Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX to Rise; Qantas Settles Ghost Flights Case, Westpac Plans $1bn Buyback

Market close update

The ASX 200 closed up +0.70% to 7,682.4 today, as eight of the eleven sectors closed up today. Real Estate led the charge, up +1.73%.

Markets showed some strong moves today, following big gains seen on Wall Street on Friday, but the big test will come tomorrow as the RBA’s board meeting concludes tomorrow with a widely expected interest rate decision to remain at 4.35% (although some think the chance of a rise remains).

What will likely spill the applecart and send stocks into a weaker start for the week will be the chance of tough rhetoric out of the RBA for future raising if inflation continues to re-accelerate.

Beyond that, today, through the session, we saw oil prices stabilise as Saudi Arabia hiked the prices of its crude by 90 cents. We have the next OPEC+ meeting coming up at the start of June which will also likely extend the current production cuts through the rest of this year.

On the ASX 200, the top performer today was PSC Insurance, up +4.60%, while tech company Block Inc fell heavily, down -9.28% today at $105.64 per share.

Oil prices stabilise after massive weekly decline

Oil prices steadied after experiencing the most significant weekly drop since February, as Saudi Arabia raised the selling prices for its crude grades to Asia for the third consecutive month.

Brent crude held above $83 per barrel after plunging more than 7% last week, marking its most substantial decline since February. While US West Texas Intermediate (WTI) crude traded near $78 per barrel.

Source: TradingView

Last week’s oil price tumble came as geopolitical tensions in the Middle East eased, paring the commodity’s year-to-date gains.

However, OPEC+ is widely expected to maintain its supply cuts in the second half of this year when it convenes for its next meeting in June, helping bolster oil prices.

Ahead of the gathering, laggards like Iraq and Kazakhstan have also outlined plans to curb their oil flows and align with the previously agreed-upon production quotas. This was a major point of discord in the last OPEC meeting, with Angola leaving OPEC at the start of the year over these supply curbs.

In the Middle East, talks over the weekend regarding a potential truce between Israel and Hamas ended without a deal. Meanwhile, options markets have shed the risk premium as fears of a broader regional conflict dissipate.

Brent option skews, which measure the pricing difference between call and put options, are at their most bearish levels in nearly two months, with the discount of calls to puts reaching its widest point since March.

As geopolitical uncertainties subside and OPEC+ maintains its supply cuts, oil prices have found some stability after last week’s substantial decline. Still, it would likely require little for it to move from here.

GrainCorp Shares Plunge After Profit Warning

Australian grain giant GrainCorp [ASX:GNC] saw its shares fall by -2.5% as of early afternoon, following a surprising profit warning issued in the morning.

The company announced that its first-half profit for the current financial year is expected to be $57 million, a significant drop from the $200 million profit recorded in the same period last year.

According to investment bank RBC, GrainCorp’s update indicates that pre-tax earnings are around 6% below market forecasts.

GrainCorp cited softening operating conditions leading into the second half of the year as the major reason for the profit warning.

The company said it’s experienced a decline in overall volumes handled across the East Coast of Australia, as well as lower end-to-end supply chain and crush margins compared to the first half of the prior financial year.

While strong volumes were recorded in Southern NSW and Victoria, these gains were offset by below-average conditions in Queensland and Northern NSW.

At the same time, drier-than-expected conditions in WA resulted in reduced grain production, impacting exportable volumes and margins for GrainCorp.

It seems prior positive updates about a ‘strong winter crop‘ have been overblown and the company is in store for a very ordinary winter period.

Midday market update

The ASX 200 is up by +0.58% to 7,672.9 around midday as markets mirror positive moves seen on Wall Street on Friday.

Interest-rate sensitive Real Estate sector is up by +1.70% so far as market cap leader Goodman Group jumped +3.75% today taking its market cap to $64.08 billion and making it the top performer so far in the ASX 200.

At noon only Healthcare, Energy, and Industrials are flat today, while all other sectors are gaining.

Westpac also saw strong gains today after releasing its half-year results and announcing a $1 billion extension to its stock buyback plans, now totalling $2.5 billion.

On the wider ASX 300 benchmark, Southern Cross Electrical Engineering is up 20.41%, while falling behind Tourism Holdings Rentals fell by -37.93% at noon.

Qantas settles ‘ghost flights’ lawsuit

Qantas [ASX:QAN] has agreed to a settlement in the ‘ghost flights’ lawsuit, which accused the company of selling tickets for flights that had already been cancelled or rescheduled.

Under the terms of the settlement, Qantas will pay $20 million in compensation to affected customers and a $100 million civil penalty.

Most customers eligible for compensation will receive payments ranging from $225 for domestic flights to $450 for international flights. These payments are in addition to any refunds or alternative travel arrangements previously provided by Qantas.

The settlement agreement requires approval from the Federal Court of Australia. However, Qantas has stated that it will commence the process of reimbursing customers immediately, even before the court’s approval.

According to the Australian Competition and Consumer Commission (ACCC), Qantas has admitted to misleading consumers by advertising and selling tickets for tens of thousands of flights that had already been cancelled, as well as cancelling thousands of additional flights without promptly notifying ticketholders.

ACCC chair Gina Cass-Gottlieb said in a statement today:

“We are pleased to have secured these admissions by Qantas that it misled its customers, and its agreement that a very significant penalty is required as a result of this conduct. The size of this proposed penalty is an important milestone in enforcing the Australian Consumer Law.

“Qantas’ conduct was egregious and unacceptable. Many consumers will have made holiday, business and travel plans after booking on a phantom flight that had been cancelled.

“We expect that this penalty, if accepted by the Court, will send a strong deterrence message to other companies. Importantly, it demonstrates that we take action to ensure that companies operating in Australia communicate clearly, accurately and honestly with their customers at all times.”

Westpac shares up on buyback announcement

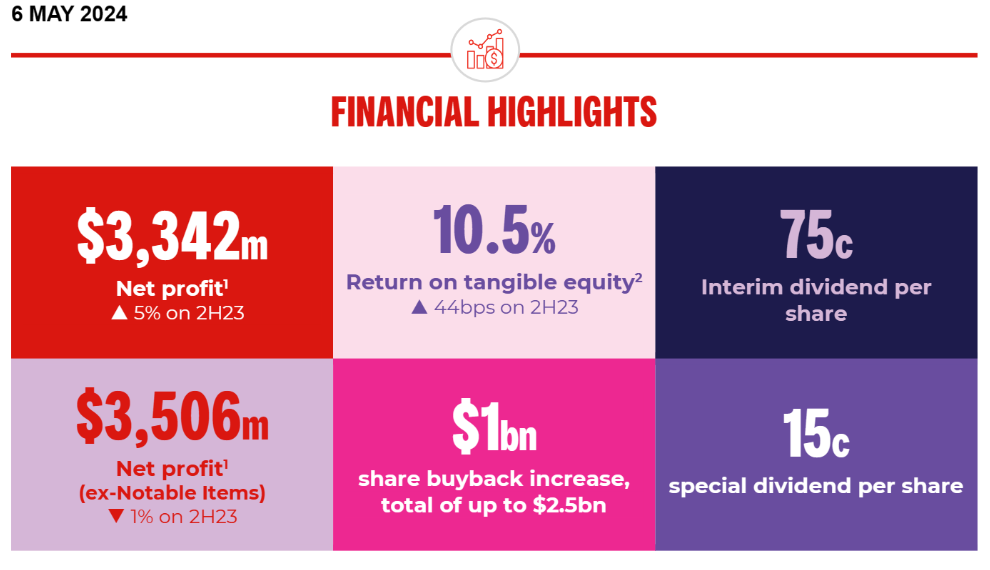

Westpac [ASX:WBC] shares are up today after an ‘OK’ half-year result from the big bank.

Westpac blamed heavy mortgage competition hurting its lending margins in the half as it reported a $3.34 billion net profit for the first half of the year, down 16% from PCP.

Despite this major analysts were fairly unmoved by the profit falls, with JP Morgan’s bank analyst Andrew Triggs describing the results as ‘solid’.

This was thanks to strong markets and treasury income offsetting weaker revenue elsewhere and net interest margins holding up better than expected.

Source: Westpac

The company’s dividend was also above forecasts at 75 cents per share plus a 15-cent special dividend, which is at the top end of the payout ratio and could be a tough act to follow.

As Mr Triggs explained today, saying, ‘maintaining this ordinary dividend may stretch the payout slightly if loan losses normalise quickly.’

The other major factor helping the share price today is the announcement that the company will increase its share buyback plan by $1 billion to $2.5 billion.

Morning market update

Good morning. Charlie here,

The ASX 200 opened up +0.42% to 7,660.8 as markets regained some momentum after ‘goldilocks’ data out of the US. Nonfarm payrolls in America increased by 175,000 for the month, well below the 240,000 consensus estimate from the Dow Jones.

The ‘bad news is good news’ is once again in vogue as markets anxiously anticipate the Fed’s next move and cling to every utterance by Central Banks.

In Australia, tomorrow’s RBA meeting is the key event for the week ahead. The market broadly expects the Central Bank to hold rates but will be listening for any change in tone.

Wall Street: S&P 500 +1.26%, Dow +1.18%, Nasdaq +1.99%.

Overseas: FTSE +0.51%, STOXX +0.63%, Nikkei flat SSE -0.26%.

The Aussie dollar rose +0.06% to US 66.11 cents.

US 10-year bond yields -7bps to 4.51%.

Australian 10-year bond yields -5bps to 4.39%.

Gold is down -0.38% to US$2,293.08, while Silver fell -0.40% to US$26.47.

Bitcoin rose +0.53% to US$64,208, while Ethereum rose +1.0% to US$3,146.

Oil Brent rose +0.35% to US$83.25, while WTI Crude rose +0.55% to US$78.54.

Iron ore rose +0.32% to US$117.70 a tonne.

Key Posts

-

4:46 pm — May 6, 2024

-

2:43 pm — May 6, 2024

-

1:18 pm — May 6, 2024

-

12:32 pm — May 6, 2024

-

12:20 pm — May 6, 2024

-

11:05 am — May 6, 2024

-

10:42 am — May 6, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988