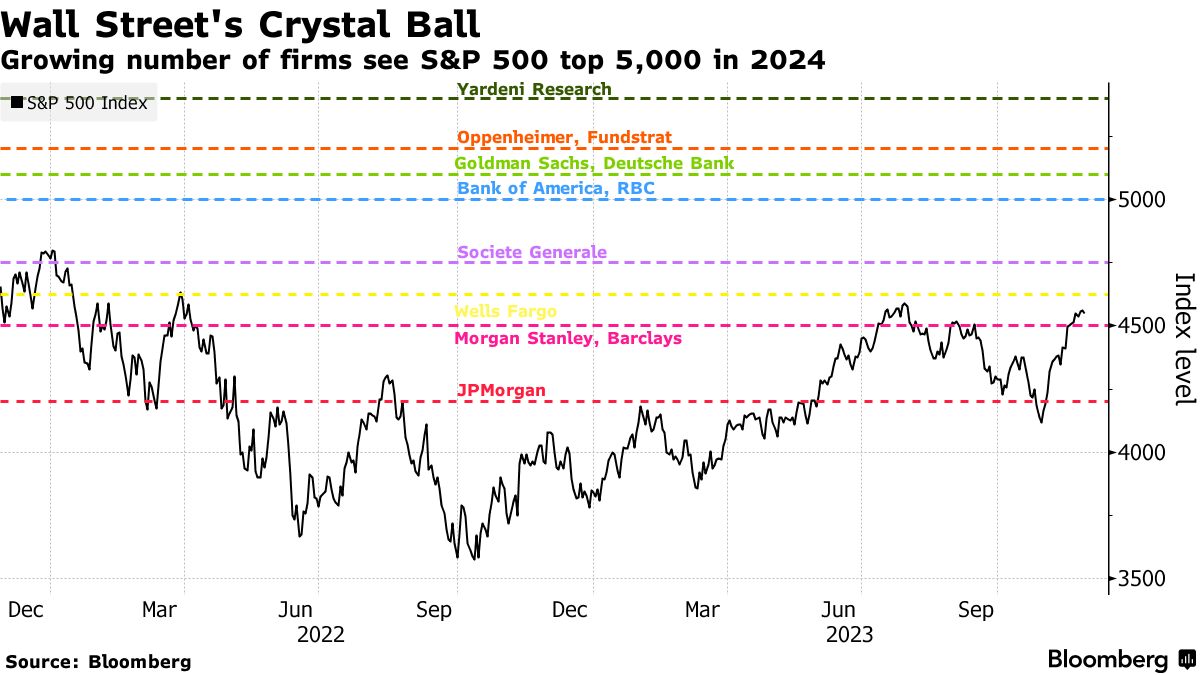

Wall Street has continued its bull run longer than some were expecting, with Goldman Sachs recently upgrading its estimates for the S&P 500 just a month after setting it.

‘The Federal Reserve’s dovish pivot last week, along with lower consumer prices, is an outcome that will allow real yields to fall while supporting stock valuations’, a team led by David Kostin wrote in a note.

‘Equities were already pricing positive economic activity but now reflect an even more robust outlook,’ they said.

The Goldman team has now set a target of 5,100 points for the S&P 500 by the end of next year. Here is what the major groups currently look like for the index next year.

Source: Bloomberg

This positive outlook and greed index move is surprising considering the movements seen into safe-haven assets like gold, cash, and to a lesser extent, bitcoin.

$1.4 trillion poured into money-market funds this year as interest rates climbed, far higher than the $95 billion that flowed into US equities. But as rates begin to fall, that cash will likely rotate into stocks, boosting the equities market.

Currently, markets are short-term overbought when looking at RSI numbers. More than 40% of S&P 500 companies have an RSI of more than 70. That is the first time in nearly a decade and is a clear sign of overheating. But some think it could instead be a sign of strength for the new year.

A note from Carson Investment Research looked back to the past to find similar examples and showed that the average was positive movement from this point.

Source: Carson Investment Research

They also argued a positive outlook because the S&P 500 is up seven weeks in a row, which they argue tends to only happen in bull markets.

There have been 29 instances of such streaks since 1950, and a year later, the market tends to be higher 86% of the time, with a median gain of 8.0%.

Source: Carson Investment Research

Propel Funeral Partners expands

Propel Funeral Partners [ASX:PFP] shares are moving up this morning as the company announced three acquisitions and the expansion of its debt facilities by $275 million.

The three new buyouts totalled $10.6 million and were split between NZ and Australia.

Norman J Penhall Funerals

Operates from one location and has been providing funeral and related services in and around Orange, NSW for over 40 years.

IC Mark Funeral Directors

Operates from two locations (including a cremation facility) and has been providing funeral and related services in and around Levin, New Zealand for over 50 years.

Howard & Gannon Funerals

Operates from one location and has been providing funeral and related services in and around Taradale, New Zealand for over 10 years.

Morning market update

Good morning all. Charlie here

The ASX 200 opened up +0.09% to 7,433.4 in what looks to be a reversal of yesterday’s trading, with stocks bouncing. Underperforming Tech and Energy stocks are likely to move higher today, mirroring moves on Wall St.

In US stocks, the Nasdaq rallied for an eighth straight session while the S&P 500 finished near best levels. The CNN Fear and Greed index has moved to ‘Extreme Greed’ for the first time since August.

Oil prices spiked over 3% on Monday as another round of Yemeni Houthi Drone attacks has pushed oil and gas companies like BP to suspend shipments through the Suez Canal into the Red Sea. As a response, the US has announced a new Task Force to counter the threat.

Wall Street: Dow flat, Nasdaq +0.61%, S&P 500 +0.45%.

Overseas: FTSE +0.50%, STOXX -0.62%, Nikkei -0.64%, SSE -0.40%

The Aussie dollar is +0.07 at US 67.04 cents.

US 10-year bond yield +2bps to 3.93%. Australian 10-year bond yields -4bps to 4.10%.

Gold is up +0.48% to US$2,027.38. Silver rose +0.27% to US$23.80.

Bitcoin rose +2.25% to US$42,582, and Ethereum rose +0.42% to US$2,220.

Oil Brent rose +1.88% to US$77.99, while WTI Crude rose +1.30% to US$72.36.

Iron ore is -1.1% at US$132.45 a tonne.

Key Posts

-

4:23 pm — December 19, 2023

-

3:57 pm — December 19, 2023

-

3:13 pm — December 19, 2023

-

2:31 pm — December 19, 2023

-

2:26 pm — December 19, 2023

-

1:25 pm — December 19, 2023

-

10:55 am — December 19, 2023

-

10:46 am — December 19, 2023

-

10:24 am — December 19, 2023

-

10:17 am — December 19, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988